TIDMTSP

RNS Number : 8197W

TruSpine Technologies PLC

29 December 2021

TRUSPINE TECHNOLOGIES PLC

("TruSpine", the "Company" or "Group")

Interim Results - for the six months ended 30 September 2021

CHIEF EXECUTIVE'S REPORT

I am pleased to report that despite the challenges presented by

Covid-19 globally, Truspine has managed to overcome many of the

obstacles presented, and we are currently in our final round of

Verification and Validation Testing.

This has been a challenging year to ensure we meet our

commercialisation targets and product roll out in 2022, which I

believe will finally position TruSpine as a true leader in Spinal

Stabilisation.

During the year, product development has progressed

significantly, both with the Cervi-LOK implant and the

instrumentation sets. Aside from the general strengthening and

expansion of the Company's IP, we have also strengthened our

management team with the appointment of Anthony Swoboda, VP for

Sales and Marketing in the USA and Janice Stone our Regulatory

affairs director.

Further to the announcement made on 2 November 2021 in relation

to the Breakthrough Technology Device application to the FDA for

the Company's Cervi-LOK(TM) product, the Company advises that the

FDA has requested further testing prior to concluding on the

device's status. Due to time constraints the Company has withdrawn

its Breakthrough Technology Device application, while further tests

are undertaken. The Company intends to resubmit its Breakthrough

Technology Device application when the further tests are completed.

The Company is convinced of the merits of the device and remain

confident that Breakthrough Device Technology status will be

granted. A further announcement will be made in due course.

The Company continues to be in a pre-revenue development phase

and remains loss-making. The loss before taxation for the six

months to 30 September 2021 was GBP483k (2020: GBP448k) after

administrative expenses of GBP481k (2020: GBP443k). Development

spend for the six months to 30 September 2021 was GBP463k (2020:

GBP277k).

Consolidated net assets as at 30 September 2021 amounted to

GBP3.0 million (2020: GBP2.4 million) including cash and cash

equivalents of GBP324,000 (2020: GBP567,000).

In September 2021 the Company raised GBP650,000 through a

Fundraise of 6,500,000 new Ordinary shares at a price of 10p per

share. GBP230,000 of the proceeds of the Fundraise were received

immediately after the period end on 4 October 2021 and were

therefore included in other receivables as at 30 September

2021.

On behalf of the Board, I would also like to thank all

shareholders for their support, and TruSpine's staff and commercial

partners for their hard work during the year.

We are a lean and progressive company with a suite of products

and IP that have the potential to provide a potential quantum shift

in patient treatment within the Spinal Fixation market, the Board

believe the Company is well positioned in terms of funding and

corporate profile. The board therefore looks to the future with

confidence.

Ian Roberts

Chief Executive

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 ("MAR").

GROUP UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30

SEPTEMBER 2021

GROUP STATEMENT OF COMPREHENSIVE INCOME

6 month 6 month Year

period ended period ended ended

30 September 30 September 29 March

2021 2020

(Unaudited) (Audited) 2021

(Audited)

Note

GBP GBP GBP

Administrative expenses (480,834) (443,458) (645,287)

Operating loss (480,834) (443,458) (645,287)

Finance expense (1,771) (4,516) (5,894)

Loss before tax (482,605) (447,974) (651,181)

-------------- ----------------- ------------

Tax credit 3 - 24,826 107,178

-------------- ----------------- ------------

(Loss)/Profit (482,605) (423,148) (544,003)

-------------- ----------------- ------------

Loss attributable to:

Owners of the parent (482,605) (423,148) (544,003)

-------------- ----------------- ------------

Other comprehensive income:

Items that will or may be

reclassified to profit or

loss:

Exchange translation differences

on foreign operations 462 (1,235) (6,870)

-------------- ----------------- ------------

Total comprehensive loss (482,143) (424,383) (6,870)

-------------- ----------------- ------------

Total comprehensive loss

attributable to equity shareholders (482,143) (424,383) (550,873)

============== ================= ============

Earnings per share basic

and diluted (pence) 4 (0.51)p (0.50)p (0.63)p

-------------- ----------------- ------------

All results in the current and preceding financial period derive

from continuing operations.

