Ethereum: Analyst Says $7,000 Target ‘Is Looming’ As Price Retests Crucial Level

January 10 2025 - 5:00AM

NEWSBTC

Ethereum (ETH) has seen an over 10% correction from the New Year

highs amid the market retrace, recently falling below the $3,300

support. Despite the ongoing pullback, some analysts remain

optimistic about ETH’s Q1 performance, suggesting new highs are

around the corner. Related Reading: Bitcoin Eyes Potential Rebound

To $98,600, But Analyst Suggests Caution Ethereum Forming Bullish

Pattern Ethereum shredded its New Year gains today after falling

below the $3,320 mark. Following the market retrace, the

second-largest cryptocurrency by market capitalization saw a 14%

drop from its Monday high of $3,744 to below the $3,300 support.

During the start-of-year rally, ETH’s price recovered 20% from the

correction’s lows, surging to pre-retrace levels for the first time

in nearly three weeks. However, the market pullback, which saw

Bitcoin fall 7.2% in 24 hours, sent Ethereum to the $3,210 level on

Thursday morning. The $3,200-$3,300 price range served as a key

support zone for ETH throughout December. After its recent

performance, several analysts have suggested the cryptocurrency is

forming an important reversal pattern, which could send ETH’s price

to new highs. On Wednesday, crypto analyst Rekt Capital noted that

Ethereum is forming a multi-month inverse Head and Shoulders

pattern in the 1M timeframe. To the analyst, “it’s clear” that the

$3,650-$3,760 area is “a major region of resistance, developing

just below the $4,000, with price forming that resistance at a

Lower High which could act as a Neckline to the pattern.” He stated

that “its terminus point is at the psychological level of $3,000,”

adding that “any pullback close to the $3,000 level could see

Ethereum develop a right shoulder.” Similarly, As Ethereum dropped

to the low of the key $3,200 range, Miky Bull highlighted the same

pattern, hinting that the $7,000 target “is looming.” According to

the chart, ETH’s price could see an 87.53% increase near the

$7,400-$7,500 price range, based on the bullish setup. No More

‘Major Retraces’ For ETH? Crypto analyst Ali Martinez also shared

his view on the bullish pattern, asserting a downswing to $2,900

“will be very bullish” for ETH. The analyst argued it would create

“an excellent buy-the-dip opportunity to target $7,000 next!”

However, it’s worth noting that the bullish pattern would be

invalidated if Ethereum falls below $2,800, where the left shoulder

formed. Meanwhile, another market watcher shared the similarities

between ETH’s performance at the start of 2024 and 2025,

highlighting the King of Altcoins falling below its yearly opening

during January 2024 before climbing up the following month. Related

Reading: ‘ADA Wave Is Coming’: Cardano Whales Go On Buying Spree As

Price Attempts Breakout He stated, “I think it’s really important

not to conflate a few days of red price action with high time frame

bias. I am firmly of the opinion that this is a yearly open

shakeout after some overly eager participants levered up too big,

too early. I am very bullish on H1 2025.” Analyst Crypto Wolf

considers there will likely be “little to no downside left,”

suggesting that ETH could retrace another 4% to 7% maximum before

it aims for all-time high (ATH) levels. As of this writing, ETH is

trading at $3,255, a 2.15% decrease in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

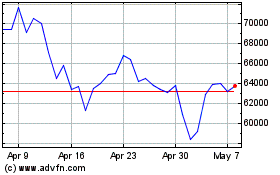

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025