XRP Bull Targets $2.80 Breakout — Key Levels To Consider

February 09 2025 - 2:30PM

NEWSBTC

According to data from CoinMarketCap, XRP recorded a substantial

price decline in the past trading week losing 16.78% of its market

value. Currently, the prominent altcoin finds itself in a

consolidation zone potentially gathering momentum for its next

breakout. Related Reading: Dogecoin Price To $1, XRP To $6, And

Solana To $1,000? Pundit Says You’re Not Bullish Enough XRP Price

At Crucial Juncture In a recent X post, popular digital asset

expert Egrag Crypto shared a technical analysis of the XRP market

presenting both possible bullish and bearish scenarios. This

analysis was based on Fibonacci retracement levels which identifies

potential support and resistance levels and the 21-day exponential

moving average which smoothens out price data giving more weight to

recent prices. According to Egrag Crypto, XRP is expected to range

between $2.27 (Fib 0.382) and $2.45 ( Fib 0.5). However, there is

potential for prices to swing within a wider boundary of $2.06 (Fib

0.236) – $2.65 (0.618). Notably, the altcoin gained by 1.67% in the

past day. However, a daily price close above the 21 EMA which is

currently at $2.70 is crucial in confirming any uptrend.

Interestingly, if market bulls are able to force a strong close

above $2.80 (Fib 0.702), this would suggest a major bullish signal

indicating the current XRP buying pressure is sufficient to break

higher resistance levels. On the other hand, Egrag Crypto warns

that traders must avoid any price fall to $1.77 which may not

necessarily invalidate the current bullish structure but would

suggest rising bearish pressure. Related Reading: Altcoins Season:

Recent Crypto Dip Shows Decline May Be Over And Bulls Are Taking

Charge XRP Market Overview At the time of writing, XRP trades

at $2.49 after a 4.43% increase in the last 24 hours as previously

stated. However, the asset’s trading volume is down by 56.85%

indicating a lack of interest and uncertainty in the market.

However, considering XRP’s overall bearish form in the last seven

days, a fall in trading volume may also suggest reduced selling

pressure pointing to a potential reversal. Generally, XRP investors

remain bullish on the asset’s prospects driven by several factors

but most notably by the potential of an XRP Spot ETF. In the past

week, there were significant developments on that front as the

Chicago Board Options Exchange filed 19b-4 applications with the US

Securities and Exchange Commission (SEC) seeking to list and trade

the XRP spot ETFs proposed by WisdomTree, Bitwise, 21 Shares, and

Canary. Once the SEC acknowledges receipt of these applications,

the US regulator is granted a 45-day window – with potential

extensions of up to 240 days – to assess and make an approval

decision on the proposed ETFs. Featured image from

Trackinsight, chart from Tradingview

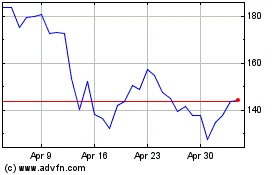

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025