TIDMFDP

RNS Number : 2645A

FD Technologies PLC

23 May 2023

23 May 2023

FD Technologies plc

("FD Technologies" or the "Group")

Results for the year ended 28 February 2023

FD Technologies (AIM: FDP.L, Euronext Growth: FDP.I) announces

its results for the year ended 28 February 2023.

Business highlights

Strong performances by KX and First Derivative

- KX exceeded its targets with annual recurring revenue (ARR) up 39%

to GBP65.3m (FY22: GBP47.0m) and net revenue retention of 119% (FY22:

106%); incremental annual contract value (ACV) increased by 93% to

GBP18.7m (FY22: GBP9.7m)

- Launched the industry's first Data Timehouse, positioning KX as the

engine for real-time analytics in the cloud and delivering up to 100x

the performance at 1/10(th) of the cost of alternative solutions

- Significant progress with a range of existing and potential partners,

including the general availability of kdb Insights Enterprise on Microsoft

Azure and an agreement to partner with AWS

- Continued our drive to accelerate time to value for customers, as

well as making our technology easier to adopt and use; our progress

is reflected in continued growth in Industry, which accounted for

more than 30% of ACV

- Momentum set to continue in the current year, benefiting from growing

demand for real-time analytics as the foundation for AI-driven business

innovation, the strengthening of KX leadership and growing market

recognition for the return on investment that KX delivers

- First Derivative delivered revenue growth of 18%, also ahead of target,

benefiting from multi-year strategic growth drivers, particularly

relating to regulatory compliance and digital transformation

- Weaker demand environment continued at MRP, with revenue down by 19%;

cost base aligned to protect EBITDA in the current year

- Providing guidance for FY24 revenue in the range of GBP315m to GBP325m,

with adjusted EBITDA in the range of GBP38m to GBP40m with continued

investment in KX to drive future growth.

Seamus Keating, CEO of FD Technologies, commented: 'We are

pleased with a year of strong execution on our strategy, with KX

and First Derivative beating our expectations for FY23.

KX in particular has made strong commercial and strategic

progress. Our price to performance advantage is particularly

compelling for the hyperscale cloud providers, as evidenced by our

partnerships with market leaders Microsoft and AWS. We have a range

of initiatives that we are progressing with these and other

partners that provide confidence in our outlook.

First Derivative also performed strongly in FY23, delivering

impressive revenue growth of 18% for the period. We continue to see

multi-year strategic growth drivers that underpin demand for our

services.

We have set ourselves ambitious but sustainable growth targets

for the years ahead which will ensure we are focused on driving

high-quality recurring revenue growth from an expanding list of

customers across a wide range of industries, while generating value

for shareholders.'

Financial summary

Year to end February 2023 2022 Change

Revenue GBP296.0m GBP263.5m 12%

--------------------------------- --------------------------------- -------

Gross profit GBP122.3m GBP106.1m 15%

--------------------------------- --------------------------------- -------

(Loss)/Profit before tax (GBP1.2m) GBP9.0m NM

--------------------------------- --------------------------------- -------

Reported diluted (LPS)/EPS (14.4p) 22.9p NM

--------------------------------- --------------------------------- -------

Net cash* GBP0.4m GBP0.3m 24%

--------------------------------- --------------------------------- -------

Adjusted performance measures

--------------------------------- --------------------------------- -------

Adjusted EBITDA** GBP34.8m GBP31.0m 12%

--------------------------------- --------------------------------- -------

Adjusted diluted EPS 35.3p 32.3p 9%

--------------------------------- --------------------------------- -------

Performance against Key Target Actual

Performance Indicators

--------------------------------- ------------------------------------------

KX annual recurring revenue (ARR)

growth 35-40% 39%

--------------------------------- ------------------------------------------

KX net revenue retention (NRR) 110% 119 %

--------------------------------- ------------------------------------------

First Derivative revenue growth 15% 18%

--------------------------------- ------------------------------------------

MRP revenue growth 10% (19%)

--------------------------------- ------------------------------------------

* Excluding lease obligations

** Adjusted for share based payments and restructure and

non-operational

costs

Financial highlights

- Group revenue up 12% to GBP296m (up 6% at constant currency), led

by good performances at KX and First Derivative, both above full year

expectations, balanced by a reduction in revenue at MRP

- KX revenue growth of 25% to GBP80.2m (FY22: GBP64.4m), with recurring

revenue up 47% to represent 72% of total KX revenue (FY22: 61%) and

reductions in both lower margin services revenue and lower value perpetual

license revenue as we continue to focus on growing our recurring revenue

- First Derivative revenue GBP174.3m, up 18% (FY22: GBP148.0m), driven

by our strategy to deliver more value from our domain and technology

expertise and our push into complementary areas such as software engineering

- MRP revenue down 19% to GBP41.5m (FY22: GBP51.1m), resulting from

lower spending on demand generation by our enterprise customers

- Adjusted EBITDA up 12% to GBP34.8m (FY22: GBP31.0m), following investment

in people and systems, including the successful implementation of

an Oracle ERP system, to enable the Group to scale

- Net cash GBP0.4m (FY22: GBP0.3m) resulting from focused cash management

Current trading and outlook

Our targets continue to be centred on key performance indicators

appropriate to value creation within each of our business units. In

KX, the opportunities we see with customers and partners gives us

confidence in delivering another strong year of ARR growth of at

least 35%. In First Derivative, the alignment of our services with

the strategic priorities of our customers provides us with

confidence that we can grow faster than the market, with revenue

growth in the range of 5% to 10% as well as a meaningful

improvement towards our three-year EBITDA margin target of 15%. In

MRP we expect the reduction in the cost base to deliver an

improvement in EBITDA for the current year.

At the Group level we expect FY24 revenue in the range of

GBP315m to GBP325m, with adjusted EBITDA in the range of GBP38m to

GBP40m.

For further information, please contact:

FD Technologies plc +44(0)28 3025 2242

Seamus Keating, Chief Executive Officer www.fdtechnologies.com

Ryan Preston, Chief Financial Officer

Ian Mitchell, Head of Investor Relations

Investec Bank plc

(Nominated Adviser and Broker)

Carlton Nelson

Virginia Bull +44 (0)20 7597 5970

Goodbody (Euronext Growth Adviser and Broker)

David Kearney

Don Harrington

Nick Donovan +353 1 667 0420

J.P. Morgan Cazenove (Broker)

James A. Kelly

Mose Adigun +44 (0) 203 493 8000

FTI Consulting

Matt Dixon

Dwight Burden

Victoria Caton +44 (0)20 3727 1000

About FD Technologies

FD Technologies is a group of data-driven businesses that unlock

the value of insight, hindsight and foresight to drive

organisations forward. The Group comprises KX, which provides

software to accelerate AI-driven innovation; First Derivative,

providing consulting services which drive digital transformation in

financial services and capital markets; and MRP, which provides

technology-enabled services for enterprise demand generation. FD

Technologies operates from 14 locations across Europe, North

America and Asia Pacific, and employs 3,000 people worldwide.