GROUP STATEMENT OF FINANCIAL POSITION

30 September 30 September 29 March

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

Non-current assets

Tangible fixed assets 33,683 21,154 34,298

Intangible assets 2,504,010 1,891,801 2,040,777

2,537,693 1,912,955 2,075,075

---------------- ---------------- -------------

Current assets

Trade and other receivables 356,189 444,080 186,690

Digital assets 225,229 - 220,602

Cash and cash equivalents 324,044 566,648 543,520

---------------- ---------------- -------------

905,462 1,010,728 950,812

---------------- ---------------- -------------

Total assets 3,443,155 2,923,683 3,025,887

---------------- ---------------- -------------

Current liabilities

Trade and other payables 386,184 448,915 229,977

Borrowings 47,500 50,000 50,000

---------------- ---------------- -------------

433,684 498,915 279,977

---------------- ---------------- -------------

Total liabilities 433,684 498,915 279,977

---------------- ---------------- -------------

Net Assets 3,009,471 2,424,768 2,745,910

---------------- ---------------- -------------

Equity attributable to owners

of the parent

Share capital 5 10,139 8,778 9,398

Share premium 3,779,855 2,632,098 3,062,103

Share based payment reserve 44,218 - 17,007

Other reserves 5 (205,000) (205,000) (205,000)

Translation reserve (25,017) (19,844) (25,479)

Retained earnings (594,724) 8,736 (112,119)

---------------- ---------------- -------------

Total equity attributable to

owners of the parent 3,009,471 2,424,768 2,745,910

---------------- ---------------- -------------

Total Equity 3,009,471 2,424,768 2,745,910

---------------- ---------------- -------------

GROUP STATEMENT OF CHANGES IN EQUITY

Share Share premium Share

capital based

payment Translation Retained

reserve Other reserves reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP

Balance as at 29 March

2020 8,385 3,727,035 - (205,000) (18,609) (1,818,116) 1,693,695

--------- -------------- -------- --------------- ------------ ------------ ----------

Profit for the six

months - - - - - (423,148) (423,148)

Other comprehensive

loss - - - - (1,235) - (1,235)

--------- -------------- -------- --------------- ------------ ------------ ----------

Total comprehensive

loss for the period - - - - (1,235) (423,148) (424,383)

--------- -------------- -------- --------------- ------------ ------------ ----------

Issue of shares, net

of issue costs 393 1,155,063 - - - - 1,155,456

Reduction in share

capital (2,250,000) 2,250,000 -

--------- -------------- -------- --------------- ------------ ------------ ----------

Transactions with

owners, recognised

directly in equity 393 (1,094,937) - - - 2,250,000 1,155,456

--------- -------------- -------- --------------- ------------ ------------ ----------

Balance as at 30

September

2020 8,778 2,632,098 - (205,000) (19,844) 8,736 2,424,768

--------- -------------- -------- --------------- ------------ ------------ ----------

Balance as at 29 March

2021 9,398 3,062,103 17,007 (205,000) (25,479) (112,119) 2.745,910

--------- -------------- -------- --------------- ------------ ------------ ----------

Loss for the six months - - - - - (482,605) (482,605)

Other comprehensive

loss - - - - 462 - 462

--------- -------------- -------- --------------- ------------ ------------ ----------

Total comprehensive

loss for the period - - - - 462 (482,605) (482,143)

--------- -------------- -------- --------------- ------------ ------------ ----------

Issue of shares, net

of issue costs 741 744,963 - - - - 745,704

Share based payment

charge - (27,211) 27,211 - - - -

--------- -------------- -------- --------------- ------------ ------------ ----------

Transactions with

owners, recognised

directly in equity 741 717,752 27,211 - - - 745,704

--------- -------------- -------- --------------- ------------ ------------ ----------

Balance as at 30

September

2021 10,139 3,779,855 44,218 (205,000) (25,017) (594,724) 3,009,471

========= ============== ======== =============== ============ ============ ==========

CONSOLIDATED STATEMENT OF CASH FLOWS

6 month 6 month Year

period ended period ended ended

30 September 30 September 29 March

2021 2020

(Unaudited) (Unaudited) 2021

(Audited)

GBP GBP GBP

Cash flow from operating activities

Loss before tax (482,605) (447,974) (651,181)

Depreciation and amortisation 615 - 1,230

Increase in Fair Value of digital

asset (4,627) - (5,022)

(Increase) in other receivables (169,499) (283,191) (25,801)

Increase in other payables 156,207 231,990 63,052

-------------------- -------------------- -------------------

Cash used in operations (499,909) (499,175) (617,722)

