Rio Tinto, Mitsubishi Offer A$122 Per Share For Coal & Allied

August 07 2011 - 6:24PM

Dow Jones News

Rio Tinto PLC (RIO) and Mitsubishi Corp. (8058.TO) will pay 122

Australian dollars (US$126) per share to buy out minorities in

Australian coal miner Coal & Allied Industries Ltd. (CNA.AU),

in an indicative deal that values the company at A$10.6 billion,

the target said Monday.

The two companies, which hold respectively 75.7% and 10.2% of

the miner operating in the Hunter Valley of New South Wales state,

would end up with stakes of 80% and 20% respectively after the

offer, they said.

Perpetual Ltd. (PPT.AU) is the only other major shareholder,

with 6.3% of the stock. Coal & Allied said it received the

"incomplete, non-binding, condition and indicative proposal" from

Rio on Saturday 6 August.

"CNA gives no assurances that the indicative proposal will lead

to a takeover offer being made," the company said.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

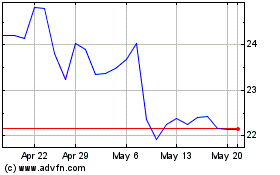

Perpetual (ASX:PPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

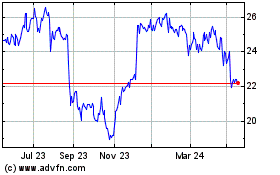

Perpetual (ASX:PPT)

Historical Stock Chart

From Dec 2023 to Dec 2024