For further information, please visit www.fdtechnologies.com and

www.kx.com

Results presentation

A presentation for analysts will be held at FTI Consulting at

9.30am today, following which a recording of the presentation will

be available on the Group's website.

Business Review

FD Technologies comprise three business units - KX, software to

accelerate AI-driven innovation; First Derivative, consulting

services which drive digital transformation in financial services

and capital markets ; and MRP, which provides technology-enabled

services for enterprise demand generation.

KX - Software to accelerate AI-driven innovation

KX's mission is to revolutionise AI-driven business innovation

through time-series analytics, empowering enterprises to extract

value from the ever-growing volume of data, much of it

machine-generated and time-stamped. As the engine for real-time

analytics in the cloud, our customers report that KX delivers 100x

the performance of alternative solutions at 1/10(th) of the cost,

fostering rapid innovation while maintaining cost efficiency.

During the year we launched the industry's first Data Timehouse,

a new class of data management and AI platform, to provide

enterprises with access to temporal data in a way that prioritises

modelling and insight. Launched on Azure through our strategic

partnership with Microsoft, this approach is backed by industry

analysts Gartner, who are urging the adoption of technologies such

as KX that are specifically built for the analysis of temporal

data.

KX's addressable market is rapidly expanding, with the AI and

data science platforms and applications sector, as estimated by

Gartner, growing at a 29% CAGR to reach $135bn by 2025. Based on

our targeted industries and geographic markets, we project our

current serviceable market opportunity to be approximately $34bn by

2025.

Strategic partnerships

Working with strategic partners is key to achieving our mission,

and our priority is to establish KX as the high-performance engine

within the hyperscale cloud platforms. We made significant progress

during the year and the recent general availability of kdb Insights

Enterprise on Microsoft Azure was a watershed moment for our

strategic partnership with Microsoft. Since the launch we have seen

positive customer reaction and strong partner engagement on joint

propositions, resulting in growth in our pipeline across multiple

industries.

The expected launch of additional products on Azure during the

year, aimed for example at application developers, will enable our

existing customers to transact via the marketplace to expand their

current KX data estate. In addition, we have a number of innovation

projects where we will integrate our technology with Large Language

Models (LLMs) to bring analytics into the day-to-day workflow of

users, dramatically improving their experience.

We recently announced that KX is partnering with Amazon Web

Services (AWS) to launch kdb Insights as a fully managed

cloud-native service on Amazon FinSpace, AWS's data management and

analytics service for the financial services industry. KX and AWS

are working together to attract both new customers and to provide

existing KX customers with a path to migrate their existing kdb

workloads to the cloud, benefitting from both the Python-enabled

capabilities of kdb Insights and managed services provided by

AWS.

We have also made progress with other hyperscalers and

established a dedicated partner team to develop and close these

opportunities. This team is engaged with cloud hyperscale

platforms, systems integrators, OEMs and independent software

vendors (ISVs) seeking to integrate our kdb technology into their

data and AI-driven applications.

Product development

At the heart of our products is kdb+, the world's fastest

time-series and real-time analytics engine. The launch of kdb

Insights Enterprise on Microsoft Azure has significantly expanded

our ability to provide our technology's performance advantages to a

wider audience. Among other benefits, it offers the versatility of

microservices and cloud resources, enables Python and SQL

developers to programme without knowing our proprietary language,

q, and provides free trial and development resources for

solution-building. This leads to broader adoption and faster value

realisation for customers.

We continue to focus on making our technology more accessible

and user-friendly, implementing a continuous development strategy

with reusable services deployable across OEMs and ISVs.

Commercial progress

FY23 was our strongest year ever for incremental ACV, which

increased by 93% from the prior year to GBP19m. We also delivered

an improvement In Net Revenue Retention (NRR) to 119% (FY22: 106%)

indicating that our strategy to increase our growth from existing

customers is delivering results.

During the year we made a number of senior appointments to drive

growth at KX. In August Ashok Reddy was appointed CEO, bringing a

track record of successfully driving AI product innovation, revenue

growth and commercial strategies at enterprise technology companies

(including IBM, CA Technologies/Broadcom and Digital.ai). KX also

recently appointed a Chief Revenue Officer, John Hoffman, with

extensive experience in building and scaling revenue at data

analytics providers.

We continue to invest in sales and marketing, expanding our

go-to-market team to target opportunities across industries. Our

strategy emphasises partnering to win new customers and growing our

direct sales capability.

While financial services customers remain our largest revenue

source, we are growing at a faster rate in other industries,

validating our view of our technology as a horizontal solution

across industries. Example customer wins in the period

included:

-- Syneos Health adopted KX to implement a Data Timehouse, using kdb Insights

Enterprise on Microsoft Azure to improve clinical trial efficiency, reduce

costs and speed time to market for life-changing therapies for patients.

-- PSE, the Polish transmission system operator, selected KX to manage large

meter data volumes and complex analytics as part of its adoption of CGI's

Central Energy Market Information System in a multi-year deal.

-- A leading investment bank adopted kdb Insights as part of its large-scale

cloud migration project, moving its KX on-premise workloads to the cloud

with no reduction in performance at a fraction of the total operating

cost.

First Derivative - driving digital transformation in financial

services and capital markets

First Derivative delivered 18% revenue growth for the year,

resulting from structural demand drivers for our services across

regulatory compliance and digital transformation. Our performance

was stronger than that of the market, as a result of our strategy

to deliver more value from our domain and technology expertise and

our push into areas such as software engineering.

During the year we saw strong demand for our core practice areas

such as transaction reporting and Know Your Customer compliance,

while the move to the cloud by our customers is creating

opportunities as they look to completely rebuild their core

software architecture. This latter trend was a driver in our

decision to establish a software engineering practice, which

delivered impressive growth in the year and where we have a growing

pipeline.

Our priorities for the current year are to continue to broaden

our service offerings and seek multi-year engagements with clients,

to increase the diversity and robustness of our revenues. We expect

to continue the internationalisation of our business, with good

growth in the year in Asia and a growing pipeline of opportunities.

We also expect our clients to continue their drive to get value

from their technology spend by achieving the optimal delivery

structure and see continued demand for our near shore capabilities

as a result.

Our positivity about our growth prospects is tempered by the

external environment which has created a level of caution within

some clients, with projects taking longer to be approved than in

recent periods. At the same time, we are seeing an easing in the

pressures of wage inflation and staff attrition, which alongside

our increasing scale should assist our expectation of margin

improvement in the current year as we move towards our FY26 goal of

15% EBITDA margin.

