TIDMBMY

RNS Number : 5050A

Bloomsbury Publishing PLC

02 June 2021

BLOOMSBURY PUBLISHING PLC

("Bloomsbury" or "the Company")

Audited Preliminary Results for the year ended 28 February

2021

Excellent revenue and profit performance

Third profit upgrade

Special dividend declared

Bloomsbury, the leading independent publisher, today announces

audited results for the year ended 28 February 2021, ahead of

expectations.

Commenting on the results, Nigel Newton, Chief Executive, said

:

"The popularity of reading has been a ray of sunshine in an

otherwise very dark year. In an outstanding year for Bloomsbury, we

delivered record results with sales up 14% to GBP185.1 million

compared to the industry which was up 2%(1) . Our profit before tax

and highlighted items(4) of GBP19.2 million showed an increase of

22% over the prior year. These results are ahead of expectations

and represent our third upgrade this year. These performances

demonstrate the strength and resilience of our strategy of

publishing for both the general and academic market.

Our Consumer division delivered a stellar performance, with

profit before tax and highlighted items(4) up by 61% to GBP14.2

million, including excellent revenue growth of 22% across the Adult

and Children's divisions. Our diverse Consumer portfolio included

backlist titles which really struck a chord with readers throughout

the pandemic on themes such as humanity, social inclusion,

escapism, fantasy, cookery and baking.

In our Non-Consumer division, Bloomsbury Digital Resources

achieved phenomenal growth of 49%, with GBP12.4 million revenue.

Our academic digital growth also significantly outperformed the UK

market, with our digital resource strategy, conceived six years

ago, ahead of and benefitting from the structural shift to online

learning.

In light of our strong financial position and cash generation,

and the importance of delivering attractive shareholder returns in

accordance with our dividend policy, the Board proposes an increase

of 10% to our final dividend(2) . The Board greatly appreciates the

support of our shareholders during such unprecedented circumstances

last year, and we are also proposing a special dividend of 9.78

pence per share.

Since the year end, we have achieved another key step in the

delivery of our long term growth strategy expanding our

Non-Consumer business, with the acquisition of the Red Globe Press

list. Acquiring these complementary lists accelerates our digital

growth and our significant presence in humanities and social

sciences academic publishing.

Considering the ongoing momentum and strength of our business,

Bloomsbury expects revenue to be ahead and profit to be comfortably

ahead of market expectations for the year ended 28 February 2022(3)

.

I would like to express my thanks to our staff, authors,

illustrators, printers, distributors and suppliers for their

outstanding work and profound resilience over the last year. Our

ability to adapt to the rapidly changing conditions, together with

the strength of our strategy supported by our strong financial

position, has enabled Bloomsbury to emerge even stronger from this

crisis and deliver this excellent performance."

Financial Highlights

-- Revenues increased by 14% to GBP185.1 million (2019/20: GBP162.8 million)

-- Profit before taxation and highlighted items(4) grew by 22%

to GBP19.2 million, up from GBP15.7 million in 2019/20

-- Profit before taxation grew by 31% to GBP17.3 million (2019/20: GBP13.2 million)

-- Diluted earnings per share, excluding highlighted items(4) ,

grew by 15% to 18.68 pence (2019/20: 16.23 pence)(5)

-- Diluted earnings per share grew by 25% to 16.71 pence (2019/20: 13.40 pence)(5)

-- Net cash of GBP54.5 million at 28 February 2021, up 74% (2020: GBP31.3 million)

-- Cash conversion of 142% (2019/20: 111%)

-- Final dividend of 7.58 pence per share (2020: bonus issue

with a value equivalent to 6.89 pence per share(2) )

-- Special dividend of 9.78 pence per share

Operational Highlights

Consumer Division

-- Outstanding Consumer revenue growth of 22% to GBP118.3 million (2019/20: GBP96.8 million)

-- Consumer profit before taxation and highlighted items(4)

increased by 61% to GBP14.2 million (2019/20: GBP8.9 million)

-- Very strong Adult Trade performance, with revenue up 17% to

GBP43.7 million (2019/20: GBP37.4 million) and profit before

taxation and highlighted items(4) up 145% to GBP3.9 million

(2019/20: GBP1.6 million)

-- Excellent Children's Trade performance, with revenue growth

of 26% to GBP74.6 million (2019/20: GBP59.4 million) and profit

before taxation and highlighted items(3) up 42% to GBP10.4 million

(2019/20: GBP7.3 million)

-- Sales of Sarah J. Maas' titles grew by 129% and Harry Potter sales grew by 7%

-- Appointment of Ian Hudson as Managing Director, Consumer

Publishing, and Paul Baggaley, Editor-in-Chief, Adult Consumer

Publishing; an industry leading team to drive our ambitious growth

plans

Non-Consumer Division

-- Resilient Non-Consumer performance, with revenue growth of 1%

to GBP66.8 million (2019/20: GBP66.0 million)

-- Non-Consumer profit before taxation and highlighted items(4)

of GBP5.4 million (2019/20: GBP6.7 million)

-- Bloomsbury Digital Resources ("BDR") revenues growth of 49%

to GBP12.4 million (2019/20: GBP8.3 million) and profit of GBP2.9

million (2019/20: GBP0.7 million)

-- Digital format sales now comprise 33% of Non-Consumer revenues, a CAGR of 31% over four years

-- Good Academic & Professional performance, with revenue

growth of 3% to GBP44.3 million (2019/20: GBP43.1 million) and

profit before taxation and highlighted items(4) of GBP4.3 million

(2019/20: GBP4.8 million)

-- Acquisition of Red Globe Press' assets in April 2021 for

GBP3.7 million, accelerating our digital growth and our significant

presence in humanities and social sciences academic publishing

-- Voted Academic Publisher of the Year at the 2021 British Book Awards

-- BDR partnerships with Taylor & Francis and Human Kinetics

launched and new partnerships with Yale University Press, Liverpool

University Press and the Stratford Festival

Notes

(1) Publishers Association: 2020 UK market up 2% year-on-year.

(2) 2019/20: bonus issue in lieu of, and with a value equivalent

to, proposed final dividend of 6.89 pence per share.

(3) The Board considers current consensus market expectation for

the year ending 28 February 2022 to be revenue of GBP177.5 million

and profit before taxation and highlighted items of GBP17.4

million.

(4) Highlighted items comprise amortisation of acquired

intangible assets, legal and other professional costs relating to

ongoing and completed acquisitions and restructuring costs, and a

grant under the US Government Paycheck Protection Program.

(5) Restatement of earnings per share due to bonus issue of shares in the year.

For further information, please contact:

Bloomsbury Publishing Plc

Nigel Newton, Chief Executive nigel.newton@bloomsbury.com

Penny Scott-Bayfield, Group Finance penny.scott-bayfield@bloomsbury.com

Director

Hudson Sandler +44 (0) 20 7796 4133

Dan de Belder / Rebekah Chapman bloomsbury@hudsonsandler.com

Certain statements, statistics and projections in this

announcement are or may be forward looking. By their nature,

forward--looking statements involve a number of risks,

uncertainties or assumptions that may or may not occur and actual

results or events may differ materially from those expressed or

implied by the forward-looking statements. Accordingly, no

assurance can be given that any particular expectation will be met

and reliance should not be placed on any forward-looking statement.