-------------------- -------------------- -------------------

Income tax credit - 24,826 107,178

-------------------- -------------------- -------------------

Net cash flows from operating

activities (499,909) (474,349) (510,544)

-------------------- -------------------- -------------------

Investing activities

Purchase of tangible assets - (21,154) (35,528)

Purchase of intangible assets (463,233) (277,105) (426,081)

Net cash used in investing activities (463,233) (298,259) (461,609)

-------------------- -------------------- -------------------

Financing activities

Proceeds from Issue of shares,

net of issue costs 745,704 1,155,456 1,387,508

(Decrease)/Increase in borrowings (2,500) 50,000 -

-------------------- -------------------- -------------------

Net cash flow from financing 743,204 1,205,456 1,387,508

-------------------- -------------------- -------------------

(Decrease)/Increase in cash and

cash equivalents in the period (219,938) 432,848 415,355

Cash and cash equivalents at

the beginning of the year 543,520 135,035 135,035

Exchange rate differences on

cash and cash equivalents 462 (1,235) (6,870)

Cash and cash equivalents at

the end of the period 324,044 566,648 543,520

-------------------- -------------------- -------------------

NOTES TO THE FINANCIAL INFORMATION

1. GENERAL INFORMATION

This financial information is for Truspine Technologies Plc

("the Company") and its subsidiary undertakings. The principal

activity of TruSpine Technologies Plc (the 'Company') and its

subsidiaries (together the 'Group') is the development of products

for the spinal fusion market. The Company is a public limited

company and was listed on the Aquis Stock Exchange on 20 August

2020. The Company is incorporated and domiciled in England and the

address of its registered office is located at Spectrum House AF33,

Beehive Ring Road, Gatwick Airport, Gatwick, RH6 0LG, United

Kingdom.

2. BASIS OF PREPARATION

The interim consolidated financial information has been prepared

with regard to International Financial Reporting Standards (IFRS)

and interpretations adopted by the European Union and as applied in

accordance with the provisions of the Companies Act 2006. The

interim financial information incorporates the results for the

group for the six month period from 30 March 2021 to 30 September

2021. The results for the year ended 29 March 2021 have been

extracted from the statutory financial statements for the Company

for the year ended 29 March 2021. The financial information set out

in these interim consolidated financial information does not

constitute statutory accounts as defined in S434 of the Companies

Act 2006. They do not include all of the information required for

full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 29 March 2021, which contained an unqualified audit

report and have been filed with the Registrar of Companies. They

did not contain statements under S498 of the Companies Act

2006.

The same accounting policies, presentation and methods of

computation have been followed in these unaudited interim financial

statements as those which were applied in the preparation of the

group's annual financial statements for the year ended 29 March

2021.

The interim consolidated financial information incorporates the

financial statements of Truspine Technologies Plc and its

subsidiaries.

The interim financial information for the six months ended 30

September 2020 was approved by the directors on 23 December

2021.

3. TAXATION

Tax recognised in profit or loss

6 month 6 month Year

period ended period ended ended

30 September 30 September 29 March

2021 2020

(Unaudited) (Unaudited) 2021

(Audited)

GBP GBP GBP

Current tax credit - 24,826 107,178

Deferred tax - - -

-------------- ---------------- -----------

Net tax credit - 24,826 107,178

-------------- ---------------- -----------

Loss before tax (482,605) (447,974) (651,181)

-----------

Standard rate of UK corporation

tax 19% 19% 19%

Loss on ordinary activities before

tax multiplied by standard rate

UK corporation tax (91,695) (85,115) (123,724)

Tax adjustment (117) - (335)

Unrelieved tax losses carried forward 91,812 85,115 124,059

UK research and development tax

credit - 24,826 107,178

-------------- ---------------- -----------

Tax credit - 24,826 107,178

-------------- ---------------- -----------

At 30 September 2021, the Group are carrying forward estimated

tax losses of GBP1.61m in respect of various activities over the

years. The Company did not recognise a deferred income tax credit

due to uncertainty concerning the timescale of its

recoverability.

4. LOSS PER ORDINARY SHARE

Basic earnings per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year,

excluding ordinary shares purchased by the Company and held as

treasury shares.