We continue to believe First Derivative is well positioned, with

high levels of repeat revenue, structural demand drivers assisting

our growth and a strategy to drive greater value from our

considerable capital markets expertise.

MRP - technology-enabled services for enterprise demand

generation

MRP is our smallest business unit, representing 14% of revenue

in FY23. It provides global sales and marketing leaders with an

account-based marketing platform (Prelytix), powered by KX, and

supporting products and services that deliver high response rates

and pipeline conversion. Prelytix tracks more than 1.5 billion

intent signals per day, enabling MRP customers to identify and

engage targets earlier and more effectively. Its global presence is

a further differentiator, resulting in Forrester naming it as a

leader in Account Based Marketing (ABM) in its Q2 2022 report on

the sector.

Throughout the year MRP's customer budgets remained under

pressure, with demand generation spend remaining weak in the

economic environment. We have seen a stabilisation in revenue run

rate since the year end and coupled with the steps taken to align

its cost base, we expect to deliver an improved EBITDA performance

for the current year. We continue to believe MRP has the

opportunity to deliver double digit revenue growth when spending on

demand generation improves.

People

The Group currently employs 3,000 people, similar to the number

employed at the same time last year. Our employee policies are

designed to enable us to attract and retain top talent and during

the year we implemented a number of initiatives to assist these

goals.

We continued to pay particular attention to learning and

development, with a strong focus on leadership, as well as the

Group's culture. We introduced our Aspiring Leadership programme,

which offers a structured and practical path to fast-track high

potential individuals into leadership roles, and appointed leaders

to run our talent and people initiatives. We also evaluated and

benchmarked every employee across the Group to ensure everyone is

paid competitively.

We continue to evolve the ways in which our people connect and

collaborate, with our latest annual engagement survey which shows

an increase in the number of our employees that feel engaged to

82%. During the year we completed the implementation of an Oracle

Cloud Fusion ERP system that includes a Human Resources Information

System, enabling us to work more strategically.

Summary and outlook

KX and First Derivative both delivered strong growth in their

KPIs for the year and are well placed to deliver on their potential

following a year of execution of strategy. In KX the growing

importance of real-time analytics and our ability to accelerate AI

workloads, combined with our product and commercial strategies are

establishing us as a key component of modern data architecture.

These factors are driving opportunities with customers and partners

that support our confidence in another year of strong growth in

ARR, of at least 35%. First Derivative continues to evolve its

service offerings to assist customers with their strategic

objectives and we expect this to enable growth ahead of its market,

with revenue expected to increase in the range of 5% to 10% and

margin improvement towards our three-year target of 15% . MRP's

EBITDA performance is expected to improve following the alignment

of its cost base, with growth expected to return when spending on

demand generation increases.

At the Group level we expect FY24 revenue in the range of

GBP315m to GBP325m, with adjusted EBITDA in the range of GBP38m to

GBP40m.

Financial review

Revenue and Margins

The table below shows the breakdown of Group performance by

business unit for each of KX, First Derivative and MRP.

FY23 FY22

----------------------------------------

Group KX First MRP Group KX First MRP Group

Derivative Derivative change

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

12

Revenue 296.0 80.2 174.3 41.5 263.5 64.4 148.0 51.1 %

10

Cost of sales (173.7) (22.3) (127.0) (24.4) (157.3) (19.9) (108.6) (28.8) %

------------------------ ------- ------------ ------- ------- ------------ -------

15

Gross profit 122.3 58.0 47.3 17.0 106.1 44.5 39.4 22.2 %

Gross margin 41% 72% 27% 41% 40% 69% 27% 44%

28

R&D expenditure (27.1) (23.0) (0.4) (3.7) (21.1) (18.6) (0.2) (2.3) %

25

R&D capitalised 23.1 19.0 0.4 3.7 18.6 16.1 0.2 2.3 %

------------------------ ------- ------------ ------- ------- ------------ -------

54

Net R&D (4.0) (4.0) - - (2.6) (2.6) - - %

Sales and marketing

costs (50.9) (26.3) (15.3) (9.4) (47.4) (23.6) (14.5) (9.3) 8 %

30

Adjusted admin expenses (32.7) (11.1) (15.4) (6.2) (25.2) (8.6) (10.9) (5.7) %

12

Adjusted EBITDA 34.8 16.6 16.7 1.4 31.0 9.8 14.0 7.3 %

Adjusted EBITDA margin 12% 21% 10% 3% 12% 15% 9% 14%

The Group delivered double-digit increases in both revenue and

adjusted EBITDA. Revenue growth was driven by strong growth in

recurring revenue at KX and good growth by First Derivative offset

by a revenue decline in MRP as a result of difficult market

conditions. This drove 15% growth in gross profit to GBP122.3m

(FY22: GBP106.1m), with increasing scale and growth in higher

margin revenues resulting in gross margin of 41% (FY22: 40%). We

continue to invest in line with our strategic objectives, including

investments in systems and people. In addition, inflationary cost

pressures which increased admin expenses and the impact of MRP,

resulted in adjusted EBITDA margin remaining at 12%.

Revenue growth was boosted during the period by the strength of

the dollar against sterling, our reporting currency, with constant

currency revenue growth of 6%. Due to the natural hedge of our

operations in the US the impact on profitability was marginal.

KX

KX total Financial services Industry

----------------------------- --------------

FY23 FY22 Change FY23 FY22 Change FY23 FY22 Change

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 80.2 64.4 25% 67.9 55.4 23% 12.4 9.1 37%

Recurring 57.6 39.2 47% 50.2 35.5 41% 7.4 3.7 102%

Perpetual 1.6 3.6 (57%) 0.2 1.8 (88%) 1.3 1.8 (24%)

Total software 59.1 42.8 38% 50.4 37.4 35% 8.7 5.4 61%

------ ----- ------ ----- ----- -----

Services 21.1 21.6 (2%) 17.5 18.0 (3%) 3.6 3.6 0%

Gross profit 58.0 44.5 30%

Adjusted

EBITDA 16.6 9.8 70%

KX delivered a strong performance in the year, with 25% revenue

growth driven by 47% growth in recurring revenue to GBP57.6m,

balanced by a 2% reduction in services to GBP21.1m. The growth was

enabled by an increase of 93% in annual contract value added to

GBP18.7m, resulting in 39% growth in ARR to GBP65.3m. Services

revenue, related to the implementation of our software, declined

marginally to GBP21.1m as we enabled our customers to achieve time

to value more quickly, reducing the cost and complexity of adopting

KX and increasing the return on investment for our customers.

Revenue from perpetual license sales continues to decline following

our decision in 2021 to focus exclusively on subscription sales for

new customers, and now represents just 2% of KX revenue.

Financial services revenue grew by 23% to GBP67.9m, with

recurring revenue up 41%. We continue to benefit from adoption of

kdb Insights by existing and new customers, attracted by its

performance, ease of use and rapid time to value, as well as native

integration with important developer languages such as Python and

SQL.