Accordingly, forward-looking statements contained in this

announcement regarding past trends or activities should not be

taken as representation that such trends or activities will

continue in the future. You should not place undue reliance on

forward-looking statements, which are based on the knowledge and

information available only at the date of this announcement's

preparation.

The Company does not undertake any obligation to update or keep

current the information contained in this announcement, including

any forward--looking statements, or to correct any inaccuracies

which may become apparent and any opinions expressed in it are

subject to change without notice.

References in this announcement to other reports or materials,

such as a website address, have been provided to direct the reader

to other sources of information on Bloomsbury Publishing Plc which

may be of interest. Neither the content of Bloomsbury's website nor

any website accessible by hyperlinks from Bloomsbury's website nor

any additional materials contained or accessible thereon, are

incorporated in, or form part of, this announcement.

Chief Executive's statement

Overview

The popularity of reading has been a ray of sunshine in an

otherwise very dark year. The year ended 28 February 2021 saw an

outstanding performance by Bloomsbury, with 14% revenue growth to

GBP185.1 million (2019/20: GBP162.8 million) and a 22% increase in

profit before taxation and highlighted items to GBP19.2 million

(2019/20: GBP15.7 million). Profit before taxation increased by 31%

to GBP17.3 million (2019/20: GBP13.2 million).

The strength of demand for our titles, in print, e-book and

audio, and the surge in sales of our digital products, demonstrate

the strength of our long-term growth strategy.

Our Bloomsbury Digital Resources ("BDR") strategy positioned us

well to deliver further growth from the accelerated shift to

digital learning, with a 73% increase in the number of Academic

customers during the year. BDR delivered 49% revenue growth

year-on-year and generated profit of GBP2.9 million (2019/20:

GBP0.7 million).

The highlighted items of GBP1.8 million (2019/20: GBP2.5

million) consist of the amortisation of acquired intangible assets

of GBP1.8 million (2019/20: GBP1.7 million), one-off legal and

other professional fees relating to the acquisitions and

restructuring costs of GBP1.3 million (2019/20: GBP0.6 million) and

a one-off US government grant under the Paycheck Protection Program

of (GBP1.3 million). The effective rate of tax for the year was 21%

(2019/20: 21%). The adjusted effective rate of tax, excluding

highlighted items, was 20% (2019/20: 19%). Diluted earnings per

share, excluding highlighted items, grew 15% to 18.68 pence

(2019/20: 16.23 pence). Including highlighted items, profit before

tax was GBP17.3 million (2019/20: GBP13.2 million) and diluted

earnings per share grew 25% to 16.71 pence (2019/20: 13.40

pence).

Strategy

Bloomsbury's long-term growth strategy is aimed at diversifying

into digital channels and building quality revenues, increasing

earnings and building on the success of the last six years. To

achieve this, we are focused on a number of long-term strategic

objectives, which include:

-- Non-Consumer

o Grow Bloomsbury's portfolio in Non-Consumer publishing.

Non-Consumer publishing is characterised by higher, more

predictable margins and greater digital and global opportunities.

2020/21: delivered 52% growth in Non-Consumer digital.

o Achieve BDR revenue of GBP15 million and profit of GBP5

million for 2021/22. 2020/21: delivered GBP12.4 million revenue, up

49%, and profit of GBP2.9 million, up GBP2.2 million.

-- Consumer

o Discover, nurture, champion and retain high-quality authors

and illustrators, while looking at new ways to leverage existing

title rights. 2020/21: Bestsellers included Why I'm No Longer

Talking to White People About Race by Reni Eddo-Lodge, Such a Fun

Age by Kiley Reid, Piranesi by Susanna Clarke and Humankind by

Rutger Bregman.

o Grow our key authors through effective publishing across all

formats alongside strategic sales and marketing. 2020/21: 129%

growth in sales of Sarah J. Maas title sales, with both new titles:

Crescent City: House of Earth and Blood and A Court of Silver

Flames reaching Number One on the New York Times bestseller

list.

o As the originating publisher of J.K. Rowling's Harry Potter,

to ensure that new children discover and read it for pleasure every

year. 2020/21: 7% growth in Harry Potter title sales, 23 years

after first publication.

-- International Expansion

o Expand international revenues and reduce reliance on UK

market: 2020/21: increased overseas revenues to 64% of Group

revenue; 81% of Academic BDR sales are international.

-- Employee Experience and Engagement

Our success is driven by our colleagues' expertise, passion and

commitment. We understand the importance of attracting, supporting

and engaging colleagues wherever they work.

o To be an attractive employer for all individuals seeking a

career in publishing regardless of background or identity;

o Focus on targeted initiatives to create an environment that

promotes diversity, nurtures talent, stimulates creativity and

collaboration, supports well-being and is respectful of

difference.

o 2020/21: Expanded our Diversity and Inclusion ("D&I")

Working Groups, supported by our nine employee-led network

groups;

o Appointed Baroness Young to the Board to help Bloomsbury

improve our D&I practices;

o With our staff, we are working on recruitment, staff

engagement, training and our networks;

o With our publishing, we seek to publish diverse voices. We

intend to monitor our publishing so we can ensure our list balance

is representative of the societies we live in, and partner with

organisations that can help us achieve these aims;

o Continued focus on employee engagement and development

initiatives, including Employee Voice Meetings, monthly online Town

Halls and our apprenticeship and mentoring schemes; and

o Increased flexible working to support employees.

-- Sustainability

o Continue to switch to renewable energy across all sites, with

the goal of Net Zero emissions in line with the Paris

Agreement.

o 2020/2021: Measured scope 1 and 2 emissions, our operational

footprint, and set reduction targets in line with the Paris

Agreement. Measured scope 3 emissions for the first time and set

targets; we are committed to working with our suppliers to make

further significant emissions reductions across our supply chain.

Our scope 1, 2 and 3 targets have been submitted to the SBTi for

validation;

o Bloomsbury was recognised by the Financial Times' 'Europe's

Climate Leaders 2021' - the 300 companies that achieved the

greatest reduction in their greenhouse gas emissions intensity

between 2014 and 2019, aligned with revenue growth;

o Supporting the Woodland Trust and Reforest'Action for three

years.

Consumer Division

The Consumer division consists of Adult and Children's trade

publishing. The Consumer division generated outstanding revenue

growth of 22% to GBP118.3 million (2019/20: GBP96.8 million).

Profit before taxation and highlighted items increased by 61% to

GBP14.2 million (2019/20: GBP8.9 million). Profit before taxation

increased to GBP14.2 million (2019/20: GBP8.8 million). The

excellent performance was from both the Adult and Children's

divisions, across front and backlist titles.

Bloomsbury's Consumer growth outperformed the rest of the UK

market, in both print and digital formats; the Publishers

Association reported Consumer growth of 7% for 2020.

