0001630212

false

0001630212

2023-11-17

2023-11-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 17, 2023

AVALON GLOBOCARE CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38728 |

|

47-1685128 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 4400

Route 9 South, Suite

3100, Freehold,

New Jersey |

|

07728 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 780-4400

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

ALBT |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☒ Emerging growth company

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement.

Membership Interest Purchase Agreement

On November 17, 2023, Avalon Globocare Corp.,

a Delaware corporation (the “Company”), entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”)

with Wenzhao Lu (the “Purchaser”), pursuant to which (i) the Purchaser acquired from the Company 30% of the total outstanding

membership interests of Avalon RT 9 Properties, LLC, a wholly owned subsidiary of the Company (“Avalon RT9”) for a cash purchase

price of $3,000,000 (the “Acquisition”), and (ii) for a period of twelve months following the closing of the Acquisition,

the Purchaser shall have the option to purchase from the Company up to an additional 70% of the outstanding membership interests of Avalon

RT9 for a purchase price of up to $7,000,000. Avalon RT9 is the owner of real property located at 4400 Route 9 South, Freehold, New Jersey

07728 (the “Property”), where the Company maintains its principal office space. An independent third party performed a valuation

of the Property prior to the parties’ entering into the Purchase Agreement.

The Purchaser is the Chairman of the Company’s

Board of Directors.

The foregoing description of the Purchase Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, which is filed

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AVALON GLOBOCARE CORP. |

| |

|

|

| Date: November 22, 2023 |

By: |

/s/ Luisa Ingargiola |

| |

Name: |

Luisa Ingargiola |

| |

Title: |

Chief Financial Officer |

Exhibit 10.1

EXECUTION VERSION

MEMBERSHIP INTEREST PURCHASE AGREEMENT

between

Avalon GloboCare Corp., Seller

and

Wenzhao Lu, Purchaser

dated as of

November 17, 2023

TABLE OF CONTENTS

| ARTICLE I DEFINITIONS |

|

1 |

| |

|

|

| ARTICLE II PURCHASE AND SALE |

|

3 |

| |

|

|

| ARTICLE III PURCHASE PRICE |

|

4 |

| |

|

|

| ARTICLE IV INSPECTION |

|

4 |

| |

|

|

| ARTICLE V CLOSING |

|

5 |

| |

|

|

| ARTICLE VI CLOSING DELIVERIES |

|

5 |

| |

|

|

| ARTICLE VII TAX MATTERS |

|

6 |

| |

|

|

| ARTICLE VIII SELLER’S COVENANTS |

|

6 |

| |

|

|

| ARTICLE IX REPRESENTATIONS AND WARRANTIES |

|

7 |

| |

|

|

| ARTICLE X CONDITIONS TO CLOSING |

|

8 |

| |

|

|

| ARTICLE XI ADDITIONAL AGREEMENTS |

|

10 |

| |

|

|

| ARTICLE XII GENERAL PROVISIONS |

|

11 |

This MEMBERSHIP INTEREST PURCHASE AGREEMENT (this

“Agreement”), dated as of the 17th day of November, 2023 (the “Effective Date”), is entered into

between Avalon GloboCare Corp., a Delaware corporation, having an address at 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728

(“Seller”), and Wenzhao Lu, an individual, having an address at 16 Evan Dr, Morganville, New Jersey 07751 (“Purchaser”).

RECITALS

WHEREAS, Seller owns ONE HUNDRED percent

(100%) of the issued and outstanding membership interests (the “Membership Interests”) in Avalon RT 9 Properties,

LLC, a New Jersey limited liability company (the “Company”);

WHEREAS, the Company is the property owner

(the “Property Owner”) of a one hundred percent (100%) fee simple interest in the property located at 4400 Route 9

South, Freehold, Block 4 Lot 46.03, on the municipal Tax map of Freehold Township, New Jersey 07728 (the “Property”);

WHEREAS, Seller wishes to sell to Purchaser,

and Purchaser wishes to purchase from Seller, Membership Interests comprising 30% of the total outstanding Membership Interests (the

“Sale Membership Interests”), subject to the terms and conditions set forth herein;

WHEREAS, Purchaser is the Chairman of the

Board of the Seller;

WHEREAS, the sale of the Sale Membership

Interests to the Purchaser as provided herein (including the Purchase Price payable therefor) has been approved by the Board of Directors

of the Seller in accordance with Section 144 of the Delaware General Corporation Law; and

NOW, THEREFORE, in consideration of the mutual

covenants and agreements hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the parties hereto hereby agree as follows:

ARTICLE

I

DEFINITIONS

“Accelerated Closing Date” has

the meaning set forth in Section 5.01.

