Tompkins Financial Corporation (NYSE American: TMP)

Tompkins Financial Corporation ("Tompkins" or the "Company")

reported diluted earnings per share of $1.30 for the third quarter

of 2024, up 18.2% from the immediate prior quarter, and up 155.3%

from the diluted earnings (loss) per share of $(2.35) reported in

the third quarter of 2023. Net income for the third quarter of 2024

was $18.6 million, up $3.0 million or 18.9% compared to the second

quarter of 2024, and up $52.0 million, or 155.9%, when compared to

the net loss of $(33.4) million reported for the third quarter of

2023. The increase in diluted earnings per share and net income

compared to the results for the third quarter of 2023 largely

reflects the Company's sale of $429.6 million of available-for-sale

securities, which resulted in a pre-tax loss of $62.9 million (or

$3.34 per share) in the third quarter of 2023.

For the nine months ended September 30, 2024, diluted earnings

(loss) per share were $3.59, up from $(0.39) for the nine months

ended September 30, 2023. Year-to-date net income (loss) was $51.2

million for the nine months ended September 30, 2024, up $56.7

million when compared to $(5.5) million for the prior year period.

The growth in year-to-date diluted earnings per share and net

income was mainly due the Company's sale of $510.5 million of

available-for-sale securities which resulted in a pre-tax loss of

$70.0 million (or $3.69 per share) for the nine months ended

September 30, 2023.

Tompkins President and CEO, Stephen Romaine, commented, "Our

third quarter net income was up over 18% as compared to the second

quarter, driven by a strengthening net interest margin and growth

across our business. For the third quarter our net interest margin

expanded 6 basis points, loan balances grew over 8% annualized and

our fee-based services continue to provide diversified growing

revenue as total noninterest income represented 31% of total

revenue. Year-to-date, our operating results were further supported

by lower expenses, as noninterest expenses were down 1.5% as

compared to prior year. As we are seeing improving profitability we

believe that we remain well positioned to continue to drive growth

through quality customer relationships supported by our strong

capital and liquidity."

SELECTED HIGHLIGHTS FOR THE PERIOD:

- Net interest margin for the third quarter of 2024 was 2.79%,

improved from the immediate prior quarter of 2.73%, and the 2.75%

reported for the same period of 2023.

- Total average cost of funds for the third quarter of 2024 was

up 5 basis points compared to the second quarter of 2024, down from

a 10 basis point increase from the first quarter of 2024 to the

second quarter of 2024.

- Total fee-based services (insurance, wealth management, service

charges on deposit accounts and cards) revenues for the third

quarter of 2024 were up $648,000 or 3.2% compared to the third

quarter of 2023.

- Total noninterest expenses for the third quarter of 2024 were

in line with the second quarter of 2024 and the third quarter of

2023.

- Total loans at September 30, 2024 were up $119.4 million, or

2.1% (8.2% on an annualized basis) compared to June 30, 2024, and

up $446.4 million, or 8.2%, from September 30, 2023.

- Total deposits at September 30, 2024 were $6.6 billion, up

$292.0 million, or 4.7%, from June 30, 2024, and down $45.5

million, or 0.7%, from September 30, 2023.

- Loan to deposit ratio at September 30, 2024 was 89.4%, compared

to 91.7% at June 30, 2024, and 82.1% at September 30, 2023.

- Regulatory Tier 1 capital to average assets was 9.19% at

September 30, 2024, up compared to 9.15% at June 30, 2024, and

9.01% at September 30, 2023.

NET INTEREST INCOME

Net interest income was $53.2 million for the third quarter of

2024, up $2.2 million or 4.4% compared to the second quarter of

2024, and $2.2 million or 4.3% compared to the third quarter of

2023. The increase in net interest income compared to both the

second quarter of 2024, and third quarter of 2023, resulted

primarily from the increase in average loan balances and the

average yield on those loan balances, partially offset by the

increase in cost of deposits.

For the nine months ended September 30, 2024, net interest

income was $154.8 million, down $2.3 million or 1.5% when compared

to the same period in 2023.

Net interest margin was 2.79% for the third quarter of 2024, up

6 basis points when compared to the immediate prior quarter, and up

4 basis points from the 2.75% reported for the third quarter of

2023. The increase in net interest margin, when compared to the

prior periods, was mainly driven by higher yields on interest

earning assets and higher average loan balances, and was partially

offset by higher funding costs.

Average loans for the quarter ended September 30, 2024 were up

$143.4 million, or 2.5%, from the second quarter of 2024, and were

up $445.7 million, or 8.3%, compared to the same period prior year.

The increase in average loans over both prior periods was mainly in

the commercial real estate and commercial and industrial

portfolios. The average yield on interest-earning assets for the

quarter ended September 30, 2024 was 4.66%, which was up from 4.56%

for the quarter ended June 30, 2024, and up from 4.06% for the

quarter ended September 30, 2023.

