VGP Trading Update: Solid Growth, Record Deliveries and Occupancy Rate Boost Recurring Rental Income

November 03 2022 - 1:00AM

VGP Trading Update: Solid Growth, Record Deliveries and Occupancy

Rate Boost Recurring Rental Income

3 November

2022, 7:00 am,

Antwerp, Belgium: VGP NV

(‘VGP’ or ‘the Group’) today published its trading update for the

first ten months of 2022, in which, against a background of

volatile macro-economic and geopolitical uncertainties VGP recorded

a robust operating performance:

- €53.1

million of new and renewed

leases signed year-to-date (of which €21.3 million during

the past 4 months) bringing the annualised committed

leases for the year to date to

€291.0 million1

(+ €34.9 million compared to 31 December 2021) (+13.6% YTD and

+21.0% y-o-y)

-

Property portfolio2 virtually fully let with occupancy at

99.6% as of 31 October 2022 (compared to 99.4 % as at 31

December 2021)

-

Based on the current inflation, we expect our already income

generating rent roll to grow by 7%

(€17

million²) through indexation

alone in 2023

-

37 projects under construction representing

1,253,000 m² (of which 16 projects totalling 346,000 m² started up

during the year) and €82.8

million in additional annual rent once fully built

and let. These buildings under construction are 93.7%

pre-let

-

28 projects delivered during the year representing

576,000 m², or € 31 million in additional annual rent (of which 11

projects totalling 240,000 m² delivered during the 2H 2022) and a

further 460,000 m² estimated for delivery in the remainder of

2022

-

Photovoltaic capacity

grew exponentially y-o-y to

120.9MWp operational or under construction and with a further

67.9MWp being planned. Once built, the significant photovoltaic

roll-out – which is already generating €3.7 million revenues YTD –

will match our 2021 tenant electricity consumption. This

contributed to the three star GRESB

developer rating and elevated the

portfolio compliance on the

Paris-aligned

1.5-degree

decarbonisation

pathway until the

year 2045 which moves us significantly

closer to a 1.5-degree ready portfolio under CRREM

-

Continuing strong relationship with Allianz Real Estate evidenced

by:

(i) Second

closing of VGP Park München joint venture

with Allianz Real Estate on track for December 2022 with

proceeds of circa

€70 million to be

expected;

(ii)

Including the upcoming closing for VGP Park München

the total JV closing in 2022 will amount to an annual

record of more than

€800

million;

(iii)

Additional closing expected in Q1 2023 with the First

Joint Venture for a total GAV of more than € 100 million. The

transaction is currently under due diligence;

(iv) Profit

distribution from the joint

ventures gaining momentum with profit distribution year to

date totalling €28.2 million with a further

ca.

€30 million

profit distribution to be received during November 2022

-

1,925,000 m² of new development land acquired

during the year (of which 378,000 m² during 2H 2022) and

696,000 m² of development land deployed during the year to support

the new developments started up during the year. Total secured

development land bank stand at 10,683,000 m² at the end of October

2022 representing a development potential of circa 5 million

m²

VGP’s Chief Executive Officer, Jan Van

Geet: “VGP is having a very solid year in terms of growth

and cash generation and an absolute record year in terms of

completions of long-let projects to our clients: now these rents

turn effective this generates a significant boost in our recurring

revenue.”

Jan Van Geet added: “These record deliveries

have made evident once again that VGP's DNA is of course closely

linked to the constant development of new projects. As we look

forward, we see a significant need for high quality new

developments, driven by many factors, as the world of tomorrow is

one of sustainability and efficiency driven by smart technologies

and artificial intelligence. I believe that we have only seen a

fraction of the efficiency potential yet, more innovations to

optimise energy and operational efficiency are inevitably going to

transform our industry in the years ahead of us. I do believe that

our team is well set-up to deliver those highly complex,

tailor-made, and sustainable solutions to the highest quality

matching future customer needs, and above all that it is set-up to

do that in all the countries we are active in in a consistent way.

