Solana Sweeps Lows But Recovers – Can Bulls Reclaim $185 by Friday?

February 19 2025 - 12:30PM

NEWSBTC

Solana has experienced intense selling pressure, now trading at its

lowest levels since November 2024 and erasing all the gains from

the post-election rally. Once a leader in the altcoin market,

Solana is now facing serious risks as the meme coin euphoria that

fueled its rise has turned into a bloodbath, raising concerns about

its long-term sustainability. Related Reading: Altseason At Risk?

Expert Believes Ethereum Must Hold $2,600 To Sustain Momentum The

speculative frenzy surrounding meme coins initially drove massive

transaction volumes and liquidity to the Solana ecosystem. However,

as the hype fades and major sell-offs continue, the impact is now

weighing heavily on SOL’s price action. Analysts suggest that the

rapid cycle of speculation and liquidation has left Solana

vulnerable to further downside. Crypto analyst Jelle shared an

analysis on X, revealing that SOL took out the recent lows but

managed to close above the previous lows, signaling a potential

relief move. Jelle emphasized that this could be a crucial moment

for SOL, as reclaiming key levels could ignite a strong recovery.

However, the coming days will be critical, as the market awaits

confirmation of a bounce or further downside. Investors are closely

watching Solana’s price action, as it teeters on the edge of a

major move. Solana Testing Critical Demand Levels Solana has faced

massive selling pressure since reaching its all-time high in late

January, with its price now struggling to recover amid a broader

downturn in the altcoin market. Negative sentiment continues to

dominate as the meme coin frenzy that once fueled Solana’s growth

has turned into a liability, dragging down liquidity and investor

confidence. Related Reading: Bitcoin STH Realized Profit Reveals

Strong Support Level – Time For A Breakout? The rapid rise and fall

of speculative meme coins on the Solana network have created an

unstable trading environment, with traders hesitant to reinvest in

the ecosystem. This shift has led to a decline in decentralized

exchange (DEX) volumes, further exacerbating Solana’s struggle to

maintain bullish momentum. The network’s fundamentals remain

strong, but price action suggests that investors are growing

cautious. Jelle’s analysis on X reveals that SOL took out the

recent lows but managed to close above the previous lows. While

this signals a potential relief move, it is far from confirming a

full recovery. Jelle wants to see a strong bounce from here—ideally

with SOL reclaiming $185 before the end of business on Friday.

Traders and investors are keeping a close watch on the 3-day and

weekly candle closes to determine the next major move for Solana. A

successful reclaim of the $185 level could restore confidence and

push the price back toward $200. However, failure to do so might

lead to further downside pressure, as Solana remains vulnerable to

broader market movements and the ongoing volatility in the meme

coin sector. SOL Price Trying To Reclaim Key Levels Solana (SOL) is

currently trading at $173, holding above the crucial $170 support

level. Bulls must defend this price to maintain short-term momentum

and prevent a deeper correction. A push above the $185 mark is

essential for a recovery, as this level aligns with the 200-day

moving average, a key indicator of long-term strength. Reclaiming

this level would signal a shift in momentum and open the door for a

stronger upside move toward higher resistance levels. However, if

SOL fails to push above the $185 mark in the coming days, selling

pressure could intensify, leading to another downturn. Bears remain

in control as long as the price stays below this critical

threshold, and a rejection at $185 could trigger further downside,

potentially revisiting support around $160 or lower. Related

Reading: Dogecoin Pulls Back To ‘The Golden Ratio’ – Analyst

Expects A Bullish Reversal The coming days will be crucial for

Solana, as traders watch for confirmation of a reversal or a

continuation of the bearish trend. A breakout above $185 could

provide the momentum needed for SOL to regain its bullish

trajectory, while a failure to reclaim this level would likely

result in further losses. Market sentiment remains fragile, with

investors closely monitoring price action for any signs of a

sustainable recovery. Featured image from Dall-E, chart from

TradingView

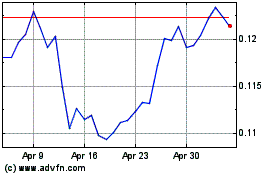

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025