TIDMPSY

RNS Number : 7898E

Psych Capital PLC

31 October 2022

31 October 2022

PSYCH CAPITAL PLC

AQSE: PSY

("Psych" or "the Company")

AUDITED RESULTS FOR THE YEARED 30 APRIL 2022

Psych Capital plc, the AQSE traded psychedelic healthcare

incubation company, is pleased to announce its audited results for

the year ended 30 April 2022.

The information set out below has been extracted from the

Company's annual report and accounts for the year ended 30 April

2022 and the full report will shortly be available on the Company's

website at https://psych.capital

"CHAIRMAN'S STATEMENT

We are pleased to present the results for Psych Capital Plc for

the year ended 30 April 2022. The Company was admitted to the AQSE

Growth market on 9 June 2022 and is the first pure-play psychedelic

company to list in London.

The nascent and growing medical psychedelic industry has

attracted a significant base of investors seeking to establish and

scale businesses in a landscape showing scientific and commercial

promise. The Company seeks to uncover opportunities at the

forefront of the rapidly evolving regulatory landscape,

developments in healthcare delivery frameworks, and scientific and

clinical research, to address the unmet needs of patients in the UK

and other markets, in the context of an escalating mental health

crisis.

The Company is pursuing two core strategies:

-- Identify, fund and support the building of future companies

conducting clinical research programs to develop psychedelic drug

development and therapeutic treatments; and

-- Scaling and growing its business-to-business ("B2B") media

and content platform (PSYCH) for the psychedelic science and

healthcare industry.

Overview

During 2021, the Company invested in Awakn Life Sciences Corp.

("Awakn"), acquiring approximately 2% per cent of Awakn's issued

share capital at the time of the investment. Awakn is a clinical

biotech company researching, developing and delivering

evidence-based psychedelic medicine to treat addiction and other

mental health conditions. The team at Awakn have delivered progress

on a number of fronts in 2022, including the successful completion

of Phase One of its Drug Discovery Program, and the approval of

Phase III of its Ketamine assisted therapy for alcohol use disorder

program, with the National Institute for Health and Care Research

("NIHR"), a UK government agency who provided funding of CA$2.5m,

which covers 66% of the costs.

The Company also acquired the PSYCH platform from Prohibition

Holdings Limited. The platform is a business-to-business media and

content platform for the psychedelic science and healthcare

industry, and provides a resource for networking, intelligence and

insights, servicing the industry through publications, newsletters

and engaging events. The PSYCH Platform is revenue generative, with

GBP62,228 of sponsorship revenue recognised during the year ended

30 April 2022.

PSYCH has amassed a significant global B2B audience, with

subscribers to the platform growing by 38% since acquisition, to

37,000 readers. This is particularly impressive given the Company's

lack of marketing activity. The platform also produces "The

Psychedelics as a Medicine Report" series, now in its 3rd Edition,

which has become one of the leading resources for the global

industry, with over 2,000 downloads per edition, and which is

recording record revenue in sponsorship from premium psychedelic

companies, including Beckley Psytech, Atai, Braxia, Filament Health

and Diamond.

Post year-end

The inaugural PSYCH Symposium was held in The National Gallery

on 11 May 2022 in London with over 350 delegates in attendance and

generated revenues of over GBP150,000 from client sponsorship and

ticket sales. The symposium attracted over 35 global thought

leaders from science, advocacy, regulation and finance, to

participate in a full day programme sharing insights, research and

inspiration for the future of the industry.

In June 2022, we listed on the Aquis Exchange, making Psych

Capital Plc the first pure play psychedelic focused company to list

on UK Capital markets. A successful capital raise was achieved as

part of our Initial Public Offering, raising gross proceeds of

GBP810,000.

We are committed to advancing the case for regulatory reform in

the UK and beyond, to improve patient access to innovative drugs

and therapy treatments. The Company welcomed the appointment of the

Conservative Party Drug Reform Group, represented by Crispin Blunt,

a pioneering politician leading regulatory reform, to the Company's

Psychedelic Medicines Technical Advisory Board.

While most of the attention in the industry is focused on

R&D and drug development, Psych Capital has conducted a full

analysis of potential healthcare delivery frameworks to identify

early-stage opportunities related to the implementation of

psychedelics as medicine. This included a full mapping of

companies, initiatives and projects that could impact the

development of the sector. Alongside market analysis, Psych Capital

explored investment opportunities into several companies and while

no investment has been finalised to date, we have identified

potential investments that could make a positive impact to the

group in the future.

The management team and board has been strengthened by the

appointment of an independent non-executive director upon admission

to the AQSE, and subsequently a CFO, both of whom are seasoned

finance professionals, with public markets, and regulatory

expertise.

