VanEck CEO Owns ‘Way Over 30%’ In Bitcoin, Asset Manager Sees $2.9M Price By 2050

July 26 2024 - 11:00PM

NEWSBTC

During the 2024 Bitcoin Conference in Nashville, Tennessee, Jan van

Eck, CEO of global asset manager and Bitcoin exchange-traded fund

(ETF) issuer VanEck, made headlines with his revealing comments

about his personal Bitcoin holdings. Van Eck Reveals Personal BTC

Holdings During his appearance at the conference, Van Eck began by

sharing his perspective on Bitcoin’s growth and evolution over

time, likening it to a “teenager” that is not yet fully formed, as

many investor classes have not yet joined the market. Related

Reading: Wall Street Expert Sees 20x Potential In Ripple Via XRP

And IPO Addressing his investment approach, Van Eck revealed that

in his conversations with other attendees at Bitcoin conferences,

he has found that they tend to hold significantly more Bitcoin in

their portfolios. He further stated: Everyone I meet at Bitcoin

conferences owns way more in their own portfolio, and I always say,

wait a minute, I always want to tell people what I’m doing

personally because they should know. Interestingly, when

asked about his portfolio, Jan Van Eck replied that he owns “well

over 30%” in Bitcoin without disclosing the amount in BTC or USD.

This disclosure comes as VanEck recently published a report

outlining a significant bullish long-term price projection for BTC,

suggesting that the Bitcoin price could reach a value of $2.9

million per coin by 2050. $2.9M Bitcoin Forecast By 2050 Per the

report, Bitcoin’s scalability issues, which have historically

hindered widespread adoption, will be resolved through the

emergence of advanced Layer-2 (L2) solutions. By combining

Bitcoin’s “immutable property rights and sound money principles”

with the increased functionality of Layer 2 technology, the asset

manager envisions creating a new, globally accessible financial

system. Under this optimistic scenario, the VanEck team believes

that by 2050, Bitcoin could be used to settle 10% of the globe’s

international trade and 5% of the world’s domestic trade.

According to the report, this level of adoption could lead to

central banks holding 2.5% of their assets in Bitcoin, driving the

price of the largest cryptocurrency on the market to a substantial

$2.9 million per coin by the year 2050. Related Reading: Why Is ETH

Price Struggling Despite The Spot Ethereum ETFs Launch? In

addition, the report estimates that Bitcoin L2 solutions could be

worth a total of $7.6 trillion, or approximately 12% of Bitcoin’s

total projected value. The asset manager further noted: Though it

has established itself as an important store of value assets, our

projection of its price more than 25 years into the future is

predicated on the assumption that increasing numbers of people

around the globe use Bitcoin as a medium of exchange. At the time

of writing, BTC was trading at $67,600, up over 4% in the last 24

hours, after hitting a weekly low of $63,500 on Thursday. Featured

image from DALL-E, chart from TradingView.com

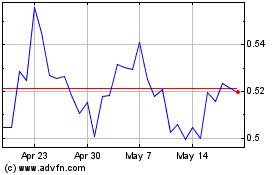

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024