“Agreement” has the meaning set

forth in the Preamble.

“Bring Down Certificate” has

the meaning set forth in Section 6.01.

“Business Day” means any day,

other than a Saturday, Sunday or legal holiday, on which commercial banks in the City of New York are open for the general transaction

of business.

“Closing” has the meaning set

forth in Section 5.01.

“Closing Date” has the meaning

set forth in Section 5.01.

“Code” means the Internal Revenue

Code of 1986, as amended, and any regulations promulgated thereunder.

“Company” has the meaning set

forth in the Recitals.

“Earnest Money Deposit” has the

meaning set forth in Section 3.01.

“Effective Date” has the meaning

set forth in the Preamble.

“Encumbrance” has the meaning

set forth in Section 2.01.

“Existing Mortgage Documents”

means: (a) that certain Mortgage and Security Agreement, dated as of September 1, 2022, entered into between the Property Owner, as borrower,

and S&P Principal LLC (“S&P”), in the principal amount of FOUR MILLION EIGHT HUNDRED THOUSAND Dollars ($4,800,000);

(b) that certain Second Mortgage and Security Agreement, dated May 24, 2023, entered into between the Property Owner and S&P, in

the principal amount of ONE MILLION Dollars ($1,000,000); (c) that certain Mortgage and Security Agreement, dated as of October 9, 2023,

entered into between the Property Owner, Mast Hill Fund, L.P. and FirstFire Global Opportunities Fund LLC (together with S&P, the

“Lenders”), in the principal amount of SEVEN HUNDRED THOUSAND Dollars ($700,000); and (d) all other documents and

agreements evidencing and securing repayment of the Existing Mortgage Financing.

“Existing Mortgage Financing”

means the mortgage loans made by the Lenders to the Company in the original principal amount of SIX MILLION FIVE HUNDRED THOUSAND Dollars

($6,500,000) as evidenced by the Existing Mortgage Documents.

“Indemnified Parties” means Seller,

Managing Member, the Property Owner, and the Company, and their respective disclosed or undisclosed, direct and indirect shareholders,

officers, directors, trustees, partners, principals, members, employees, agents, affiliates, representatives, consultants, accountants,

contractors, and attorneys or other advisors, and any successors or assigns of the foregoing.

“Joinder” has the meaning set

forth in Section 6.02.

“Managing Member” means the sole

Member under the Operating Agreement.

“Managing Member Approval” shall

have the meaning set forth in Section 10.03.

“Membership Interests” has the

meaning set forth in the Recitals.

“Membership Interest Call Notice”

has the meaning set forth in Section 11.01.

“Membership Interest Call Price”

has the meaning set forth in Section 11.01.

“Membership Interest Call Transaction”

has the meaning set forth in Section 11.01.

“Membership Interest Purchase Option”

has the meaning set forth in Section 11.01.

“Operating Agreement” means that

certain Operating Agreement of the Company dated February 28, 2017 entered into between Seller, as sole member and the Company;

“Organizational Documents” means

with respect to the Company and the Property Owner, the articles of organization or certificate of formation, as applicable, the Operating

Agreement, member resolutions, certificates evidencing the membership interests, if any, and all amendments or modifications to the foregoing

and similar governing instruments required by the laws of the governing jurisdiction of formation or organization.

“Option Exercise MIPA” has the

meaning set forth in Section 11.01.

“Option Period” has

the meaning set forth in Section 11.01.

“Permitted Encumbrance” means

any mortgage, pledge, lien, charge, or security interest resulting from the Existing Mortgage Financing.