Adult Trade

The Adult division achieved very strong growth with a 17%

increase in revenue to GBP43.7 million (2019/20: GBP37.4 million)

and profit before taxation and highlighted items increasing by 145%

to GBP3.9 million (2019/20: GBP1.6 million). This was driven by

bestsellers from our front and backlist.

Bestsellers in the year from our backlist included the Sunday

Times and New York Times bestseller Why I'm No Longer Talking to

White People About Race by Reni Eddo-Lodge, the Sunday Times

bestsellers Such a Fun Age by Kiley Reid, Lose Weight and Get Fit

by Tom Kerridge and Three Women by Lisa Taddeo. New York Times

bestsellers included White Rage by Carol Anderson and Women Rowing

North by Mary Pipher. Further backlist bestsellers included

Dishoom: From Bombay with Love by Shamil Thakrar, Kavi Thakrar and

Naved Nasir and The Song of Achilles by Madeline Miller.

Frontlist success came from new titles including Humankind by

Rutger Bregman, the New York Times bestsellers Piranesi by Susanna

Clarke and Outlawed by Anna North , The Book of Trespass by Nick

Hayes, We Are Bellingcat by Eliot Higgins and The Mask Falling by

Samantha Shannon.

Children's Trade

Children's sales also delivered excellent growth, with a 26%

increase to GBP74.6 million (2019/20: GBP59.4 million). Profit

before taxation and highlighted items increased by 42% to GBP10.4

million (2019/20: GBP7.3 million). Sales of the Harry Potter titles

were 7% ahead of last year. Harry Potter and the Philosopher's

Stone was the third bestselling children's book of the year on UK

Nielsen Bookscan. Harry Potter and the Philosopher's Stone, Harry

Potter and the Chamber of Secrets and Harry Potter and the

Half-Blood Prince were all Sunday Times bestsellers in the year,

showing the reach of this classic series, twenty three years after

it first began.

Sarah J. Maas' sales grew by 129% compared to last year, with

two new New York Times and Sunday Times bestselling titles

published during the year: Crescent City: House of Earth and Blood,

in March 2020, and A Court of Silver Flames, in February 2021, and

strong backlist sales. Other highlights on the Children's list

included the third in Brigid Kemmerer's Cursebreaker trilogy, A Vow

So Bold and Deadly, Skysteppers by Katherine Rundell, Cinderella is

Dead by Kaylynn Bayron, The World Made a Rainbow by Michelle

Robinson, illustrated by Emily Hamilton, and Ways to Make Sunshine

and Love is a Revolution by Renee Watson.

Non-Consumer Division

The Non-Consumer division consists of Academic &

Professional, including Bloomsbury Digital Resources, and Special

Interest. Revenues in the division increased by 1% to GBP66.8

million (2019/20: GBP66.0 million). Profit before taxation and

highlighted items for the Non-Consumer division was GBP5.4 million

(2019/20: GBP6.7 million). Profit before taxation was GBP3.6

million (2019/20: GBP5.0 million).

Academic & Professional revenues increased by 3% to GBP44.3

million (2019/20: GBP43.1 million) and profit before taxation and

highlighted items was GBP4.3 million (2019/20: GBP4.8 million). The

accelerated demand for digital products and swift adoption of

digital learning by academic institutions helped drive excellent

performance of BDR and accelerated demand for e-books, which offset

reduced print sales. Our Academic digital growth outperformed the

rest of the UK market, with our BDR digital strategy, conceived six

years ago, ahead of and benefitting from the market changes. Our

achievements were recognised at the 2021 British Book Awards,

winning Academic Publisher of the Year.

We are focused on delivering further digital growth from

accelerating our established and most successful digital products,

including the award-winning Drama Online, building partnerships and

launching new products. Key achievements during the year,

demonstrating the opportunities to further leverage our digital

platforms and content, were:

o 73% increase in the number of Academic customers during the

year ;

o Maintaining our customer renewal rate above 90%;

o Growth of Bloomsbury Collections to over 13,000 front and

backlist Bloomsbury Academic titles; over 40% higher than last

year. These include titles from our acquisitions of Oberon and

Zed;

o Launch of the new content partnerships with Taylor &

Francis and Human Kinetics;

o New partnerships with Yale University Press, Liverpool

University Press and the Stratford Festival.

Special Interest revenue was GBP22.5 million (2019/20: GBP22.9

million), and profit before taxation and highlighted items was

GBP1.1 million (2019/20: GBP1.9 million), with resilient demand for

wildlife titles, Wisden and Osprey games during the year.

Acquisitions

In March 2020, we acquired certain assets of Zed Books Limited,

the academic and non-fiction publisher. The consideration was

GBP1.7 million, of which GBP1.5 million was satisfied in cash on

completion and during the year and the remainder paid in March

2021. Zed has been integrated into Bloomsbury's Academic &

Professional division.

During the year we also integrated Oberon Books Ltd ("Oberon"),

acquired in December 2019, into the Academic & Professional

division, and included its key titles in Drama Online.

Since the year end, in April 2021, we have achieved another key

step in the delivery of our strategic growth strategy and driving

our Non-Consumer business, with the acquisition of certain assets

of Red Globe Press ("RGP"), the academic imprint, from Springer

Nature Group as previously announced. The consideration was GBP3.7

million, GBP1.8 million of which was satisfied in cash on

completion in June 2021. The acquired RGP titles are a good

strategic fit, strengthen Bloomsbury's existing academic

publishing, and establish new areas of academic publishing in

Business and Management, Study Skills and Psychology. RGP's three

digital products will be migrated to BDR's own platform and its

content added to Bloomsbury Collections.

Bloomsbury has a strong and successful track record in strategic

acquisitions, with 17 acquisitions completed since 2008. We are

actively targeting further acquisition opportunities in line with

our long-term growth strategy.

Cash and financing

Bloomsbury's cash generation was strong with cash at the year

end of GBP54.5 million, up GBP23.1 million, and cash conversion of

142% (2019/20: 111%). During the year we invested GBP1.1 million of

capital expenditure in BDR and GBP1.5 million of the GBP1.7 million

cash consideration for the acquisition of Zed Books Limited.

The Group has an unsecured revolving credit facility with Lloyds

Bank Plc. The facility comprises a committed revolving loan

facility of GBP8 million in the first half and an additional GBP4

million in the second half, totalling GBP12 million, to match

Bloomsbury's cashflow cycle, and an uncommitted incremental term

loan facility of up to GBP6 million. At 28 February 2021, the Group

had no draw down (2020: GBPnil) of this facility.

Dividend

The Group has a progressive dividend policy aiming to keep

dividend earnings cover in excess of two times, supported by strong

cash cover. The Board is recommending a final dividend of 7.58

pence per share, totalling GBP6.2 million. Together with the

interim dividend, this makes a total dividend for the year ended 28

February 2021 of 8.86 pence per share, an 8% increase on the 8.17

pence value of the dividend for the year ended 29 February

2020.

The Board greatly appreciates the support of our shareholders

during such unprecedented circumstances last year and we are also

proposing a special dividend of 9.78 pence per share, totalling

GBP8.0 million.

