March 8, 2018

Akzo Nobel N.V. publishes results

for the full-year and the fourth quarter 2017 (AKZA; AKZOY)

Akzo

Nobel N.V. (continuing and discontinued

operations):

-

On track to create two focused,

high performing businesses

-

Separation of Specialty

Chemicals on track for April 2018; Specialty Chemicals business

now reported as discontinued operations

-

Revenue, including discontinued

operations, up 3% (up 4% excluding currency impact) at €14,575

million

-

EBIT1, including

discontinued operations, up 2% to €1,525 million

-

Operating income, including

discontinued operations, at €1,396 million includes identified

items of €129 million, mainly related to the transformation of

AkzoNobel, including the separation of Specialty Chemicals

-

Net income attributable to

shareholders at €832 million (2016: €970 million)

-

Total dividend per share

proposed for 2017 up 52% to €2.50 (2016: €1.65). €4.00 special

cash dividend paid in December 2017 as advance proceeds related to

the separation of Specialty Chemicals business

-

Net cash inflow from

operating activities at €969 million (2016: €1,291 million)

-

2020 financial guidance

reconfirmed2:

AkzoNobel Paints and Coatings (reported as continuing operations):

-

Revenue up 2% (up 4%

excluding currency impact) and in both Business Areas, mainly due to volume growth and acquisitions, partly

offset by unfavorable currency and price/mix

-

Volumes 2% higher; up 7%

for Decorative Paints with growth in all regions, down 1% for

Performance Coatings due to adverse conditions in the marine, and

oil and gas industries

-

EBIT at €905 million (2016:

€928 million), resulting from higher raw material costs, partly

offset by increased selling prices, continuous improvement and cost

control

-

ROS at 9.4% (2016: 9.8%).

ROI at 13.9% (2016: 14.4%)

-

Adjusted EPS from

continuing operations at €2.56 (2016: €2.38)

-

Three acquisitions to help

grow the business

-

Opening of the most advanced

and sustainable paints factory: Ashington, UK

-

Dulux voted healthiest

brand in the UK

Akzo Nobel N.V. CEO, Thierry

Vanlancker, commented:

"In 2017 we delivered another year of increased

EBIT with revenue growth for all Business Areas, driven by a

combination of higher volumes and bolt-on acquisitions. We are

taking various measures amongst which cost control to deal with

industry-wide headwinds, including higher raw material costs and

challenges for the Marine and Protective Coatings business.

"We strengthened our leading global position

in performance coatings through the acquisitions of V.Powdertech

business for Powder Coatings, Flexcrete Technologies Ltd. for

Protective Coatings and Disa Technology (Disatech) for Specialty

Coatings.

"In 2017, we opened the world's most advanced and

sustainable paint plant in Ashington, UK. This will be the

production center for our leading global brand, Dulux. Other

examples of our focus on strengthening the business include a €13

million investment in a new innovation hub in the UK, and the

opening of a new Performance Coatings facility in Chonburi,

Thailand.

"In September, we were ranked number one on the

Dow Jones Sustainability Index. During the year, we put particular

emphasis on increasing our energy efficiency, reducing material

waste and continuing to deliver more eco-premium solutions for our

customers.

"We are on track to create two focused, high

performing businesses. The internal separation of the Specialty

Chemicals business is complete and a full separation remains on

track for April 2018. The transformation of AkzoNobel into a

focused Paints and Coatings company is progressing well, with phase

one on track to achieve €110 million savings in 2018, contributing

directly towards delivering the 2020 financial guidance."

Outlook AkzoNobel Paints and

Coatings:

Headwinds experienced during 2017, including

higher raw material costs and adverse effects from foreign

currency, are projected to continue in 2018, especially during the

start of the year.

We anticipate ongoing positive developments for

Decorative Paints in all regions, particularly Asia. Trends for

Performance Coatings are expected to be positive for most segments

and regions, while still challenging for Marine and Protective

Coatings.

We continue to implement various measures to

mitigate current market challenges, including increased selling

prices and cost discipline. Our "Winning Together - 15 by 20"

strategy will create a focused Paints and Coatings company and

deliver our 2020 guidance.

