AXA 2020 Underlying Earnings Fell Amid Coronavirus Hit

February 25 2021 - 12:39AM

Dow Jones News

By Mauro Orru

AXA SA said Thursday that underlying earnings for 2020 fell

mostly due to the impact of coronavirus-related property and

casualty claims and higher natural catastrophes.

The French insurance giant said underlying earnings for the year

fell to 4.26 billion euros ($5.18 billion) from EUR6.45 billion,

while net profit slipped to EUR3.16 billion from EUR3.86

billion.

The company said coronavirus-related property and casualty

claims and solidarity measures had an impact of EUR1.5 billion on

2020 underlying earnings.

Revenue for the year fell to EUR96.72 billion from EUR103.53

billion.

Annual premium equivalent, known as APE, rose 1% to EUR5.34

billion. APE measures new business growth by combining the value of

payments on new regular premium policies, and 10% of the value of

payments made on one-time, single-premium products.

AXA's solvency II ratio--a key measure of financial strength for

insurance companies--was 200% at Dec. 31, compared with 198% at the

end of 2019.

"After carefully considering the group's balance sheet position,

cash flows and overall operational performance as well as the

continuing uncertainties related to the ongoing Covid-19 crisis,

the board of directors decided to propose a dividend of EUR1.43 per

share," Chief Executive Thomas Buberl said.

AXA had proposed a dividend at the same level the previous year

but it was forced to cut it to EUR0.73 a share due to the

coronavirus pandemic.

Write to Mauro Orru at mauro.orru@wsj.com

(END) Dow Jones Newswires

February 25, 2021 01:24 ET (06:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

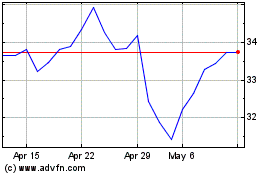

Axa (EU:CS)

Historical Stock Chart

From Jan 2025 to Feb 2025

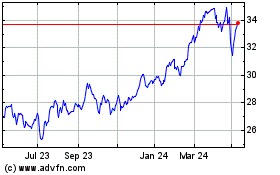

Axa (EU:CS)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Axa (Euronext): 0 recent articles

More Axa News Articles