TIDMSUS

RNS Number : 5562A

S & U PLC

25 May 2023

25(th) May 2023

S&U plc

("S&U" or "the Group")

AGM Statement and Trading Update

S&U PLC (LSE: SUS) , the specialist motor and property

finance lender, issues a trading statement for the period 1

February 2023 to 24 May 2023, prior to its AGM today.

S&U is pleased to report another strong trading performance

in the first quarter of this financial year. Group profit,

turnover, debt quality and collections are ahead of last year. In

addition, S&U continues to strengthen its financial, regulatory

and branding foundations which will enable it to grasp significant

opportunities for growth, anticipated at its full year results in

March.

Profit before tax for the period is GBP0.3m ahead of the same

period last year, despite a rise in Group borrowing costs of nearly

GBP3m for the period versus the same period last year. This is the

result of interest rates which have significantly risen since early

2022 and a net receivables book which has now reached GBP418m (25

May 2022: GBP340m). Group collections are excellent, with

Advantage, our Grimsby-based motor finance business, reaching a

record GBP48m of regular repayments in the period, up over GBP4m on

the same period last year.

These results have been achieved against a continuing national

backdrop of unpredictable monetary and fiscal policy, and its

effect on economic growth and consumer confidence. Whilst there are

recent signs of improvement, particularly in the continued strength

of the UK used car market, commercial prudence and preparations for

the new Consumer Duty framework due in July, have seen a hiatus in

the rapid growth of the Group's motor net receivables which

characterised the last quarter of 2022/23.

Hence, in the latest quarter these grew by GBP1.5m against

GBP14.5m in the last quarter of 2022/23.

Now, consistently good credit quality, both at Advantage and

Aspen, our property bridging loan business, and increased return on

capital employed (ROCE) in both, have justified new medium-term

funding facilities of GBP230m with our club of banking partners

which increases our total funding facilities by GBP70m to

GBP280m.

This gives significant headroom of just under GBP100m to fund

the steady and sustainable growth we anticipate over the next two

years.

Advantage Finance

Continued constraints on new car supply have maintained a robust

market for used car finance, both in terms of values and demand for

our products. Net receivables at the end of the period stand at a

record GBP311m (25 May 2022: GBP268m) and credit quality is

reflected in above budget 94% collections rates for the period, and

in record numbers of up-to-date customers. Contractual payment

arrears at Advantage are now 25% less than a year ago which is

testament to their excellent and empathetic collections regime.

Whilst the quarter has seen a deliberate pause in transactions

growth, current run rates and an increase in transaction sizes to

higher scoring customers, indicate a return to growth for the rest

of the financial year.

We expect this growth to be driven by two important initiatives.

First, Advantage's vibrant new Branding Strategy with its new motto

"We see more than your score" reflecting its traditional empathy

for, and connection with, its loyal customers. This new branding

can be seen on S&U plc's website,

https://www.suplc.co.uk/investor.html#videos

Second, by Advantage's vigorous adoption of the FCA's new

Customer Duty. This will clearly record Advantage's customer

policies and procedures which have served the company so well, and

will, we anticipate, continue to improve our competitive advantage.

We now fervently hope that the Customer Duty's introduction will

coincide with a much greater degree of regulatory consistency

between the Financial Conduct Authority and the Financial Ombudsman

Service.

It is also to be hoped that the Treasury's new stated objective

for regulatory authorities to focus on "growth and competitiveness"

will encourage a more dynamic commercial environment.

Aspen Bridging

Despite a subdued residential property market, rising interest

rates and investor caution, our bridging lender Aspen has produced

solid results in the past quarter. Profit before tax is up 20.6% on

last year, ROCE has reached 10.2% for the first time (2022: 8.8%)

and net receivables at the end of the period are now GBP107m (25

May 2022: GBP72m).

Aspen collection receipts totalled GBP22.3m in the first quarter

(2022: GBP20.2m), including lower than anticipated extension and

recovery receipts as the UK refinancing market slowed.

Nevertheless, credit quality remains good with only 10 of the c.140

loans in default at the end of the period. All [defaulted loans]

are expected to be recovered by the end of June.

Treasury

As mentioned earlier, a new GBP230m club facility with HSBC,

NatWest and AIB for an initial three-year term at competitive rates

has now been implemented, increasing our total committed facilities

by GBP70m to GBP280m. With current gearing at just 79%, this gives

the Group ample facilities to fund the renewed and further growth

in business now anticipated.

Commenting on S&U's trading Outlook, Anthony Coombs, S&U

chairman, said: "I pay tribute to the way in which Advantage and

Aspen have used the inevitable and sensible pause in growth of the

past quarter to prepare the quality, regulatory and marketing

springboard to capitalise on the great commercial opportunities now

before us. We believe that these opportunities will now herald

another era of responsible and sustainable growth for the Group,

its staff, customers, and shareholders."

Enquiries S&U plc c/o SEC Newgate

Anthony Coombs

Financial Public Relations

Bob Huxford, Molly Gretton, Harry

Handyside SEC Newgate 020 7653 9848

--------------- ----------------

Broker

Andrew Buchanan, Adrian Trimmings,

Sam Milford Peel Hunt LLP 020 7418 8900

--------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSOVROSUVUAR

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

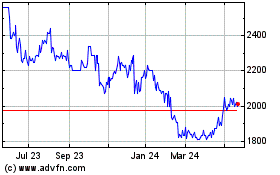

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

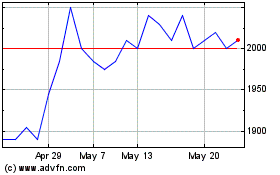

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024