Industry revenue grew by 37% to GBP12.4m with recurring revenue

growing by 102% to GBP7.4m. Growth was led by subscription

contracts across the healthcare, energy and manufacturing markets

with both new and existing customers.

Alongside the growth in ARR our go-to-market team was also

engaged with partners, particularly Microsoft and AWS, on joint

go-to-market initiatives to support general availability of kdb

Insights Enterprise on Microsoft Azure and kdb Insights on AWS

FinSpace.

Performance metrics FY23 FY22 Change

Annual recurring revenue (ARR)

GBPm 65.3 47.0 39%

Net revenue retention (NRR) 119% 106%

Gross margin 72% 69%

R&D expenditure as % of revenue 29% 29%

Sales and marketing spend

as % of revenue 33% 37%

Adjusted EBITDA margin 21% 15%

The annual contract value signed in the period was GBP18.7m, up

93% on the prior year (FY22: GBP9.7m) and driven by the growth in

new subscription deals in the period and our work with partners.

This resulted in ARR increasing by 39% to GBP65.3m. NRR of 119% is

ahead of the 106% in FY22 and in line with our mid-term target of

120%, with customer churn remaining at low levels.

First Derivative

FY23 FY22 Change

GBPm GBPm

Revenue 174.3 148.0 18%

Gross profit 47.3 39.4 20%

Adjusted

EBITDA 16.7 14.0 20%

Revenue for the period was GBP174.3m, with growth of 18% ahead

of our target for the year of 15%. We saw the strongest growth in

supporting our customers in their near shore operations, which are

expanding as they pull offshore delivery work into centres such as

Dublin. We believe our services are well aligned with our

customers' strategic priorities, with regulatory change, digital

transformation and cost efficiency consistent themes.

Attrition and wage inflation rates were challenges across the

industry during the year, which we managed effectively, although

they did limit scope for margin improvement. We see an easing of

these pressures in the year ahead in response to some caution from

customers, as discussed in the business review. This is reflected

in our guidance for lower revenue growth during the year, although

reduced recruitment and onboarding costs and our growing scale

should enable EBITDA margin progress.

Performance metrics FY23 FY22

-----

Gross margin 27% 27%

Adjusted EBITDA margin 10% 9%

Gross margin was maintained at 27% for the year. Underlying this

were increased costs in recruiting, training and deploying new

consultants in response to industry-wide attrition pressures,

mitigated by our ability to pass through wage inflation and the

impact of delivering greater value from our expertise and domain

knowledge.

MRP

FY23 FY22

GBPm GBPm Change

Revenue 41.5 51.1 (19%)

Gross profit 17.0 22.2 (23%)

Adjusted

EBITDA 1.4 7.3 (80%)

MRP derives revenue by combining cutting-edge predictive

analytics with a full suite of account-based sales and marketing

solutions. Throughout the year, concerns over the business outlook

caused many of our customers to pause or reduce their demand

generation activity, leading to a decline in revenue at MRP.

While we took action to align costs during the year, adjusted

EBITDA decreased to GBP1.4m (FY22: GBP7.3m). In response, MRP has

implemented cost savings that have reduced annualised operating

costs by c. GBP6.0m and as a result we expect an improved

performance in adjusted EBITDA in FY24.

Performance metrics FY23 FY22

-----

Gross margin 41% 44%

Adjusted EBITDA margin 3% 14%

Gross margin declined slightly to 41% (FY22: 44%) as a result of

lower services utilisation balanced by cost efficiencies in

third-party costs incurred in our display marketing offering. Admin

expenses increased as we invested in upgrading cybersecurity

protection, improved legal capability and incurred wage

inflation.

Group Performance

Adjusted EBITDA

The reconciliation of operating (loss)/profit to adjusted EBITDA

is provided below:

FY23 FY22

GBPm GBPm

Operating (loss)/profit (1.5) 6.4

Restructure and non-operational costs 8.7 3.1

Non-operational other income - (2.5)

Non-operational IT expenses* 5.6 2.3

Share based payment and related costs 0.4 1.7

Depreciation and amortisation 21.6 20.1

----- -----

Adjusted EBITDA 34.8 31.0

*Non-operational IT expenses represents ERP implementation costs

that are required to be expensed under accounting standards

(Loss)/profit before tax

Adjusted profit before tax increased to GBP12.1m, with the

increase in adjusted EBITDA balanced by higher depreciation and

software amortisation charges. Financing costs increased by GBP0.9m

reflecting higher interest rates partially offset as we continue to

pay down debt.

The Group reported a loss before tax of GBP1.2m for the year,

compared to a profit of GBP9.0m in FY22. The major factors were

restructuring costs, particularly at MRP, the cost of implementing

the Group's new Oracle ERP system and one-off costs to address

legacy employee tax liabilities while on assignment.

The reconciliation of adjusted EBITDA to reported profit before

tax is provided below.

FY23 FY22

GBPm GBPm

Adjusted EBITDA 34.8 31.0

Adjustments for:

Depreciation (7.3) (6.8)

Amortisation of software development costs (11.5) (10.2)

Net financing costs (3.9) (3.0)

Adjusted profit before tax 12.1 11.0

Adjustments for:

Amortisation of acquired intangibles (2.8) (3.1)

Share based payment and related costs (0.4) (1.7)

Restructure and non-operational costs (8.7) (3.1)

Non-operational other income - 2.5

Non-operational IT expenses (5.6) (2.3)

Profit/(loss) on foreign currency translation 2.1 (1.8)

Share of profit of associate - 0.3

Profit on disposal of associate 3.0 6.9

Net financing costs (0.9) 0.2

Reported (loss)/profit before tax (1.2) 9.0

(Loss)/earnings per share

The Group reported a loss after tax of GBP4.0m for the year,

compared to a profit after tax of GBP6.4m in FY22. Adjusted profit

after tax was GBP9.9m, an 8% increase on the prior year, resulting

in a 9% increase in adjusted diluted earnings per share for the

period to 35.3p.

The calculation of adjusted profit after tax is detailed

below:

FY23 FY22

GBPm GBPm

Reported (loss)/profit before tax (1.2) 9.0

Tax (2.8) (2.6)

-------- ------

Reported (loss)/profit after tax (4.0) 6.4

Adjustments from (loss)/profit before tax (as per

the table above) 13.3 2.1

Tax effect of adjustments (2.4) (1.3)

Discrete tax items 3.0 1.9

Adjusted profit after tax 9.9 9.1

Weighted average number of ordinary shares (diluted) 28.0m 28.0m

Reported (LPS)/EPS (diluted) (14.4p) 22.9p

Adjusted EPS (diluted) 35.3p 32.3p

Cash generation and net cash (excluding lease liabilities)

The Group generated GBP33.5m of cash from operating activities

before the exceptional Oracle ERP implementation cash outlay

incurred during the year of GBP5.1m, representing a 96% conversion

of adjusted EBITDA. We continued to focus on cash collection and

working capital improvements and the target for the full year from

operating activities, cash conversion was in the range of 80-85% of

adjusted EBITDA .