“Pre-Closing Tax Period” means

any taxable period of the Company that ends on or before the Closing Date and the portion of any Straddle Period through the end of the

Closing Date.

“Property” has the meaning set

forth in the Recitals.

“Property Owner” has the meaning

set forth in the Recitals.

“Purchase Price” has the meaning

set forth in Section 3.01.

“Purchaser” has the meaning set

forth in the Preamble.

“Purchaser’s Representatives”

has the meaning set forth in Section 4.01.

“Sale Membership Interests” has

the meaning set forth in the Recitals.

“Seller” has the meaning set

forth in the Preamble.

“Tax” or “Taxes”

means any federal, state, local, foreign, or other tax, fee, levy, duty, assessment, or other governmental charge, any amounts paid under

an agreement with a governmental authority relating to a tax or in lieu of a tax, and any interest, additions to tax, and penalties in

connection therewith.

“Tax Return” means any return,

report, information return, declaration, claim for refund, or other document, together with all amendments, attachments, and supplements

thereto (including all related or supporting information), required to be maintained for or supplied to any governmental authority responsible

for the administration or collection of Taxes.

ARTICLE

II

PURCHASE AND SALE

Section 2.01 Sale Membership Interests.

Seller agrees to sell to Purchaser, and Purchaser agrees to purchase from Seller, in accordance with the terms and conditions of this

Agreement, the Sale Membership Interests, free and clear of any mortgage, pledge, lien, charge, security interest, claim or other encumbrance

(“Encumbrance”) other than a Permitted Encumbrance, but subject to the terms and restrictions of: (a) the Operating

Agreement; and (b) the Existing Mortgage Documents. For purposes hereof, the Sale Membership Interests shall include but are not limited

to: (i) the Seller’s portion of the capital account in the Company corresponding to the Sale Membership Interests; (ii) the Seller’s

right to share in the profits and losses of the Company based on the percentage ownership of the Company evidenced by the Sale Membership

Interests; (iii) the Seller’s right to receive distributions from the Company based on the percentage ownership of the Company

evidenced by the Sale Membership Interests; and (iv) all of the voting rights attributable to the Sale Membership Interests.

ARTICLE

III

PURCHASE PRICE

Section 3.01 Purchase Price.

(a) The

purchase price for the Sale Membership Interests is THREE MILLION Dollars ($3,000,000) (the “Purchase Price”).

(b) The

Purchaser shall pay the Purchase Price to Seller in cash, by wire transfer of immediately available funds to an account of Seller in

accordance with the wire instructions set forth on Schedule I, as follows:

(i) The

sum of three hundred thousand dollars ($300,000) (the “Earnest Money Deposit”), upon the execution of this Agreement;

and

(ii) The

balance of the Purchase Price in the amount of two million seven hundred thousand dollars ($2,700,000), on the Closing Date.

ARTICLE

IV

INSPECTION

Section 4.01 Purchaser’s

Inspection Rights. Purchaser and its agents, employees, consultants, inspectors, and appraisers (collectively ‘Purchaser’s

Representatives’) shall have the right from time to time through the Closing Date, to the extent in Seller’s possession

or control, to have access to and inspect all books and records, contracts, financial, operating, tax, organizational, and other documents

and information related to the Company as Purchaser or Purchaser’s Representatives may reasonably request. Notwithstanding any

such inspection, or anything to the contrary herein contained, Purchaser’s obligations hereunder shall not be limited or otherwise

affected as a result of any fact, circumstance, or other matter of any kind discovered following the date hereof in connection with any

such inspection, access, or otherwise; it being agreed that Seller is permitting Purchaser such right of inspection and access as a courtesy

to Purchaser in its preparation for purchasing the Membership Interests. Without limiting the generality of the foregoing: (a) Purchaser

agrees that it shall not have any so-called “due diligence period” and that it shall have no right to terminate this Agreement

or obtain a reduction of the Purchase Price because of any such fact, circumstance, or other matter so discovered; and (b) Purchaser

shall have no right to terminate this Agreement or obtain a return of the Earnest Money Deposit except as otherwise expressly provided

in this Agreement. If the Closing under this Agreement shall not occur for any reason whatsoever, Purchaser shall promptly return to

Seller copies of all due diligence materials delivered by Seller to Purchaser and shall destroy all copies and abstracts thereof.