6 month 6 month Year

period ended period ended Ended

30 September 30 September 29 March

2021

(Unaudited) 2020 2021

(Unaudited) (Audited)

GBP GBP GBP

(Loss) attributable to equity

holders of the Company (482,605) (423,148) (544,003)

Weighted average number of

ordinary shares in issue 94,546,805 84,581,810 86,210,308

Loss per share basic and diluted

(pence) (0.51)p (0.50)p (0.63)p

--------------- -------------------- --------------------

5. SHARE CAPITAL

Group and Company

-----------

Share premium Share based

Number of Share payment

Group shares capital reserve Other reserve Total

GBP GBP GBP GBP GBP

------------------------ ----------- -------- ------------- ----------- ------------- -----------

Issued and fully paid

As at 29 March 2020 83,845,194 8,385 3,727,035 - (205,000) 3,530,420

----------- -------- ------------- ----------- ------------- -----------

Movement during the

period 3,933,773 393 (1,094,937) - - (1,094,544)

----------- -------- ------------- ----------- ------------- -----------

As at 30 September 2020 87,778,967 8,778 2,632,098 - (205,000) 2,435,876

----------- -------- ------------- ----------- ------------- -----------

Movement during the

period 6,205,000 620 430,005 17,007 - 447,632

----------- -------- ------------- ----------- ------------- -----------

As at 29 March 2021 93,983,967 9,398 3,062,103 17,007 (205,000) 2,883,508

----------- -------- ------------- ----------- ------------- -----------

Movement during the

period 7,405,000 741 717,752 27,211 - 745,704

----------- -------- ------------- ----------- ------------- -----------

As at 30 September 2021 101,388,967 10,139 3,779,855 44,218 (205,000) 3,629,212

----------- -------- ------------- ----------- ------------- -----------

Share Capital - Amount subscribed for share capital at nominal

value.

Share Premium - Amount subscribed for share capital in excess of

nominal value.

On 7 May 2020, a resolution was passed approving a reduction of

capital whereby the share premium account of the Company was

cancelled by an amount of GBP2,250,000.

In September 2021 the Company raised GBP650,000 through a

Fundraise of 6,500,000 new Ordinary shares at a price of 10p per

share comprising a Placing and a Subscription. 2,300,000 New

Ordinary Shares were issued by way of the Placing raising gross

proceeds of GBP230,000 and 4,200,000 New Ordinary Shares were

issued through the Subscription raising gross proceeds of

GBP420,000. In addition 125,000 New Ordinary Shares were issued to

a third-party involved in the Fundraise in lieu of services

rendered. Each New Ordinary Share issued has one warrant attached

granting the holder the right to subscribe for an additional one

New Ordinary Share at an exercise price of 15 pence per share for a

period of 3 years following admission. The were admitted to trading

on AQSE on 30 September 2021. The gross placing proceeds of

GBP230,000 were not received until 4 October 2021 after the period

end and were included in other receivables at 30 September

2021.

6. EVENTS AFTER THE REPORTING DATE

On 29 October 2021 383,800 New Ordinary Shares were issued to a

third-party involved in Fundraising in lieu of services rendered.

Each New Ordinary Share issued has one warrant attached granting

the holder the right to subscribe for an additional one New

Ordinary Share at an exercise price of 15 pence per share for a

period of 3 years following admission.

On 17 November 2021 216,102 shares were issued to WH Ireland

Limited at various prices in lieu of brokerage services provided to

the Company.

The Directors of the Company take responsibility for this

announcement.

Enquiries:

TruSpine Technologies Plc Tel: +44 (0)20 3638 5025

Ian Roberts, CEO

Cairn Financial Advisers LLP (AQSE Corporate Tel: +44 (0)20 7213

Adviser) 0880

Liam Murray / Ludovico Lazzaretti

Oberon Capital (Broker) Tel: +44 (+44 (0) 20 3179

5300

Robert Hayward / Mike Seabrook

/ Chris Crawford

Walbrook PR (Financial PR Tel: +44 (0) 20 7933 7870 or +44

& IR) (0) 7876 741 001

Anna Dunphy truspine@walbrookpr.com

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBXBDDIGDDGBI

(END) Dow Jones Newswires

December 29, 2021 02:00 ET (07:00 GMT)

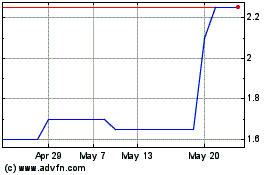

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Dec 2024 to Jan 2025

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Jan 2024 to Jan 2025