Is Altcoin Season Around the Corner? Bitcoin Halving Points to Potential Boom, Analyst Reveals

July 13 2024 - 3:00AM

NEWSBTC

Although Bitcoin recent price plunge has sent several Altcoins on a

free fall, with declines ranging from 30% to 70%, there appears to

be a beacon of hope set to shine through the murk. The recent

Bitcoin Halving in April is what the altcoin market needs to

recover and surge beyond its highest levels. Related Reading:

Analyst Predicts Major Gains for These Altcoins But Warn Against

XRP and ADA Bitcoin Halving: A Gateway to Altcoin Prosperity?

Bitcoin usually undergoes a Halving every four years, and this

major event halves the block reward for miners in half. This fall

in supply has normally triggered a bullish rally not only for

Bitcoin but also for the altcoin market. Crypto analyst Wise Advice

elaborates that following each Bitcoin halving, there is a

pronounced potential for altcoins to surge. The analyst

particularly noted: I know when altcoin season will happen. And

I’ll show you it… ‘Halving’ It all depends on it […] When halving

happens, after 1–1.5 years, the BTC ATH come And near that, ETH and

other altcoins boom. Historically, this Halving period has seen an

explosion of attention for altcoins, driving their prices higher

due to the scarcity concerns from Bitcoin following this event. For

example, in the previous Bitcoin Halving on November 9, 2021,

leading altcoins, including — Ethereum (ETH) and Solana (SOL),

Polkadot. (DOT), Avalanche (AVAX) all recorded a new all-time high.

For context, ETH peaked at $4,800 on November 10, SOL came in too

with its new peak at $250 5 days earlier as revealed by Wise

Advice, while DOT’s peak at $55 happened on the 4th of that month,

and AVAX peak at $144 occurred later that month on the 21st. How

Does The Halving Points To Alts Season Now? As Wise Advice’ post

suggests, such patterns underscore a recurrent theme: post-halving,

money flows from Bitcoin into altcoins, significantly buoying their

market positions. The analyst explained: The more they buy, the

higher the price goes. And it makes investors profitable. They sell

a part of it and send to Ethereum and other tokens. The market cap

of these are way lower, so even the inflow of $100 million can make

a huge change (a month before the ATH, Bitcoin MC was in 2.5 times

larger than Ethereum.) That’s why Solana and Polkadot’s ATH was 4-5

days faster. Then money goes to even smaller Alts. And they start

to overperform big ones. The smaller they were, the bigger the

growth was. Notably, this shift is often reflected in Bitcoin’s

dominance index—a metric that measures Bitcoin’s market

capitalization relative to the total market cap of all

cryptocurrencies. As observed post-halving, a decline in this index

signals a growing interest in altcoins. Related Reading: Crypto

Analyst Says Bitcoin Could Reach $100,000, But What About Altcoins?

Bitcoin dominance is now at 54.60%, a slight decrease from above

55%. Earlier this month, according to TradingView. Notably, the

fact that the index is still somewhat high, as it still stands

above 50%, suggests that the market still favors BTC. However, the

recent decrease could be the early signs of an emerging altcoin

season. Analysts at Glassnode make a similar point, linking present

market circumstances with those in late 2020 when smaller stocks

and riskier assets boomed, pointing towards an impending altcoin

season. Rotation coming? Yesterday, we saw how #Nasdaq declined

>2% – while #IWM rallied >3%. This is a clear indication of

Rotation. The move to riskier assets. Will we also see this is #BTC

and #Alts? Well – in November 2020, we had a day just like

yesterday. IWM soared and… pic.twitter.com/WG9pooRxh1 — 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰

(@Negentropic_) July 12, 2024 Featured image created with DALL-E,

Chart from TradingView

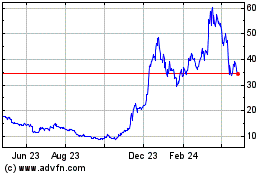

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

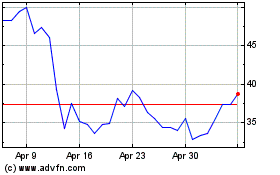

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025