-

After the decline in H1 revenue related to the

ongoing health crisis, the Group restored growth over the second

half of the year, with revenue over the summer season higher than

the summer 2019 level.

- Strong reservation trends for the first quarter 2021/2022.

Regulatory News:

Pierre & Vacances (Paris:VAC):

1]

Revenue

Under IFRS accounting:

- Q4 2020/2021 revenue totalled €520.2

million (€480.5 million for the tourism activities and €39.7

million for the property development activities). - Full-year

2020/2021 revenue totalled €937.2 million (€773 million for the

tourism activities and €164.2 million for the property development

activities).

The Group nevertheless continues to comment on its revenue and

the associated financial indicators, in compliance with its

operating reporting namely:

- with the presentation of joint undertakings

in proportional consolidation, - excluding the impact of IFRS16

application

Moreover, the operating and legal reorganisation implemented

since 1 February 2021 resulting in the regrouping of each of the

Group’s activities into distinct and autonomous Business Lines, has

led to a change in sectoral information in application of IFRS8.

The main consequence for communication of the Group’s revenue is

the presentation of the contribution from the Adagio operating

entity. The entity includes the contribution from leases taken out

by the PVCP Group and entrusted to the joint-venture Adagio SAS for

management, as well as the share of the contribution from Adagio

SAS held by the Group.

A reconciliation table presenting revenue stemming from

operating reporting and revenue under IFRS accounting is presented

at the end of the press release.

€ millions

2020/2021

2019/2020

Change

vs. 2019/ 2020

2018/2019

according to operating

reporting

according to operating

reporting

according to operating

reporting

Change vs. 2018/ 2019

Tourism

496.8

423.6

+17.3%

486.3

+2.2%

- Center Parcs Europe

305.7

262.7

+16.4%

266.3

+14.8%

- Pierre & Vacances Tourisme

Europe

158.3

139.7

+13.3%

171.6

-7.7%

- Adagio

32.8

21.2

+55.2%

48.4

-32.2%

o/w accommodation revenue

331.5

285.9

+16.0%

328.3

+1.0%

- Center Parcs Europe

212.3

186.0

+14.2%

183.4

+15.8%

- Pierre & Vacances Tourisme

Europe

92.5

82.4

+12.3%

102.7

-9.9%

- Adagio

26.6

17.5

+51.9%

42.3

-37.0%

Property development

54.7

68.5

-20.1%

76.9

-28.8%

Total Q4

551.6

492.1

+12.1%

563.2

-2.1%

Tourism

801.1

1022.7

-21.7%

1365.1

-41.3%

- Center Parcs Europe

489.7

615.4

-20.4%

768.2

-36.3%

- Pierre & Vacances Tourisme

Europe

236.2

304.4

-22.4%

414.9

-43.1%

- Adagio

75.2

102.9

-27.0%

182.0

-58.7%

o/w accommodation revenue

532.8

685.7

-22.3%

923.6

-42.3%

- Center Parcs Europe

338.6

420.0

-19.4%

516.6

-34.5%

- Pierre & Vacances Tourisme

Europe

133.6

179.4

-25.5%

250.2

-46.6%

- Adagio

60.6

86.3

-29.8%

156.8

-61.4%

Property development

252.4

275.0

-8.2%

307.7

-18.0%

Full-year total

1053.5

1297.8

-18.8%

1672.8

-37.0%

Q4 2020/2021:

The recovery in revenue witnessed when the sites reopened during

the third quarter of the year, gained further momentum over the

summer period. The Group posted strong performances in the fourth

quarter with revenue growth in the tourism activities reaching

17.3% relative to the year-earlier period, and +2.2% relative to

summer 2019.

- Revenue at Center Parcs Europe grew by a

robust 16.4% relative to the year-earlier period, and was even

higher than the level seen in Q4 2019 (+14.8%).

This growth was driven by both the Domains

located in BNG1 (revenue up 16% vs. 2020 and +21% vs. 2019),

benefiting especially from the renovated offer, and by the French

Domains (+17% vs. 2020 and +1.1% vs. 2019).

These performances validate the Reinvention

strategy to premiumise and renovate the Domains, for a constantly

improved customer experience.

- Pierre & Vacances Tourisme Europe

posted revenue up 13.3% relative to summer 2020, with a significant

recovery in Spain (+82.4%) and a strong performance in France

(+5.5%, of which +1.1% on accommodation, despite the 12% narrowing

in the offer).

The decline in revenue relative to Q4 2019

(-7.7%) was primarily related to the lack of foreign customers in

Spain (revenue down 25%) and the reduction in the stock of

accommodation operated in France (revenue down 3.4%, of which -6.1%

on accommodation revenue on an 18% decline in the offer).