Subject to Shareholder approval at our AGM on 21 July 2021, the

final and special dividend will be paid on 27 August 2021 to

Shareholders on the register on the record date of 30 July

2021.

Including the proposed 2020/21 final dividend, over the past ten

years, the dividend has increased at a compound annual growth rate

of 6.5%.

Social Initiatives

As part of Bloomsbury's ongoing commitment to our wider

communities, and in addition to our focus on promoting literature,

literacy and education, we actively support numerous organisations

worldwide. We published The Book of Hopes: Words and Picture to

Comfort, Inspire and Entertain Children, edited by Katherine

Rundell, with contributions from more than 110 children's writers

and illustrators. A donation from the sale of each book is made to

NHS Charities Together. We also published The World Made a Rainbow,

by Michelle Robinson and Emily Hamilton, with a donation from the

sale of each book being made to Save the Children. In addition to

our donation to Black Lives Matter, in partnership with Waterstones

in July 2020, we donated 10% of profits of sales of Reni

Eddo-Lodge's Why I'm No Longer Talking to White People About Race

to BTEG and Inquest.

We also supported the Society of Authors emergency appeal fund

and The Trussell Trust's network of foodbanks. These initiatives

are in addition to our three-year partnership with the National

Literacy Trust, which included our financial support for their

emergency appeal to help support children, parents, teachers and

schools through the pandemic, our educational resources and

activity ideas made available through their website and donation of

over 60,000 books. In addition, for every copy of Dishoom: From

Bombay with Love sold, we donate towards the price of a meal for a

hungry child to both of Dishoom's chosen charities, Magic Breakfast

and The Akshaya Patra Foundation.

Coronavirus Victims

We also share the sad news of the loss of two colleagues in

India from coronavirus. Yogesh Sharma, Senior Vice President for

Sales and Marketing, who passed away in May, was a founding member

of Bloomsbury India and his contribution to the growth of the

company was vital. Aravind Murthy, Bloomsbury's India's Regional

Sales Manager-South, passed away in April. Aravind was an amazing

sales manager, very dependable, hardworking, focused, and

passionate about his work. We will miss them deeply and send our

sympathy and support to the families of Aravind and Yogesh and to

our colleagues in India.

Board Changes

As announced in December 2020, Baroness Lola Young of Hornsey

joined the Board as a Non-Executive Director on 1 January 2021.

Baroness Young also became a member of the Nomination

Committee.

In addition, John Warren will step down from the Board at the

conclusion of Bloomsbury's 2021 AGM taking place on 21 July 2021.

John joined the Board in 2015 and is the Senior Independent

Director and Chair of the Audit Committee. It is intended that John

will be succeeded by Leslie-Ann Reed as Chair of the Audit

Committee and Senior Independent Director.

Sir Richard Lambert, Chairman of Bloomsbury, said: "On behalf of

myself, the Chief Executive, Nigel Newton, and the Board, I would

like to thank John for his tremendous contribution to Bloomsbury

during his six-year tenure. John has been a wonderful colleague -

rigorous, shrewd and good humoured. He will be much missed."

Future Publishing

Our BDR strategic initiatives include the launch of a new Drama

Online collection from the market-leading US drama publisher

Theatre Communications Group, expanding Bloomsbury Collections to

include more than 7,000 Red Globe Press titles and the migration of

Red Globe Press' three digital products to BDR's own platform.

Our strong Consumer publishing list for 2021/22 includes Tom

Kerridge's Outdoor Cooking: The Ultimate Modern Barbeque Bible,

Lost Focus by Johan Hari, Gino's Italian Family Adventure by Gino

D'Acampo and Animal by Lisa Taddeo.

We will be publishing the Sarah J. Maas' second Crescent City

title, House of Sky and Breath, in January 2022. Our Children's

frontlist for 2021/22 includes Harry Potter - A Magical Year: The

Illustrations of Jim Kay, a beautiful new gift book with a moment

for every day of the year, Defy the Night , the much-anticipated

new series from Brigid Kemmerer, and Renée Watson 's new book Ways

To Grow Love.

Outlook

The start of our 2021/22 has seen a continuation of strong

trading. Whilst the Board remains mindful of the external

environment, the outstanding performance in 2020/21 increases our

confidence in the strength of the business and long-term

strategy.

At this early stage of the new financial year, and considering

the ongoing momentum and strength of our business, Bloomsbury

expects revenue to be ahead and profit to be comfortably ahead of

market expectations for the year ended 28 February 2022.*

* The Board considers current consensus market expectation for

the year ending 28 February 2022 to be revenue of GBP177.5 million

and profit before taxation and highlighted items of GBP17.4

million.

Audited Consolidated Income Statement

FOR THE YEARED 28 FEBRUARY 2021

Year ended Year ended

28 February 29 February

2021 2020

Notes GBP'000 GBP'000

---------------------------------------- ------ ------------ ------------

Revenue 2 185,136 162,772

Cost of sales (85,533) (74,978)

---------------------------------------- ------ ------------ ------------

Gross profit 99,603 87,794

Marketing and distribution costs (23,393) (21,373)

Administrative expenses (58,267) (52,949)

Share of result of joint venture (110) -

---------------------------------------- ------ ------------ ------------

Operating profit before highlighted

items 19,637 15,947

Highlighted items 3 (1,804) (2,475)

---------------------------------------- ------ ------------ ------------

Operating profit 17,833 13,472

Finance income 120 270

Finance costs (604) (513)

---------------------------------------- ------ ------------ ------------

Profit before taxation and highlighted

items 19,153 15,704

Highlighted items 3 (1,804) (2,475)

---------------------------------------- ------ ------------ ------------

Profit before taxation 17,349 13,229

Taxation 4 (3,652) (2,728)

---------------------------------------- ------ ------------ ------------

Profit for the year attributable

to owners of the Company 13,697 10,501

---------------------------------------- ------ ------------ ------------

Earnings per share attributable to

owners of the Company

Basic earnings per share 6 16.94p 13.58p

Diluted earnings per share 6 16.71p 13.40p

---------------------------------------- ------ ------------ ------------

Audited Consolidated Statement of Comprehensive Income

FOR THE YEARED 28 FEBRUARY 2021

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 GBP'000

------------------------------------------------------ ------------ ------------

Profit for the year 13,697 10,501

Other comprehensive income

Items that may be reclassified to the income

statement:

Exchange differences on translating foreign

operations (2,877) 856

Items that may not be reclassified to the

income statement:

Remeasurements on the defined benefit pension

scheme 89 (115)

------------------------------------------------------ ------------ ------------

Other comprehensive income for the year net

of tax (2,788) 741

Total comprehensive income for the year attributable

to the owners of the Company 10,909 11,242

------------------------------------------------------ ------------ ------------

Items in the statement above are disclosed net of tax.