Average total deposits of $6.4 billion for the third quarter of

2024 were up $41.4 million, or 0.7%, compared to the second quarter

of 2024, and down $67.0 million or 1.0% compared to the same period

in 2023. The cost of interest-bearing deposits of 2.35% for the

third quarter of 2024 was up 8 basis points from 2.27% for the

second quarter of 2024, and up 61 basis points from 1.74% for the

third quarter of 2023. The ratio of average noninterest bearing

deposits to average total deposits for the third quarter of 2024

was 28.9% compared to 29.1% for the second quarter of 2024, and

31.0% for the third quarter of 2023. The average cost of

interest-bearing liabilities for the third quarter of 2024 of 2.71%

represents an increase of 7 basis points over the second quarter of

2024, and an increase of 73 basis points over the same period in

2023.

NONINTEREST INCOME

Noninterest income of $23.4 million for the third quarter of

2024 was up $65.0 million or 156.2% compared to the same period in

2023. Year-to-date noninterest income of $67.3 million was up $75.9

million or 881.7% compared to the same period in 2023. The increase

in quarterly and year-to-date noninterest income compared to the

same periods in 2023 was mainly due to the $62.9 million and $70.0

million, respectively, pre-tax loss on the sale of

available-for-sale securities in 2023 as discussed above. Other

income was up $1.3 million for the quarter ended September 30, 2024

compared to the same period in 2023, and included increases in

gains on loan sales, derivative swap fee income, and BOLI income.

Also included in the increase for the third quarter of 2024 over

the same period prior year were fee-based revenues which included

wealth management fees, up $583,000, service charges on deposit

accounts, up $118,000, card services income, up $61,000.

NONINTEREST EXPENSE

Noninterest expense was $49.9 million for the third quarter of

2024, which was in line with the third quarter of 2023.

Year-to-date noninterest expense for the period ended September 30,

2024 was $149.7 million, a decrease of $2.3 million or 1.5%

compared to the $152.0 million reported for the same period in

2023. The year-over-year decrease was mainly driven by lower other

expenses (legal fees, marketing, professional fees, retirement plan

expense, and travel and meeting expense), partially offset by

higher FDIC insurance expense.

INCOME TAX EXPENSE

The provision for income tax expense was $5.9 million for an

effective rate of 23.9% for the third quarter of 2024, compared to

tax benefit of $8.3 million and an effective rate of 20.0% for the

same quarter in 2023. For the nine months ended September 30, 2024,

the provision for income tax expense was $16.0 million and the

effective tax rate was 23.7% compared to a tax benefit of $619,000

and an effective tax rate of 10.3% for the same period in 2023.

Lower tax expense for both the quarter and year-to-date periods in

2023 was mainly a result of lower income associated with the loss

on the sale of securities described above.

ASSET QUALITY

The allowance for credit losses represented 0.94% of total loans

and leases at September 30, 2024, up from 0.92% reported at both

June 30, 2024 and December 31, 2023. The increase in the allowance

for credit losses coverage ratio was driven primarily by updated

economic forecasts for unemployment and gross domestic product for

the quarter, as well as model assumption updates for prepayment

speeds, curtailment rates, and recovery lag. The increase in

allowance for credit losses was partially offset by lower

off-balance sheet reserves due to model changes related to

utilization rates and a decrease in loan pipeline. The ratio of the

allowance to total nonperforming loans and leases was 88.51% at

September 30, 2024, compared to 84.94% at June 30, 2024, and

156.96% at September 30, 2023. The decrease in the ratio compared

to the same prior year period was due to the increase in

nonperforming loans and leases discussed in more detail below.

Provision for credit losses for the third quarter of 2024 was

$2.2 million compared to $1.2 million for the same period in 2023.

Provision for credit losses for the nine months ended September 30,

2024 was $5.2 million compared to $2.6 million for the nine months

ended September 30, 2023. The increase in provision expense for the

quarter and year-to-date periods compared to the same periods in

2023 was mainly driven by loan growth which was up $119.4 million

or 2.1%, and $446.4 million or 8.2%, respectively, and the increase

in net charge-offs in 2024 over 2023. Net charge-offs for three and

nine months ended September 30, 2024 were $912,000 and $1.6

million, respectively, compared to net charge-offs of $177,000 and

net recoveries of $1.1 million for the same periods in 2023.

Nonperforming assets represented 0.78% of total assets at

September 30, 2024, down slightly from 0.79% reported at June 30,

2024, and up compared to 0.41% at September 30, 2023. At September

30, 2024, nonperforming loans and leases totaled $62.6 million,

compared to $62.5 million at June 30, 2024 and $31.4 million at

September 30, 2023. The increase in nonperforming loans and leases

at September 30, 2024 compared to September 30, 2023 was mainly due

to the addition in the fourth quarter of 2023 of one relationship

totaling approximately $33.3 million with two commercial real

estate properties included in the office space and mixed use

properties portion of the commercial real estate portfolio. The

Company believes that the existing collateral securing the loans

was sufficient to cover the exposure as of September 30, 2024.

