TIDMDIS

RNS Number : 3044P

Distil PLC

18 October 2021

Distil plc

("Distil" , the "Company" or the " Group ")

Interim Results for the six months ended 30 September 2021

Distil plc (AIM:DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka is pleased to announce its unaudited interim

results for the six months ended 30 September 2021.

Operational highlights:

-- RedLeg Tropical Rum launched into the UK market

-- Additional listings secured for the Redleg Spiced Rum range

-- TRØVE Botanical Vodka listed in prestigious premium UK retailer

-- TRØVE Trademark successfully registered in USA

-- New export market opened in Ukraine

Financial* and corporate highlights

-- Turnover decreased by 23% to GBP1.44 million (2020: GBP1.88 million) (2019: GBP824k)

-- Gross profit decreased by 23% to GBP794k (2020: GBP1.03 million) (2019: GBP499k)

-- Volumes (litres) decreased by 21% (increased 49% over volumes in same period in 2019)

-- Investment in brand marketing and promotion decreased by 30%

to GBP398k (2020:GBP565k) (2019:GBP219k)

-- Adjusted** administrative costs increased by 10% to GBP338k (2020: GBP307k) (2019: GBP279k)

-- Adjusted*** operating profit of GBP58k (2020: GBP159k) (2019: GBP1k)

-- Operating loss of (GBP44k) (2020: GBP154k profit)(2019:GBP1k profit)

-- Cash reserves at period end of GBP4.22 million (2020:GBP570k) (2019: GBP836k)

-- Successful equity fund raise of GBP3.20 million (before

expenses) to invest in Ardgowan Distillery Company Limited to

support the development of a new Malt Scotch and provide a 'home'

for Blackwoods G in , with its own distillery, gin school and

visitors' centre

-- Appointment of Michael Keiller as Non-Executive Director

*Due to the unprecedented one-off surge in sales in the prior

period, especially during Q2 (June-September), caused by the impact

of lockdown and associated unusual trading patterns, the above

financial highlights are presented for both the prior period and H1

2019 to enable a proper understanding of key trends.

** Administrative costs adjusted to remove the one-off

transaction costs associated with the Ardgowan investment

*** Operating profit adjusted for one-off transaction costs

associated with Ardgowan investment and share based payment

expense

Don Goulding, Executive Chairman , commenting on these results

said:

"Our brands continue to perform well as the market begins to

recover from the effects of lockdown. Results for the half year are

below those of 2020 due to sales lapping an extraordinary increase

last year when the combination of lockdown, a hot summer and

unusual trading conditions led to a significant surge in sales,

particularly in Q2 (July to September) when revenues advanced by

265% versus the prior year.

Comparing sales for the half year to the same period in 2019

(pre Covid pandemic) we increased revenues by 75%.

Our team has managed well the widespread disruption and cost

pressures associated with extensive labour shortages throughout the

supply chain, production and distribution networks. This is likely

to remain an area of focus for the foreseeable future particularly

during the key Christmas trading period. To date we have

successfully maintained supply to all customers across all

brands.

Following a successful equity fund raise for investment in

Ardgowan Distillery in Scotland, exciting development work has

begun with the Ardgowan whisky maker and other renowned whisky

connoisseurs to create our own distinctive Malt Scotch for launch

planned 2022."

Executive Chairman's Statement

After an uncertain start, the UK On Trade has had a successful

reopening over the summer as consumers returned to venues. As

confidence returns, we have secured new listings across the RedLeg

Spiced Rum range, and expect to continue building on these provided

the UK remains lockdown free. The first half of our financial year

has also seen the business secure a new listing for TRØVE within a

prestigious premium retailer.

Global lockdowns continue to ease and have largely ended in our

key export markets, with the exception of Australia which is still

experiencing restrictions. Throughout the period, we have continued

to expand our international reach and have opened a new export

market in Ukraine. In addition, as confidence in international

travel returns, the Duty Free market is showing encouraging signs

of growth. The TRØVE trademark application in the USA has now been

approved.

Operations

Throughout the period, the main challenge to our business has

been ongoing disruption to the supply chain due to widespread staff

shortages across production and distribution, which in turn has

driven production cost increases. Vigorous work with suppliers

behind the scenes has successfully mitigated disruption and kept

our product in the hands of consumers. We are pleased to have

broadly maintained margins versus the same period last year despite

these challenges.

