Captor Capital Sells Orange County Retail Location to MedMen

November 16 2018 - 8:34AM

Captor Capital Corp. (“Captor” or the “Company”) (CSE:CPTR;

FRANKFURT:NMV; USOTC:NWURF) has signed a

definitive agreement (“the Agreement”) to sell the retail

operations and license for a dispensary location in Santa Ana,

California, through an all-stock transaction with MedMen

Enterprises Inc. (“MedMen”) (CSE: MMEN; OTCQX: MMNFF; FSE: A2JM6N)

valued at approximately US$16 million. The store is currently

MedMen branded and managed.

“Through the sale of this dispensary we have

achieved a strong return on our original investment for our

shareholders,” said Captor Capital CEO, John Zorbas. “With the

completion of this divestment, Captor will continue upon our

strategy of owning and developing a new set of self-operated retail

store brands to support our cultivation, manufacturing, and

distribution operations.”

Upon closing, MedMen will issue approximately

3,740,228 Class B Subordinate Voting shares (the “Shares”) to

Captor Capital. At current market price, the Agreement transaction

is valued at US$16,229,567. The final purchase price is subject to

adjustment for accrued liabilities at the time of closing.

MedMen Chief Executive Officer Adam Bierman and

President Andrew Modlin own a combined 2.8 percent of Captor

Capital. As such, an independent committee of the Board reviewed

and approved the transaction. Cormark Securities provided a

fairness opinion to the Board of Directors of MedMen, stating that

in its opinion, and based upon and subject to the assumptions,

limitations, and qualifications set forth therein, the transaction

is fair, from a financial point of view.

The Agreement is subject to regulatory approvals

by various local and state authorities and other customary closing

conditions. The Company expects the transaction to close within 60

days.

About Captor Capital

Captor Capital Corp. is a Canadian firm focused

on the cannabis sector listed on the Canadian Securities Exchange,

the OTC, and the Frankfurt Stock Exchange. A vertically integrated

cannabis company, Captor provides recreational and medical

marijuana based products to consumers via its leading brands and

dispensary locations.

The company follows a strategy of acquiring

cash flowing established companies and organizations with growth

potential that require capital to scale. Captor currently has a

number of revenue generating cannabis investments including a

wholly owned MedMen branded dispensary in West Hollywood, the CHAI

dispensary in Santa Cruz and Higher Ground in Castroville, CA. The

Company also owns Mellow Extracts, a highly regarded producer of

cannabis extracts based in Costa Mesa, CA. Captor Capital is

currently looking at additional revenue generating investments in

the cannabis space and will be updating the market in due

course.

Contact Gavin Davidson, Communications Captor

Capital Corp. 705.446.6630 gavin@captorcapital.com

Forward-Looking Statements

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS

REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains or refers to

forward-looking information, and is based on current expectations

that involve a number of business risks and uncertainties. Factors

that could cause actual results to differ materially from any

forward-looking statement include, but are not limited to

availability of investment opportunities, economic circumstances,

market fluctuations and uncertainties, uncertainties relating to

the availability and costs of financing needed in the future,

changes in equity markets, inflation, changes in exchange rates,

and the other risks involved in the investment industry and junior

capital markets. Forward-looking statements are subject to

significant risks and uncertainties, and other factors that could

cause actual results to differ materially from expected results.

Readers should not place undue reliance on forward-looking

statements. These forward-looking statements are made as of the

date hereof and the Company assumes no responsibility to update

them or revise them to reflect new events or circumstances other

than as required by law.

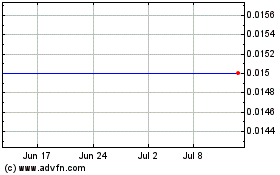

MedMen Enterprises (CSE:MMEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

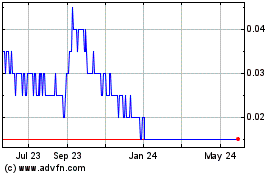

MedMen Enterprises (CSE:MMEN)

Historical Stock Chart

From Nov 2023 to Nov 2024