This is critical as our long-term development activities will

always be driven by our ability to meet such client demand and our

profitability looking forward.”

Jan Van Geet concluded: “It is equally important

to point out to the fact that, as an economy does not develop in a

linear way we have, besides the developer gains, always built

different sources of recurring income – besides rental income and

income from our renewable energy sources also facility and property

management fees and asset management fees. These recurrent income

streams, boosted by the record delivery of buildings over the past

years are now becoming a substantial part of our income and give us

ample room to pay out dividends in the future and strengthen

substantially VGP’s balance sheet on a standalone basis. Indeed, we

have always deliberately chosen to keep recurring income from our

assets partly on our balance sheet ourselves, partly through JVs we

manage. Furthermore as a result, combined with the existing cash on

balance sheet, undrawn RCFs and planned Munich joint venture

closing we have enough means available to cover our commitments

well beyond 2023.”OPERATING HIGHLIGHTS –

10M 2022

Lease activities and

resilience

- Signed and

renewed rental income of €53.1 million driven by 721,000 m2 of new

lease agreements signed (corresponding to €40.3 million of new

annualised rental income3), combined with 241,000 m2 of lease

agreements renewed (corresponding to €12.7 million of annualised

rental income4) and €3.7 million of indexation.

- Of the signed

rent agreements in 2022 over half the committed rent comes from

Logistics (53%) (of which 40% is general logistics, 13% is non-food

retail logistics and 1% is food-retail logistics), followed by

E-commerce (21%) and Light industrial (15%) (of which 4% is

automotive related industry) and 10% is defined in another

category.

- Germany was the

main driver of the growth in committed leases with €17.4 million

(40%) of new leases5 signed during the year (of which € 5.8 million

on behalf of the Joint Ventures6). The other countries also

performed very well: new leases being signed in Romania +€ 4.3

million (10%) (€0.3 million on behalf of JV portfolio), Spain +€4.0

million (9%) (€2.6 million on behalf of JV portfolio), Netherlands

+€3.9 million (9%) (€3.4 million on behalf of the JV portfolio),

Slovakia +€3.6 million (9 %) (€0.9 million on behalf of JV

portfolio), Czech Republic +€ 3.4 million (8%) (€2.5 million on

behalf of JV portfolio), Hungary +€2.8 million (6%) (€0.1 million

on behalf of JV portfolio), Austria +€2.4 million (5%) (€0.1

million on behalf of JV portfolio), Latvia +€0.7 million (2%) (own

portfolio), Italy +€1.0 million (2%) (€0.4 million on behalf of JV

portfolio) and Portugal +€0.6 million (1%) (own portfolio).

- Terminations

represented a total of €9.1 million or 170,000 m2 (of which 118,000

m2 within the Joint Ventures’ portfolio). VGP has been able to

release premisses so far at overall higher rental prices. As an

example, in Germany, VGP’s largest market, VGP was able to increase

as such its average rental price per square meter by 15%.

- The total signed

lease agreements increased to €291.0 million annualised committed

rental income (equivalent to circa 5.0 million m2 of lettable area)

from €256.1 million as of 31 December 2021. A 13.6% increase

year-to-date.

- The signed

committed lease agreements of the own portfolio represent a total

of 2,038,000 m² of lettable area (€116.5 million of annualised

committed leases) with the weighted average term of the annualised

committed leases standing at 9.8 years7 as at the end of October

2022.

- The signed

committed lease agreements of the Joint Ventures’ portfolio

represent a total of 2,971,000 m² of lettable area (€174.5 million

of annualised committed leases) with the weighted average term of

the annualised committed leases standing at 7.3 years8 as at the

end of October 2022.

- The weighted

average term of the annualised leases of the combined own and Joint

Ventures’ portfolio stood at 8.3 years9 at the end of October 2022

compared to 8.6 years at the end of December 2021.

