RELX Skips Buybacks, Focuses on Recovery From Pandemic Hit -- Update

February 11 2021 - 7:28AM

Dow Jones News

--RELX expects largest segments to return to pre-pandemic growth

this year

--Events disruption hurt group's 2020 profit and increased

debt-to-earnings ratio

--CFO Nick Luff said dividend increase signals confidence in

business

By Adria Calatayud

RELX PLC doesn't plan to buy back shares this year, as it

focuses on bringing its underlying revenue growth and its

debt-to-earnings ratio back to pre-coronavirus levels, Chief

Financial Officer Nick Luff said Thursday.

Buybacks had been a feature at the LexisNexis owner since 2012,

but the company suspended its latest share-repurchase program of

400 million pounds ($553.4 million) in April due to the coronavirus

pandemic and doesn't plan to resume it for now.

"We have ruled out buybacks for this year. We will have to make

a judgment a year from now," Mr. Luff told The Wall Street Journal.

A resumption of buybacks will depend on the degree to which

exhibitions activity picks up, the performance of the company's

three largest segments and its expenditure on acquisition, Mr. Luff

said.

With venue closures hurting the company's events segment, the

FTSE 100 information-and-analytics group reported lower net profit

and revenue for 2020, although its performance was broadly in line

with analysts' expectations.

The pandemic dragged down RELX's earnings and pushed up its

ratio of net debt to adjusted earnings before interest, taxes,

depreciation and amortization to 3.3 times last year, calculated in

U.S. dollars. This compares with 2.5 times in 2019.

Mr. Luff said the company wants to bring its leverage ratio back

down this year, and that the lack of buybacks will help it in that

effort. To compensate for the absence of buybacks, RELX's board

raised its full-year dividend to 47 pence a share from 45.7 pence

in 2019.

The increased dividend should be seen as a sign of confidence in

the business, Mr. Luff said.

RELX said it made a net profit for last year of GBP1.22 billion

compared with GBP1.51 billion for 2019.

The company said adjusted operating profit--one of its preferred

earnings metrics, which strips out exceptional and other one-off

items--fell 17% to GBP2.08 billion, but was slightly ahead of

analysts' expectations of GBP2.03 billion.

RELX, which also owns medical journal The Lancet and the London

Book Fair, generated revenue of GBP7.11 billion, down 10% on year.

Analysts had expected revenue of GBP7.19 billion, according to a

consensus based on estimates by 16 analysts polled by FactSet.

On an underlying basis, revenue was down 9%.

RELX said it expects that each of its three largest

segments--scientific, technical and medical, risk-and-business

analytics, and legal--will deliver underlying revenue and adjusted

operating profit growth in 2021 similar to pre-pandemic trends.

Some universities face budgetary pressures which could weigh on

subscription revenue in RELX's scientific, technical and medical

segment, the group's largest, but Mr. Luff said the company is

giving them choices and that these constraints are factored into

guidance of modest underlying revenue growth this year for the

segment.

However, the company warned that the timing and pace of recovery

in its exhibitions segment remains uncertain.

Mr. Luff said the company is running events in Japan and other

Asian countries as well as in online formats, although it is

unclear when it will be able to host exhibitions again in Europe

and North America. Nothing major is planned in Europe and North

America until the end of the third quarter, and that will depend on

restrictions being lifted, he said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

February 11, 2021 08:13 ET (13:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

RELX (EU:REN)

Historical Stock Chart

From Dec 2024 to Jan 2025

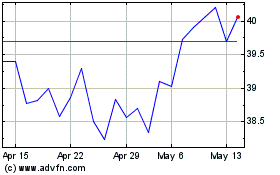

RELX (EU:REN)

Historical Stock Chart

From Jan 2024 to Jan 2025