James Hardie Industries plc (ASX: JHX) announced today the

appointment of Mr. Jason Miele as Senior Vice President & Chief

Financial Officer.

Mr. Miele’s appointment as CFO commences immediately, and he

will be based in Chicago, Illinois, reporting to James Hardie CEO,

Dr. Jack Truong.

Mr. Miele has over 13 years of experience with James Hardie and

has served in a number of important roles during his tenure,

including most recently, as Vice President – Investor and Media

Relations, a position he has held since in February 2017. In that

role, Mr. Miele had responsibility for overseeing James Hardie’s

investor relations strategy and communicating James Hardie’s

business strategy and its financial performance to various

stakeholders including shareholders, investment analysts, and the

financial media. Prior to that, Mr. Miele served in a variety of

roles of increasing responsibility, in finance functions such as

Treasury, Controllership and Operational Finance, including

reporting to the CFO as the Global Treasurer and later the Global

Controller. Mr. Miele has supported the James Hardie business

during his tenure, working in multiple geographies including

Dublin, Ireland, Amsterdam, Netherlands, Mission Viejo, CA and

Chicago, IL in the United States and most recently, Sydney,

Australia.

Mr. Miele has a bachelor’s degree from the University of

California at Santa Barbara, where he graduated with a degree in

Business Economics with an emphasis in Accounting. After receiving

his degree, he commenced his career, gaining early experience with

Pacific Health Care Systems, Inc. and PricewaterhouseCoopers,

LLP.

Commenting on Mr. Miele’s appointment, James Hardie’s CEO Dr.

Jack Truong said: “I am pleased to announce Jason Miele’s

appointment as Senior Vice President and CFO of James Hardie. Jason

brings a strong track record of financial and business leadership,

as well as an in-depth knowledge of the James Hardie business. His

financial skills, international experience and leadership

attributes complement our strong performance-oriented culture and

make him the right choice to lead our finance organization during

this critical time as we continue to execute on our global

strategic plan.”

With Mr. Miele’s appointment, current Interim Chief Financial

Officer Ms. Anne Lloyd will step down from her position, effective

immediately. Ms. Lloyd, who is also a member of the Board of

Directors of James Hardie, will continue to serve as a

non-executive member of the Board.

Dr. Truong commented, “I would like to thank Anne for her

service as Interim Chief Financial Officer. I appreciate her

leadership and contributions to James Hardie during this

transition. Anne’s oversight during this interim period provided us

the opportunity to conduct a comprehensive search for a new CFO,

considering both internal and external candidates, ensuring we

identified the best leader.”

This media release has been authorized by the James Hardie Board

of Directors

Forward Looking Statements

This Media Release contains forward-looking statements. James

Hardie Industries plc (the “Company”) may from time to time make

forward-looking statements in its periodic reports filed with or

furnished to the Securities and Exchange Commission, on Forms 20-F

and 6-K, in its annual reports to shareholders, in offering

circulars, invitation memoranda and prospectuses, in media releases

and other written materials and in oral statements made by the

Company’s officers, directors or employees to analysts,

institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not

historical facts are forward-looking statements and such

forward-looking statements are statements made pursuant to the Safe

Harbor Provisions of the Private Securities Litigation Reform Act

of 1995.

Examples of forward-looking statements include:

- statements about the Company’s future performance;

- projections of the Company’s results of operations or financial

condition;

- statements regarding the Company’s plans, objectives or goals,

including those relating to strategies, initiatives, competition,

acquisitions, dispositions and/or its products;

- expectations concerning the costs associated with the

suspension or closure of operations at any of the Company’s plants

and future plans with respect to any such plants;

- expectations concerning the costs associated with the

significant capital expenditure projects at any of the Company’s

plants and future plans with respect to any such projects;

- expectations regarding the extension or renewal of the

Company’s credit facilities including changes to terms, covenants

or ratios;

- expectations concerning dividend payments and share

buy-backs;

- statements concerning the Company’s corporate and tax domiciles

and structures and potential changes to them, including potential

tax charges;

- uncertainty from the expected discontinuance of LIBOR and

transition to any other interest rate benchmark;