- The Annualised

Committed Leases are composed of €207.7 million lease agreements

which have already become effective as of 31 October 2022 and €83.3

million signed lease agreements which will become effective in the

future. The breakdown as to when the Annualised Committed Leases

will become effective is as follows:

| In

Million EUR |

Current |

<1 year |

1-2 years |

2-3 years |

>3 years |

Total |

| Own |

64.1 |

44.2 |

5.7 |

0.6 |

1.9 |

116.5 |

| Joint Ventures at

100% |

143.6 |

30.9 |

0.0 |

0.0 |

0.0 |

174.5 |

|

Total |

207.7 |

75.1 |

5.7 |

0.6 |

1.9 |

291.0 |

- Virtually all

lease agreements include indexation clauses, of which the majority

are uncapped, making the property portfolio well protected against

inflation. Most of the existing leases are indexed in the first

months of the year with the year-to-date indexation totalling €3.7

million of rent equivalent. It is expected that this amount will

rapidly ramp up when the current high inflation levels will be

charged through to tenants during the first half of 2023.

- Based on the

lease agreements becoming effective in 2023, for every 5% of

inflation 4% will be passed on as indexation through increase of

rent. Assuming a 10% inflation rate, rent would be increased by 7%

during the same year (8% rent increase in respect of the own

portfolio and 7% in respect of the Joint Ventures’ portfolio).

Development activities

- During the

second half of 2022, VGP completed another 11 buildings

representing 240,000 m² of lettable area, i.e.: in the Czech

Republic: one building of 29,500 m² in VGP Park Hradek nad

Nisou, one building of 15,800 m² in VGP Park Kladno, and one

building of 5,500 m² in VGP Park Chomutov; in Germany: one building

of 67,200 m² in VGP Park Laatzen and one building of 20,400 m² in

VGP Park Rostock; in Spain: one building of 29,600 m² in VGP Park

Sevilla Dos Hermanas and two buildings totalling 34,800 m² in VGP

Park Zaragoza; in the other countries, one building of 10,700 m² in

VGP Park Budapest Aerozone (Hungary), one building of 18,300 m² in

VGP Park Bratislava (Slovakia), and finally one building of 8,200

m² in VGP Park Graz 2 (Austria).

- This brings the

total of delivered projects for the first ten months of 2022 to 28

projects, adding 576,000 m2 of lettable area representing €31.6

million of annualized leases and which are 99.3% let.

- 16 new projects

have started up in the course of 2022 which represent 316,000 m2 of

future lettable area representing €23.3 million of annualised

leases once fully built and let.

- A total of 39

projects under construction at the end of October 2022 which will

add 1,253,000 m2 of future lettable area representing €82.8 million

of annualised leases once fully built and let (93.7% pre-let).

- Geographical

split of parks under construction, based on square meters: 57% are

located in Germany (17% attributable to VGP Park München and 40% to

other projects in Germany), 11% in Romania, 8% in Hungary, 6% in

the Netherlands, 6% in Latvia, 5% in the Czech Republic, 2% in

Spain, 2% in Slovakia, 2% in Portugal and 1% in Austria.

- VGP continues

to focus on maintaining its development margins by reviewing any

new and existing developments against their respective² targeted

yield on costs10. Reflective of current market dynamics, the

targeted average yield on costs are well above 7% for Western

Europe, above 7.5% for Southern Europe and above 8% for Central and

East Europe11.

Land bank

- During the

second half of 2022, VGP expanded its land bank further and as at

31 October 2022, the Group (including the Joint Ventures at 100%)

has a remaining development land bank in full ownership of

8,164,000 m² (of which 1,307,000 m² held by the Joint

Ventures) which allows the Group to develop ca. 3,680,000 m²

of future lettable area (of which 622,000 m² on behalf of the Joint

Ventures). In addition, the Group has another 2,519,000 m² of

secured land plots which are expected to be purchased during the

next 6 to 18 months, subject to obtaining the necessary

permits.

