false

--12-31

0001726711

0001726711

2025-03-07

2025-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 7, 2025

Aditxt, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 2569 Wyandotte Street, Suite 101, Mountain View, CA |

|

94043 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 870-1200

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425 ) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

ADTX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of

Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously reported

in a Current Report on Form 8-K filed by Aditxt, Inc. (the “Company”), on October 3, 2024, the Company was

notified (the “October Notification Letter”) by the staff (the “Staff”) of The Nasdaq Stock Market,

LLC (“Nasdaq”) that it was not in compliance with the minimum bid price requirements set forth in Nasdaq Listing

Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market as the bid price of its securities had closed at less than

$1.00 per share over the previous 30 consecutive business days. Therefore, in accordance with Nasdaq Listing Rule 5810(c)(3)(A), the company

was provided 180 calendar days, or util April 1, 2025, to regain compliance with the rule.

On March 7, 2025, the

Company was notified by the Listing Qualifications Staff (the “Staff”) of Nasdaq that it has determined that as of March 6,

2025, the Company’s securities had a closing bid price of $0.10 or less for ten consecutive trading days. As a result, the Company

is subject to the provisions contemplated under Listing Rule 5810(c)(3)A)(iii) and the Staff has determined to delist the Company’s

securities from The Nasdaq Capital Market.

The Company intends to

submit an appeal to Nasdaq on March 14, 2025, which will stay the delisting and suspension of the Company’s securities pending the

decision of the Nasdaq Hearings Panel (the “Panel”). Hearings are typically scheduled to occur approximately 30-45

days after the date of the hearing request. At the hearing, the Company intends to present its views and its plans to regain compliance

with the minimum bid price rules to the Panel. There can be no assurance that the Company will be able to evidence compliance with the

minimum bid price rules or any other applicable requirements for continued listing on The Nasdaq Capital Market prior to the hearing.

It is the Company’s understanding that the Panel typically issues its decision within 30 days after the hearing.

Item 3.03 Material Modification to Rights of

Security Holders.

To the extent required by Item 3.03 of Form 8-K,

the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year

As previously reported in a Current Report on

Form 8-K filed by the Company on March 3, 2025, the Company held a special meeting of stockholders (the “Special Meeting”).

At the Special Meeting, the stockholders approved a proposal to amend the Company’s certificate of incorporation to effect a reverse

split of the Company’s outstanding shares of common stock, par value $0.001 at a specific ratio within a range of one-for five (1:for:5)

to a maximum of one-for-two hundred fifty (1:for:250), with the exact ratio to be determined by the Company’s board of directors

in its sole discretion.

Following the Special Meeting, the board of directors

approved a one-for-two hundred fifty (1-for-250) reverse split of the Company’s issued and outstanding shares of common stock (the

“March Reverse Stock Split”). On March 12, 2025, the Company filed with the Secretary of State of the State of Delaware

a certificate of amendment to its certificate of incorporation (the “Certificate of Amendment”) to effect the March

Reverse Stock Split. The March Reverse Stock Split will become effective as of 4:01 p.m. Eastern Time on March 14, 2025, and the Company’s

common stock will begin trading on a split-adjusted basis when the Nasdaq Stock Market opens on March 17, 2025. The March Reverse Stock

Split is primarily intended to bring the Company into compliance with Nasdaq’s minimum bid

price requirement.

When the March Reverse Stock Split becomes effective,

every 250 shares of the Company’s issued and outstanding common stock will be automatically combined, converted and changed into

1 share the Company’s common stock, without any change in the number of authorized shares or the par value per share. In addition,

a proportionate adjustment will be made to the per share exercise price and the number of shares issuable upon the exercise of all outstanding

stock options, restricted stock units and warrants to purchase shares of common stock and the number of shares reserved for issuance pursuant

to the Company’s equity incentive compensation plans. Any fraction of a share of common stock created as a result of the March Reverse

Stock Split will be rounded up to the next whole share. Holders of the Company’s common stock held in book-entry form or through a bank,

broker or other nominee do not need to take any action in connection with the March Reverse Stock Split. Stockholders of record will be

receiving information from the Company’s transfer agent regarding their common stock ownership post-March Reverse Stock Split.

