Regulatory News:

The Board of Directors of TotalEnergies EP Gabon (Paris:EC) met

on March 24, 2022, to approve the financial statements for the year

ending December 31st, 2021.

In 2021, the Brent averaged 70.9 dollars per barel ($/b), up 70%

compared to 2020 ($41.8/b).

TotalEnergies EP Gabon's equity share of operated and

non-operated oil production1 amounted to 22 900 barrels per day in

20221 compared to 25 600 barrels per day in 2020. The production

has been significantly affected by a damage to a subsea electrical

cable supplying the Anguille and Torpille offshore fields, which

occurred on September 18, 2021.

On December 7, 2021, after receiving the approval of Gabonese

authorities, TotalEnergies EP Gabon announced the closing of its

agreement to divest to Perenco Oil and Gas Gabon non-strategic

assets.

Considering the favorable evolution of prices, the 2021 revenues

amounted to $655 million compared to $435 million in 2020.

In this context, TotalEnergies EP Gabon funds generated from

operations in 2021 amounted to $339 million, three times higher

than 2020.

In 2021, the net income amounted to $33 million, against a loss

of -$87 million in 2020.

In coherence with the results achieved, the Board of Directors

decided that it will recommend at the Annual Shareholders' Meeting

on May 30th, 2021 that shareholders approve the payment of a

dividend of $16,67 per share for a total payout of $75 million for

all shareholders.

The dividend will be payable in euros (or the equivalent in CFA

francs), based on the €/$ exchange rate on the date of the Annual

Meeting.

Main Financial Indicator

2021

2020

2021

vs

2020

Average Brent price

$/b

70. 9

41. 8

70%

Average TotalEnergies EP Gabon crude price

(1)

$/b

64. 8

36. 5

78%

Crude oil production from fields operated

by TotalEnergies EP Gabon

Kb/D (2)

15. 0

19. 1

-22%

Crude oil production from Total Gabon

interests (3)

Kb/d

22. 9

25. 6

-11%

Sales volumes (4)

Mb (5)

8. 9

10. 2

-13%

Revenue (6)

$ M

655

435

51%

Funds generated from operations (7)

$ M

339

112

x 3

Capital expenditure

$ M

65

60

8%

Net income

$ M

33

- 87

n.a

Indicators presented in the above table include assets sold to

Perenco Oil & Gas Gabon until December 7, 2021, closing date of

the transaction.

(1)

The crude price calculation excludes

profit oil reverting to the Gabonese Republic as per production

sharing contracts, these barrels being handed over in kind to the

host state.

(2)

Kb/d: Thousand barrels per day.

(3)

Including profit oil reverting to the

Gabonese Republic as per production sharing contracts.

(4)

Sales volume excludes profit oil reverting

to the Gabonese Republic as per production sharing contracts, these

barrels being handed over in kind to the host state.

(5)

Mb: Million of barrels.

(6)

Revenue from hydrocarbon sales and

services (transportation, processing and storage),, including

profit oil reverting to the Gabonese Republic as per production

sharing contracts.

(7)

Funds generated from operations are

comprised of the operating cash flow, the gains or losses on

disposals of assets and the working capital changes.

2021 Results

Selling price In 2021, Brent averaged $70.9 per barrel

($/bbl), up 70% compared to 2020 ($41.8/bbl). Reflecting the Brent

prices, the average selling price of the crude oil grade marketed

by TotalEnergies EP Gabon amounted to $64.8/bbl, up 78% compared to

2020.

Production TotalEnergies EP Gabon's equity share of

operated and non-operated oil production averaged 22 900 barrels

per day in 2021, down 11% compared to 2020.

This was mainly due to:

- A damage to a subsea electrical cable supplying the Anguille

and Torpille offshore fields, which occurred September 18, 2021.

The power supply has been restored on January 15, 2021.

- The interests divested in seven mature offshore fields (Grondin

non-operated sector) effective since December 7, 2021.

- The five-year shutdown of the Torpille field during the second

quarter 2021.

- A partial production shutdown on the Baudroie operated field

due to a damage on the evacuation line.

- The natural decline of the fields.

partly offset by:

- A better availability of the operated production from Torpille

field following the five-year shutdown.

- The gains on the non-operated Grondin sector, from the

conversion campaign of well activation from gas-lift to electrical

submersible pumps.

Revenues The 2021 revenues amounted to $655 million

compared to $435 million in 2020. This increase is explained by the

significant increase of the selling price of the crude oil grade

marketed by TotalEnergies EP Gabon between the two periods.