- statements regarding tax liabilities and related audits,

reviews and proceedings;

- statements regarding the possible consequences and/or potential

outcome of legal proceedings brought against us and the potential

liabilities, if any, associated with such proceedings;

- expectations about the timing and amount of contributions to

Asbestos Injuries Compensation Fund (AICF), a special purpose fund

for the compensation of proven Australian asbestos-related personal

injury and death claims;

- expectations concerning the adequacy of the Company’s warranty

provisions and estimates for future warranty-related costs;

- statements regarding the Company’s ability to manage legal and

regulatory matters (including but not limited to product liability,

environmental, intellectual property and competition law matters)

and to resolve any such pending legal and regulatory matters within

current estimates and in anticipation of certain third-party

recoveries; and

- statements about economic conditions, such as changes in the US

economic or housing recovery or changes in the market conditions in

the Asia Pacific region, the levels of new home construction and

home renovations, unemployment levels, changes in consumer income,

changes or stability in housing values, the availability of

mortgages and other financing, mortgage and other interest rates,

housing affordability and supply, the levels of foreclosures and

home resales, currency exchange rates, and builder and consumer

confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,”

“guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,”

“objective,” “outlook” and similar expressions are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. Readers are cautioned not to place

undue reliance on these forward-looking statements and all such

forward-looking statements are qualified in their entirety by

reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current

expectations, estimates and assumptions and because forward-looking

statements address future results, events and conditions, they, by

their very nature, involve inherent risks and uncertainties, many

of which are unforeseeable and beyond the Company’s control. Such

known and unknown risks, uncertainties and other factors may cause

actual results, performance or other achievements to differ

materially from the anticipated results, performance or

achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are

discussed under “Risk Factors” in Section 3 of the Form 20-F filed

with the Securities and Exchange Commission on 21 May 2019 and

subsequently amended on 8 August 2019, include, but are not limited

to: all matters relating to or arising out of the prior manufacture

of products that contained asbestos by current and former Company

subsidiaries; required contributions to AICF, any shortfall in AICF

and the effect of currency exchange rate movements on the amount

recorded in the Company’s financial statements as an asbestos

liability; the continuation or termination of the governmental loan

facility to AICF; compliance with and changes in tax laws and

treatments; competition and product pricing in the markets in which

the Company operates; the consequences of product failures or

defects; exposure to environmental, asbestos, putative consumer

class action or other legal proceedings; general economic and

market conditions; the supply and cost of raw materials; possible

increases in competition and the potential that competitors could

copy the Company’s products; reliance on a small number of

customers; a customer’s inability to pay; compliance with and

changes in environmental and health and safety laws; risks of

conducting business internationally; compliance with and changes in

laws and regulations; currency exchange risks; dependence on

customer preference and the concentration of the Company’s customer

base on large format retail customers, distributors and dealers;

dependence on residential and commercial construction markets; the

effect of adverse changes in climate or weather patterns; possible

inability to renew credit facilities on terms favorable to the

Company, or at all; acquisition or sale of businesses and business

segments; changes in the Company’s key management personnel;

inherent limitations on internal controls; use of accounting

estimates; the integration of Fermacell into our business; and all

other risks identified in the Company’s reports filed with

Australian, Irish and US securities regulatory agencies and

exchanges (as appropriate). The Company cautions you that the

foregoing list of factors is not exhaustive and that other risks

and uncertainties may cause actual results to differ materially

from those referenced in the Company’s forward-looking statements.

Forward-looking statements speak only as of the date they are made

and are statements of the Company’s current expectations concerning

future results, events and conditions. The Company assumes no

obligation to update any forward-looking statements or information

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200225006085/en/

Investor / Analyst Enquires: Anna Collins

Telephone: +61 2 8845 3356 Email:

media@jameshardie.com.au

Media Enquires: Jim Kelly, Domestique Telephone:

+61 412 549 083 Email: jim@domestiqueconsulting.com.au

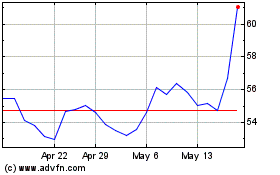

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2024 to Jan 2025

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Jan 2024 to Jan 2025