At the year end we had a net cash position of GBP0.4m, broadly

unchanged from the prior year. The factors impacting the movement

in net cash (excluding lease liabilities) are summarised in the

table below:

FY23 FY22

GBPm GBPm

Opening net cash/(debt) (excluding lease liabilities) 0.3 (9.9)

Cash generated from operating activities before n

on-operational IT expenses 33.5 29.9

Non-operational IT expenses (5.1) (1.0)

------- -------

Cash generated from operating activities 28.5 28.9

Taxes paid (1.5) (0.4)

Capital expenditure: property, plant and equipment (2.9) (2.8)

Proceeds from sale of property, plant and equipment - 0.9

Capital expenditure: intangible assets (23.4) (18.9)

Sale of other investments and associates 0.1 11.0

Investments 8.1 0.1

Issue of new shares 3.1 0.8

Interest, foreign exchange and other (11.9) (9.3)

------- -------

Closing net cash (excluding lease liabilities) 0.4 0.3

The drivers of cash performance in FY23 were the increasing

spend on research and development, of which GBP23.1m was

capitalised, and the sale of our investment in Quantile

Technologies, following the completion of its sale to LSEG during

the year.

After the year-end we refinanced our banking facilities, which

had been due to expire in June 2024, on improved terms. The total

facility remains at GBP130m and is entirely comprised of a

revolving credit facility, replacing a GBP65m term loan and GBP65m

revolving credit facility. The interest rate payable is SONIA/SOFR

plus a fixed margin that depends on the level of debt relative to

adjusted EBITDA. The margin on the new revolving credit facility is

equal to 1.85% to 2.85%, this compares favourably to the previous

margin of 2% to 3%. The lead arranger for the facility remains Bank

of Ireland, with continued participation from Barclays and AIB and

new participation from HSBC.

Definition of terms

The Group uses the following definitions for its key

metrics:

Annual recurring revenue (ARR) : the value at the end of the

accounting period of recurring software revenue to be recognised in

the next twelve months, formerly defined as "exit annual recurring

revenue".

Annual contract value (ACV): the sum of the value of each

customer contract signed during the year divided by the number of

years in each contract.

Net revenue retention rate (NRR) : is based on the actual

revenues in the quarter annualised forward to twelve months and

compared to the revenue from the four quarters prior. The customer

cohort is comprised of customers in the quarter that have generated

revenue in the prior four quarters.

Adjusted admin expenses: is a measure used in internal

management reporting which comprises administrative expenses per

the statement of comprehensive income of GBP66.6m (FY22: GBP51.9m)

adjusted for depreciation and amortisation of GBP21.6m (FY22:

GBP20.1m), share based payments and related costs of GBP0.4m (FY22:

GBP1.7m) and, restructure and non-operational costs of GBP8.7m

(FY22: GBP3.1m), IT Systems implementation costs expensed GBP5.6m

(FY22: GBP2.3m) and other income GBP(2.4)m (FY22: GBP(0.5)m).

Consolidated statement of comprehensive income

Year ended 28 February 2023

2023 2022

Note GBP'000 GBP'000

----------------------------------------------------- ---- --------- ---------

Revenue 2 296,042 263,463

Cost of sales (173,701) (157,327)

Gross profit 2 122,341 106,136

----------------------------------------------------- ---- --------- ---------

Operating costs

Research and development costs (27,112) (21,125)

- of which capitalised 23,138 18,553

Sales and marketing costs (50,927) (47,355)

Administrative expenses (66,592) (51,949)

Impairment loss on trade and other receivables (2,645) (695)

Total operating costs (124,138) (102,571)

----------------------------------------------------- ---- --------- ---------

Other income 249 2,816

Operating (loss)/profit (1,548) 6,381

----------------------------------------------------- ---- --------- ---------

Finance income 24 262

Finance expense (4,777) (3,015)

Gain/(loss) on foreign currency translation 2,107 (1,834)

----------------------------------------------------- ---- --------- ---------

Net finance costs (2,646) (4,587)

Share of gain of associate, net of tax - 262

Profit on disposal of associate 3,017 6,943

(Loss)/profit before taxation (1,177) 8,999

Income tax expense (2,836) (2,572)

(Loss)/profit for the year (4,013) 6,427

----------------------------------------------------- ---- --------- ---------

(Loss)/profit for the year (4,013) 6,427

Other comprehensive income

Items that will not be reclassified subsequently

to profit or loss

Equity investments at FVOCI - net change in fair

value (522) (1,408)

Net gain on sale of FVOCI holding - 150

Items that will or may be reclassified subsequently

to profit or loss

Net exchange gain on net investment in foreign

subsidiaries 12,052 3,237

Net loss on hedge of net investment in foreign

subsidiaries (3,124) (1,183)

----------------------------------------------------- ---- --------- ---------

Other comprehensive income for the year, net of

tax 8,315 796

----------------------------------------------------- ---- --------- ---------

Total comprehensive income for the year attributable

to owners of the parent 4,393 7,223

----------------------------------------------------- ---- --------- ---------

Note Pence Pence

----------------------------------------------------- ---- --------- ---------

(Loss)/earnings per share

Basic 3a (14.4) 23.1

Diluted 3a (14.4) 22.9

----------------------------------------------------- ---- --------- ---------

All profits are attributable to the owners of the Company and

relate to continuing activities.

Consolidated balance sheet

As at 28 February 2023

2023 2022

Note GBP'000 GBP'000

--------------------------------------------- ---- ------- -------

Assets

Property, plant and equipment 4 25,593 28,343

Intangible assets and goodwill 5 175,660 155,607

Other financial assets 9,356 19,676

Trade and other receivables 2,548 3,745

Deferred tax assets 21,313 17,998

--------------------------------------------- ---- ------- -------

Non-current assets 234,470 225,369

--------------------------------------------- ---- ------- -------

Trade and other receivables 96,749 74,029

Current tax receivable 6,114 4,172

Cash and cash equivalents 36,905 48,564

--------------------------------------------- ---- ------- -------

Current assets 139,768 126,765

--------------------------------------------- ---- ------- -------

Total assets 374,238 352,134

--------------------------------------------- ---- ------- -------

Equity

Share capital 140 139

Share premium 103,789 100,424

Share option reserve 18,974 18,404

Fair value reserve 3,002 9,755

Currency translation adjustment reserve 5,354 (3,574)

