Cosmos Price Analysis: Why This Analyst Says ATOM Has ‘A Great Chart’

August 16 2024 - 12:30PM

NEWSBTC

Cosmos is presently held between a rock and a hard place in the

market, according to crypto analyst Alan Santana. To him, this is a

very opportunistic time for long-term investors, most especially

those with a bullish outlook. Related Reading: Is Dogecoin (DOGE)

Headed For A 40% Slide? This Analyst Thinks So He feels that ATOM

is currently trading at quite a remarkable discount from the highs

posted, hence positioning itself for a very compelling risk-reward

entry. According to Santana, Cosmos has “a great chart” because the

coin is trading very low compared to historical prices. ✴️ Cosmos

(ATOM) Pre-2025 Bull-Market Accumulation Zone & Strategy Cosmos

has a great chart… How are you doing my dear friend? Ready for a

new yesterday, tomorrow-today? Are you ready to explore this chart

with me in this wonderful day? Cosmos has a great chart because it

is… pic.twitter.com/SH4yrF76yd — Alan Santana (@lamatrades1111)

August 14, 2024 Cosmos: Accumulation Phase and Risks Santana

emphasized that Cosmos was in its critical phase of accumulation.

On the other hand, ATOM has historically formed higher long-term

lows, which could be a technical indicator setting a stage for

future gains. However, accumulation comes with risks. The key level

to watch would be $1.923, a low from March 2020. Should the price

of ATOM go below this threshold, it would somewhat undermine the

bullish narrative Santana presents. Such a decline could be

interpreted as a shift in market sentiment and would result in

weaker performance compared with other cryptocurrencies. Another

pressure on ATOM comes from insider selling. As soon as the

developers, miners, or exchanges begin to sell their holdings en

masse, that usually becomes a red flag indicator of problems within

the project or, at the very least, a lack of belief in its further

perspective. This might be why, in particular, Cosmos can’t hold up

that well compared to other altcoins, which have been able to stay

above their June 2022 lows. Bearish Forecast And Market Sentiment

Although Santana’s sentiment is slightly overly hopeful, the market

sentiment is overwhelmingly bearish. According to CoinCodex’s most

recent prediction, Cosmos will lose 8.56% and its price will fall

even further to $4.13 by September 15, 2024. All technical

indicators in this forecast are bearish. The Fear & Greed Index

has finally reached 27, showing much fear in the market. For

Cosmos, there have been nine green days during the last 30 days—out

of a possible total of 30. This translates into a positive return

rate of 30%. Its current price volatility is at 11.64%, indicating

a highly uncertain and risky time frame. Well, considering the

current state of the market, it may not be an ideal time to invest

in Cosmos. Based on the factors mentioned above, namely the price

drop forecast and the current sense of fear in the market, it would

seem that caution is due. Related Reading: Bitcoin Cash (BCH):

Analyst Pinpoints Prime Moment For Strategic Buy Weighing The Risks

and Rewards Although Santana’s analysis shows that this could

actually be beneficial for future gain, the outlook immediately is

not so promising. The factors therefore have to be taken into

consideration by the investor prior to buying. Cosmos is a

high-risk, high-reward scenario. The current low price and previous

higher lows could yield huge rewards for long-term investors who

can handle the storm. However, adverse mood, insider selling, and

price decrease expectations are risks. Featured image from Zipmex,

chart from TradingView

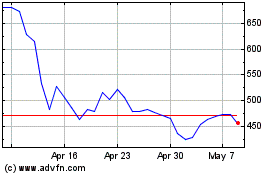

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024