Funds Generated From Operations TotalEnergies EP Gabon

funds generated from operations in 2021 amounted to $339 million,

three times higher than 2020.

Investments Capital expenditure amounted to $65 million

in 2021, up 8% compared to 2020. They mainly include operations

related to the five-year shutdown of the Torpille field, integrity

works on operated sector, the conversion of well activation from

gas-lift to electrical submersible pumps and the installation of a

gas pipeline on non-operated Grondin sector.

Net income The 2021 net income amounted to $33 million,

compared to a loss of -$87 million in 2020. The net income is

mainly impacted by the significant prices increase, the capital

loss on disposal (-$32 million after tax) and the reversal of asset

retirement obligation provisions (+$8 million after tax).

Highlights since the beginning of

fourth quarter 2021

Board of Directors on November 16, 2021 The Board of

Directors reviewed and approved the budget for 2022.

Combined General Meeting on November 25, 2021 During the

Combined Shareholders' Meeting, the shareholders adopted all the

resolutions submitted to the vote, including the change of the

company’s name to “TotalEnergies EP Gabon” and the modification of

the company’s legal status.

Divestment of non-operated assets and Cap Lopez Terminal

On December 7, 2021, after receiving the approval of the Gabonese

authorities, TotalEnergies EP Gabon announced the closing of its

agreement to divest to Perenco Oil and Gas Gabon non-strategic

assets.

Repair and recommissioning of a subsea electrical cable

Following an incident on September 18, 2021, to a subsea cable

supplying electricity to the offshore installations of Anguille and

Torpille, temporary equipments were mobilized on these facilities

in order to partially restore, from October 2021, the production of

offshore fields. The cable repair was completed on January 15,

2022.

This incident resulted in a shortfall of about 10,000 barrels

per day in the last quarter of 2021, or about 2,500 barrels per day

on average over the year 2021.

About TotalEnergies EP Gabon TotalEnergies EP Gabon is

58.28% owned by TotalEnergies S. E, 25% by the Gabonese Republic

and 16.72% by the public.

About TotalEnergies TotalEnergies is a global

multi-energy company that produces and markets energies: oil and

biofuels, natural gas and green gases, renewables and electricity.

Our 105,000 employees are committed to energy that is ever more

affordable, cleaner, more reliable and accessible to as many people

as possible. Active in more than 130 countries, TotalEnergies puts

sustainable development in all its dimensions at the heart of its

projects and operations to contribute to the well-being of

people.

@TotalEnergies TotalEnergies TotalEnergies

TotalEnergies

Cautionary Note The terms "TotalEnergies", "TotalEnergies

Company" and "Company" appearing in this document are used to refer

to TotalEnergies SE and the consolidated entities that

TotalEnergies SE controls directly or indirectly. Similarly, the

terms "we", "us", "our" may also be used to refer to these entities

or their employees. The entities in which TotalEnergies SE holds a

stake directly or indirectly are separate and autonomous legal

persons. TotalEnergies SE cannot be held liable for acts or

omissions emanating from these companies.

This document may contain forward-looking statements. They may

prove to be inaccurate in the future and are dependent on risk

factors. Neither TotalEnergies SE nor any of its subsidiaries

undertakes or assumes any commitment or responsibility to investors

or any other stakeholder to update or revise, in particular as a

result of new information or future events, any or all of the

statements, forward-looking information, trends or objectives

contained in this document. Information regarding risk factors that

could have a material adverse effect on TotalEnergies' financial

results or operations is also available in the most up-to-date

versions of the Universal Registration Document filed by

TotalEnergies SE with the Autorité des marchés financiers and Form

20-F filed with the United States Securities and Exchange

Commission ("SEC").

__________________ 1 Including profit oil reverting to the

Gabonese Republic as per production sharing contracts

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220324005923/en/

TotalEnergies EP Gabon

actionnariat-epgabon@totalenergies.com

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com

l @TotalEnergiesPR Investor Relations: +33 (0)1 47 44 46 46 l

ir@totalenergies.com

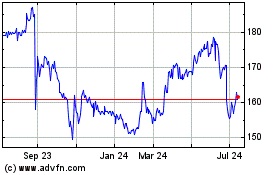

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Oct 2024 to Nov 2024

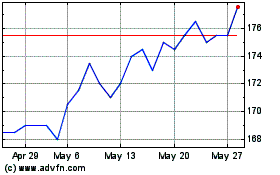

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Nov 2023 to Nov 2024