The Company’s common stock will continue

to trade on the Nasdaq Stock Market LLC under the existing symbol “ADTX”, but the security has been assigned a new CUSIP number

(007025802).

The foregoing description of the Certificate of

Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment,

which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 7.01 Regulation

FD Disclosure

On March 12, 2025, the

Company issued a press release announcing the March Reverse Stock Split. A copy of the press release

is furnished to this Current Report on Form 8-K as Exhibit 99.1.

The information in this

Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K is furnished and shall not be deemed to be “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section. The information in this Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K shall not be incorporated by reference

into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current

Report, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 12, 2025

| |

Aditxt, Inc. |

| |

|

|

| |

By: |

/s/ Amro Albanna |

| |

Name: |

Amro Albanna |

| |

Title: |

Chief Executive Officer |

-3-

Exhibit 3.1

CERTIFICATE OF AMENDMENT

to the

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

of

ADITXT, INC.

ADITXT, INC., a corporation

organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify

as follows:

FIRST: The name of the Corporation

is Aditxt, Inc. The Certificate of Incorporation was filed with the Secretary of State of the State of Delaware (the “Secretary

of State”) on September 28, 2017, as amended ( the “Certificate of Incorporation”).

SECOND: ARTICLE IV, SECTION

I of the Corporation’s Certificate of Incorporation shall be amended by inserting Subsection “(e)” at the end of such

section which shall read as follows:

e. Reverse Stock Split.

As of March 14, 2025 at 4:01 p.m. Eastern Time (the “Effective Time”) of this Certificate of Amendment pursuant to the Section

242 of the General Corporation Law of the State of Delaware, each two hundred fifty (250) shares of the Corporation’s Common Stock,

issued and outstanding immediately prior to the Effective Time (the “Old Common Stock”) shall automatically without further

action on the part of the Corporation or any holder of Old Common Stock, be reclassified, combined, converted and changed into one (1)

fully paid and nonassessable shares of common stock, par value of $0.001 per share (the “New Common Stock”), subject

to the treatment of fractional share interests as described below (the “Reverse Stock Split”). The conversion of the Old Common

Stock into New Common Stock will be deemed to occur at the Effective Time. From and after the Effective Time, certificates representing

the Old Common Stock shall represent the number of shares of New Common Stock into which such Old Common Stock shall have been converted

pursuant to this Certificate of Amendment. Holders who otherwise would be entitled to receive fractional share interests of New Common

Stock upon the effectiveness of the reverse stock split shall be entitled to receive a whole share of New Common Stock in lieu of any

fractional share created as a result of such Reverse Stock Split.

THIRD: The stockholders of

the Corporation have duly approved the foregoing amendment in accordance with the provisions of Section 242 of the General Corporation

Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be duly adopted and executed in its corporate name and on its behalf by its duly authorized

officer as of the 12th day of March, 2025.

| ADITXT, INC. |

|

| |

|

|

| By: |

/s/ Amro Albanna |

|

| Name: |

Amro Albanna |

|

| Title: |

Chief Executive Officer |

|

Exhibit 99.1

Aditxt, Inc. (NASDAQ:

ADTX) Announces 1-for-250 Reverse Stock Split Effective at the Open of Trading on March 17, 2025

Mountain View, Ca. (March 12, 2025) –Aditxt,

Inc. (NASDAQ: ADTX) (“Aditxt” or the “Company”), an innovation platform

dedicated to discovering, developing, and deploying promising health innovations, announced today that it will effect a 1-for-250

reverse split of its common stock. Commencing with the opening of trading on the Nasdaq Capital Market on March 17, 2025, the Company’s

common stock will trade on a post-split basis under the same symbol ADTX. The reverse stock split was approved by the Company’s

stockholders at the special meeting held on February 28, 2025, with the final ratio determined by the Company’s board of directors.