Full-year 2017 in €

million

Paints and Coatings |

|

|

|

|

|

| Q4

20165 |

Q4 2017 |

Delta% |

|

FY

20165 |

FY 2017 |

Delta% |

| 2,291 |

2,283 |

(-) |

Revenue |

9,434 |

9,612 |

2 |

| 149 |

178 |

19 |

EBIT1 |

928 |

905 |

(2) |

| 6.5 |

7.8 |

|

ROS3 % |

9.8 |

9.4 |

|

| |

|

|

ROI4 % |

14.4 |

13.9 |

|

Paints and

Coatings performance in 2017

Decorative Paints revenue was up

2% (up 4% excluding currency impact) driven by strong volume

growth, partly offset by adverse currencies and price/mix effects.

Volumes were up 7% overall, with growth in all regions.

Performance Coatings revenue was

up 2% (up 4% excluding currency impact), mainly due to the acquired

Industrial Coatings business, partly offset by adverse currencies.

Volumes 1% lower due to adverse conditions in the marine, and oil

and gas industries offsetting growth in most segments and

regions.

Developments

in Paints and Coatings in

2017

Growing the

business

AkzoNobel opened a new facility in Ashington, UK, which is the

world's most advanced and sustainable paint factory. The hi-tech

plant is the new center of production for Dulux, the world's

leading decorative paint brand.

In Dongguan, China, the company

opened a Specialty Coatings facility dedicated to producing

aerospace coatings for the North and South Asian aviation market.

This new facility will offer improved and faster service to

existing, as well as new customers, in this rapidly-growing

market.

Leading brands,

products and customer solutions

Customers at automotive body repair shops can now save time and

money thanks to an industry first digital solution introduced by

AkzoNobel's Vehicle Refinishes business. Carbeat provides

significant benefits by giving a real-time overview of the repair

process. The application is deployed on a large touch screen

monitor, designed to make using the system quick and intuitive,

while providing a comprehensive overview of all the work in

production.

Acquisitions and

divestments

In 2017, the company acquired the V.Powdertech business, the

leading Thai manufacturer of powder coatings, which supplies a

range of products for domestic appliances, furniture and general

industrial applications. The company also completed the

acquisitions of Flexcrete Technologies Ltd. and Disa Technology

(Disatech) to further strengthen the portfolio of its Protective

and Specialty Coatings business.

Specialty Chemicals (reported as

discontinued operations)

-

Separation of Specialty

Chemicals, via a private sale or legal demerger, on track for

April 2018

-

Revenue up 4% (up 5%

excluding currency impact), mainly due to positive volume and

price/mix effects, partly offset by adverse currencies

-

Volumes up 3% with positive

developments in all business units and regions

-

EBIT1 up 10% to

€689 million, with favorable volumes and cost control more than

compensating for adverse currencies and raw material price

inflation

-

Return on sales

(ROS)3 at 13.8%

(2016: 13.2%); return on investment

(ROI)4 at 19.1%

(2016: 17.9%)

-

14 capacity expansions

announced or completed to support the growth of customers

-

Breakthrough technology to

produce ethylene amines and derivatives from ethylene oxide

-

Multiple contracts to

increase the use of renewable electricity

Full-year 2017 in €

million

Specialty Chemicals |

|

|

|

|

|

| Q4 2016 |

Q4 2017 |

Delta% |

|

FY 2016 |

FY 2017 |

Delta% |

| 1,169 |

1,228 |

5 |

Revenue |

4,783 |

4,985 |

4 |

| 118 |

165 |

40 |

EBIT1 |

629 |

689 |

10 |

| 10.1 |

13.4 |

|

ROS3 % |

13.2 |

13.8 |

|

| |

|

|

ROI4 % |

17.9 |

19.1 |

|

| |

|

|

|

|

|

|

Specialty Chemicals performance

in 2017

Revenue was up 4% (up 5% excluding

currency impact), due to positive volume developments and price/mix

effects, partly offset by adverse currencies. Volumes were up in

all business units and in all regions. Europe, Asia and Latin

America showed strong growth during the whole year while North

America suffered most from supply chain disruptions, such as

Hurricane Harvey.