Special Mention and Substandard loans and leases totaled $126.0

million at September 30, 2024, compared to $116.2 million reported

at June 30, 2024, and $122.9 million reported at September 30,

2023.

CAPITAL POSITION

Capital ratios at September 30, 2024 remained well above the

regulatory minimums for well-capitalized institutions. The ratio of

total capital to risk-weighted assets was 13.21% at September 30,

2024, compared to 13.26% at June 30, 2024, and 13.46% at September

30, 2023. The ratio of Tier 1 capital to average assets was 9.19%

at September 30, 2024, compared to 9.15% at June 30, 2024, and

9.01% at September 30, 2023.

LIQUIDITY POSITION

The Company's liquidity position at September 30, 2024 was

stable and consistent with the immediate prior quarter end.

Liquidity is enhanced by ready access to national and regional

wholesale funding sources including Federal funds purchased,

repurchase agreements, brokered deposits, Federal Reserve Bank's

Discount Window advances and Federal Home Loan Banks (FHLB)

advances. The Company maintained ready access to liquidity of $1.4

billion, or 18.0% of total assets at September 30, 2024. As a

member of the FHLB, the Company can use certain unencumbered

mortgage-related assets and securities to secure borrowings from

the FHLB. At September 30, 2024 the Company had an available

borrowing capacity at the FHLB of $769.5 million. Through various

programs at the Federal Reserve Bank, the Company has the ability

to use certain loans and securities to secure borrowings from the

Federal Reserve Bank's Discount Window. At September 30, 2024 the

available borrowing capacity with the Federal Reserve Bank was

$142.0 million, secured by loans. In addition to the available

borrowing lines at the FHLB and Federal Reserve Bank, at September

30, 2024, the Company maintained $508.7 million of unencumbered

securities which could be pledged to further enhance secured

borrowing capacity.

ABOUT TOMPKINS FINANCIAL CORPORATION

Tompkins Financial Corporation is a banking and financial

services company serving the Central, Western, and Hudson Valley

regions of New York and the Southeastern region of Pennsylvania.

Headquartered in Ithaca, NY, Tompkins Financial is parent to

Tompkins Community Bank and Tompkins Insurance Agencies, Inc.

Tompkins Community Bank provides a full array of wealth management

services under the Tompkins Financial Advisors brand, including

investment management, trust and estate, financial and tax planning

services. For more information on Tompkins Financial, visit

www.tompkinsfinancial.com.

"Safe Harbor" Statement under the Private Securities

Litigation Reform Act of 1995:

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. The statements contained in this press release that are not

statements of historical fact may include forward-looking

statements that involve a number of risks and uncertainties.

Forward-looking statements may be identified by use of such words

as "may", "will", "estimate", "intend", "continue", "believe",

"expect", "plan", "commit", or "anticipate", as well as the

negative and other variations of these terms and other similar

words. Examples of forward-looking statements may include

statements regarding the sufficiency of existing collateral to

cover exposure related to nonperforming loans and future growth.

Forward-looking statements are made based on management’s

expectations and beliefs concerning future events impacting the

Company and are subject to uncertainties and factors relating to

the Company’s operations and economic environment, all of which are

difficult to predict and many of which are beyond the control of

the Company, that could cause actual results of the Company to

differ materially from those expressed and/or implied by

forward-looking statements and historical performance. The

following factors, in addition to those listed as Risk Factors in

Item 1A in our Annual Report on Form 10-K and our Quarterly Reports

on Form 10-Q as filed with the Securities and Exchange Commission,

are among those that could cause actual results to differ

materially from the forward-looking statements: changes in general

economic, market and regulatory conditions; our ability to attract

and retain deposits and other sources of liquidity; gross domestic

product growth and inflation trends; the impact of the interest

rate and inflationary environment on the Company's business,

financial condition and results of operations; other income or cash

flow anticipated from the Company's operations, investment and/or

lending activities; changes in laws and regulations affecting

banks, bank holding companies and/or financial holding companies,

including the Dodd-Frank Act, and state and local government

mandates; the impact of any change in the FDIC insurance assessment

rate or the rules and regulations related to the calculation of the

FDIC insurance assessment amount; technological developments and

changes; cybersecurity incidents and threats; the ability to

continue to introduce competitive new products and services on a

timely, cost-effective basis; governmental and public policy

changes, including environmental regulation; reliance on large

customers; the ability to access financial resources in the

amounts, at the times, and on the terms required to support the

Company's future businesses; and the economic impact of national

and global events, including the response to bank failures, war and

geopolitical matters (including the war in Israel and surrounding

regions and the war in Ukraine), widespread protests, civil unrest,

political uncertainty, and pandemics or other public health crises.

The Company does not undertake any obligation to update its

forward-looking statements.