Outlook and prospects

Whilst macroeconomic pressure stemming from the conflict in

Ukraine, concerns regarding inflationary pressures, and political

uncertainty have led to market volatility, the nascent psychedelic

industry continues to develop rapidly. The publication of

potentially transformative clinical trial results expected in late

2022/ early 2023 are eagerly anticipated by the market, with MDMA

and psilocybin-assisted therapy expected to be regulated by the

FDA.

Our latest PSYCH reports forecast that the European economies

stand to save over US$60 billion each year through innovations in

psychedelic healthcare, with the market for psychedelic-assisted

therapies expected to be worth US$1.5 billion by 2030. In the

United States, where healthcare costs are far greater, the economy

stands to save US$270 billion. Across the Atlantic the market could

exceed US$4 billion by 2030, driven by the regulation of MDMA and

psilocybin.

Psych Capital, with our network of experts, proprietary market

intelligence, and access to deal flow, is in a strong position to

invest in early-stage opportunities in the medical psychedelic

industry. We have been exploring several potential M&A

transactions which have come to us at preferential valuations

compared to the prior six months, and we look forward to updating

the market on developments.

Joseph Colliver

Non-Executive Chairman

The Directors of the Company accept responsibility for the

contents of this announcement.

ENQUIRIES:

Company:

Psych Capital plc

William Potts info@psych.capital

Stephen Murphy

https://psych.capital

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

Mark Anwyl 020 7469 0930

Statement of Comprehensive Income

Year ended

30 April 2022

GBP

---------------

Revenue 62,228

Cost of sales (22,257)

---------------

Gross profit 39,971

Administrative expenses (622,445)

---------------

Operating loss (582,474)

Fair value gains on fixed asset investments 38,541

---------------

Loss on ordinary activities before taxation (543,933)

Income tax -

---------------

Total comprehensive loss for the financial year (543,933)

===============

Basic loss per share attributable to owners of the parent 0.012

Statement of Financial Position

As at

30 April 2022

GBP

---------------

Non-current Assets

Intangible assets 387,500

Investments 338,542

---------------

Total Non-current Assets 726,042

===============

Current Assets

Cash and cash equivalents 322,634

Other receivables 150,568

---------------

Total Current Assets 473,202

===============

Current Liabilities

Trade and other payables 723,177

---------------

Total Liabilities 723,177

===============

Net Current Assets/(Liabilities) (249,975)

Net Assets 476,067

===============

Equity

Issued share capital 183,333

Share premium 836,667

Retained earnings (543,933)

Total Equity 476,067

===============

Statement of Changes in Equity

Share Share Retained Total

capital premium earnings equity

GBP GBP GBP GBP

--------- --------- ---------- ----------

Transactions with equity owners

At incorporation - issue of share capital

2 ordinary shares at GBP0.0001 each - - - -

Ordinary Shares issued

39,998 shares at GBP0.0001 each 4 - - 4

Ordinary Shares issued 183,329 836,667 - 1,019,996

Total comprehensive income

Total comprehensive income

for the year ended 30 April 2022 - - (543,933) (543,933)

--------- --------- ---------- ----------

As at 30 April 2022 183,333 836,667 (543,933) 476,067

--------- --------- ---------- ----------

Statement of Cash Flows

Year ended

30 April 2022

GBP

---------------

Cash flows from operating activities

Loss before tax (543,933)

Adjusted for:

Fair value gain on investments (38,541)

Amortisation of intangible assets 62,500

(Increase) in trade and other receivables (150,568)

Increase in trade and other payables 273,177

---------------

Net cash used in operating activities (397,365)

---------------

Cash flows from investing activities

Purchase of investments (240,001)

Net cash used in investing activities (240,001)

---------------

Cash flows from financing activities

Proceeds from the issue of shares 960,000

---------------

Net cash generated from financing activities 960,000

---------------

Net increase in cash and cash equivalents 322,634

Cash and cash equivalents at beginning of year -

---------------

Cash and cash equivalents at end of year 322,634"

===============

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public

domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXEAKEFDEFAFFA

(END) Dow Jones Newswires

October 31, 2022 12:04 ET (16:04 GMT)

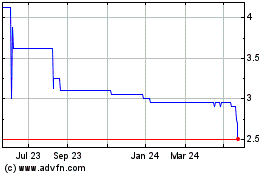

Shortwave Life Sciences (AQSE:PSY)

Historical Stock Chart

From Dec 2024 to Jan 2025

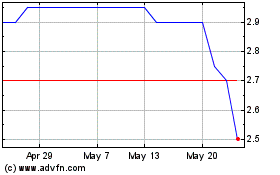

Shortwave Life Sciences (AQSE:PSY)

Historical Stock Chart

From Jan 2024 to Jan 2025