As a result

of the reverse stock split, the CUSIP number for the Company’s common stock will now be 007025802. As a result of the reverse stock

split, every 250 shares of issued and outstanding common stock will be exchanged for 1 share of common stock, with any fractional shares

being rounded up to the next higher whole share. Immediately after the reverse stock split becomes effective, the Company will have approximately

1,031,102 shares of common stock issued and outstanding.

The

reverse stock split is primarily intended to bring the Company into compliance with Nasdaq’s minimum bid price requirement.

Additional

information concerning the reverse stock split can be found in Aditxt’s definitive proxy statement filed with the Securities

and Exchange Commission on January 27, 2025.

About Aditxt

Aditxt, Inc.® is a social innovation platform

dedicated to accelerating promising health innovations. Aditxt’s ecosystem of research institutions, industry partners, and shareholders

collaboratively drives their mission to “Make Promising Innovations Possible Together.” The innovation platform is the cornerstone

of Aditxt’s strategy, where multiple disciplines drive disruptive growth and address significant societal challenges. Aditxt operates

a unique model that democratizes innovation, ensures every stakeholder’s voice is heard and valued, and empowers collective progress.

Aditxt currently operates two programs focused

on immune health and precision health. The Company plans to introduce two additional programs dedicated to public health and women’s

health. For these, Aditxt has entered into an Arrangement Agreement with Appili Therapeutics, Inc. (“Appili”) (TSX: APLI; OTCPink:

APLIF), which focuses on infectious diseases, and a Merger Agreement with Evofem Biosciences, Inc. (“Evofem”) (OTCQB: EVFM).

Each program will be designed to function autonomously while collectively advancing Aditxt’s mission of discovering, developing,

and deploying innovative health solutions to tackle some of the most urgent health challenges. The closing of each of the transactions

with Appili and Evofem is subject to several conditions, including but not limited to approval of the transactions by the respective target

shareholders and Aditxt raising sufficient capital to fund its obligations at closing. These obligations include cash payments of approximately

$17 million for Appili and $17 million for Evofem, which includes approximately $15.2 million required to satisfy Evofem’s senior secured

noteholder; should Aditxt fail to secure these funds, Evofem’s senior secured noteholder is expected to seek to prevent the closing of

the merger with Evofem. On December 23, 2024, Evofem announced the cancellation of its special stockholders meeting and the withdrawal

of the merger proposal with Aditxt from consideration by the stockholders. No assurance can be provided that all of the conditions to

closing will be obtained or satisfied or that either of the transactions will ultimately close.

For more information, www.aditxt.com.

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of federal securities laws. Forward-looking statements include statements regarding

the Company’s intentions, beliefs, projections, outlook, analyses, or current expectations concerning, among other things, the Company’s

ongoing and planned product and business development; the Company’s ability to finance and execute its strategic M&A initiatives;

the Company’s ability to obtain the necessary funding and partner to commence clinical trials; the Company’s intellectual

property position; the Company’s ability to develop commercial functions; expectations regarding product launch and revenue; the

Company’s results of operations, cash needs, spending, financial condition, liquidity, prospects, growth, and strategies; the Company’s

ability to raise additional capital; expected usage of the Company’s ELOC and ATM facilities; the industry in which the Company

operates; and the trends that may affect the industry or the Company. Forward-looking statements are not guarantees of future performance,

and actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors,

as well as market and other conditions and those risks more fully discussed in the section titled “Risk Factors” in Aditxt’s

most recent Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in the Company’s

other filings with the Securities and Exchange Commission. All such statements speak only as of the date made, and the Company undertakes

no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

Corporate Communications

Jeff Ramson, PCG Advisory

T: 646-863-6893

jramson@pcgadvisory.com

v3.25.0.1

Cover

|

Mar. 07, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2025

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt, Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2569 Wyandotte Street

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

650

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

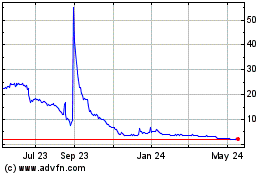

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Feb 2025 to Mar 2025

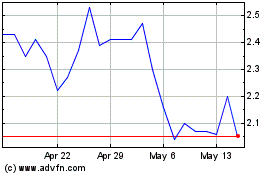

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Mar 2024 to Mar 2025