- The Adagio residences restored growth

(+55.2% vs. 2020), even though business remained below the

pre-crisis level (-32.2% vs. 2019) given the extent to which the

aparthotels are dependent on foreign customers.

Full year 2020/2021:

After a first half affected by the restrictive measures caused

by the health crisis, a gradual recovery in Q3 and strong

performances over the summer, full-year revenue totalled €801.1

million, down 21.7% relative to the previous year, and -41.3%

relative to 2018/2019.

- Revenue from property development

Q4 2020/2021 property development revenue totalled €54.7

million, compared with €68.5 million in the year-earlier period,

stemming primarily from Senioriales residences (€16.5 million), the

Center Parcs Domain Landes de Gascogne (Lot-et-Garonne region)

(€9.1 million) and Center Parcs renovation operations (€17.2

million).

Over the full year, revenue from property development businesses

totalled €252.4 million (compared with €275.0 million over the

year-earlier period), of which €66.6 million from Seniorales

residences, €39.2 million for the development of the Center Parcs

Domain Landes de Gascogne, and €114.2 million from renovations of

Center Parcs Domains.

2] Outlook

The portfolio of tourism reservations booked so far for Q1

2021/2022 is higher than it was over the past two years, for both

Center Parcs Europe and Pierre & Vacances Tourisme Europe.

- Review of negotiations with individual lessors

As announced in the press release of 8 September 2021, the Group

has proposed a new improved amendment to its individual property

lessors, planning for a 100% payment of the contractual rental

amount for the current period starting on 1 July 2021. On 15

October, more than 63% of individual owners had accepted the

Group’s new proposal.

The Group is also studying all options available with a view to

managing the situation of residual rental liabilities for which an

agreement has not been reached with the owners who did not accept

the proposal to date.

- Review of equity strengthening process underway

The equity strengthening process aimed at finding new investors

is continuing as planned. The Group has received several reiterated

indicative offers and has begun a first pre-selection of potential

investor candidates, who are now intensifying their audit works

with a view to making their firm offer.

Due to technical problems beyond its control, on 1 October 2021,

the Group was obliged to pay its ORNANE bond holders an amount

corresponding to interest calculated on a half-yearly basis instead

of a quarterly basis. The surplus paid on 1 October 2021 will be

considered as an early payment and will therefore be deducted from

the amount of interest due to be paid on 1 January 2022.

3] Reconciliation tables – Revenue

€ millions

2020/2021

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2020/2021

IFRS

Tourism

801.1

-28.1

773.0

- Center Parcs Europe

489.7

-10.9

478.8

- Pierre & Vacances Tourisme

Europe

- Adagio

236.2

75.2

0.5

-17.7

236.7

57.5

Property development

252.4

-10.8

-77.3

164.2

Total FY 2021

1053.5

-39.0

-77.3

937.2

€ millions

2019/2020

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2019/2020

IFRS

Tourism

1022.7

-40.3

982.4

- Center Parcs Europe

615.4

-19.2

596.2

- Pierre & Vacances Tourisme

Europe

- Adagio

304.4

102.9

0.0

-21.1

304.4

81.8

Property development

275.0

-18.9

-67.0

189.1

Total FY 2020

1 297.8

-59.2

-67.0

1171.5

IFRS11 adjustments: for

its operating reporting, the Group continues to integrate joint

operations under the proportional integration method, considering

that this presentation is a better reflection of its performance.

In contrast, joint ventures are consolidated under equity

associates in the consolidated IFRS accounts.

Impact of IFRS16: The

application of IFRS16 as of 1 October 2019 leads to the

cancellation, in the financial statements, of a share of revenue

and the capital gain for disposals undertaken under the framework

of property operations with third-parties (given the Group’s

right-of-use rights). See below for the impact on FY

revenue.

Given that the Group’s business model is based on two distinct

businesses, as monitored and presented in its operating reporting,

adjustment for this would not measure and reflect the underlying

performance of the Group’s property business, and for this reason

in its financial communication, the Group continues to present

property development operations as they are recorded from its

operating monitoring.

1Belgium, the Netherlands, Germany

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211019005896/en/

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

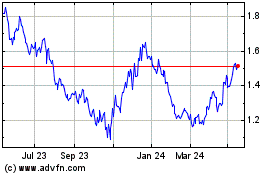

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

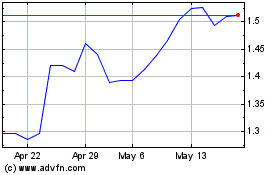

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Jan 2024 to Jan 2025