TOMPKINS FINANCIAL

CORPORATION

CONSOLIDATED STATEMENTS OF

CONDITION

(In thousands, except share and per share

data) (Unaudited)

As of

As of

ASSETS

9/30/2024

12/31/2023

(Audited)

Cash and noninterest bearing balances due

from banks

$

110,375

$

67,212

Interest bearing balances due from

banks

21,945

12,330

Cash and Cash

Equivalents

132,320

79,542

Available-for-sale debt securities, at

fair value (amortized cost of $1,410,405 at September 30, 2024 and

$1,548,482 at December 31, 2023)

1,309,279

1,416,650

Held-to-maturity debt securities, at

amortized cost (fair value of $276,599 at September 30, 2024 and

$267,455 at December 31, 2023)

312,446

312,401

Equity securities, at fair value

801

787

Total loans and leases, net of unearned

income and deferred costs and fees

5,881,261

5,605,935

Less: Allowance for credit losses

55,384

51,584

Net Loans and Leases

5,825,877

5,554,351

Federal Home Loan Bank and other stock

30,936

33,719

Bank premises and equipment, net

77,603

79,687

Corporate owned life insurance

75,966

67,884

Goodwill

92,602

92,602

Other intangible assets, net

2,238

2,327

Accrued interest and other assets

146,359

179,799

Total Assets

$

8,006,427

$

7,819,749

LIABILITIES

Deposits:

Interest bearing:

Checking, savings and money market

3,655,041

3,484,878

Time

1,042,007

998,013

Noninterest bearing

1,880,848

1,916,956

Total Deposits

6,577,896

6,399,847

Federal funds purchased and securities

sold under agreements to repurchase

67,506

50,996

Other borrowings

539,327

602,100

Other liabilities

100,350

96,872

Total Liabilities

$

7,285,079

$

7,149,815

EQUITY

Tompkins Financial Corporation

shareholders' equity:

Common Stock - par value $.10 per share:

Authorized 25,000,000 shares; Issued: 14,426,922 at September 30,

2024; and 14,441,830 at December 31, 2023

1,443

1,444

Additional paid-in capital

299,741

297,183

Retained earnings

526,423

501,510

Accumulated other comprehensive loss

(101,200

)

(125,005

)

Treasury stock, at cost – 129,317 shares

at September 30, 2024, and 132,097 shares at December 31, 2023

(6,552

)

(6,610

)

Total Tompkins Financial

Corporation Shareholders’ Equity

719,855

668,522

Noncontrolling interests

1,493

1,412

Total Equity

$

721,348

$

669,934

Total Liabilities and

Equity

$

8,006,427

$

7,819,749

TOMPKINS FINANCIAL

CORPORATION

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per share data)

(Unaudited)

Three Months Ended

Nine Months Ended

9/30/2024

06/30/2024

9/30/2023

9/30/2024

9/30/2023

INTEREST AND DIVIDEND INCOME

Loans

$

77,814

$

73,646

$

67,030

$

223,059

$

191,399

Due from banks

168

184

125

506

447

Available-for-sale debt securities

9,037

9,371

6,599

28,019

19,960

Held-to-maturity debt securities

1,222

1,219

1,221

3,659

3,654

Federal Home Loan Bank and other stock

888

820

490

2,309

1,113

Total Interest and Dividend

Income

89,129

$

85,240

$

75,465

$

257,552

$

216,573

INTEREST EXPENSE

Time certificates of deposits of $250,000

or more

4,158

4,048

3,158

12,216

7,472

Other deposits

22,553

21,236

16,348

64,213

39,861

Federal funds purchased and securities

sold under agreements to repurchase

11

11

15

35

44

Other borrowings

9,214

8,992

4,931

26,267

12,041

Total Interest Expense

35,936

34,287

24,452

102,731

59,418

Net Interest Income

53,193

50,953

51,013

154,821

157,155

Less: Provision for credit loss

expense

2,174

2,172

1,150

5,200

2,578

Net Interest Income After

Provision for Credit Loss Expense

51,019

48,781

49,863

149,621

154,577

NONINTEREST INCOME

Insurance commissions and fees

11,283

9,087

11,397

30,629

29,578

Wealth management fees

4,925

4,849

4,342

14,711

13,529

Service charges on deposit accounts

1,872

1,766

1,754

5,434

5,140

Card services income

2,921

3,278

2,860

9,138

8,629

Other income

2,299

2,802

990

7,321

4,534

Net gain (loss) on securities

transactions

85

(6

)

(62,967

)

65

(70,019

)

Total Noninterest Income

23,385

21,776

(41,624

)

67,298

(8,609

)

NONINTEREST EXPENSE

Salaries and wages

25,664

24,919

23,811

75,280

73,660

Other employee benefits

6,276

6,545

7,319

19,232

20,707

Net occupancy expense of premises

3,065

3,139

3,108

9,761

9,734

Furniture and fixture expense

1,797

1,910

2,079

5,832

6,238

Amortization of intangible assets

86

80

83

242

250

Other operating expense

12,989

13,349

13,466

39,329

41,403

Total Noninterest Expenses

49,877

49,942

49,866

149,676

151,992

Income/(Loss) Before Income

Tax Expense/(Benefit)

