BELGRAVIA CAPITAL INTERNATIONAL and Fanlogic Commence Design of Blockchain Loyalty Program for the Global Cannabis Industry

January 25 2018 - 6:00AM

BELGRAVIA CAPITAL INTERNATIONAL INC. (CSE:BLGV) (OTCQB:BLGVF)

(“Belgravia Capital”, “Belgravia”, or the “Company”) is pleased to

announce the execution of a letter of intent with Fanlogic

Interactive Inc. (

“Fanlogic”) for the joint

development of the world’s first unified cannabis automated

industry loyalty rewards program. The program will be

developed on a Belgravia/Fanlogic Blockchain proprietary platform.

The revenue model will include set up fees, and the generation of

commissions on smart-contracted incremental and tracked customer

purchases.

The program will be customer accessible on

mobile and other electronic media distributed apps. The

blockchain-distributed app will provide real-time loyalty reward

points to customers of licensed distributors and other legal

distributors of medicinal cannabis and related products.

Belgravia is a technology-based finance service

provider that is focused on the International legal cannabis

industry. Fanlogic is a peer-to-peer social media company

generating and retaining customers for B2C businesses. Fanlogic

uses digital referrals, branded fantasy games, sweepstakes, and

couponing and loyalty programs. This world-class leader is

expanding its digital customer generation and retention system by

integrating blockchain concepts into its proprietary SaaS platform.

Blockchain models remove impediments to direct business-to-customer

relations and real-time transaction completion and value

enhancement. An example of value enhancement is real-time

crediting of loyalty points on the completion of a digitally

recorded transaction. Loyalty points will be generated as

blockchain resident tokens.

The Letter of Intent covers the goals and

specifications of the blockchain development program including: (i)

reducing system management costs with smart contracts that report

secure, tracked, and transparent transactions of off chain systems,

(ii) reducing error and fraud costs; (iii) enabling frictionless

systems by placing the entire customer rewards as tokens in the

same digital wallet; (iv) increasing market value of the rewards by

making the coins inter-operable that means exchangeable into other

rewards and also providing a liquid market to get cash value if

desired; and (v) making the entire process blockchain real-time,

which means scalable to meet user need.

Mr. Mehdi Azodi, President and Chief Executive

Officer of Belgravia, stated: “We are absolutely delighted to be

expanding our technology platform of services to the legal

International cannabis distribution industry. The synergies with

the highly experienced team at Fanlogic create a very positive

dynamic to work very effectively and in rapid fashion to execute

the developments in the upcoming year. We are working towards

introducing advanced loyalty reward programs to Canadian licensed

distributors of medicinal cannabis products and will also look to

generate services for International players in correlation with

legalization; specific to their individual jurisdictions and in

accordance with International law. Decentralized blockchain

databases will provide customers with real-time shopping choices in

a way far more efficient than data aggregators; which currently use

centralized systems and interfere with direct business-to-consumer

relationships and services.”

Randolph Brownell, CEO of Fanlogic, stated:

“Blockchain is a solution that, if utilized properly, allows for

the modernization and monetization of traditional and disruptive

business lines. Loyalty is our principal focus for deployment

of blockchain, and with the relationship with a leading-edge

company like Belgravia, we have the opportunity to be a first mover

in this loyalty segment. I am thrilled to begin developing

this partnership with Belgravia and to explore delivering loyalty

and branding to the International legal cannabis industry.”

About Belgravia

CapitalBelgravia Capital International is focused on the

provision of clearly value-added services to the international

legal Cannabis industry. This includes the production of

specialized organic fertilizers for Cannabis Sativa plants, and the

organization and development of blockchain technology software for

seed-to-sale tracking and quality attestation of intermediate and

consumer products. The wholly-owned subsidiary of Belgravia, ICP

Organics, is a research and development company incorporating

agronomic and health perspectives in the Cannabis space. Belgravia

is also developing a royalty-streaming subsidiary.

Belgravia Capital intends to establish joint

research and development partnerships with Licensed Producers

operating under ACMPR regulations in Canada and in other

jurisdictions where medicinal cannabis is fully legal. Belgravia

Capital may invest in various private and public companies in

diversified sectors on an opportunistic basis. For more

information, please visit www.belgraviacapital.ca.

Forward-Looking

Statements Certain information set forth in this news

release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Forward-looking statements include

statements that use forward-looking terminology such as “may”,

“will”, “expect”, “anticipate”, “believe”, “continue”, “potential”

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements include, without

limitation, statements regarding planned investment activities

& related returns, trends in the markets for fertilizers and

medicinal or recreational use of cannabis, the timing or assurance

of the legalization of recreational cannabis, the timing for

completion of research and development activities, the potential

value of royalties from water and other resources, and other

statements that are not historical facts. These forward-looking

statements are subject to numerous risks and uncertainties, certain

of which are beyond the control of the Company, including, but not

limited to, changes in market trends, the completion, results and

timing of research undertaken by the Company, risks associated with

resource assets, the impact of general economic conditions,

commodity prices, industry conditions, dependence upon regulatory,

environmental, and governmental approvals, the uncertainty of

obtaining additional financing, and risks associated with cannabis

use for medicinal or recreational purposes. Readers are cautioned

that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be

placed on forward-looking statements.

For More Information, Please

Contact:Mehdi Azodi, President & CEOBelgravia Capital

(416) 779-3268 mazodi@blgv.ca

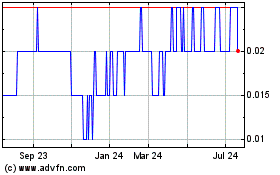

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Mar 2025 to Apr 2025

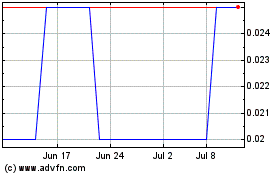

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Apr 2024 to Apr 2025