TIDMECP

RNS Number : 5421H

Eight Capital Partners PLC

24 November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation. Upon the publication of the

announcement via a regulatory information service, this information

is considered to be in the public domain.

24 November 2022

Eight Capital Partners plc

("ECP", "Eight Capital" or "the Company")

Update on Fundraise: conversion of EUR 33.77 million of private

and listed debt

Eight Capital partners plc, the financial services operating

company that aims to grow revenue through businesses engaged in

"Fintech" operations including in the digital banking and lending,

and, asset and wealth management ("WealthTech") sectors, is pleased

to provide the following update on its up to GBP10 million placing

and broker option, and, debt conversion process (together, the

"Fundraise"), announced on 3 November 2022.

The Fundraise forms the next important step for ECP to progress

its stated strategy of becoming a significant Fintech operating

group and increasing its market capitalisation to more than GBP50

million. The Fundraise comprises three elements: (i) a conversion

option for existing bondholders ("Conversion Option"); (ii) a

broker option for existing shareholders ("Broker Option"); and

(iii) a placing to institutional and professional investors

("Placing").

The Conversion Option gives existing bond and debt holders the

opportunity to convert their debt holdings into equity on the same

terms as all other investors in the capital raise. This has been

well received amongst existing bondholders and the Company has

entered into conversion agreements with existing bondholders to

convert EUR3,850,000 of existing bonds into equity. As stated in

the Company's circular of 29 September 2022 ("Rule 9 Circular"),

IWEP Limited has completed the transfer of its shareholding and

receivables in the Company to Trumar Capital LLC ("Trumar"), a

company of which Dominic White and Susan White are the sole

members, such that there has been no change in the ultimate

beneficial owner as a result of the transfer. Trumar, as the

Company's largest shareholder and debt holder, remains committed to

converting debt held by it and it will therefore convert a further

EUR29.92 million of debt alongside the other converting

bondholders.

The total debt conversion of EUR33.77 million (approximately

GBP29.2 million at an exchange rate of EUR1.1547:GBP1) will be

converted on the same terms as the conversions set out in the Rule

9 Circular, resulting in the issue of 146,228,457,606 new ordinary

shares ("Conversion Shares") at the conversion price of 0.02 pence

per share and the granting of one for one warrants, which are

exercisable at 0.05 pence per share for a period of 12 months.

Following this conversion, the balance of debt outstanding in the

Company is EUR7,701,810. As a result of the significant number of

ordinary shares which have been and are to be issued as a result of

the debt conversions, the Company will seek to consolidate the

Company's issue share capital by way of a capital reorganisation at

the next general meeting.

The Broker option was put in place in order to offer existing

ordinary shareholders the opportunity to participate in the

fund-raise on the same terms as all other investors. Such

participation is subject to each shareholder's status. The closing

date for applications under the Broker Option was 5.00 p.m. on

Monday, 21 November 2022. There has been interest from some

shareholders although there were no finalised subscriptions by the

closing date. The Broker Option has now closed.

The Placing process to institutional and high net worth

investors is underway.

The Company will update shareholders further as any equity

placings and further debt conversions are completed.

Admission, Issue of Equity and Total Voting Rights

Application will be made for the admission of the

146,228,457,606 Conversion Shares to trading on AQSE Growth Market

("Admission") which is expected to occur on or around 30 November

2022. The new ordinary shares will rank pari-passu in all respects

with the Company's existing issued ordinary shares.

Following the issue of the Conversion Shares and the

participation by Trumar, a company beneficially owned by Dominic

White, a director, in the conversions, Trumar will be interested in

143,486,668,446 ordinary shares, representing 88.64 per cent. of

the Company's issued share capital on Admission.

Following to the issue of the Conversion Shares, the Company

will have 161,873,969,648 ordinary shares in issue. The Company has

no shares in treasury, therefore this figure may be used by

shareholders, from Admission, as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure and

Transparency Rules.

This transaction is the next important step in Eight Capital's

Transformational Growth Plan announced in September 2021. It

significantly expands the Company's balance sheet and positions it

well for the implementation of its Fintech strategy described in

detail in the announcement of 3 November 2022.

Eight Capital will now work on delivering the Placing and any

further debt conversions, while in parallel implementing the

Fintech strategy.

Dominic White, a director of the Company, is also a director and

the beneficial owner of Trumar Capital LLC, ECP's main shareholder.

Pursuant to AQSE Rule 4.6, the further conversion of debt by Trumar

Capital LLC, and the resulting issue of warrants to it, constitutes

a related party transaction.

For further information, please visit www.eight.capital or

contact:

Eight Capital Partners plc +44 20 3300 0715

Dominic White info@eight.capital

Luciano Maranzana

Cairn Financial Advisers LLP

AQSE Corporate Adviser

Jo Turner / James Lewis +44 20 7213 0880

Walbrook PR Limited +44 20 7933 8780 / +44 7768 807631

Paul Vann/Nick Rome eightcapital@walbrookpr.com

About Eight Capital Partners:

Eight Capital partners plc is a financial services operating

company that aims to grow revenue through businesses engaged in

"Fintech" operations including in the digital banking and lending,

and, asset and wealth management ("WealthTech") sectors.

ECP seeks to grow its group revenue in these high growth fintech

sub-sectors, which it expects to also increase in value, such that

they generate an attractive rate of return for shareholders,

predominantly through capital appreciation.

www.eight.capital

Eight Capital Partners operates two subsidiary businesses:

Epsion Capital:

Epsion Capital is an independent corporate advisory firm based

in London with an extensive experience in UK and European capital

markets. The team of senior and experienced ECM and M&A

professionals is specialised across multiple markets, sectors and

geographies and it prides itself on a commercial approach that

allows the clients to achieve their growth ambitions.

www.epsioncapital.com

Innovative Finance:

Innovative Finance is a corporate finance advisory business that

develops mergers and acquisitions and financing solutions across

multiple sectors, primarily in Europe, with access to international

transactions. It focuses on investments in Europe which are linked

to technological developments in the financial services industry.

www.innovfinance.com

Forward Looking Statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXEALFLAEDAFFA

(END) Dow Jones Newswires

November 24, 2022 09:05 ET (14:05 GMT)

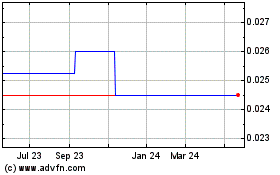

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Nov 2024 to Dec 2024

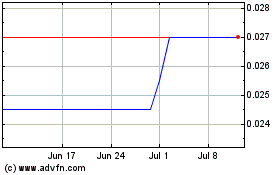

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Dec 2023 to Dec 2024