24,527

20,615

(41,627

)

67,243

(6,024

)

Income Tax

Expense/(Benefit)

5,858

4,902

(8,304

)

15,958

(619

)

Net Income/(Loss) Attributable

to Noncontrolling Interests and Tompkins Financial

Corporation

18,669

15,713

(33,323

)

51,285

(5,405

)

Less: Net Income Attributable to

Noncontrolling Interests

31

31

31

93

93

Net Income/(Loss) Attributable

to Tompkins Financial Corporation

$

18,638

15,682

(33,354

)

51,192

(5,498

)

Basic Earnings (Loss) Per Share

$

1.31

$

1.10

$

(2.35

)

$

3.60

$

(0.39

)

Diluted Earnings (Loss) Per Share

$

1.30

$

1.10

$

(2.35

)

$

3.59

$

(0.39

)

Average Consolidated Statements of

Condition and Net Interest Analysis (Unaudited)

Quarter Ended

Quarter Ended

September 30, 2024

June 30, 2024

Average

Average

Balance

Average

Balance

Average

(Dollar amounts in thousands)

(QTD)

Interest

Yield/Rate

(QTD)

Interest

Yield/Rate

ASSETS

Interest-earning assets

Interest-bearing balances due from

banks

$

13,189

$

168

5.07

%

$

11,707

$

184

6.33

%

Securities (1)

U.S. Government securities

1,664,611

9,740

2.33

%

1,717,975

10,067

2.36

%

State and municipal (2)

87,799

560

2.54

%

89,518

566

2.55

%

Other securities

3,282

60

7.27

%

3,260

59

7.32

%

Total securities

1,755,692

10,360

2.35

%

1,810,753

10,692

2.38

%

FHLBNY and FRB stock

38,534

888

9.17

%

37,681

820

8.76

%

Total loans and leases, net of unearned

income (2)(3)

5,830,899

78,040

5.32

%

5,687,548

73,839

5.22

%

Total interest-earning assets

7,638,314

89,456

4.66

%

7,547,689

85,535

4.56

%

Other assets

276,610

262,372

Total assets

$

7,914,924

$

7,810,061

LIABILITIES & EQUITY

Deposits

Interest-bearing deposits

Interest bearing checking, savings, &

money market

$

3,509,116

$

16,635

1.89

%

$

3,498,746

$

15,754

1.81

%

Time deposits

1,016,949

10,076

3.94

%

987,348

9,530

3.88

%

Total interest-bearing deposits

4,526,065

26,711

2.35

%

4,486,094

25,284

2.27

%

Federal funds purchased & securities

sold under agreements to repurchase

42,449

11

0.10

%

40,298

11

0.11

%

Other borrowings

709,474

9,214

5.17

%

688,611

8,992

5.25

%

Total interest-bearing

liabilities

5,277,988

35,936

2.71

%

5,215,003

34,287

2.64

%

Noninterest bearing deposits

1,838,725

1,837,325

Accrued expenses and other liabilities

101,679

94,764

Total liabilities

7,218,392

7,147,092

Tompkins Financial Corporation

Shareholders’ equity

695,057

661,523

Noncontrolling interest

1,475

1,446

Total equity

696,532

662,969

Total liabilities and equity

$

7,914,924

$

7,810,061

Interest rate spread

1.95

%

1.91

%

Net interest income (TE)/margin on earning

assets

53,520

2.79

%

51,248

2.73

%

Tax Equivalent Adjustment

(327

)

(295

)

Net interest income

$

53,193

$

50,953

Average Consolidated Statements of

Condition and Net Interest Analysis (Unaudited)

Quarter Ended

Quarter Ended

September 30, 2024

September 30, 2023

Average

Average

Balance

Average

Balance

Average

(Dollar amounts in thousands)

(QTD)

Interest

Yield/Rate

(QTD)

Interest

Yield/Rate

ASSETS

Interest-earning assets

Interest-bearing balances due from

banks

$

13,189

$

168

5.07

%

$

11,585

$

125

4.29

%

Securities (1)

U.S. Government securities

1,664,611

9,740

2.33

%

1,890,659

7,294

1.53

%

State and municipal (2)

87,799

560

2.54

%

90,212

576

2.53

%

Other securities

3,282

60

7.27

%

3,272

59

7.18

%

Total securities

1,755,692

10,360

2.35

%

1,984,143

7,929

1.59

%

FHLBNY and FRB stock

38,534

888

9.17

%

24,511

490

7.94

%

Total loans and leases, net of unearned

income (2)(3)

