MKR Jumps 5% As Grayscale Adds MakerDAO To Its Crypto Fund Lineup

August 14 2024 - 3:00AM

NEWSBTC

To further diversify its crypto investment portfolio, asset manager

and ETF issuer Grayscale has unveiled the launch of the Grayscale

MakerDAO Trust. This latest addition to Grayscale’s product suite

allows investors to gain exposure to MKR, the utility and

governance token underpinning the Ethereum-based MakerDAO

ecosystem. Grayscale Expands Crypto Portfolio MakerDAO is an

autonomous organization operating a decentralized finance (DeFi)

protocol, providing users access to a permissionless, open

stablecoin system and various other on-chain financial

services. According to Tuesday’s announcement by the firm,

through the Grayscale MakerDAO Trust, investors can now participate

in the growth and development of the protocol’s MKR ecosystem.

Related Reading: Cardano Is Not ‘Dead’: Crypto Analyst Predicts

Surge To $5 “As demand for crypto exposure continues to grow,

Grayscale is committed to expanding our suite of products and

providing innovative investment opportunities,” said Rayhaneh

Sharif-Askary, Grayscale’s Head of Product & Research. “The

launch of the Grayscale MakerDAO Trust allows investors to

experience the growth of the entire MakerDAO ecosystem, aiming to

remove DeFi’s dependency on traditional finance infrastructure by

providing a permissionless, decentralized, and open stablecoin

system,” Sharif-Askary also stated. The new trust functions

similarly to Grayscale’s other single-asset investment vehicles,

with the fund solely invested in MKR tokens. The trust is now open

for daily subscription by eligible individual and institutional

accredited investors, providing them a convenient way to gain

exposure to the MakerDAO protocol. This announcement comes on the

heels of Grayscale’s recent launches of the Grayscale Bittensor

Trust, dedicated to the TAO token supporting the Bittensor

Protocol, and the Grayscale Sui Trust, focused on the SUI token

underpinning the Sui Layer 1 blockchain. MKR Price Action

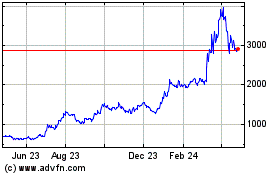

Grayscale’s news sparked a spike in the MKR token, which hit an

8-month low of $1.7 on August 5 amid the broader market crash and

global economic uncertainties that led to an increased

sell-off. MKR is trading at $2.10, up nearly 6% in the last

few hours, coupled with a 16% increase in trading volume in the

24-hour time frame, amounting to $124 million, indicating investor

interest in the token’s prospects. Related Reading: Strong

Bearish Signal Appears In Solana Chart, Where Is Price Headed Next?

MKR must consolidate above the $2.06 level to further capitalize on

this latest surge, as it has acted as a resistance wall for the

token over the past few days before Tuesday’s bullish news on the

MKR/USDT daily chart. This would be key for MKR’s future advances

and the potential to surpass its next resistance barrier at

$2.16. However, if there is a resurgence of demand and buying

pressure for the token and the broader market, which can also

contribute to MKR’s 10% surge last week, it would position

MakerDAO’s native token to tackle its next resistance at $2.31,

$2.42 and $2.73 on its way to reclaiming the $3 mark.

Featured image from DALL-E, chart from TradingView.com

Maker (COIN:MKRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

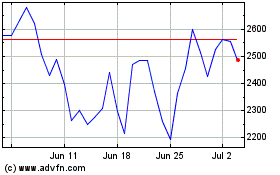

Maker (COIN:MKRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024