- This brings the

remaining total owned and committed land bank for development as at

31 October 2022 to 10,683,000 m², which represents a remaining

development potential of ca. 4,812,000 m² of which

706,000 m² (15%) in Germany, 733,000 m² (15%) in Romania,

639,000 m² (13%) in the Netherlands, 464,000 m² (10%) in

the Slovak Republic, 487,000 m² (10%) in Serbia, 422,000 m²

(9%) in Spain, 323,000 m² (6%) in Hungary, 316,000 m²

(7%) in Italy, 263,000 m² (5%) in the Czech Republic,

138,000 m² (3%) in Austria, 149,000 m² (3%) in France,

120,000 m² (2%) in Portugal, 38,000 m² (1%) in Croatia and the

remaining balance of 14,000 m² in Latvia.

- From an asset

value perspective, the land bank is predominantly Western

European-based but on the bases of square meters the land bank is

well spread across the countries in which we operate.

- Due to the

overall market circumstances, we do anticipate more, predominantly

brownfield, opportunities to become available in the coming 12

months – we remain vigilant and are prepared for such opportunities

to be seized at the right time.

ESG initiatives and

sustainable energy

- 89 roof-solar

installations with a total capacity of 120.9 MWp – of which own

operational photovoltaic capacity doubled y-o-y to 40.4MWp, 15.1MWp

third-party operated and 65.4MWp of own installations are currently

under construction. This is being realised through a € 40.7 million

investment to date (and a further €28.8 million committed). In

addition, the identified pipeline equates to an additional power

generation capacity of 67.9 MWp.

- The potential

current annual energy production, including PV projects under

construction and in the pipeline is estimated at 168,318 MWh per

year, which is equal to the total electricity consumption of all

our tenants in VGP buildings in 2021.

- The GRESB score

for the Group has made significant progress in 2022; the

development portfolio received one additional star to three green

stars.

- VGP performed

its second CRREM study (Carbon Risk Real Estate Monitor) in 2022.

The analysis was done on the entire portfolio (based on GRESB

submission; as of December 2021; including JVs at 100%). The

results are encouraging as the portfolio remains compliant on a

1.5°C decarbonization pathway until 2037 which is a 10-year

improvement versus last year’s results. Taking also into account

the expected annual energy production of current photovoltaic

systems in the pipeline the portfolio compliance will be extended

until 2045 and over 40% still compliant in 2050.

- The first

certificate for EU Taxonomy compliance was received for a standing

asset and going forward VGP aims for all new developments to

achieve an EPC A energy label, EU taxonomy compliance, a BREEAM

Excellent or DGNB Gold certificate and will no longer use gas

heating where this is feasible.

- The Group’s

earlier announced carbon reduction roadmap targets across scope 1-3

are set taking the science-based target constraints into account

(see Corporate Responsibility Report 2021 for further details), the

Group has now engaged on a formal SBTi validation path, feedback is

anticipated in 2023.

Allianz Real Estate and developments

with regards to Joint

Ventures

- Second closing

of VGP Park München joint venture with Allianz Real Estate on track

for December 2022 with proceeds of ca. €70 million to be excepted.

Additional equity recycling expected during the first half of 2023

through the partial refinancing by already secured bank debt.

- Including the

upcoming closing for VGP Park München, VGP and Allianz Real Estate

will have completed 4 Joint Venture closings in 2022 resulting in a

transfer of a record more than €800 million in gross asset

value.

- Next closing

expected in Q1 2023 with the First Joint Venture for a total gross

asset value of more than €100 million. The transaction is currently

under due diligence.

- Profit

distribution from joint ventures is gaining momentum with profit

distribution year to date totalling €28.2 million with a further

ca. €30 million profit distribution to be received during November

2022.

Outlook

- Notwithstanding

assets being transferred to the joint ventures, the recurring cash

generating part of VGP’s business is continuing to grow to a

considerable size with total contracted annual rental and fee

income on a proportional look-through basis due to rise

substantially during the next 12 months. Thus will significantly

increase the recurring cash generation of the Group.