5,830,899

78,040

5.32

%

5,385,195

67,199

4.95

%

Total interest-earning assets

7,638,314

89,456

4.66

%

7,405,434

75,743

4.06

%

Other assets

276,610

224,442

Total assets

$

7,914,924

$

7,629,876

LIABILITIES & EQUITY

Deposits

Interest-bearing deposits

Interest bearing checking, savings, &

money market

$

3,509,116

$

16,635

1.89

%

$

3,615,395

$

12,674

1.39

%

Time deposits

1,016,949

10,076

3.94

%

826,082

6,832

3.28

%

Total interest-bearing deposits

4,526,065

26,711

2.35

%

4,441,477

19,506

1.74

%

Federal funds purchased & securities

sold under agreements to repurchase

42,449

11

0.10

%

57,624

15

0.10

%

Other borrowings

709,474

9,214

5.17

%

403,829

4,931

4.84

%

Total interest-bearing

liabilities

5,277,988

35,936

2.71

%

4,902,930

24,452

1.98

%

Noninterest bearing deposits

1,838,725

1,990,320

Accrued expenses and other liabilities

101,679

101,646

Total liabilities

7,218,392

6,994,896

Tompkins Financial Corporation

Shareholders’ equity

695,057

633,494

Noncontrolling interest

1,475

1,487

Total equity

696,532

634,980

Total liabilities and equity

$

7,914,924

$

7,629,876

Interest rate spread

1.95

%

2.08

%

Net interest income (TE)/margin on earning

assets

53,520

2.79

%

51,291

2.75

%

Tax Equivalent Adjustment

(327

)

(278

)

Net interest income

$

53,193

$

51,013

Average Consolidated Statements of

Condition and Net Interest Analysis (Unaudited)

Year to Date Period

Ended

Year to Date Period

Ended

September 30, 2024

September 30, 2023

Average

Average

Balance

Average

Balance

Average

(Dollar amounts in thousands)

(YTD)

Interest

Yield/Rate

(YTD)

Interest

Yield/Rate

ASSETS

Interest-earning assets

Interest-bearing balances due from

banks

$

12,369

$

506

5.46

%

$

12,630

$

447

4.73

%

Securities (1)

U.S. Government securities

1,712,727

30,109

2.35

%

1,965,039

22,022

1.50

%

State and municipal (2)

89,063

1,697

2.55

%

91,858

1,764

2.57

%

Other securities

3,273

179

7.31

%

3,281

169

6.87

%

Total securities

1,805,063

31,985

2.37

%

2,060,178

23,955

1.55

%

FHLBNY and FRB stock

36,948

2,309

8.35

%

21,519

1,113

6.93

%

Total loans and leases, net of unearned

income (2)(3)

5,713,780

223,656

5.23

%

5,314,221

191,946

4.83

%

Total interest-earning assets

7,568,160

258,456

4.56

%

7,408,548

217,461

3.92

%

Other assets

274,143

224,594

Total assets

$

7,842,303

$

7,633,142

LIABILITIES & EQUITY

Deposits

Interest-bearing deposits

Interest bearing checking, savings, &

money market

$

3,517,993

$

47,424

1.80

%

$

3,715,931

$

31,905

1.15

%

Time deposits

997,800

29,005

3.88

%

749,198

15,428

2.75

%

Total interest-bearing deposits

4,515,793

76,429

2.26

%

4,465,129

47,333

1.42

%

Federal funds purchased & securities

sold under agreements to repurchase

43,837

35

0.11

%

57,077

44

0.10

%

Other borrowings

673,809

26,267

5.21

%

351,600

12,041

4.58

%

Total interest-bearing

liabilities

5,233,439

102,731

2.62

%

4,873,806

59,418

1.63

%

Noninterest bearing deposits

1,835,776

2,019,917

Accrued expenses and other liabilities

97,593

100,491

Total liabilities

7,166,808

6,994,214

Tompkins Financial Corporation

Shareholders’ equity

674,048

637,472

Noncontrolling interest

1,447

1,456

Total equity

675,495

638,928

Total liabilities and equity

$

7,842,303

$

7,633,142

Interest rate spread

1.94

%

2.29

%

Net interest income (TE)/margin on earning

assets

155,725

2.75

%

158,043

2.85

%

Tax Equivalent Adjustment

(904

)

(888

)

Net interest income

$

154,821

$

157,155

Tompkins Financial Corporation - Summary Financial Data

(Unaudited)

(In thousands, except per share data)

