Crypto Exchanges Bitcoin Supply Can Only Last For 9 Months, ByBit Report

April 17 2024 - 12:00PM

NEWSBTC

Cryptocurrency exchange and trading platform, Bybit has released a

new report highlighting the impacts of the upcoming Bitcoin halving

event on the supply dynamics of Bitcoin within exchanges in the

crypto space. The crypto firm has provided valuable insights on how

the halving event would enhance scarcity and considerably influence

the price of BTC. Exchanges Set To Face Bitcoin Supply Crunch

On Tuesday, April 16, Bybit published a new report, providing a

detailed analysis of the Bitcoin halving event set to take place

this month. The crypto firm disclosed that the Bitcoin reserves

within the world’s crypto exchanges have been depleting at a rapid

pace, leaving only nine months of BTC supply left on

exchanges. Related Reading: Arbitrum’s Massive $107 Million

Token Unlock Threatens To Send Price Below $1 For a clearer

perspective, Bybit explains that with just two million Bitcoin left

in its total supply, a daily influx of $500 million into Spot

Bitcoin ETFs would result in approximately 7,142 BTC leaving

exchanges daily. This suggests that it would take only nine months

to completely consume all of the remaining BTC reserves on

exchanges. Bybit has stated that a major contributor to this

supply squeeze would be the upcoming Bitcoin halving event, which

would reduce the cryptocurrency’s total supply by 50% by cutting

Bitcoin miners’ rewards in half. The crypto exchange has also

disclosed that after the halving event, the sell-side supply of BTC

flowing into Centralized Exchanges (CEXs) will become grossly

reduced. Additionally, Bitcoin’s “supply squeeze will ostensibly be

worse.” BTC To Become “Twice As Rare As Gold” In its report, Bybit

compared Bitcoin’s supply after the halving event with that of

gold. The crypto exchange revealed that Bitcoin was steadily

growing to become one of the safest investment choices, even for

the most seasoned and sophisticated investors within the crypto

space. According to the exchange, the Bitcoin halving event

would significantly impact the cryptocurrency’s scarcity factor,

making it an even rarer asset than gold. Basing this analysis

on the Stock-to-Flow (S2F) ratio, Bybit disclosed that Bitcoin’s

S2F ratio is around 56 currently, while gold’s ratio is 60. After

the halving event this April, Bitcoin’s S2F ratio is projected to

increase to 112. Related Reading: Arkham Releases Top 5

Crypto Rich List – You Won’t Believe How Much Is Inaccessible “Each

Bitcoin halving sharpens the narrative of Bitcoin as not just a

currency, but a scarce digital asset, akin to digital gold. This

upcoming halving in 2024 will thrust BTC into an era of

unprecedented scarcity, making it twice as rare as gold,” the

Co-founder and CEO of Bybit, Ben Zhou stated. While

highlighting the significance of Bitcoin’s rarity following the

halving event, another report also disclosed that the price of

Bitcoin would experience significant upward pressure post-halving.

This suggests that BTC’S supply squeeze could potentially propel

its price to new heights during this period. Furthermore, the

report revealed that several crypto analysts predict that the

post-halving increase in Bitcoin’s price would be less remarkable

than the early pre-halving surge which saw the price of Bitcoin

hitting new all-time highs of more than $73,000. BTC price drops

below $63,000 | Source: BTCUSD on Tradingview.com Featured image

from Analytics Vidhya, chart from Tradingview.com

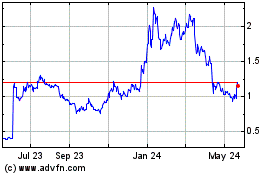

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

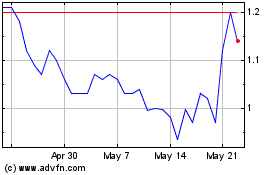

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024