Audited Consolidated Statement of Financial Position

AS AT 28 FEBRUARY 2021

28 February 29 February

2021 2020

Notes GBP'000 GBP'000

---------------------------------------- ------ ------------ ------------

Assets

Goodwill 44,688 45,030

Other intangible assets 21,337 21,630

Investments 162 516

Property, plant and equipment 1,846 1,914

Right-of-use assets 11,433 13,343

Deferred tax assets 3,904 2,756

Trade and other receivables 7 1,005 1,237

---------------------------------------- ------ ------------ ------------

Total non-current assets 84,375 86,426

---------------------------------------- ------ ------------ ------------

Inventories 26,774 27,164

Trade and other receivables 7 93,542 84,805

Cash and cash equivalents 54,466 31,345

---------------------------------------- ------ ------------ ------------

Total current assets 174,782 143,314

---------------------------------------- ------ ------------ ------------

Total assets 259,157 229,740

---------------------------------------- ------ ------------ ------------

Liabilities

Retirement benefit obligations 14 185

Deferred tax liabilities 2,386 2,347

Lease liabilities 11,135 12,945

Provisions 232 182

---------------------------------------- ------ ------------ ------------

Total non-current liabilities 13,767 15,659

---------------------------------------- ------ ------------ ------------

Trade and other liabilities 74,341 61,844

Lease liabilities 1,808 1,585

Current tax liabilities 456 328

Provisions 536 651

Total current liabilities 77,141 64,408

---------------------------------------- ------ ------------ ------------

Total liabilities 90,908 80,067

---------------------------------------- ------ ------------ ------------

Net assets 168,249 149,673

---------------------------------------- ------ ------------ ------------

Equity

Share capital 1,020 942

Share premium 47,319 39,388

Translation reserve 6,630 9,507

Other reserves 9,623 7,778

Retained earnings 103,657 92,058

---------------------------------------- ------ ------------ ------------

Total equity attributable to owners of

the Company 168,249 149,673

---------------------------------------- ------ ------------ ------------

Audited Consolidated Statement of Changes in Equity

AS AT 28 FEBRUARY 2021

Capital Share-based Own shares

Share Share Translation Merger redemption payment held by Retained Total

capital premium reserve reserve reserve reserve EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

At 28 February

2019 942 39,388 8,651 1,803 22 6,095 (802) 87,639 143,738

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Profit for the

year - - - - - - - 10,501 10,501

Other

comprehensive

income

Exchange

differences

on translating

foreign

operations - - 856 - - - - - 856

Remeasurements

on the defined

benefit

pension

scheme - - - - - - - (115) (115)

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Total

comprehensive

income for the

year - - 856 - - - - 10,386 11,242

Transactions

with

owners

Dividends to

equity

holders of the

Company - - - - - - - (6,009) (6,009)

Share options

exercised - - - - - - 31 (4) 27

Deferred tax on

share-based

payment

transactions - - - - - - - 46 46

Share-based

payment

transactions - - - - - 629 - - 629

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Total

transactions

with owners of

the Company - - - - - 629 31 (5,967) (5,307)

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

At 29 February

2020 942 39,388 9,507 1,803 22 6,724 (771) 92,058 149,673

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Profit for the

year - - - - - - - 13,697 13,697

Other

comprehensive

income

Exchange

differences

on translating

foreign

operations - - (2,877) - - - - - (2,877)

Remeasurements

on the defined

benefit

pension

scheme - - - - - - - 89 89

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Total

comprehensive

income for the

year - - (2,877) - - - - 13,786 10,909

Transactions

with

owners

Issue of share

capital 47 7,931 - - - - - - 7,978

Bonus issue of

share capital 31 - - - - - - (31) -

Dividends to

equity

holders of the

Company

Purchase of

shares

by the - - - - - - - (1,045) (1,045)

Employee

Benefit Trust - - - - - - (674) - (674)

Share options

exercised - - - - - - 1,298 (1,114) 184

Deferred tax on

share-based

payment

transactions - - - - - - - 3 3

Share-based

payment

transactions - - - - - 1,221 - - 1,221

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Total

transactions

with owners of

the Company 78 7,931 - - - 1,221 624 (2,187) 7,667

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

At 28 February

2021 1,020 47,319 6,630 1,803 22 7,945 (147) 103,657 168,249

--------------- -------- -------- ----------- --------- ----------- ----------- ---------- --------- --------

Audited Consolidated Statement of Cash Flows

FOR THE YEARED 28 FEBRUARY 2021

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 GBP'000

-------------------------------------------------- ------------ ------------

Cash flows from operating activities

Profit for the year 13,697 10,501

Adjustments for:

Depreciation of property, plant and equipment 473 502

Depreciation of right-of-use assets 1,806 1,775

Amortisation of intangible assets 5,485 4,301

Impairment of investments 300 -

Finance income (120) (270)

Finance costs 604 513

Share of loss of Joint Venture 110 7

Share-based payment charges 1,416 761

Tax expense 3,652 2,728

-------------------------------------------------- ------------ ------------

27,423 20,818

Increase in inventories (357) (620)

Increase in trade and other receivables (11,281) (4,385)

Increase in trade and other liabilities 13,789 2,489

-------------------------------------------------- ------------ ------------

Cash generated from operating activities 29,574 18,302

Income taxes paid (4,406) (1,706)

-------------------------------------------------- ------------ ------------

Net cash generated from operating activities 25,168 16,596

-------------------------------------------------- ------------ ------------

Cash flows from investing activities

Purchase of property, plant and equipment (422) (294)

Purchase of intangible assets (3,804) (3,137)

Purchase of business, net of cash acquired - (310)

Purchase of rights to assets (1,547) (1,213)

Purchase of joint ventures

Interest received (56) (223)

--------------------------------------------------

110 254

-------------------------------------------------- ------------ ------------

Net cash used in investing activities (5,719) (4,923)

-------------------------------------------------- ------------ ------------

Cash flows from financing activities

Equity dividends paid (1,045) (6,009)

Purchase of shares by the Employee Benefit Trust (674) -

Proceeds from exercise of share options 184 27

Proceeds from share issue 7,978 -

Repayment of lease liabilities (1,451) (1,531)

Lease liability interest paid (442) (492)

Interest paid (149) (3)

-------------------------------------------------- ------------ ------------

Net cash from/ (used) in financing activities 4,401 (8,008)

-------------------------------------------------- ------------ ------------

Net increase in cash and cash equivalents 23,850 3,665

Cash and cash equivalents at beginning of year 31,345 27,580

Exchange (loss)/gain on cash and cash equivalents (729) 100

-------------------------------------------------- ------------ ------------

Cash and cash equivalents at end of year 54,466 31,345

-------------------------------------------------- ------------ ------------

NOTES

1. Accounting policies

a) Basis of Preparation

The financial information set out above does not constitute the

company's statutory accounts for the years ended 28 February 2021

or 29 February 2020 but is derived from those accounts. Statutory

accounts for 2020 have been delivered to the registrar of

companies, and those for 2021 will be delivered in due course. The

auditor has reported on those accounts; their reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The Group financial statements were prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and the Group financial

statements were also prepared in accordance with international

financial reporting standards ("IFRS") adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union.