Quarter-Ended

Year-Ended

Period End Balance Sheet

Sep-24

Jun-24

Mar-24

Dec-23

Sep-23

Dec-23

Securities

$

1,622,526

$

1,630,654

$

1,679,542

$

1,729,838

$

1,701,636

$

1,729,838

Total Loans

5,881,261

5,761,864

5,640,524

5,605,935

5,434,860

5,605,935

Allowance for credit losses

55,384

53,059

51,704

51,584

49,336

51,584

Total assets

8,006,427

7,869,522

7,778,034

7,819,749

7,691,162

7,819,749

Total deposits

6,577,896

6,285,896

6,449,616

6,399,847

6,623,436

6,399,847

Federal funds purchased and securities

sold under agreements to repurchase

67,506

35,989

43,681

50,996

56,120

50,996

Other borrowings

539,327

773,627

522,600

602,100

296,800

602,100

Total common equity

719,855

674,630

667,906

668,522

610,851

668,522

Total equity

721,348

676,093

669,338

669,934

612,356

669,934

Average Balance Sheet

Average earning assets

$

7,638,314

$

7,547,689

$

7,517,705

$

7,407,976

$

7,405,434

$

7,408,404

Average assets

7,914,924

7,810,061

7,801,125

7,666,982

7,629,876

7,641,672

Average interest-bearing liabilities

5,277,988

5,215,003

5,206,836

5,020,544

4,902,930

4,910,792

Average equity

696,532

662,969

666,752

622,280

634,980

634,732

Share data

Weighted average shares outstanding

(basic)

14,215,607

14,214,574

14,211,910

14,194,503

14,185,763

14,254,661

Weighted average shares outstanding

(diluted)

14,283,255

14,239,626

14,238,357

14,246,024

14,224,748

14,301,221

Period-end shares outstanding

14,394,255

14,395,204

14,405,019

14,405,920

14,350,177

14,405,920

Common equity book value per share

$

50.01

$

46.86

$

46.37

$

46.41

$

42.57

$

46.41

Tangible book value per share

(Non-GAAP)**

$

43.50

$

40.35

$

39.85

$

39.88

$

36.01

$

39.88

**See "Non-GAAP measures" below for a

discussion of non-GAAP financial measures and a reconciliation of

non-GAAP financial measures to the most directly comparable

financial measures presented in accordance with GAAP.

Income Statement

Net interest income

$

53,193

$

50,953

$

50,675

$

52,359

$

51,013

$

209,514

Provision for credit loss expense (5)

2,174

2,172

854

1,761

1,150

4,339

Noninterest income

23,385

21,776

22,137

18,850

(41,624

)

10,241

Noninterest expense (5)

49,877

49,942

49,857

51,300

49,866

203,292

Income tax expense/(benefit)

5,858

4,902

5,198

3,114

(8,304

)

2,495

Net income/(loss) attributable to Tompkins

Financial Corporation

18,638

15,682

16,872

15,003

(33,354

)

9,505

Noncontrolling interests

31

31

31

31

31

124

Basic earnings (loss) per share (4)

1.31

1.10

1.19

1.06

(2.35

)

0.66

Diluted earnings (loss) per share (4)

1.30

1.10

1.18

1.05

(2.35

)

0.66

Nonperforming Assets

Nonaccrual loans and leases

$

62,381

$

62,253

$

62,544

$

62,165

$

31,381

$

62,165

Loans and leases 90 days past due and

accruing

193

215

151

101

52

101

Total nonperforming loans and leases

62,574

62,468

62,695

62,266

31,433

62,266

OREO

81

80

0

131

0

131

Total nonperforming assets

$

62,655

$

62,548

$

62,695

$

62,397

$

31,433

$

62,397

Tompkins Financial Corporation - Summary Financial Data

(Unaudited) - continued

Quarter-Ended

Year-Ended

Delinquency - Total loan and lease

portfolio

Sep-24

Jun-24

Mar-24

Dec-23

Sep-23

Dec-23

Loans and leases 30-89 days past due and

accruing

$

7,031

$

5,286

$

8,015

$

4,210

$

40,893

$

4,210

Loans and leases 90 days past due and

accruing

193

215

151

101

52

101

Total loans and leases past due and

accruing

7,224

5,501

8,166

4,311

40,945

4,311

Allowance for Credit Losses

Balance at beginning of period

$

53,059

$

51,704

$

51,584

$

49,336

$

48,545

$

45,934

Impact of adopting ASC 326

0

0

0

0

0

64

Provision for credit losses

3,237

1,864

348

2,658

968

$

4,865

Net loan and lease charge-offs

(recoveries)

912

509

228

410

177

$

(721

)

Allowance for credit losses at end of

period

$

55,384

$

53,059

$

51,704

$

51,584

$

49,336

$

51,584

Allowance for Credit Losses -

Off-Balance Sheet Exposure

Balance at beginning of period

$

3,084

$

2,776

$

2,270

$

3,167

$

2,985

$

2,796

Provision (credit) for credit losses

(1,063

)

308

506

(897

)

182

$

(526

)