Retained earnings 69,609 67,391

--------------------------------------------- ---- ------- -------

Equity attributable to owners of the Company 200,868 192,539

--------------------------------------------- ---- ------- -------

Liabilities

Loans and borrowings 6 17,026 62,504

Trade and other payables 3,681 3,190

Deferred tax liabilities 15,758 15,307

--------------------------------------------- ---- ------- -------

Non-current liabilities 36,465 81,001

--------------------------------------------- ---- ------- -------

Loans and borrowings 39,911 9,054

Trade and other payables 41,466 33,606

Deferred income 48,407 26,990

Current tax payable 682 382

Employee benefits 6,439 8,562

--------------------------------------------- ---- ------- -------

Current liabilities 136,905 78,594

--------------------------------------------- ---- ------- -------

Total liabilities 173,370 159,595

--------------------------------------------- ---- ------- -------

Total equity and liabilities 374,238 352,134

--------------------------------------------- ---- ------- -------

Consolidated statement of changes in equity

Year ended 28 February 2023

Share Currency

Share Share Merger option Fair value translation Retained Total

capital premium reserve reserve reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- -------- -------- -------- ---------- ------------ --------- -------

Balance at 1 March

2022 139 100,424 - 18,404 9,755 (3,574) 67,391 192,539

------------------------------ -------- -------- -------- -------- ---------- ------------ --------- -------

Total comprehensive

income for the year

Loss for the year - - - - - - (4,013) (4,013)

Other comprehensive

income

Net exchange gain on

net investment in foreign

subsidiaries - - - - - 12,052 - 12,052

Net exchange loss on

hedge of net investment

in foreign subsidiaries - - - - - (3,124) - (3,124)

Transfer of reserve

of sale of equity investment - - - - (6,231) - 6,231 -

Net change in fair

value of equity investments

at FVOCI - - - - (522) - - (522)

------------------------------ -------- -------- -------- -------- ---------- ------------ --------- -------

Total comprehensive

income for the year - - - - (6,753) 8,928 2,218 4,393

Transactions with

owners of the Company

Tax relating to share

options - - - 245 - - - 245

Exercise of share options 1 3,079 - - - - - 3,080

Issue of shares - 286 - - - - - 286

Share based payment

charge - - - 325 - - - 325

------------------------------ -------- -------- -------- -------- ---------- ------------ --------- -------

Balance at 28 February

2023 140 103,789 - 18,974 3,002 5,354 69,609 200,868

------------------------------ -------- -------- -------- -------- ---------- ------------ --------- -------

Consolidated statement of changes in equity (continued)

Year ended 28 February 2022

Share Currency

Share Share Merger option Fair value translation Retained Total

capital premium reserve reserve reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------- -------- -------- ---------- ------------ --------- -------

Balance at 1 March

2021 139 99,396 8,118 16,790 10,682 (5,628) 53,177 182,674

----------------------------- -------- -------- -------- -------- ---------- ------------ --------- -------

Total comprehensive

income for the year

Profit for the year - - - - - - 6,427 6,427

Other comprehensive

income

Net exchange gain on

net investment in foreign

subsidiaries - - - - - 3,237 - 3,237

Net exchange loss on

hedge of net investment

in foreign subsidiaries - - - - - (1,183) - (1,183)

Net change in fair

value of equity investments

at FVOCI - - - - (1,408) - - (1,408)

Net gain/(loss) on

sale of FVOCI holding - - - - 481 - (331) 150

----------------------------- -------- -------- -------- -------- ---------- ------------ --------- -------

Total comprehensive

income for the year - - - - (927) 2,054 6,096 7,223

Transactions with owners

of the Company

Tax relating to share

options - - - 80 - - - 80

Exercise of share options - 773 - - - - - 773

Issue of shares - 255 - - - - - 255

Share based payment

charge - - - 1,534 - - - 1,534

Transfer (see note

21) - - (8,118) - - - 8,118 -

----------------------------- -------- -------- -------- -------- ---------- ------------ --------- -------

Balance at 28 February

2022 139 100,424 - 18,404 9,755 (3,574) 67,391 192,539

----------------------------- -------- -------- -------- -------- ---------- ------------ --------- -------

Consolidated cash flow statement

Year ended 28 February 2023

2023 2022

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Cash flows from operating activities

(Loss)/profit for the year (4,013) 6,427

Adjustments for:

Net finance costs 2,646 4,587

Depreciation of property, plant and equipment 7,265 6,308

Amortisation of intangible assets 14,331 13,817

Equity-settled share based payment transactions 325 1,534

Profit on disposal of associate (3,017) (6,943)

Loss/(profit) on disposal of fixed assets 5 (222)

Other income (9) (2,499)

Grant income (240) (317)

Share of profit of associate - (262)

Tax expense 2,836 2,572

---------------------------------------------------- -------- --------

20,129 25,002

Changes in:

Trade and other receivables (14,604) (1,585)

Trade and other payables and deferred income 22,970 5,473

---------------------------------------------------- -------- --------

Cash generated from operating activities 28,495 28,890

Taxes paid (1,467) (407)

---------------------------------------------------- -------- --------

Net cash from operating activities 27,028 28,483

---------------------------------------------------- -------- --------

Cash flows from investing activities

Interest received 24 19

Acquisition of subsidiaries - (118)

Acquisition of other investments - (95)

Sale of associate 100 11,001

Sale of other investments 8,139 175

Acquisition of property, plant and equipment (2,940) (2,777)

Proceeds from sale of property, plant and equipment 67 920

Acquisition of intangible assets (23,468) (18,931)

---------------------------------------------------- -------- --------

Net cash used in investing activities (18,078) (9,806)

---------------------------------------------------- -------- --------

Cash flows from financing activities

Proceeds from issue of share capital 3,080 773

Repayment of borrowings (17,823) (19,141)

Payment of lease liabilities (4,000) (3,598)

Interest paid (3,666) (2,932)

---------------------------------------------------- -------- --------

Net cash used in financing activities (22,409) (24,898)

---------------------------------------------------- -------- --------

Net decrease in cash and cash equivalents (13,459) (6,221)

Cash and cash equivalents at 1 March 48,564 55,198

Effects of exchange rate changes on cash held 1,800 (413)

---------------------------------------------------- -------- --------

Cash and cash equivalents at 28 February 36,905 48,564

---------------------------------------------------- -------- --------

1. Basis of preparation

The consolidated financial statements consolidate those of the

Company and its subsidiaries (together referred to as the

"Group").

The financial information included in this preliminary

announcement does not constitute statutory accounts of the Group

for the years ended 28 February 2023 nor 28 February 2022 but is

derived from those accounts. Statutory accounts for 2022 have been

delivered to the Registrar of Companies and those for 2023 will be

delivered following the Company's Annual General Meeting. The

auditors have reported on those accounts; their reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498(2) or (3) of the Companies Act 2006.

Both the consolidated financial statements and the Company

financial statements have been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards ("IFRSs").