- At the moment of

publication of the FY2022 financial results, scheduled for release

on 23 February 2023, VGP will further communicate on the dividend

proposal. The expected dividend distribution will be reviewed in

the light of the current dividend policy and taking the longer-term

target of dividend coverage (by recurring net rental and fee income

and dividend distributions received from the joint ventures minus

recurring expenses) into consideration.

- Due to the overall market

circumstances VGP anticipates more, predominantly brownfield,

opportunities to become available during the next 12 months. VGP

remains vigilant and is prepared for such opportunities to be

seized at the right time and price.

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433investor.relations@vgpparks.eu |

|

Karen Huybrechts(Head of Marketing) |

Tel: +32 (0)3 289 1432 |

Forward-looking statements:

This press release may contain forward-looking statements. Such

statements reflect the current views of management regarding future

events, and involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release considering new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any liability for

statements made or published by third parties and does not

undertake any obligation to correct inaccurate data, information,

conclusions or opinions published by third parties in relation to

this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European developer, manager and

owner of high-quality logistics and semi-industrial real estate.

VGP operates a fully integrated business model with capabilities

and longstanding expertise across the value chain. Founded in 1998

as a Belgian family-owned real estate developer in the Czech

Republic, VGP with a staff of circa 380 FTEs today and operates in

19 European countries directly and through several 50:50 joint

ventures. As of June 2022, the Gross Asset Value of VGP, including

the joint ventures at 100%, amounted to € 6.53 billion and the

company had a Net Asset Value (EPRA NTA) of € 2.34 billion. VGP is

listed on Euronext Brussels. (ISIN: BE0003878957).

For more information, please visit:

http://www.vgpparks.eu

1 Including

Joint Ventures at 100%. As at 31 October 2022 the annualised

committed leases of the Joint Ventures stood at €174.5 million

(€151.1 million as at 31 December 2021).2

Including Joint

Ventures at 100%.3

Of which 493,000 m²

(€27.8 million) related to the own portfolio.4

Of which 200,000 m²

(€10.5 million) related to the Joint Ventures’ portfolio.5

Including rent

indexation effects.

6 Joint

Ventures means either and each of (i) the First Joint Venture i.e.

VGP European Logistics S.à.r.l., the 50:50 joint venture between

VGP and Allianz and (ii) the Second Joint Venture i.e. VGP European

Logistics 2 S.à.r.l., the 50:50 joint venture between VGP and

Allianz, and (iii) the Third Joint Venture i.e. VGP Park München

GmbH, the 50:50 joint venture between VGP and

Allianz, and (iv) the Fourth Joint Venture i.e. VGP European

Logistics 3 S.à.r.l., the 50:50 joint venture between VGP and

Allianz and (v) LPM Joint Venture, i.e. LPM Holding B.V., the 50:50

joint venture between VGP and Roozen Landgoederen Beheer.7

The weighted

average term of the committed leases up to the first break stands

at 9.5 years as at 31 October 2022.8

The weighted

average term of the committed leases up to the first break stands

at 6.9 years as at 31 October 2022.9

The weighted

average term of the committed leases up to the first break stands

at 8.0 years as at 31 October 2022.

10 Yields on cost are calculated as

annualised rent divided by total project cost (including land

acquisition costs and project development costs). 11

Western Europe includes Netherlands, Germany, France.

Southern Europe includes Portugal, Spain, Italy Central Europe

includes Czech Republic, Austria, Hungary. East Europe include

Serbia, Romania, Latvia

- 2022.11.03_VGP - Trading update November 2022 (EN)

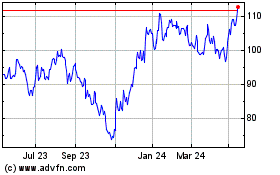

VGP NV (EU:VGP)

Historical Stock Chart

From Dec 2024 to Jan 2025

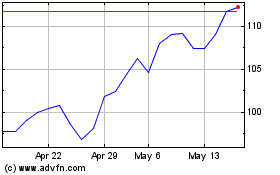

VGP NV (EU:VGP)

Historical Stock Chart

From Jan 2024 to Jan 2025