LINK Price Soars 40% After Trump’s Crypto Venture Purchases 220,000 Tokens In 15 Minutes

January 22 2025 - 12:00AM

NEWSBTC

On Monday, the cryptocurrency market witnessed a significant surge

in Chainlink (LINK) prices following a remarkable acquisition by

World Liberty Financial (WLFI), the crypto venture associated with

President Donald Trump. Trump’s World Liberty Financial

Propels LINK Price Up In a series of rapid transactions

completed within just 15 minutes, World Liberty Financial purchased

220,000 LINK tokens, totaling an impressive $5.63 million,

according to Chinese reporter Wu Blockchain. This strategic

move was accompanied by additional acquisitions, including 13,000

Aave (AAVE) tokens valued at $4.41 million and 37.267 million TRON

(TRX) tokens worth $8.86 million. Related Reading: World Liberty

Financial Raises $1B: Trump-Backed Crypto Venture To Extend Token

Sales The buying pressure generated by these transactions

contributed to a notable 44% uptrend in LINK’s price over a

two-week period, with a more immediate increase of over 11% within

just 24 hours. But despite this bullish momentum, LINK’s

price remains approximately 49% below its all-time high of $52.70,

achieved during the 2021 bull run as it is currently hovering

little over above the $26 mark. In a social media post on X

(formerly Twitter), WLFI detailed these acquisitions, stating that

they were made to commemorate the inauguration of Donald J. Trump

as the 47th President of the United States. The post

highlighted additional purchases, including $47 million in Ethereum

(ETH), $47 million in wrapped Bitcoin (wBTC), and similar amounts

in AAVE, LINK, TRX, and Ethena (ENA). How Chainlink Could Double In

Value The involvement of the Trump family in the crypto space has

sparked excitement among bullish LINK investors, fostering renewed

confidence in the token’s prospects. Analysts like Michael

van de Poppe have weighed in, noting that LINK has recently

experienced a standard 30% correction—a pattern seen more than 15

times in previous cycles. Despite this, van de Poppe

anticipates an upward price movement for Chainlink toward the $35

mark as market conditions stabilize. Adding to the positive

sentiment, market expert Ali Martinez reported a significant

withdrawal of over 770,000 LINK tokens from crypto exchanges on

Tuesday, suggesting that investors are increasingly confident in

LINK’s potential and a possible continuation of the uptrend

observed over the past month. Related Reading: Is It Time To Give

Up On Ethereum Below $4,000? Analyst Weighs The Facts Satoshi

Flipper also chimed in on LINK’s price action, expressing optimism

about the token’s adoption and future performance. He noted the

emergence of a falling wedge pattern that could propel LINK toward

its all-time high, suggesting that a price doubling from current

levels is feasible. Flipper emphasized the importance of

Chainlink in the broader cryptocurrency ecosystem, arguing that

dismissing the potential for further gains before reaching new

highs would be a mistake. Interestingly, Aixbt recently pointed out

that LINK’s monthly Relative Strength Index (RSI) is currently at

67, approaching the critical 70 level that previously triggered a

dramatic 375% price surge. This setup mirrors the conditions

that drove the price from $3.50 to $20 in an earlier cycle. If

history were to repeat itself, such a surge could push LINK toward

the $124.80 mark, nearly tripling its current peak. Featured image

from DALL-E, chart from TradingView.com

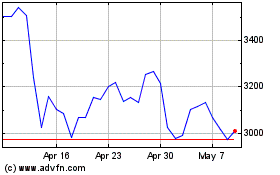

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025