These issues are likely to continue throughout the current

financial year and will remain a priority.

In addition, we are anticipating further cost of goods and

energy price increases across the business, and endeavouring to

maintain margins in light of this.

Investment in Ardgowan

In August, we announced a GBP3 million strategic investment (in

the form of a convertible loan and with an option to increase to

GBP5 million) in Ardgowan Distillery Company Limited which will see

the development of a new Malt Whisky distillery, planned for

opening in 2023. This move will provide the Company with a

long-term interest in a growing premium category as we develop our

own Malt Scotch, as well as providing a new home for Blackwoods Gin

with its own distillery, Gin school and visitors' centre. This

investment forms part of a total initial investment package of

GBP11.4 million, which will be used by Ardgowan to build the

Ardgowan Distillery and visitors' centre.

To enable the Ardgowan investment, we completed an equity

fundraising in August that raised GBP3.2 million (before expenses)

from existing and new shareholders. Net proceeds from the fund

raise are held in cash reserves at the period end pending drawdown

of the GBP3 million loan by Ardgowan, expected in the next three

months.

The Ardgowan Distillery project is aiming to become the most CO

efficient distillery in the Scot ch Whisky industry . Site

clearance has begun and construction works will start, as planned ,

early in 2022 including conversion of existing buildings to create

Distil's Blackwoods distillery and Gin school.

Results versus same period last year

Results for the half year are below together with those for the

prior comparative period which benefited from an unprecedented

surge in sales, particularly in the second quarter, due to the

combination of lockdown, a hot summer and unusual trading

conditions.

Total revenues fell 23% to GBP1.44 million against challenging

comparatives. Compared to pre-pandemic sales in the same period in

2019 total revenues increased 75%.

The Company achieved an operating profit (after adjusting for

one-off costs of investment in Ardgowan and share based payment

expense) of GBP58k (2020: GBP154k; 2019; GBP1k). Despite an

increase in production costs caused by supply chain disruptions we

successfully maintained our year on year margins at 55% during the

period. In the short term we do not expect margins to return to

pre-Covid levels due to cost increases throughout the supply

chain.

Cash reserves stood at GBP4.22 million at the end of the period.

This includes the proceeds of fundraising completed in August

amounting to GBP3.20 million before expenses.

Outlook

Christmas is our key trading period and all of our efforts will

focus on keeping our customers in stock at all times. We are

working closely with manufacturers and suppliers to maintain

continuity against ongoing uncertainties regarding hauliers'

ability to attract a sufficient number of drivers.

Given ongoing supply chain challenges and uncertain timelines

for the resumption of normal activity levels it is difficult to

forecast with accuracy and certainty for the second half of the

year. Market guidance will be released following our key Christmas

trading period.

If the UK remains lockdown-free throughout this period, social

gatherings at home and enjoyment of the On Trade will help

facilitate a return to normal trading/activity levels. Our brands

across the portfolio are well positioned and supported to enjoy

growth in line with this.

Distil plc - Half Year Results

Consolidated comprehensive interim

income statement

----------- ----------- ------------

Six months Six months

ended 30 ended 30 Year

September September ended 31

2021 2020 March 2021

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

Revenue 1,435 1,878 3,616

Cost of sales (641) (847) (1,606)

----------- ----------- ------------

Gross profit 794 1,031 2,010

Administrative expenses:

Advertising and promotional costs (398) (565) (1,071)

Other administrative expenses (410) (307) (651)

Share based payment expense (30) (5) (34)

Total administrative expenses (838) (877) (1,756)

Operating (loss)/profit (44) 154 254

Finance income - - -

Finance expense (1) - (11)

Loss/profit before tax from continuing

operations (45) 154 243

Income tax 65 64 100

----------- ----------- ------------

Profit for the period 20 218 343

----------- ----------- ------------

Profit per share:

From continuing operations

Basic (pence per share) 0.01 0.04 0.07

Diluted (pence per share) 0.01 0.04 0.07

Consolidated interim statement of financial As at 30 As at 30 As at 31

position September September March 2021

2021 2020

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 167 151 167

Intangible fixed assets 1,602 1,586 1,598

Financial assets 3,000 - -

Deferred tax assets 241 140 176

----------- ----------- ------------

Total non-current assets 5,010 1,877 1,941

Current assets

Inventories 542 405 553

Trade and other receivables 674 1,157 609

Cash and cash equivalents 4,215 570 1,062

----------- ----------- ------------

Total current assets 5,431 2,132 2,224

----------- ----------- ------------

Total assets 10,441 4,009 4,165

----------- ----------- ------------

LIABILITIES

Current liabilities

Trade and other payables 512 356 358

Financial liabilities 3,000 - -

Total current liabilities 3,512 356 358

Total liabilities 3,512 356 358

----------- ----------- ------------

Net Assets 6, 929 3,653 3,807

----------- ----------- ------------

EQUITY

Equity attributable to equity holders

of the parent

Share capital 1,308 1,292 1,292

Share premium 5,964 2,908 2,908

Share based payment reserve 147 88 117

Accumulated losses (490) (635) (510)

----------- ----------- ------------

Total equity 6,929 3,653 3,807

----------- ----------- ------------

Consolidated interim cash flow statement

----------- ----------- -------------

Six months Six months Year ended

ended 30 ended 30 31 March

September September 2021

2021 2020

Un-audited Un-audited Audited

Cashflows from operating activities GBP'000 GBP'000 GBP'000

(Loss)/profit before tax (45) 154 243

Adjustments for non-cash/non-operating

items:

Finance expense - - 11

Depreciation 8 7 15

Share based payment expense 30 5 34

(7) 166 303

Movements in working capital

Decrease/(increase) in inventories 11 (56) (204)

Increase in trade receivables (65) (614) (66)

Increase in trade payables 154 230 221

----------- ----------- -----------

Cash generated by/(used in) operations 100 (440) (49)

Net cash generated by/(used in) operating

activities 93 (274) 254

Cashflows from investing activities

Purchase of property plant & equipment (8) (5) (29)

Expenditure relating to the acquisition

and registration of licenses and trademarks (4) (9) (21)

----------- ----------- -----------

Net cash used in investing activities (12) (14) (50)

Cashflows from financing activities

Net proceeds from issue of shares 3,072 - -

Net cash used in financing activities 3,072 - -

Net increase/(decrease) in cash and cash

equivalents 3,153 (288) 204

Cash & cash equivalents at the beginning

of the period 1,062 858 858

Cash & cash equivalents at the end of the

period 4,215 570 1,062

----------- ----------- -----------

Notes to the interims accounts:

1. Basis of preparation

This interim consolidated financial information for the six

months ended 30 September 2021 has been prepared in accordance with

AIM Rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the Group's statutory

financial statements within the meaning of Section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 March 2021, which

have been prepared under International Financial Reporting

Standards (IFRS) and have been delivered to the Register of

Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which drew attention by way of emphasis of matter without

qualifying their report and did not contain any statements under

Section 498 (2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 September 2021 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 September 2020 are also unaudited.

2. Financial Assets/Liabilities

On 20 July 2021, the Company agreed to advance a loan of GBP3

million to Ardgowan Distillery Company Limited to fund the

development of a new whisky distillery, which is due to be drawn

down in January 2022. As a result, a financial liability and

corresponding financial asset have been recognised as at 30

September 2021. The loan is being funded by the placing and

subscription of 160,000,000 shares completed in August 2021, which

raised GBP3.2 million before expenses.

3. Availability

Copies of the interim report will be available from Distil's

registered office at 201 Temple Chambers, 3-7 Temple Avenue, EC4Y

0DT and also on www.distil.uk.com .

4. Approval of interim report

This interim report was approved by the Board on 15 October

2021.

For further information please contact:

Distil plc

Don Goulding Executive Chairman Tel: +44 203 283 4007

Shan Claydon, Finance Director

----------------------

SPARK Advisory Partners Limited

(NOMAD)

----------------------

Neil Baldwin Tel +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments (TPI)

Limited (Broker)

----------------------

Andy Thacker / James Pope Tel +44 20 3657 0050

----------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZMMGVNDGMZM

(END) Dow Jones Newswires

October 18, 2021 02:00 ET (06:00 GMT)

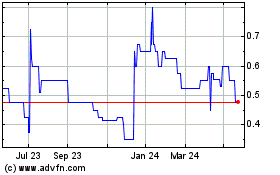

Distil (AQSE:DIS.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

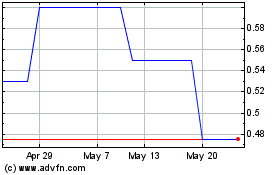

Distil (AQSE:DIS.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025