Except as described below, the accounting policies applied in the

year ended 28 February 2021 are consistent with those applied in

the financial statements for year ended 29 February 2020 with the

exception of a number of new accounting standards and amendments

which have not had a material impact on the Group's results.

b) Going concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence at least 12

months from the date of this preliminary announcement, being the

period of the detailed going concern assessment reviewed by the

Board, and therefore continue to adopt the going concern basis of

accounting in preparing the condensed consolidated financial

statements.

The Board has modelled a severe but plausible downside scenario,

including the impact of coronavirus. This assumes:

-- Print revenues are reduced by 25% - 50% during 2021/22, with recovery during 2022/23;

-- Downside assumptions about extended debtor days during

2021/22, with recovery during 2022/23;

-- Cash preservation measures implemented and variable costs reduced.

Under this severe but plausible downside scenario, the Group has

sufficient liquidity to be able to manage these downside

assumptions.

The Group has an unsecured revolving credit facility with Lloyds

Bank Plc. The facility comprises a committed revolving loan

facility of GBP8 million in the first half and an additional GBP4

million in the second half, totalling GBP12 million, to match

Bloomsbury's cashflow cycle, and an uncommitted incremental term

loan facility of up to GBP6 million. The facilities are subject to

two covenants, being a maximum net debt to EBITDA ratio of 2.5x and

a minimum interest cover covenant of 4x. The agreement is to May

2022.

At 28 February 2021, the Group had no draw down of this

facility.

2. Revenue and segmental analysis

The Group is comprised of two worldwide publishing divisions:

Consumer and Non-Consumer, reflecting the core customers for our

different operations. The Consumer division is split into two

operating segments: Children's Trade and Adult Trade, and

Non-Consumer is split into two operating segments: Academic &

Professional and Special Interest.

Each reportable segment represents a cash-generating unit for

the purpose of impairment testing. We have allocated goodwill

between reportable segments. These divisions are the basis on which

the Group primarily reports its segment information. Segments

derive their revenue from book publishing, sale of publishing and

distribution rights, management and other publishing services.

The analysis by segment is shown below:

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Interest

Professional

Year ended 28 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

February 2021 GBP'000 GBP'000 GBP'000

---------------- ----------- --------- --------- ------------- ---------- ------------- ------------ ---------

External

revenue 74,599 43,761 118,360 44,307 22,469 66,776 - 185,136

Cost of sales (37,128) (20,812) (57,940) (16,767) (10,826) (27,593) - (85,533)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Gross profit 37,471 22,949 60,420 27,540 11,643 39,183 - 99,603

Marketing and

distribution

costs (9,386) (6,278) (15,664) (4,678) (3,051) (7,729) - (23,393)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Contribution

before

administrative

expenses 28,085 16,671 44,756 22,862 8,592 31,454 - 76,210

Administrative

expenses

excluding

highlighted

items (17,543) (12,706) (30,249) (18,494) (7,420) (25,914) (300) (56,463)

Share of result

of joint

venture - - - - - - (110) (110)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Operating

profit/(loss)

before

highlighted

items/ segment

results 10,542 3,965 14,507 4,368 1,172 5,540 (410) 19,637

Amortisation of

acquired

intangible

assets - (17) (17) (1,578) (214) (1,792) - (1,809)

Other

highlighted

items - - - - - - 5 5

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Operating

profit/(loss) 10,542 3,948 14,490 2,790 958 3,748 (405) 17,833

Finance income - - - 51 - 51 69 120

Finance costs (161) (105) (266) (117) (59) (176) (162) (604)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit/(loss)

before

taxation

and

highlighted

items 10,381 3,860 14,241 4,302 1,113 5,415 (503) 19,153

Amortisation of

acquired

intangible

assets - (17) (17) (1,578) (214) (1,792) - (1,809)

Other

highlighted

items - - - - - - 5 5

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit/(loss)

before

taxation 10,381 3,843 14,224 2,724 899 3,623 (498) 17,349

Taxation - - - - - - (3,652) (3,652)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit/(loss)

for the year 10,381 3,843 14,224 2,724 899 3,623 (4,150) 13,697

---------------- ----------- --------- --------- ------------- ---------- ------------- ------------ ---------

Operating

profit/(loss)

before

highlighted

items/ segment

results 10,542 3,965 14,507 4,368 1,172 5,540 (410) 19,637

Depreciation 912 528 1,440 556 283 839 - 2,279

Amortisation of

internally

generated

intangibles 446 383 829 2,586 261 2,847 - 3,676

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

EBITDA before

highlighted

items 11,900 4,876 16,776 7,510 1,716 9,226 (410) 25,592

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Interest

Professional

Year ended 29 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

February 2020 GBP'000 GBP'000 GBP'000

---------------- ----------- --------- --------- ------------- ---------- ------------- ------------ ---------

External

revenue 59,354 37,416 96,770 43,123 22,879 66,002 - 162,772

Cost of sales (30,840) (19,627) (50,467) (13,606) (10,905) (24,511) - (74,978)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Gross profit 28,514 17,789 46,303 29,517 11,974 41,491 - 87,794

Marketing and

distribution

costs (8,269) (5,619) (13,888) (4,636) (2,849) (7,485) - (21,373)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Contribution

before

administrative

expenses 20,245 12,170 32,415 24,881 9,125 34,006 - 66,421

Administrative

expenses

excluding

highlighted

items (12,845) (10,503) (23,348) (19,975) (7,151) (27,126) - (50,474)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Operating

profit before

highlighted

items/ segment

results 7,400 1,667 9,067 4,906 1,974 6,880 - 15,947

Amortisation of

acquired

intangible

assets - (18) (18) (1,504) (214) (1,718) - (1,736)

Other

highlighted

items - - - - - - (739) (739)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Operating

profit/(loss) 7,400 1,649 9,049 3,402 1,760 5,162 (739) 13,472

Finance income - - - 116 - 116 154 270

Finance costs (110) (94) (204) (201) (88) (289) (20) (513)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit before

taxation and

highlighted

items 7,290 1,573 8,863 4,821 1,886 6,707 134 15,704

Amortisation of

acquired

intangible

assets - (18) (18) (1,504) (214) (1,718) - (1,736)

Other

highlighted

items - - - - - - (739) (739)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit/(loss)

before

taxation 7,290 1,555 8,845 3,317 1,672 4,989 (605) 13,229

Taxation - - - - - - (2,728) (2,728)

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

Profit/(loss)

for the year 7,290 1,555 8,845 3,317 1,672 4,989 (3,333) 10,501

---------------- ----------- --------- --------- ------------- ---------- ------------- ------------ ---------

Operating

profit before

highlighted

items/ segment

results 7,400 1,667 9,067 4,906 1,974 6,880 - 15,947

Depreciation 821 515 1,336 626 315 941 - 2,277

Amortisation of

internally

generated

intangibles 360 210 570 1,817 178 1,995 - 2,565

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

EBITDA before

highlighted

items 8,581 2,392 10,973 7,349 2,467 9,816 - 20,789

---------------- ----------- --------- --------- ------------- ---------- ------------ ---------

External revenue by source

United

Kingdom North America Australia India Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- --------- -------- --------

Year ended 28 February

2021 117,429 53,872 11,084 2,751 185,136

------------------------ -------- ------------- --------- -------- --------

Year ended 29 February

2020 104,440 42,415 11,107 4,810 162,772

------------------------ -------- ------------- --------- -------- --------

During the year sales to one customer exceeded 10% of Group

revenue (2020: one customer). The value of these sales was

GBP68,597,000 (2020: GBP43,405,000).

