false

0001635077

0001635077

2024-02-27

2024-02-27

0001635077

ACON:CommonStockParValue0.00001PerShareMember

2024-02-27

2024-02-27

0001635077

ACON:WarrantsEachExercisableForOneShareOfCommonStockMember

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 27,

2024

Aclarion,

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-41358 |

47-3324725 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 8181 Arista Place, Suite 100 |

|

| Broomfield, Colorado |

80021 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (833) 275-2266

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

Trading |

|

| Title of each class |

Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

ACON |

Nasdaq Stock Market |

| Common

Stock Warrants |

ACONW |

Nasdaq Stock Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

Public Offering; Placement Agent Agreement; Warrants; Prefunded

Warrants

On February 26, 2024, Aclarion, Inc. (“Aclarion” or the

“Company”) entered into a placement agency agreement (the “Placement Agent Agreement”) with Maxim Group LLC (“Maxim”

or the “Placement Agent”) pursuant to which the Company engaged Maxim as the placement agent for a registered public offering

by the Company (the “Offering”), of an aggregate of 5,175,000 units (“Units”) at a price of $0.58 per Unit, for

gross proceeds of approximately $3.0 million, before deducting offering expenses.

Each Unit is comprised of (i) one share of common stock or, in lieu

of common stock or one prefunded warrant to purchase a share of common stock, and (ii) two common warrants, each common warrant to purchase

a share of common stock. The prefunded warrants are immediately exercisable at a price of $0.00001 per share of common stock and only

expire when such prefunded warrants are fully exercised. The common warrants are immediately exercisable at a price of $0.58 per share

of common stock and will expire five years from the date of issuance.

The Placement Agent agreed to use its reasonable best efforts to arrange

for the sale of the Units. The Company agreed to pay the Placement Agent a placement agent fee in cash equal to 7.00% of the gross proceeds

from the sale of the Units. The Company also agreed to reimburse the Placement Agent for all reasonable travel and other out-of-pocket

expenses, including the reasonable fees of legal counsel, not to exceed $100,000. The Placement Agent Agreement also contains representations,

warranties, indemnification and other provisions customary for transactions of this nature. The representations, warranties and covenants

contained in the Placement Agent Agreement were made only for purposes of such agreement and as of a specific date, were solely for the

benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

The Company intends to use the proceeds from the Offering, together

with our existing cash, to repay outstanding debt, build out product platforms, expand our sales and marketing efforts, and for general

and administration expenses and other general corporate purposes.

The Offering closed on February 27, 2024.

Securities Purchase Agreement

On February 26, 2024, the Company entered into a Securities Purchase

Agreement (the “Purchase Agreement”) with certain investors named therein (the “Investors”), pursuant to which

the Company agreed to issue and sell Units to such Investors.

The Purchase Agreement contains customary representations and warranties

and agreements of the Company and the Investors and customary indemnification rights and obligations of the parties. The representations,

warranties and covenants contained in the Purchase Agreement were made only for purposes of such agreement and as of a specific date,

were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

Warrant Agency Agreement

In connection with the Offering, on February 27, 2024, the Company

also entered into a Warrant Agency Agreement (the “Warrant Agency Agreement”) with Vstock Transfer LLC, pursuant to which

Vstock agreed to act as transfer agent with respect to the common warrants and the prefunded warrants.

*******

The foregoing summaries of the Purchase Agreement, the common warrants,

the prefunded warrants, the Placement Agent Agreement, and the Warrant Agency Agreement do not purport to be complete and are subject

to, and qualified in their entirety by, such documents attached as exhibits to this Current Report on Form 8-K, which are incorporated

herein by reference.

This Current Report on Form 8-K does not constitute an offer to sell

any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such state or jurisdiction.

Item 8.01 Other Events

As previously disclosed, the Company received

written notice from Nasdaq that the Company was not in compliance with Nasdaq Listing Rule 5550(b)(1) (the “Rule”), which

requires the Company to maintain a minimum of $2.5 million in stockholders’ equity for continued listing on The Nasdaq Capital Market.

Subsequent to a hearing before a Nasdaq Hearings Panel, the Company was granted an extension, ultimately, through February 27, 2024, to

evidence compliance with the Rule.

As a result of the Offering described above, the

Company believes it has stockholders’ equity of at least $2.5 million as of the date of this filing. The Company awaits Nasdaq’s

formal determination that it has evidenced compliance with the Rule and the terms of the Panel’s decision such that the listing

matter may be closed.

Forward-Looking Statements

This current report on Form 8-K contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). Such forward-looking statements

include but are not limited to statements about the use of proceeds of the Offering and other statements that are not historical facts.

These forward-looking statements are subject to risks and uncertainties that may cause actual results or events to differ materially from

those projected, including but not limited to the risks that the Company does not utilize the proceeds from the Offering as outlined herein.

Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are

made and reflect management’s current estimates, projections, expectations and beliefs. The Company undertakes no obligation to

publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACLARION, INC. |

| |

|

|

| February 27, 2024 |

By: |

/s/ John Lorbiecki |

| |

Name: |

John Lorbiecki |

| |

Title: |

Chief Financial Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACON_CommonStockParValue0.00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACON_WarrantsEachExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

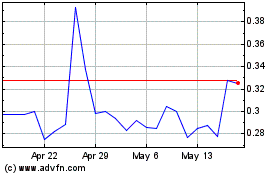

Aclarion (NASDAQ:ACON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aclarion (NASDAQ:ACON)

Historical Stock Chart

From Apr 2023 to Apr 2024