2. Operating and business segments

Information about reportable segments

KX FD MRP Total

---------------- ---------------- ---------------- ------------------

2023 2022 2023 2022 2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Revenue by segment

Revenue 80,239 64,418 174,329 147,988 41,474 51,057 296,042 263,463

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Gross profit 57,971 44,520 47,345 39,376 17,025 22,240 122,341 106,136

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Adjusted EBITDA 16,621 9,782 16,712 13,982 1,429 7,283 34,762 31,047

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Restructure and non-operational

costs (8,716) (3,082)

IT systems implementation

costs expensed (5,562) (2,287)

Non-operational other

income - 2,499

Share based payment and

related costs (436) (1,671)

Depreciation and amortisation (18,799) (16,994)

Amortisation of acquired

intangibles (2,797) (3,131)

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Operating (loss)/profit (1,548) 6,381

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Net finance costs (2,646) (4,587)

Profit on disposal of

associate 3,017 6,943

Share of profit of associate,

net of tax - 262

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

(Loss)/profit before

taxation (1,177) 8,999

-------------------------------- ------- ------- ------- ------- ------- ------- -------- --------

Geographical location analysis

Revenues Non-current assets

---------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------- ------- --------- ---------

UK 104,163 79,355 87,589 87,448

EMEA 55,062 46,463 17,028 16,826

The Americas 114,848 110,697 106,317 118,576

Asia Pacific 21,969 26,948 2,223 2,952

------------- ------- ------- --------- ---------

Total 296,042 263,463 213,157 225,802

------------- ------- ------- --------- ---------

Disaggregation of revenue

KX FD MRP Total

---------------- ---------------- ---------------- ----------------

2023 2022 2023 2022 2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------- ------- ------- ------- ------- ------- ------- -------

Type of good or service

Sale of goods - perpetual 1,556 3,589 - - - - 1,556 3,589

Sale of goods - recurring 58,326 39,192 - - 22,446 27,015 80,772 66,207

Rendering of services 20,357 21,637 174,329 147,988 19,028 24,042 213,714 193,667

------------------------------ ------- ------- ------- ------- ------- ------- ------- -------

80,239 64,418 174,329 147,988 41,474 51,057 296,042 263,463

------------------------------ ------- ------- ------- ------- ------- ------- ------- -------

Timing of revenue recognition

At a point in time 1,556 3,589 - - - - 1,556 3,589

Over time 78,683 60,829 174,329 147,988 41,474 51,057 294,486 259,874

------------------------------ ------- ------- ------- ------- ------- ------- ------- -------

80,239 64,418 174,329 147,988 41,474 51,057 296,042 263,463

------------------------------ ------- ------- ------- ------- ------- ------- ------- -------

3. a) (Loss)/earnings per ordinary share

Basic

The calculation of basic (loss)/earnings per share at 28

February 2023 was based on the loss attributable to ordinary

shareholders of GBP4,013k (2022: profit GBP6,427k), and a weighted

average number of ordinary shares in issue of 27,962k (2022:

27,782k).

2023 2022

Pence Pence

per share per share

--------------------------------- ---------- ----------

Basic ( loss)/earnings per share (14.4) 23.1

--------------------------------- ---------- ----------

Weighted average number of ordinary shares

2023 2022

Number Number

'000 '000

---------------------------------------------------------- ------ ------

Issued ordinary shares at 1 March 27,826 27,717

Effect of share options exercised 124 58

Effect of shares issued as remuneration 12 7

---------------------------------------------------------- ------ ------

Weighted average number of ordinary shares at 28 February 27,962 27,782

---------------------------------------------------------- ------ ------

Diluted

The calculation of diluted (loss)/earnings per share at 28

February 2023 was based on the loss attributable to ordinary

shareholders of GBP4,013k (2022: profit GBP6,427k) and a weighted

average number of ordinary shares after adjustment for the effects

of all dilutive potential ordinary shares of 27,962k (2022:

28,036k).

2023 2022

Pence Pence

per share per share

---------------------------------- ---------- ----------

Diluted (loss)/earnings per share (14.4) 22.9

---------------------------------- ---------- ----------

Weighted average number of ordinary shares (diluted)

2023 2022

Number Number

'000 '000

-------------------------------------------------------- ------ ------

Weighted average number of ordinary shares (basic) 27,962 27,782

Effect of dilutive share options in issue - 254

-------------------------------------------------------- ------ ------

Weighted average number of ordinary shares (diluted) at

28 February 27,962 28,036

-------------------------------------------------------- ------ ------

At 28 February 2023 in accordance with IAS 33, due to the loss

in the financial period share options in issue are anti-dilutive

meaning there is no difference between basic and diluted earnings

per share. In the prior year 518,137 shares were excluded from the

diluted weighted average calculation as their effect would have

been anti-dilutive. The average market value of the Group's shares

for the purposes of calculating the dilutive effect of share

options was based on quoted market prices for the year during which

the options were outstanding.

3. b) (Loss)/ earnings before tax per ordinary share

(Loss)/earnings before tax per share are based on loss before

taxation of GBP1,177k (2022: profit GBP8,999k). The number of

shares used in this calculation is consistent with note 3(a)

above.

2023 2022

Pence Pence

per share per share

------------------------------------------------------ ---------- ----------

Basic (loss)/earnings before tax per ordinary share (4.3) 32.4

Diluted (loss)/earnings before tax per ordinary share (4.3) 32.1

------------------------------------------------------ ---------- ----------

Reconciliation from (loss)/earnings per ordinary share to

(loss)/ earnings before tax per ordinary share:

2023 2022

Pence Pence

per share per share

--------------------------------------------- ---------- ----------

Basic (loss)/earnings per share (14.4) 23.1

Impact of taxation charge 10.1 9.3

--------------------------------------------- ---------- ----------

Basic (loss)/earnings before tax per share (4.3) 32.4

--------------------------------------------- ---------- ----------

Diluted (loss)/earnings per share (14.4) 22.9

Impact of taxation charge 10.1 9.2

--------------------------------------------- ---------- ----------

Diluted (loss)/earnings before tax per share (4.3) 32.1

--------------------------------------------- ---------- ----------

(Loss)/earnings before tax per share is presented to facilitate

pre-tax comparison returns on comparable investments.

3. c) Adjusted earnings after tax per ordinary share

Adjusted earnings after tax per share is based on an adjusted

profit after taxation of GBP9,864k (2022: GBP9,051k). The adjusted

profit after tax has been calculated by adjusting the loss after

tax GBP4,013k (2022: profit GBP6,427k) for the amortisation of

acquired intangibles after tax effect of GBP2,565k (2022:

GBP2,715k), share based payment and related charges after tax

effect of GBP353k (2022: GBP1,353k), restructure and

non-operational costs after tax effect of GBP14,781k (2022:

GBP4,473k), profit on disposal of associate after tax and share of

profit of associate after tax effect of GBP3,017k (2022:

GBP7,206k), the profit on foreign currency translation after tax

effect of GBP1,707k (2022: loss GBP1,485k), finance costs after tax

effect of GBP902k (2022: GBPnil) and finance income from sale of

investment after tax effect of GBPnil (2022: GBP197k). The number

of shares used in this calculation is consistent with note 3(a)

above.

