RELX Chairman Steps Down; Looks to Smaller Buyback in 2020

February 13 2020 - 2:26AM

Dow Jones News

By Jaime Llinares Taboada

RELX PLC said Thursday that Chairman Anthony Habgood is stepping

down and that it intends to launch a smaller buyback in 2020 than

in previous years.

The London-based information-and-events group said Mr. Habgood

will retire once a successor is appointed. Adrian Hennah, a

nonexecutive director, has also resigned.

Relx said it is looking to launch a GBP400 million ($519

million) share buyback in 2020, of which GBP100 million has already

been completed. This would be down from GBP600 million in 2019 and

GBP700 million over the previous three years.

The company behind the Lancet medical journal and the London

Book Fair reported a net profit of GBP1.51 billion for the year

ended Dec. 31, 2019, up from GBP1.42 billion a year earlier, but

below the market consensus of GBP1.54 billion, taken from FactSet

and based on nine analysts' forecasts.

Adjusted underlying operating profit--one of the company's

preferred metrics which strips out items related to acquisitions

and disposals--rose 5% to GBP2.49 billion.

Total revenue increased 5% to GBP7.87 billion, reflecting good

growth in electronic and face-to-face sales, and the further

development of the analytics and decision tools, the company said.

Underlying revenue growth was 4%.

The board raised the dividend to 45.7 pence per share, from 42.1

pence a year earlier.

For 2020, Relx said it expects to "deliver another year of

underlying growth in revenue and in adjusted operating profit,

together with growth in adjusted earnings per share on a constant

basis".

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

February 13, 2020 03:11 ET (08:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

RELX (EU:REN)

Historical Stock Chart

From Dec 2024 to Jan 2025

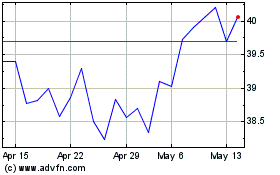

RELX (EU:REN)

Historical Stock Chart

From Jan 2024 to Jan 2025