TIDMHSP

RNS Number : 5366X

Hargreaves Services PLC

21 December 2023

Hargreaves Services plc

("Hargreaves" or the "Group")

Trading Update, Notice of Interim Results and Enhanced Dividend

Payout

Hargreaves Services plc (AIM: HSP), a diversified group

delivering services to the industrial and property sectors,

provides the following update on trading ahead of reporting its

interim results for the six months ended 30 November 2023.

Hargreaves Raw Material Services GmbH ("HRMS") (German Joint

Venture)

As communicated at the time of the full year results trading

conditions in HRMS were expected to be subdued. However, the

combined impact of reduced commodity prices and an economic

slowdown in Germany is proving to be more marked than anticipated,

especially so in the current quarter within the ferrous waste

recycling activities. As a result, the Board now expects that HRMS

will record a net loss in the first half and that the full year

profit after tax contribution from HRMS will be approximately one

quarter of that originally expected and materially lower than the

contribution in the comparative period of GBP15.5m.

As previously indicated, because of the cash generation

associated with the slowdown in activity, HRMS has been able to

return GBP8m of surplus cash to the Group, which was received in

November 2023. In view of the substantial accumulated distributable

reserves on the HRMS Balance Sheet and management's assessment of

the likely average level of profitability of the business across

the cycle, the Board has agreed with the management of HRMS that an

annual distribution of GBP7m is sustainable for the foreseeable

future and will become a regular cash receipt for the Group from

the joint venture.

Services

The Services business had a strong first half to the year. The

Board anticipates reporting a growth in Profit before Tax on the

comparative interim period after adjusting for the GBP2.0m one-off

gain on asset disposal recognised in the first half of the last

financial year. Services profits for the full year are expected to

be circa GBP2.0m higher than previously expected. Much of this

improvement is due to the volume of activity at HS2 and other

earthmoving activities, with activity in this segment expected to

remain at elevated levels throughout calendar year 2024.

Hargreaves Land

In line with trends experienced across the broader market, sales

activity within Hargreaves Land has softened in recent months.

However, in August 2023 the business exchanged contracts with Avant

Homes for the sale of 20 acres of serviced residential land for a

total consideration of GBP18.5m payable in four instalments over

three years. The transaction is expected to complete in January

2024 underpinning the business unit's contribution in the financial

year.

The Board is also pleased to announce the sale of the Group's

interest in the Energy from Waste plant at the Westfield

development site for cash consideration of GBP7.6m, in line with

management expectations. The sale represents eight acres of the 50

acres available at Westfield. This demonstrates the ability of

Hargreaves Land to create, deliver and realise value from the

Group's land development sites.

The period has also seen good progress with the permitting,

development and commissioning of the Group's portfolio of renewable

energy land assets, with the first package of assets likely to go

to market in the financial year ending 31 May 2025.

Pension scheme

The Group is making good progress with the buy-out of the

Group's defined benefit pension schemes, with direct discussions

underway with potential insurers to take on the liability. Current

indications suggest that the cost of closing out the Group's

obligations under the scheme will be no higher than GBP9m,

materially lower than our original estimate of GBP15m. The Board

expects to complete the transaction in early 2024, thereby

eliminating annual deficit reduction payments of GBP1.8m.

Return of capital to shareholders

As a result of the positive cashflow impact of the impending

buy-out of the pension scheme and the expected additional

sustainable annual cash receipt from HRMS, the Board intends,

subject to unforeseen circumstances to increase the annual dividend

payable to shareholders to 36p per share, representing an increase

of over 70% on the prior year dividend of 21p. It is the intention

of the Board to pay 50% of this dividend at the interim stage, with

the remaining 50% as a final dividend. The timetable for payment of

the interim dividend will be set out within the interim results

statement.

Balance Sheet

On 30 November 2023, the Group had cash and cash equivalents of

GBP18.7m compared to GBP21.9m at 31 May 2023, reflecting continued

investment into the Blindwells development ahead of expected

receipts in the second half. The Group also had leasing debt

totaling GBP28.8m (GBP36.4m on 31 May 2023).

Commenting on the Trading Update, Group Chair Roger McDowell

said: "The Services business has continued to be a key growth

driver for Hargreaves, with its strong revenue base providing the

Group with a robust underpinning to trading. The slowdown in

activity at HRMS has been more pronounced than we had previously

anticipated, but has facilitated an increase in cash returned to

the Group. This, coupled with the impending buy out of the Group's

defined benefit pension scheme obligations at a much lower cost

than previously indicated, has allowed the Board to signal a

substantial increase in the full-year dividend. With further

opportunities to return cash to our shareholders on the horizon

from the realisation of our renewables portfolio, and additional

growth opportunities, the Group is well-positioned to deliver long

term sustainable returns."

Notice of Interim Results

The Board expects to report its interim results for the six

months ended 30 November 2023 on Wednesday 24 January 2024. Details

of the analyst and investor meetings which will accompany the

results will be provided in due course.

The Company considers that market expectations prior to the

release of this announcement for the year ending 31 May 2024 are

revenues of GBP209.1m, underlying PBT of GBP23.0m and underlying

earnings per share of 62.8p.

For further details:

Hargreaves Services www.hsgplc.co.uk

Gordon Banham, Chief Executive Officer Tel: 0191 373 4485

Stephen Craigen, Chief Financial Office

Walbrook PR (Financial PR & Tel: 020 7933 8780 or hargreavesservices@walbrookpr.com

IR) Mob: 07980 541 893 / 07747 515 393

Paul McManus / Louis Ashe-Jepson 07884 664 686

Charlotte Edgar

Singer Capital Markets (Nomad and Corporate Tel: 020 7496 3000

Broker)

Sandy Fraser

About Hargreaves Services plc ( www.hsgplc.co.uk )

Hargreaves Services plc is a diversified group delivering

services to the industrial and property sectors, supporting key

industries within the UK and South East Asia. The Company's three

business segments are Services, Hargreaves Land and an investment

in a German joint venture, Hargreaves Raw Materials Services GmbH

(HRMS). Services provides critical support to many core industries

including Energy, Environmental, UK Infrastructure and certain

manufacturing industries through the provision of materials

handling, mechanical and electrical contracting services, logistics

and major earthworks. Hargreaves Land is focused on the sustainable

development of brownfield sites for both residential and commercial

purposes. HRMS trades in specialist commodity markets and owns DK

Recycling, a specialist recycler of steel waste material.

Hargreaves is headquartered in County Durham and has operational

centres across the UK, as well as in Hong Kong and a joint venture

in Duisburg, Germany.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTTMBTTMTITTLJ

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

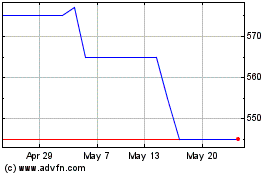

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

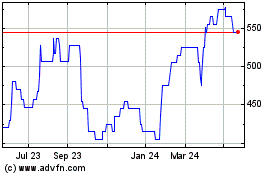

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024