Bitwise CIO Believes The Crypto Crash Sets The Stage For Bitcoin To Thrive – Key Reasons Why

August 06 2024 - 9:00PM

NEWSBTC

In the aftermath of a tumultuous week that saw Bitcoin (BTC)

plummet to a seven-month low of $49,000 on Monday, global financial

markets were rattled by a significant downturn, sparking concerns

across stock exchanges and the crypto sphere. However, amid

the chaos, Bitwise’s Chief Investment Officer Matt Hougan analyzed

the drivers behind the recent market meltdown. He explained

why he believes traders’ fears may be misplaced and that the market

dip holds key opportunities for potential Bitcoin price

appreciation. Crypto Crash Or Opportunity? In a recent note

to investors, Hougan pointed to the broader market chaos, including

a 12% single-day crash in Japan’s Nikkei index and a 4% tumble in

Nasdaq futures, sparking the crypto selloff. He drew parallels to

the market turmoil seen at the onset of the COVID-19 pandemic in

March 2020, when Bitcoin crashed 37% in a single day. “It felt as

if we might never recover. The media claimed Bitcoin had failed its

test as a hedge asset,” Hougan recalled. However, he noted that in

the year following that crash, Bitcoin surged over 1,000% to new

record highs of $57,322. Hougan believes a similar dynamic could

play out this time, arguing that Bitcoin’s fundamental case remains

intact, regardless of short-term price volatility. Related

Reading: UNI Price Bounces Back 13% Above $5.6, Can Bulls Maintain

Control? “Nothing fundamental had changed about Bitcoin because of

Covid,” Hougan said. “The maximum number of Bitcoin that could

exist (21 million) was the same on March 11 as on March 12. You

didn’t need to rely on any bank, government, or company to store

wealth in Bitcoin on March 11, which was still true on March 12.”

Moreover, Hougan contends that the factors that propelled Bitcoin’s

rise during the pandemic – the expansion of central bank

intervention, the limitations of centralized institutions, and the

growing digitization of the economy – are still in play

today. Will Bitcoin Emerge Stronger? Hougan also acknowledged

in his remarks the near-term uncertainty, noting that it remains

unclear whether the crypto market has found its bottom yet. He

pointed to the potential for further deleveraging and contagion

risk among crypto firms as key monitoring factors. However, the

Bitwise CIO urged investors to look past the short-term noise and

focus on Bitcoin’s long-term trajectory. He warned against the

temptation of market timing, reminding readers that “the four most

expensive words in finance are ‘this time it’s different.'”

Historically, Hougan said, crypto has tended to trade lower

initially during periods of broader economic panic, only to end up

higher over the following 12 months. He expressed confidence that

the current market meltdown will be no exception and that Bitcoin

will emerge stronger from the turmoil. “In fact, I’m betting the

other way,” Hougan concluded. “Resist the urge to look at intraday

prices, and focus instead on where Bitcoin could be next year, in

five years, and in ten years.” Related Reading: Helium (HNT) Stays

Afloat With 31% Gains Amid Crypto Market Mayhem When writing, the

largest cryptocurrency on the market has climbed back to the

$56,300 level, surging 4.5% in the last 24 hours. Featured

image from DALL-E, chart from TradingView.com

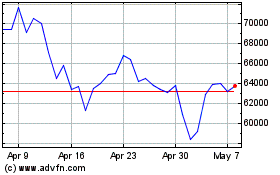

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024