External revenue by product type

Children's Adult Academic Special

Year ended 28 February Trade Trade Consumer & Professional Interest Non-Consumer Total

2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ---------- -------- -------- --------------- --------- ------------ --------

Print 63,708 34,644 98,352 23,267 18,200 41,467 139,819

Digital 7,636 8,298 15,934 19,015 2,730 21,745 37,679

Rights and Services(1) 3,255 819 4,074 2,025 1,539 3,564 7,638

Total 74,599 43,761 118,360 44,307 22,469 66,776 185,136

----------------------- ---------- -------- -------- --------------- --------- ------------ --------

Children's Adult Academic Special

Year ended 29 February Trade Trade Consumer & Professional Interest Non-Consumer Total

2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ---------- -------- -------- --------------- --------- ------------ --------

Print 52,646 29,460 82,106 28,438 18,571 47,009 129,115

Digital 3,029 6,772 9,801 12,099 2,235 14,334 24,135

Rights and Services(1) 3,679 1,184 4,863 2,586 2,073 4,659 9,522

Total 59,354 37,416 96,770 43,123 22,879 66,002 162,772

----------------------- ---------- -------- -------- --------------- --------- ------------ --------

(1) Rights and Services revenue includes revenue from copyright

and trademark licences, management contracts, advertising and

publishing services.

Total assets

28 February 29 February

2021 2020

GBP'000 GBP'000

------------------------- ------------ ------------

Children's Trade 10,361 11,016

Adult Trade 7,495 6,747

Academic & Professional 58,527 59,128

Special Interest 12,773 13,492

Unallocated 170,001 139,357

Total assets 259,157 229,740

------------------------- ------------ ------------

Unallocated primarily represents centrally held assets including

system development, property plant and equipment, right-of-use

assets, receivables and cash.

Analysis of non-current assets (excluding deferred tax assets)

by geographic location

28 February 29 February

2021 2020

GBP'000 GBP'000

------------------------------------- ----------- -----------

United Kingdom (country of domicile) 73,711 75,839

North America 6,633 7,638

Other 127 193

Total 80,471 83,670

------------------------------------- ----------- -----------

3. Highlighted items

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 GBP'000

------------------------------------- ------------ ------------

Legal and other professional

fees 203 461

Coronavirus onerous costs - 180

Restructuring costs 1,076 98

Paycheck Protection Program (1,284) -

grant

Other highlighted items (5) 739

Amortisation of acquired intangible

assets 1,809 1,736

-------------------------------------- ------------ ------------

Total highlighted items 1,804 2,475

-------------------------------------- ------------ ------------

Highlighted items charged to operating profit comprise

significant non-cash charges and major one-off initiatives which

are highlighted in the income statement because, in the opinion of

the Directors, separate disclosure is helpful in understanding the

underlying performance and future profitability of the

business.

All highlighted items are included in administrative expenses in

the income statement.

For the year ended 28 February 2021, legal and other

professional fees of GBP203,000 were incurred as a result of the

Group's ongoing and completed acquisitions, including certain

assets of Red Globe Press and Zed Books Limited. Restructuring

costs primarily relate to restructuring in both divisions. The

Paycheck Protection Program grant was received from the US

Government's Small Business Administration.

For the year ended 29 February 2020 Legal and other professional

fees of GBP461,000 were incurred as a result of the Group's ongoing

and completed acquisitions, including those of Oberon Books Limited

and our joint venture, Beijing CYP & Gakken Education

Development Co., Ltd. Coronavirus onerous costs of GBP180,000 are

irrecoverable costs crystallised in the year associated with book

fairs and conferences that have been cancelled due to the

coronavirus. Restructuring costs relate to the acquisition of

Oberon Books Limited and I.B. Tauris & Co. Limited.

4. Taxation

Factors affecting tax charge for the year

The tax on the Group's profit before tax differs from the

standard rate of corporation tax in the United Kingdom of 19.00%

(2020: 19.00%). The reasons for this are explained below:

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 % GBP'000 %

--------------------------------------------- -------- ------ ------------ ------

Profit before taxation 17,349 100.0 13,229 100.0

--------------------------------------------- -------- ------ ------------ ------

Profit on ordinary activities multiplied

by the standard rate of corporation

tax in the UK of 19.00% (2020: 19.00%) 3,296 19.0 2,514 19.0

Effects of:

Non-deductible revenue expenditure 80 0.5 153 1.1

Non-taxable income (131) (0.8) - -

Movement in unrecognised temporary

differences (52) (0.3) 47 0.4

Different rates of tax in foreign

jurisdictions 444 2.6 142 1.1

Tax losses 217 1.2 (124) (0.9)

Movement in deferred tax rate 132 0.8 - -

Adjustment to tax charge in respect

of prior years

Current tax 289 1.7 (33) (0.3)

Deferred tax (391) (2.3) (57) (0.4)

--------------------------------------------- -------- ------ ------------ ------

Tax charge for the year before disallowable

costs on highlighted items 3,884 22.4 2,642 20.0

Highlighted items:

Disallowable costs 38 0.2 86 0.6

Disallowable credits (270) (1.6) - -

--------------------------------------------- -------- ------ ------------ ------

Tax charge for the year 3,652 21.0 2,728 20.6

--------------------------------------------- -------- ------ ------------ ------

Different rates of tax in foreign jurisdictions is where we are

paying tax at higher rates in the US and Australia as well as

paying state taxes in the US.

Adjustments to prior periods primarily arise where an outcome is

obtained on certain tax matters which differs from expectations

held when the related provision was made. Where the outcome is more

favourable than the provision made, the difference is released,

lowering the current year tax charge. Where the outcome is less

favourable than our provision, an additional charge to current year

tax will occur.

The disallowable credits relate to the US Government Paycheck

Protection Program grant.

We are not aware of any significant unprovided exposures that

are considered likely to materialise.

5. Dividends

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 GBP'000

----------------------------------------- ------------ ------------

Amounts paid in the year

Prior period final dividend per share

(2020: 6.75p) - 5,051

Interim 1.28p dividend per share (2020:

1.28p) 1,045 958

----------------------------------------- ------------ ------------

Total dividend payments in the year 1,045 6,009

----------------------------------------- ------------ ------------

Amounts arising in respect of the year

Interim 1.28p dividend per share for

the year (2020: 1.28p) 1,045 958

Proposed 7.58p final dividend per share

for the year (2020: nil) 6,182 -

Proposed 9.78p special dividend per

share for the year (2020: nil) 7,976 -

----------------------------------------- ------------ ------------

Total dividend 18 .64p per share for

the year (2020: 1.28p) 15,203 958

----------------------------------------- ------------ ------------

The Directors are recommending a final dividend of 7.58 pence

per share and a special dividend of 9.78 pence per share, which,

subject to Shareholder approval at the Annual General Meeting, will

be paid on 27 August 2021 to Shareholders on the register on the

record date of 30 July 2021.

