Historical Trends Show What To Expect For Bitcoin Price Following The Halving

April 17 2024 - 3:00PM

NEWSBTC

The 2024 Bitcoin halving is only two days away, and there are

already varying expectations of what might happen to the BTC price

once the event is completed. One way to get an idea of how it could

play out for the Bitcoin price, though, is through historical data

and how the cryptocurrency has performed at times like these.

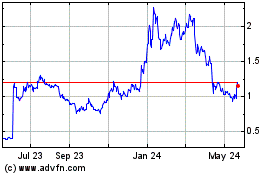

Bitcoin Price Trends For Previous Halvings There have been three

halvings so far since Bitcoin was first launched in 2009 and with

each one, Bitcoin has demonstrated various reactions to the event.

The first halving took place on November 28, 2012, the second

happened on July 9, 2016, and the last one was on May 11, 2020.

Related Reading: Arbitrum’s Massive $107 Million Token Unlock

Threatens To Send Price Below $1 For the purpose of this report,

only the last two halving will be referenced given that adoption

had began to climb at the time that these two happened. The 2016

halving happened when Bitcoin was trading around $650, but in the

weeks following the halving, the BTC price would drop another 30%,

reaching as low as $460 before climbing back up once again. BTC

price crashed 30% post-halving in 2016 | Source: Tradingview.com

Then, during the 2020 halving, the BTC price was trending just

under $10,000, and following the halving, would see a drop in price

as well. However, this drop was not as significant as the 2016

drop, with the BTC price only falling around 15% during this time.

BTC price crashed 15% post-halving in 2020 | Source:

Tradingview.com This has formed quite a trend with the halving,

where the Bitcoin price falls after the event, which is

expected to be bullish. Therefore, if this trend continues, then

BTC could see a sharp drop in price despite the expectation that

the halving will be bullish for price. However, it is important to

consider that subsequent halvings have seen a lower post-halving

crash compared to their predecessors. So, if this holds this year,

Bitcoin could still be looking at a crash but to a much lesser

degree. For example, the 2020 post-halving crash was half of the

2016 post-halving crash, so holding this trend, the crash this time

around could only be an around 7-8% crash. BTC Deviates From

Established Halving Trends While the historical data does suggest

where Bitcoin could be headed following the crash, it is also

important to note that the digital asset has deviated from a number

of pre-halving trends. One of these deviations is the fact that the

Bitcoin price hit a new all-time high before the halving, something

that has never happened before. This could suggest that there will

be a complete deviation from these established trends, meaning that

a crash may not follow the halving after all. Related Reading: XRP

Price Set For 3,000% Rally To $22, Analyst Predicts Another

deviation is that the few weeks leading up to the last two Bitcoin

halvings have been green. However, in 2024, the last three weeks

leading up to the halving have been red as the BTC price has been

in decline. This also lends credence to the fact that there could

also be a deviation from its post-halving trends. One thing to keep

in mind though, is that the crypto market has always been uncertain

and Bitcoin has a habit of doing what no one expected. The Bitcoin

Fear & Greed Index has seen a pull back from the extreme greed

territory, but it continues to remain in greed, which means

investors are still bullish. In this case, if Bitcoin were to do

the opposite of what is expected, then it could follow the

established trend and crash back down. BTC deviates from

pre-halving trend | Source: BTCUSD on Tradingview.com Featured

image from Adobe Stock, chart from Tradingview.com

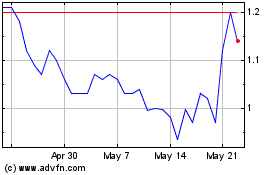

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024