Allowance for credit losses at end of

period

$

2,021

$

3,084

$

2,776

$

2,270

$

3,167

$

2,270

Loan Classification - Total

Portfolio

Special Mention

$

58,758

$

48,712

$

46,302

$

50,368

$

65,993

$

50,368

Substandard

67,261

67,509

72,412

72,717

56,947

72,717

Ratio Analysis

Credit Quality

Nonperforming loans and leases/total loans

and leases

1.06

%

1.08

%

1.11

%

1.11

%

0.58

%

1.11

%

Nonperforming assets/total assets

0.78

%

0.79

%

0.81

%

0.80

%

0.41

%

0.80

%

Allowance for credit losses/total loans

and leases

0.94

%

0.92

%

0.92

%

0.92

%

0.91

%

0.92

%

Allowance/nonperforming loans and

leases

88.51

%

84.94

%

82.47

%

82.84

%

156.96

%

82.84

%

Net loan and lease losses (recoveries)

annualized/total average loans and leases

0.06

%

0.04

%

0.02

%

0.03

%

0.01

%

(0.01

)%

Capital Adequacy

Tier 1 Capital (to average assets)

9.19

%

9.15

%

9.08

%

9.08

%

9.01

%

9.08

%

Total Capital (to risk-weighted

assets)

13.21

%

13.26

%

13.43

%

13.36

%

13.46

%

13.36

%

Profitability (period-end)

Return on average assets *

0.94

%

0.81

%

0.87

%

0.78

%

(1.73

)%

0.12

%

Return on average equity *

10.65

%

9.51

%

10.18

%

9.56

%

(20.84

)%

1.50

%

Net interest margin (TE) *

2.79

%

2.73

%

2.73

%

2.82

%

2.75

%

2.84

%

Average yield on interest-earning

assets*

4.66

%

4.56

%

4.47

%

4.34

%

4.06

%

4.03

%

Average cost of deposits*

1.67

%

1.61

%

1.54

%

1.43

%

1.20

%

1.09

%

Average cost of funds*

2.01

%

1.96

%

1.86

%

1.62

%

1.41

%

1.27

%

* Quarterly ratios have been

annualized

Tompkins Financial Corporation - Summary Financial Data

(Unaudited) - continued

Non-GAAP Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (GAAP). Where non-GAAP disclosures are used

in this press release, the comparable GAAP measure, as well as

reconciliation to the comparable GAAP measure, is provided in the

below tables. The Company believes the non-GAAP measures provide

meaningful comparisons of our underlying operational performance

and facilitate management's and investors' assessments of business

and performance trends in comparison to others in the financial

services industry. These non-GAAP financial measures should not be

considered in isolation or as a measure of the Company's

profitability or liquidity; they are in addition to, and are not a

substitute for, financial measures under GAAP. The non-GAAP

financial measures presented herein may be different from non-GAAP

financial measures used by other companies, and may not be

comparable to similarly titled measures reported by other

companies. Further, the Company may utilize other measures to

illustrate performance in the future. Non-GAAP financial measures

have limitations since they do not reflect all of the amounts

associated with the Company's results of operations as determined

in accordance with GAAP.

Reconciliation of Tangible Book Value

Per Share (non-GAAP) to Common Equity Book Value Per Share

(GAAP)

Quarter-Ended

Year-Ended

Sep-24

Jun-24

Mar-24

Dec-23

Sep-23

Dec-23

Common equity book value per share

(GAAP)

$

50.01

$

46.86

$

46.37

$

46.41

$

42.57

$

46.41

Total common equity

$

719,855

$

674,630

$

667,906

$

668,522

$

610,851

$

668,522

Less: Goodwill and intangibles

93,760

93,847

93,926

94,003

94,086

94,003

Tangible common equity (Non-GAAP)

626,095

580,783

573,980

574,519

516,765

574,519

Ending shares outstanding

14,394,255

14,395,204

14,405,019

14,405,920

14,350,177

14,405,920

Tangible book value per share

(Non-GAAP)

$

43.50

$

40.35

$

39.85

$

39.88

$

36.01

$

39.88

(1) Average balances and yields on available-for-sale securities

are based on historical amortized cost. (2) Interest income

includes the tax effects of taxable-equivalent adjustments using an

effective income tax rate of 21% in 2024 and 2023 to increase tax

exempt interest income to taxable-equivalent basis. (3) Nonaccrual

loans are included in the average asset totals presented above.

Payments received on nonaccrual loans have been recognized as

disclosed in Note 1 of the Company's consolidated financial

statements included in Part I of the Company's Annual Report on

Form 10-K for the fiscal year ended December 31, 2023. (4) Earnings

per share for the full fiscal year may not equal the sum of the

quarterly earnings per share as a result of rounding of average

shares. (5) Amounts in prior periods' financial statements are

reclassified when necessary to conform to the current period's

presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025366968/en/

Stephen S. Romaine, President & CEO Matthew Tomazin,

Executive VP, CFO & Treasurer Tompkins Financial Corporation

(888) 503-5753

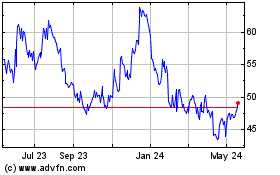

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

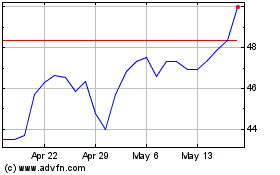

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Nov 2023 to Nov 2024