Banimmo : Consolidated earnings at 31 December 2015

February 26 2016 - 12:45AM

Operating result

stands at € 4.5 million.

Adjustment of the

accounting values resulting in a net loss of € 33.2 million (in

particular € 22.4 million value reduction for a part of the

mezzanine debt granted to Urbanove).

Important operational activity

throughout the bookyear:

-

Disposal of 4 buildings for a total value of €78

million.

-

Signature of an undertaking to purchase a retail

complex in Anglet (France, 5,100 sqm).

-

Delivery of 2 office buildings in Belgium

(Veridis: 6,500 sqm and Deloitte: 7,300 sqm) and of Halle Secrétan

(4,200 sqm) in Paris.

-

Extensive renovation works at Marché

Saint-Germain (4,600 sqm) in Paris (6th)fully let

and to be delivered in the first half of 2016.

Adjusted Net Asset Value stands

at 11.2 € per share.

Press on the link hereunder for

the complete press release in pdf form.

Consolidated annual results 31

December 2015

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Banimmo via Globenewswire

HUG#1989685

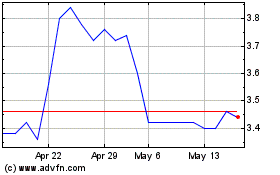

Banimmo (EU:BANI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Banimmo (EU:BANI)

Historical Stock Chart

From Jan 2024 to Jan 2025