TIDMSQZ

RNS Number : 2891E

Serica Energy PLC

29 June 2023

Serica Energy plc

("Serica" or "the Company")

Corporate Presentations for Annual General Meeting

London , 29 June 2023 - Serica Energy plc (AIM: SQZ), announces

that at the Annual General Meeting today, presentations will be

made by both the Chair, Tony Craven Walker, and the Chief

Executive, Mitch Flegg. Copies of the presentations will be

available on the Company website www.serica-energy.com under

Investors/Presentations.

Production

2023 group production remains strong. The monthly net production

(in boe/d) for each of the assets in the portfolio is as

follows:

Jan Feb 23 Mar Apr 23 May Jun 23

23 23 23

(to date)

Bittern 7,403 4,982 6,593 3,650 5,101 6,339

Bruce 5,558 5,385 8,187 7,574 8,645 7,963

Columbus 2,785 2,155 2,661 2,147 1,540 2,480

Erskine 1,846 1,700 1,369 1,425 1,815 1,930

Evelyn 5,844 3,589 5,373 3,937 4,357 6,074

Gannet E 4,387 4,416 11,934 7,421 9,201 10,649

Guillemot W&NW 167 151 328 102 232 279

Orlando 2,265 4,102 4,024 3,899 3,367 3,343

Rhum 14,581 12,980 15,228 18,389 18,791 17,525

Total 44,836 39,460 55,697 48,544 53,049 56,582

Net production for the combined Serica and Tailwind portfolios

has averaged over 49,000 boe/d YTD (to 24 June). There will be

several planned maintenance programmes on our assets this summer.

Some of these outages have just commenced and some will occur

during the second half of the year so full year 2023 production

guidance remains unchanged at 40,000 - 47,000 boe/d.

Costs

Unaudited production costs for the group are running at

approximately US$17/boe YTD on a proforma basis including Tailwind

assets from 1 January 2023. This in line with our expectations for

the period as inflationary pressures continue within the UK North

Sea.

Commodity Prices

Year to date realised commodity prices of approximately

100p/therm for gas and US$64/bbl for oil on a proforma basis

incorporating Tailwind assets from 1 January 2023. This includes a

mix of volumes sold at spot prices and volumes sold at fixed

prices. The remaining fixed price volumes are:

Gas: 50,000 therms/day at 41p for Q3 2023

Oil: 11,000 bbls/day at US$61 for 2H 2023

5,000 bbls/day at US$70 for 1H 2024

2,700 bbls/day at US$80 for 2H 2024

Capital Expenditure

Serica has a strong balance sheet with significant net cash

enabling it to continue its onging programme of investing in the

portfolio to add value. Serica is also a current UK Ring Fence

Corporation Tax and EPL payer. The costs of our 2023/4 Capital

Expenditure programme can be offset against our taxable revenues

and will further qualify for the EPL investment incentives designed

to encourage companies to invest.

The acquisition of the former Tailwind assets has added a range

of opportunities to Serica's hopper of potential future organic

investments.

Serica's planned 2023/24 investment programme includes two Light

Well Intervention Vessel campaigns (2023 & 2024) on the Bruce

and Keith fields and a four-well drilling campaign in the Triton

Area (Bittern B1z, Gannet GE-05, Evelyn Phase 2 and a Guillemot NW

infill well).

Following detailed interpretation of the North Eigg exploration

well results, Serica has decided that there is an insufficient

accessible volume of oil to justify re-entering the suspended well

and drilling a sidetrack. Following consultation with the NSTA, we

have elected to go into the second term of the P2501 Licence for

the purpose of completing the abandonment of the North Eigg well.

Only the area immediately around the well necessary for the

abandonment is being retained with the remainder of the block being

relinquished.

Mitch Flegg, Chief Executive, commented:

"Serica has established a diverse and balanced portfolio in the

UKCS. The acquisition of Tailwind has provided an additional

independent production hub and has resulted in a more balanced

split between oil and gas. The benefits of this are already

becoming apparent with production remaining at consistently high

levels since completion of the deal.

In 2022 the reserves added to the combined Serica and Tailwind

portfolios were more than three times the volume of oil and gas

produced. This is an outstanding reserves replacement record and we

are already working on an exciting programme of value-adding

investment opportunities across the enlarged company in

2023/24.

We are disappointed that we have been unable to identify a

viable sidetrack target for the North Eigg exploration well.

Especially given the current licencing and fiscal uncertainties for

UK North Sea activities, we believe that a disciplined approach to

investment is important. In the near term, this means maturing

better short-cycle investment opportunities within our

portfolio.

As previously announced, Serica is proposing a final dividend of

14 pence per share, bringing the total dividend in respect of the

last financial year to 22 pence per share. We are aiming to

maintain or increase the dividend in future years."

Regulatory

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014 as retained in the UK pursuant to

S3 of the European Union (Withdrawal) Act 2018.

The technical information contained in the announcement has been

reviewed and approved by Fergus Jenkins, VP Technical at Serica

Energy plc. Mr. Jenkins (MEng in Petroleum Engineering from

Heriot-Watt University, Edinburgh) is a Chartered Engineer with

over 25 years of experience in oil & gas exploration,

development and production and is a member of the Institute of

Materials, Minerals and Mining (IOM3) and the Society of Petroleum

Engineers (SPE).

Enquiries:

+44 (0)20 7390

Serica Energy plc 0230

Mitch Flegg, CEO / Andy Bell, CFO

+44 (0)20 7418

Peel Hunt (Nomad & Joint Broker) 8900

Richard Crichton / David McKeown

+44 (0)20 7029

Jefferies (Joint Broker) 8000

Tony White / Will Soutar

+44 (0)20 7390

Vigo Consulting (IR/PR) 0230

Patrick d'Ancona / Finlay Thomson serica@vigoconsulting.com

NOTES TO EDITORS

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of UKCS assets.

On 20 December 2022, Serica announced that it had entered into

an agreement to acquire the entire issued share capital of Tailwind

Energy Investments Ltd from Tailwind Energy Holdings LLP. The

transaction completed on 23 March 2023.

Following the addition of the Tailwind assets to its portfolio,

Serica has a balance of gas and oil production. The Company is

responsible for about 5% of the natural gas produced in the UK, a

key element in the UK's energy transition.

Serica's producing assets are focused around two main hubs: the

Bruce, Keith and Rhum fields in the UK Northern North Sea, which it

operates, and a mix of operated and non-operated fields tied back

to the Triton FPSO. Serica also has operated interests in the

producing Columbus (UK Central North Sea) and Orlando (UK Northern

North Sea) fields and a non-operated interest in the producing

Erskine field in the UK Central North Sea.

Serica's portfolio of assets includes several organic investment

opportunities which are currently being pursued or are under

consideration.

Further information on the Company can be found at

www.serica-energy.com . The Company's shares are traded on the AIM

market of the London Stock Exchange under the ticker SQZ and the

Company is a designated foreign issuer on the TSX. To receive

Company news releases via email, please subscribe via the Company

website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPURUQUPWGQR

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

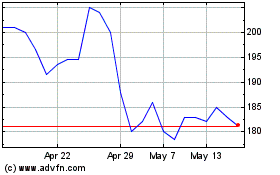

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From Apr 2024 to May 2024

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From May 2023 to May 2024