Mithra initiates monetization process, receives bridge loan from

existing lenders

Mithra initiates

monetization process, receives bridge loan from existing

lenders

-

Mithra appoints advisors and initiates a process to monetize its

assets or execute a sale of its business

-

Mithra has entered into a new secured bridge loan facility in a

committed amount of up to EUR 13.5 million, subject to milestones;

with an uncommitted facility of a further EUR 5 million

-

Bridge loan facility provides expected liquidity runway to fund the

monetization process with respect to key assets through 30

April

-

Secured lenders to certain key Mithra operating entities agree to

standstill and forbear all debt service (including by extending

maturity) in support of the monetization process

Liege, Belgium, 05 March 2024 – 07:00

CET – Mithra (Euronext Brussels: MITRA), a company

dedicated to women’s health, today announces the initiation of a

monetization process and signing of a new secured bridge loan

facility (the "Facility") expected to fund that

process through 30 April. The monetization process and Facility are

further to Mithra’s 06 February 2024 announcement on its cash

position.

Monetization Process

In an effort to maximize value for all of

Mithra’s stakeholders, the Company has initiated a monetization

process to realize value from its assets involving the sale of

various selected assets, particularly Estetra SRL, and/or the

business as a whole (the "Monetization Process").

The Company is finalizing negotiations with an internationally

recognized investment bank to help conduct the Monetization Process

in collaboration with DC Advisory and Alvarez & Marsal, who are

advising on liquidity management and advising on monetization,

among other things.

As is described below, the Monetization Process

with respect to key assets is being funded under the Facility,

subject to achievement of milestones.

Parties interested in participating in the

Monetization Process should contact Ed Kulik of DC Advisory

(Ed.Kulik@dcadvisory.com) and Thomas Dillenseger of Alvarez &

Marsal (TDillenseger@alvarezandmarsal.com).

Liquidity / Terms of

Facility

The Facility provides up to EUR 13.5 million to

be drawn in multiple tranches upon the satisfaction of certain

milestones, as well as an uncommitted EUR 5 million "accordion"

facility (which can be used once the committed amount has been

fully drawn and only if the lenders consent).

The cash received under the Facility, if

received in full, creates expected cash runway intended to fund the

business through 30 April, permitting a focus on the Monetization

Process.

The borrower under the Facility is Estetra SRL

with a guarantee from Mithra Pharmaceuticals SA (such guarantee

being limited in recourse to the secured assets). The Facility is

secured on all of the assets of Estetra SRL, a share pledge over

shares in Estetra SRL and a pledge on intercompany receivables of

Mithra Pharmaceuticals SA on Estetra SRL.

The maturity date of the Facility is sixty days

from the first utilization date of the Facility. The initial

conditions precedent have been met, and the first drawdown of EUR 9

million is expected to be drawn on 6 March 2024.

The remaining tranches can be drawn during

successive periods of ten business days (starting within ten

business days after signing) each time for an amount not exceeding

EUR 2.5 million (and, for the avoidance of doubt, never exceeding

in aggregate the total committed amount). Drawdowns under the

remaining tranches are conditional upon additional milestones

having been met, which primarily include various data and plans

being provided to the Lenders in relation to the implementation of

the Monetization Process, the appointment of (an) investment

bank(s) to advise on the Monetization Process, the entry into an

intercreditor agreement with other secured lenders, including

receipt of third-party guarantor consent, and the actual

implementation of the Monetization Process. The Facility is subject

to mandatory prepayment in full upon a change of control over

Estetra SRL and the proceeds of sales of assets of Estetra SRL will

also be applied to a mandatory prepayment. The Facility contains

various undertakings and events of default.

The lenders under the Facility consist of funds

managed by Highbridge Capital Management, LLC and funds managed by

Whitebox Advisors, LLC (each a “Lender”). The

Lenders under the Facility will enter into an intercreditor

agreement with ING Belgium NV/SA and Belfius Bank NV/SA, the other

existing secured creditors to Estetra SRL, who have agreed in

principle to forebear and standstill with respect to any defaults

under their agreements.

