Dismal 1Q Earnings at AGNC - Analyst Blog

May 06 2013 - 7:07AM

Zacks

American Capital Agency Corp. (AGNC) -- a real

estate investment trust (REIT) -- reported disappointing

first-quarter 2013 results with its net spread income per share of

78 cents significantly lagging the Zacks Consensus Estimate of

$1.08.

Moreover, it compared unfavorably with the prior-quarter figure

of $1.42 cents per share. Hurt by lower pricing on its

mortgage-backed securities (MBS) portfolio, American Capital

Agency’s book value suffered a considerable downfall during the

quarter.

Net interest income came in at $407 million in the reported

quarter, which was above the Zacks Consensus Estimate of $380

million and marginally below $408 million recorded in the prior

quarter.

Behind the Headline Numbers

American Capital Agency reported an economic loss on common equity

for the quarter of 4.6%, or 18.7% annualized. As of Mar 31, 2013,

the company's investment portfolio comprised $76.3 billion of

agency securities and $27.3 billion of net TBA (to-be-announced)

mortgage positions, at fair value.

As of that date, the company's agency securities included $74.8

billion of fixed-rate securities, $0.8 billion of adjustable-rate

securities and $0.7 billion of collateralized mortgage obligations

(CMOs).

American Capital Agency’s fixed-rate investment portfolio consisted

of $22.6 billion less than or equal to 15-year fixed-rate

securities, $0.4 billion 20-year fixed-rate securities and $51.8

billion 30-year fixed-rate securities. Net TBA mortgage portfolio

included $12.5 billion 15-year net TBA securities and $14.8 billion

30-year net TBA securities, at fair value.

The investment portfolio of American Capital Agency was financed

with $67.1 billion of repurchase agreements and other debt,

resulting in a leverage ratio of 5.7x, including the net payable

for agency securities not yet settled, or 8.1x inclusive of

off-balance sheet TBA financing.

During the reported quarter, the company’s average asset yield on

its agency security portfolio was 2.80% (down 2 basis points

sequentially) and its average cost of funds was 1.28% (up 9 bps

sequentially), resulting in a net interest rate spread of 1.52% (a

decline of 11 bps sequentially).

As of Mar 31, 2013, the company's net book value per common share

was $28.93, down from $31.64 as of Dec 31, 2012. This was due to

lower pricing on the company's MBS portfolio and lower "pay-ups"

(or price premiums) on specified pools of securities with favorable

prepayment attributes.

As of Mar 31, 2013, American Capital Agency had cash and cash

equivalents of $2.8 billion compared with $2.4 billion at year-end

2012.

Dividend Update

On Mar 7, 2013, the company declared a first quarter dividend on

its common stock of $1.25 per share. This was paid on Apr 26, 2013

to common stockholders of record as of Mar 20, 2013. As a matter of

fact, the company has paid a total of $3.3 billion in common

dividends, or $25.11 per common share, since its May 2008 initial

public offering.

In Conclusion

Though the lower-than-expected results during the first quarter at

American Capital Agency came as a disappointment, we note that the

company’s exclusive focus on fixed-rate agency securities

guaranteed by the U.S. government limits its credit risks.

However, increased volatility and deterioration in the broader

residential mortgage and RMBS markets may restrict the upside

potential of the company going forward. The company is externally

managed and advised by American Capital AGNC Management, LLC, an

affiliate of American Capital, Ltd. (ACAS).

American Capital Agency currently has a Zacks Rank #3 (Hold).

However, the other REIT stocks which are performing well and worth

a look include iStar Financial Inc. (SFI) and

Western Asset Mortgage Capital Corp. (WMC), both

carrying a Zacks Rank #1 (Strong Buy).

AMER CAP LTD (ACAS): Free Stock Analysis Report

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ISTAR FINL INC (SFI): Free Stock Analysis Report

WESTERN AST MTG (WMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

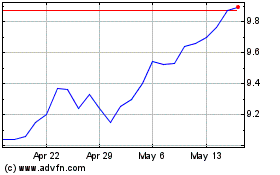

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jul 2023 to Jul 2024