Developments

in Specialty Chemicals in 2017

Growing with our

customers

During 2017, Specialty Chemicals announced or completed a further

14 capacity expansions to support customer growth. These included

investments in Brazil, China, Denmark, Germany, the Netherlands,

Spain, Sweden and the US, as well as a joint arrangement with Atul

to produce monochloroacetic acid in India.

Innovation

The 2017 edition of the Imagine Chemistry open innovation challenge

generated more than 200 ideas for sustainable products and

processes, several of which are being targeted for

commercialization. The company also signed an agreement with

Itaconix for the development and commercialization of bio-based

polymers, and announced a breakthrough technology to produce

ethylene amines and their derivatives from ethylene oxide.

Sustainability and

energy

The company led an initiative with DSM, Google and Philips in the

Netherlands to source green power from the Bouwdokken windpark and

signed a deal with Vattenfall which will enable renewable

electricity supply in the Nordics to increase to 100% in 2020. We

also teamed up with a bio-steam facility in Delfzijl, the

Netherlands, to reduce annual CO2 emissions by

around 100,000 tons.

The Q4 and

full-year 2017 report can be viewed and downloaded at

www.akzonobel.com/quarterlyresults

1 Operating income excluding identified

items

2 Excluding unallocated corporate center costs and invested

capital; assumes no significant market disruption

3 ROS% is EBIT divided by revenue

4 ROI% is 12 months EBIT divided by 12 months average invested

capital

5 Represented to present the Specialty Chemicals business as

discontinued operations

This is a public announcement by

AkzoNobel N.V. pursuant to section 17 paragraph 1 of the European

Market Abuse Regulation (596/2014).

About AkzoNobel

N.V.

AkzoNobel creates everyday essentials to make people's lives more

liveable and inspiring. As a leading global paints and coatings

company and a major producer of specialty chemicals, we supply

essential ingredients, essential protection and essential color to

industries and consumers worldwide. Backed by a pioneering

heritage, our innovative products and sustainable technologies are

designed to meet the growing demands of our fast-changing planet,

while making life easier. Headquartered in Amsterdam, the

Netherlands, we have approximately 45,000 people in around 80

countries, while our portfolio includes well-known brands such as

Dulux, Sikkens, International, Interpon and Eka. Consistently

ranked as a leader in sustainability, we are dedicated to

energizing cities and communities while creating a protected,

colorful world where life is improved by what we do.

Not for

publication - for more information

| Corporate

Media Relations |

Corporate

Investor Relations |

| T +31

(0)88 - 969 7833 |

T +31

(0)88 - 969 7856 |

Contact:

Diana Abrahams

|

Contact:

Lloyd Midwinter

|

Safe Harbor

Statement

This press release contains statements which address such key

issues such as AkzoNobel's growth strategy, future financial

results, market positions, product development, products in the

pipeline and product approvals. Such statements should be carefully

considered, and it should be understood that many factors could

cause forecasted and actual results to differ from these

statements. These factors include, but are not limited to, price

fluctuations, currency fluctuations, developments in raw material

and personnel costs, pensions, physical and environmental risks,

legal issues, and legislative, fiscal, and other regulatory

measures. Stated competitive positions are based on management

estimates supported by information provided by specialized external

agencies. For a more comprehensive discussion of the risk factors

affecting our business please see our latest

annual report, a copy of which can be found on our website:

www.akzonobel.com.

Photo CFO Maarten de Vries

PDF Media Release

PDF Q4 FY Report

Photo CEO Thierry Vanlancker

Infographic Specialty Chemicals

Infographic Paints and Coatings

Factsheet Specialty Chemicals

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: AkzoNobel NV via Globenewswire

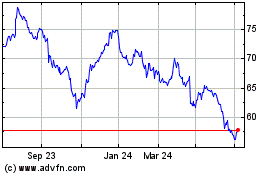

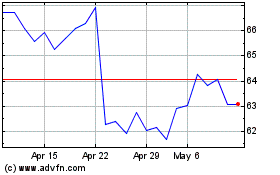

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Jan 2024 to Jan 2025