The Facility does not bear interest; however,

the Facility provides for a forbearance fee of 2% on the amounts

outstanding under Mithra’s existing senior secured convertible

facility with the Lenders (which is in consideration of the waivers

and forbearance that the Lenders have provided to Mithra under that

facility while Mithra explored strategic alternatives to maximize

value for all of its stakeholders, as referenced in Mithra’s 6

February 2024 announcement on its cash position) and a 5%

commitment fee on the committed amounts (including the accordion

when and if it becomes committed). Both fees will be paid in kind

by compounding these amounts with the principal amount of the

Facility. The Facility also provides for an exit fee of 5% (or 10%

in the absence of third party guarantor consent) of any amounts

paid, repaid or cancelled under the Facility and a make-whole fee

equal to the amount necessary to ensure that the total return on

investment of the Lenders (including the funded amounts and

compounded fees and interest, but excluding the commitment fee) is

equal to 20% (or 30% in the absence of third party guarantor

consent ) of the Facility. The exit fee and make-whole fee are

payable in cash upon any repayment, prepayment or cancellation of

the Facility.

The EUR 12.8 million of cash currently held in

escrow as described in the Mithra's 15 February announcement

regarding the sale of its holding in Mayne Pharma is expected to be

used to repay indebtedness owed to the Lenders under the existing

facility.

However, there is a risk that Mithra will not be

able to draw the full amount, for instance if it is not able to

initiate a Monetization Process. Even if a Monetization Process is

initiated, there is a material risk that that process will not be

successful, in whole or in part, or may not be sufficient to repay

Mithra's existing indebtedness. If Mithra is not able to draw funds

under the Facility or is otherwise not able to raise or generate

sufficient cash, this will adversely affect Mithra's continued

operations and ability to operate as a going concern.

For more information, please contact:

|

Mithra Pharmaceuticals SAAlex Sokolowski, PhDHead

of IR & Communicationsinvestorrelations@mithra.com +32 (0)4 349

28 22 |

Frédérique Depraetere Communications Directorinfo@mithra.com+32

(0)4 349 28 22 |

About Mithra Mithra

Pharmaceuticals SA (Euronext: MITRA) is a Belgian biopharmaceutical

company dedicated to transforming women’s health by offering new

choices through innovation, with a particular focus on

contraception and menopause. Mithra’s goal is to develop products

offering better efficacy, safety and convenience, meeting women’s

needs throughout their life span. Mithra explores the potential of

the unique native estrogen estetrol in a wide range of applications

in women health and beyond. After having successfully launched the

first estetrol-based product in 2021, the contraceptive pill

ESTELLE®, Mithra is now focusing on its second product DONESTA®,

the next-generation hormone therapy. Mithra also offers partners a

complete spectrum of solutions from early drug development,

clinical batches and commercial manufacturing of complex polymeric

products (vaginal ring, implants) and complex liquid injectables

and biologicals (vials, pre-filled syringes or cartridges) at its

technological platform Mithra CDMO. Active in more than 100

countries around the world, is headquartered in Liège, Belgium.

www.mithra.com

ESTELLE ®, and DONESTA® are registered

trademarks of Mithra Pharmaceuticals or one of its affiliates.

Important informationThe

contents of this announcement include statements that are, or may

be deemed to be, "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words "believes",

"estimates," "anticipates", "expects", "intends", "may", "will",

"plans", "continue", "ongoing", "potential", "predict", "project",

"target", "seek" or "should", and include statements the Company

makes concerning the intended results of its strategy. By their

nature, forward-looking statements involve risks and uncertainties,

and readers are cautioned that any such forward-looking statements

are not guarantees of future performance. The Company's actual

results may differ materially from those predicted by the

forward-looking statements. The Company undertakes no obligation to

publicly update or revise forward-looking statements, except as may

be required by law.

|

Subscribe to our mailing list on investors.mithra.com to receive

press releases by email or follow us on social media:LinkedIn • X •

Facebook |

- 2024-03-05_Mithra_Press-Release_New Secured Bridge Loan_FR

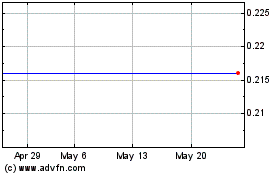

Mithra Pharmaceuticals (EU:MITRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mithra Pharmaceuticals (EU:MITRA)

Historical Stock Chart

From Jan 2024 to Jan 2025