For the year ended 29 February 2020, Bloomsbury made a bonus

issue to Shareholders in lieu of, and with a value equivalent to,

it's proposed final cash dividend of 6.89 pence per ordinary

share.

6. Earnings per share

The basic earnings per share for the year ended 28 February 2021

is calculated using a weighted average number of Ordinary shares in

issue of 80,867,938 (2020: 77,344,388) after deducting shares held

by the Employee Benefit Trust.

The diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary shares to take account of all

dilutive potential Ordinary shares, which are in respect of

unexercised share options and the Performance Share Plan.

Year ended Year ended

28 February 29 February

2021 2020

Number

Number Restated*

Weighted average shares in issue 80,867,938 77,344,388

Dilution 1,082,577 1,026,939

------------------------------------- ------------ ------------

Diluted weighted average shares

in issue 81,950,515 78,371,327

------------------------------------- ------------ ------------

GBP'000 GBP'000

------------------------------------- ------------ ------------

Profit after tax attributable to

owners of the Company 13,697 10,501

Basic earnings per share 16.94p 13.58p

------------------------------------- ------------ ------------

Diluted earnings per share 16.71p 13.40p

------------------------------------- ------------ ------------

GBP'000 GBP'000

------------------------------------- ------------ ------------

Adjusted profit attributable to

owners of the Company 15,310 12,720

Adjusted basic earnings per share 18.93p 16.45p

------------------------------------- ------------ ------------

Adjusted diluted earnings per share 18.68p 16.23p

------------------------------------- ------------ ------------

Adjusted profit is derived as follows:

Year ended Year ended

28 February 29 February

2021 2020

GBP'000 GBP'000

Profit before taxation 17,349 13,229

Amortisation of acquired intangible

assets 1,809 1,736

Other highlighted items (5) 739

------------------------------------- ------------ ------------

Adjusted profit before tax 19,153 15,704

------------------------------------- ------------ ------------

Tax expense 3,652 2,728

Deferred tax movements on goodwill

and acquired intangible assets (41) 202

Tax expense on other highlighted

items 232 54

Adjusted tax 3,843 2,984

------------------------------------ ------ ------

Adjusted profit 15,310 12,720

----------------- ------- --------

The Group includes the benefit of tax amortisation of intangible

assets in the calculation of adjusted

tax as this more accurately aligns the adjusted tax charge with

the expected cash tax payments.

*Restatement of earnings per share due to the bonus issue of

shares (note 8).

7. Trade and other receivables

28 February 29 February

2021 2020

GBP'000 GBP'000

Non-current

Accrued income 1,005 1,237

------------------------------------------- ------------ ------------

Current

Gross trade receivables 61,897 54,252

Less: loss allowance (3,230) (1,832)

------------------------------------------- ------------ ------------

Net trade receivables 58,667 52,420

Income tax recoverable 171 481

Other receivables 3,623 1,510

Prepayments 1,072 1,350

Accrued income 5,219 4,201

Royalty advances 24,790 24,843

Total current trade and other receivables 93,542 84,805

------------------------------------------- ------------ ------------

Total trade and other receivables 94,547 86,042

------------------------------------------- ------------ ------------

Non-current receivables relate to accrued income on long-term

rights deals.

Trade receivables principally comprise amounts receivable from

the sale of books due from distributors. The majority of trade

debtors are secured by credit insurance and in certain territories

by third party distributors.

A provision is held against gross advances payable in respect of

published title advances which may not be fully earned down by

anticipated future sales. As at 28 February 2021, GBP7,786,000

(2020: GBP5,604,000) of royalty advances are expected to be

recovered after more than 12 months.

8. Restatement of earnings per share due to the bonus issue of

shares in the year

On 28 August 2020 a bonus issue in lieu of final dividend of

2,513,674 Ordinary Shares of 1.25 pence

each, were provided to Shareholders on the register on the

record date of 31 July 2020. This bonus

issue was made to Shareholders in lieu of, and with a value

equivalent to, the final dividend

Bloomsbury would have declared in the absence of

coronavirus.

Year ended

29 February Year ended

2020 29 February

Restated 2020

--------------------------------------------------------------------------------- ------------ ------------

Basic earnings per share 13.58p 14.03p

Diluted earnings per share 13.40p 13.84p

Adjusted basic earnings per share 16.45p 17.00p

Adjusted diluted earnings per share 16.23p 16.77p

Weighted average number of shares used in basic earnings per share calculation 77,344,388 74,830,714

Weighted average number of shares used in diluted earnings per share calculation 78,371,327 75,857,653

--------------------------------------------------------------------------------- ------------ ------------

9. Post Balance Sheet Events

On 23 April 2021, the Group announced the acquisition of certain

assets of Red Globe Press ("RGP"), the academic imprint, from

Macmillan Education Limited, a part of Springer Nature Group. The

transaction completed on 1 June 2021. The consideration is GBP3.7

million, of which GBP1.8 million was satisfied in cash at

completion and up to GBP1.9 million will be paid post-completion,

subject to assignment of certain contracts.

RGP specialises in high-quality publishing for Higher Education

students globally in Humanities and Social Sciences, Business and

Management, and Study Skills. RGP has a backlist of more than 7,000

titles and publishes more than 100 new titles per year, with

content including digital platforms, textbooks, research-driven

materials and general academic publishing. The acquired RGP titles

are a good strategic fit, strengthen Bloomsbury's existing academic

publishing, and establish new areas of academic publishing in

Business and Management, Study Skills and Psychology. RGP's three

digital products will be migrated to Bloomsbury Digital Resources'

own platform and its content added to Bloomsbury Collections. The

business will operate within Bloomsbury's Academic &

Professional division. There are opportunities for profit

enhancements following the integration of the business into

Bloomsbury.

The Group will take on inventories, advances and intangible

assets associated with taking on the titles, imprint and digital

products. No cash or trade receivables will transfer as part of the

acquisition. Given the timing of the acquisition in relation to the

date these accounts were signed no further information is available

for disclosure.

10. Annual General Meeting

The Annual General Meeting will be held on 21 July 2021.

11. Report and Accounts

Copies of the Annual Report and Financial Statements will be

circulated to shareholders in July and can be viewed after the

posting date on the Bloomsbury website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPUBCQUPGPWG

(END) Dow Jones Newswires

June 02, 2021 02:00 ET (06:00 GMT)

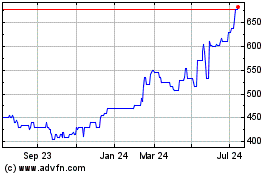

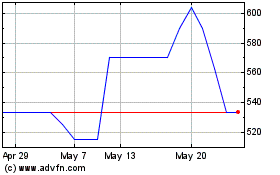

Bloomsbury Publishing (AQSE:BMY.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bloomsbury Publishing (AQSE:BMY.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025