KPN and ABP join forces through new TowerCo

June 05 2024 - 12:30AM

KPN and ABP join forces through new TowerCo

KPN and Dutch pension fund ABP have signed an

agreement to create a new tower company (TowerCo). This strategic

partnership is in line with KPN's ‘Connect, Activate & Grow’

strategy to optimize the value of its passive infrastructure assets

and retain strategic flexibility. It demonstrates KPN’s intent to

optimize shareholder value and continue to operate the best digital

infrastructure in the Netherlands.

With the increasing consumption of data and the

deployment of new technologies, there is an increasing need for a

strong and stable grid of mobile sites providing continuous

coverage in the Netherlands. Following ongoing demand for network

growth and densification, increasing direct exposure to Dutch

passive telecom infrastructure is strategically imperative for

KPN.

TowerCo will hold the passive mobile

infrastructure assets of KPN, as well as those of NOVEC and OTC

(portfolio companies owned by TenneT and ABP respectively), leading

to a portfolio of c. 3,800 towers and rooftops in the Netherlands

and also has received a built-to-suit commitment for the next 10

years from KPN. TowerCo and KPN have entered into a long-term

master service agreement, stipulating the terms under which KPN

will continue to be a tenant of TowerCo for an initial period of 20

years. TowerCo aims to further increase tenancy levels of its

network by providing access to attractive and fully modernized

towers and rooftops.

Through the transaction KPN gains higher

flexibility over a substantial part of its mobile sites, enabling

strategic synergies regarding the deployment, maintenance, and

optimization of the network infrastructure. This flexibility allows

KPN to ensure that its mobile network continues to meet the

performance standards required to deliver high-quality services to

subscribers, to accommodate new technologies, such as 5G, and to

expand coverage into underserved areas. It also allows for the

harmonization of contracts into a futureproof agreement covering

~60% of our tower and rooftop portfolio. As part of the transaction

some of the existing lease terms have been reset.

In this transaction, ABP is represented by its

asset manager APG. KPN will hold a 51% consolidating stake in

TowerCo and ABP the remaining 49%, with TenneT selling its stake in

NOVEC as part of this transaction. KPN has agreed an upfront cash

payment of ~€ 120m to NOVEC/OTC’s current shareholders for the

stake in the company and the amended lease terms, subject to

closing adjustments. On a pro forma, full year basis, the

consolidated impact of the transaction on KPN’s 2024 Adjusted

EBITDA AL would be ~€30m; on a similar basis, the impact on KPN’s

Operating Free Cash Flow would be ~€20m. The transaction has no

impact on employment and is subject to approval by the works

council and regulator. Perella Weinberg acted as financial advisor

to KPN in this transaction.

The accompanying webcast will be held today,

June 5, 2024 at 10:00 CEST. This webcast and related documents can

be accessed via our website ir.kpn.com.

For more information: KPN Royal Dutch Telecom

Investor Relations Wilhelminakade 123 3072 AP Rotterdam

E-mail: ir@kpn.com

Formal disclosures:

Royal KPN N.V. Head of IR: Matthijs van Leijenhorst Inside

information: Yes Topic: KPN and ABP join forces through new

TowerCo05/06/2024KPN-N

- KPN and ABP join forces through new TowerCo

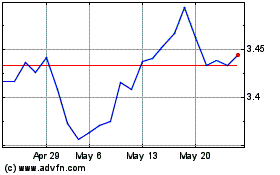

Koninklijke KPN NV (EU:KPN)

Historical Stock Chart

From Nov 2024 to Dec 2024

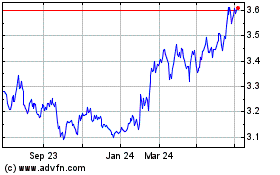

Koninklijke KPN NV (EU:KPN)

Historical Stock Chart

From Dec 2023 to Dec 2024