2023 2022

Pence Pence

per share per share

------------------------------------------------------- ---------- ----------

Adjusted basic earnings after tax per ordinary share 35.3 32.6

Adjusted diluted earnings after tax per ordinary share 35.3 32.3

------------------------------------------------------- ---------- ----------

4. Property, plant and equipment

Group

Leasehold Plant and Office Right-of-use

improvements equipment furniture assets Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------- ---------- ---------- ------------ --------

Cost

At 1 March 2022 5,444 14,372 1,366 30,171 51,353

Additions 441 2,362 137 1,035 3,975

Disposals (104) (34) - (880) (1,018)

Reclass 1,468 (1,468) - - -

Exchange adjustments 230 624 89 1,443 2,386

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2023 7,479 15,856 1,592 31,769 56,696

--------------------- ------------- ---------- ---------- ------------ --------

Depreciation

At 1 March 2022 3,544 8,544 1,116 9,806 23,010

Charge for the year 671 2,257 171 4,166 7,265

Disposals (32) - - (451) (483)

Reclass (38) (9) 47 - -

Exchange adjustments 116 539 28 628 1,311

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2023 4,261 11,331 1,362 14,149 31,103

--------------------- ------------- ---------- ---------- ------------ --------

Leasehold Plant and Office Right-of-use

improvements equipment furniture assets Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------- ---------- ---------- ------------ --------

Cost

At 1 March 2021 6,224 11,886 1,349 32,590 52,049

Additions 318 2,442 17 377 3,154

Disposals (1,144) (10) - (3,131) (4,285)

Exchange adjustments 46 54 - 335 435

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2022 5,444 14,372 1,366 30,171 51,353

--------------------- ------------- ---------- ---------- ------------ --------

Depreciation

At 1 March 2021 3,321 6,845 894 7,448 18,508

Charge for the year 531 1,673 219 3,885 6,308

Disposals (337) (10) - (1,636) (1,983)

Exchange adjustments 29 36 3 109 177

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2022 3,544 8,544 1,116 9,806 23,010

--------------------- ------------- ---------- ---------- ------------ --------

Carrying amounts

At 1 March 2021 2,903 5,041 455 25,142 33,541

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2022 1,900 5,828 250 20,365 28,343

--------------------- ------------- ---------- ---------- ------------ --------

At 28 February 2023 3,218 4,525 230 17,620 25,593

--------------------- ------------- ---------- ---------- ------------ --------

5. Intangible assets and goodwill

Group

Internally

Customer Acquired Brand developed

Goodwill lists software name software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- --------- -------- ---------- --------

Cost

Balance at 1 March 2022 106,501 12,834 29,769 743 101,540 251,387

Additions - - 330 - - 330

Development costs - - - - 23,138 23,138

Exchange adjustments 10,141 1,083 2,877 59 978 15,138

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2023 116,642 13,917 32,976 802 125,656 289,993

-------------------------- -------- -------- --------- -------- ---------- --------

Amortisation

Balance at 1 March 2022 - 11,832 26,106 703 57,139 95,780

Amortisation for the year - 944 1,816 37 11,534 14,331

Exchange adjustment - 1,003 2,527 55 637 4,222

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2023 - 13,779 30,449 795 69,310 114,333

-------------------------- -------- -------- --------- -------- ---------- --------

Internally

Customer Acquired Brand developed

Goodwill lists software name software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- --------- -------- ---------- --------

Cost

Balance at 1 March 2021 103,527 12,467 28,535 733 83,531 228,793

Development costs - - - - 18,553 18,553

Additions - - 378 - - 378

Exchange adjustments 2,974 367 856 10 (544) 3,663

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2022 106,501 12,834 29,769 743 101,540 251,387

-------------------------- -------- -------- --------- -------- ---------- --------

Amortisation

Balance at 1 March 2021 - 10,426 22,619 652 47,583 81,280

Amortisation for the year - 1,083 2,475 42 10,217 13,817

Exchange adjustment - 323 1,012 9 (661) 683

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2022 - 11,832 26,106 703 57,139 95,780

-------------------------- -------- -------- --------- -------- ---------- --------

Carrying amounts

At 1 March 2021 103,527 2,041 5,916 81 35,948 147,513

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2022 106,501 1,002 3,663 40 44,401 155,607

-------------------------- -------- -------- --------- -------- ---------- --------

At 28 February 2023 116,642 138 2,527 7 56,346 175,660

-------------------------- -------- -------- --------- -------- ---------- --------

6.Loans and borrowings

This note provides information about the contractual terms of

the Group and Company's interest-bearing loans and borrowings,

which are measured at amortised cost.

Group Company

---------------- ----------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------- ------- ------- -------

Current liabilities

Secured bank loans 36,499 5,311 36,499 5,311

Lease liabilities 3,412 3,743 1,007 1,445

------------------------ ------- ------- ------- -------

39,911 9,054 37,506 6,756

------------------------ ------- ------- ------- -------

Non-current liabilities

Secured bank loans - 42,925 - 42,926

Lease liabilities 17,026 19,579 7,522 8,549

------------------------ ------- ------- ------- -------

17,026 62,504 7,522 51,475

------------------------ ------- ------- ------- -------

Terms and repayment schedule

After the year end, we refinanced our banking facilities, which

had been due to expire in June 2024, on improved terms. The total

facility remains at GBP130m and is entirely comprised of a

revolving credit facility, replacing a GBP65m term loan and GBP65m

revolving credit facility. The interest rate payable is SONIA/SOFR

plus a fixed margin that depends on the level of debt relative to

adjusted EBITDA. The margin on the new revolving credit facility is

equal to 1.85% to 2.85%, this compares favourably to the previous

margin of 2% to 3%. The lead arranger for the facility remains Bank

of Ireland, with continued participation from Barclays and AIB and

new participation from HSBC.

7. Subsequent events

On 19 May 2023 the parent company FD Technologies plc renewed

its banking facilities, which had been due to expire in June 2024.

Further details of the loan financing arrangement are included in

note 6.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKBBKCBKDQPB

(END) Dow Jones Newswires

May 23, 2023 02:00 ET (06:00 GMT)

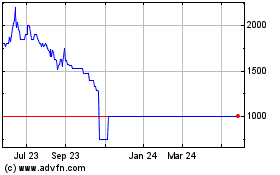

FD Technologies (AQSE:FDP.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

FD Technologies (AQSE:FDP.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025