ARTICLE

V

CLOSING

Section 5.01 Closing; Closing Date.

The closing of the transaction contemplated hereby (the “Closing”) shall occur at 12:01 a.m. Eastern standard time

on December 31, 2023 (the “Closing Date”) in accordance with the terms and conditions of this Agreement, at the offices

of Lowenstein Sandler LLP, located at 1251 Avenue of the Americas, New York, NY 10020. The Closing and exchange of documents may also

take place by facsimile or other electronic transmission. The consummation of the transactions contemplated by this Agreement shall be

deemed to occur at 12:01 a.m. on the Closing Date. Notwithstanding the foregoing,

(a) The

Closing Date may be accelerated to a date that is mutually agreed upon by the Purchaser and the Seller (such accelerated date, the “Accelerated

Closing Date”).

(b) The

Seller and the Purchaser shall be entitled to adjourn the Closing Date or the Accelerated Closing Date one or more times on at least

ten (10) Business Days’ notice to the other party to satisfy any conditions to such party’s obligations to consummate the

Closing under this Agreement.

(c) The

Closing Date, Accelerated Closing Date, and/or any other date to which the Closing is adjourned or accelerated in accordance with the

terms of this Agreement shall be deemed the “Closing Date” hereunder.

Purchaser acknowledges and agrees that time shall

be of the essence with respect to the performance by Purchaser of its obligations to purchase the Sale Membership Interests, pay the

Purchase Price, and otherwise consummate the transactions contemplated in this Agreement on the Closing Date.

ARTICLE

VI

CLOSING DELIVERIES

Section 6.01 Seller’s Closing Deliveries.

Seller shall deliver or cause to be delivered to Purchaser the following at the Closing, except as otherwise specified below:

(a) A

consent of the board of directors of Seller authorizing the transaction contemplated hereby and the execution and delivery of the documents

required to be executed and delivered hereunder.

(b) The

Managing Member Approval.

(c) A

revised Members’ Schedule (Exhibit A to the Operating Agreement and Exhibit A hereto) reflecting the Purchaser’s

purchase of the Sale Membership Interests and ownership interest in the Company.

(d) A

written certificate stating that all representations and warranties contained in Section 9.01 remain, as of the Closing Date, true, correct,

and complete in all material respects as when first made hereunder (the “Bring Down Certificate”).

(e) A

valid and properly executed Internal Revenue Service Form W-9.

Section 6.02 Purchaser’s Closing Deliveries.

On the Closing Date, Purchaser shall deliver or cause to be delivered to Seller the following:

(a) The

balance of the Purchase Price as set forth in Section 3.01(b).

(b) The

Joinder Agreement, executed by the Purchaser, a form of which is set forth in Exhibit B hereto (the “Joinder”).

ARTICLE

VII

TAX MATTERS

Section 7.01 Allocations of Company Income

and Loss. For the avoidance of doubt, Seller and Purchaser agree that the Company as a disregarded entity for income tax purposes

shall allocate all items of Company income, gain, loss, deduction, or credit attributable to the Sale Membership Interests for the taxable

year of the Closing through the Closing Date to Seller and that after the Closing Date, the Company, which will be treated as a partnership

for income tax purposes, shall allocate all items of Company income, gain, loss, deduction, or credit attributable to the Sale Membership

Interests to Seller and Purchaser for the taxable year of the Closing after the Closing Date as provided in the Operating Agreement.

Section 7.02 Tax Audit Procedures. Seller

shall be the partnership representative for purposes of Subchapter C of Chapter 63 of the Code, as revised by Section 1101 of the Bipartisan

Budget Act of 2015, as such provisions may thereafter be amended and including Treasury Regulations or other guidance issued thereunder.

Section 7.03 Transfer Taxes. Seller

shall pay, and shall reimburse Purchaser for, any sales, use or transfer taxes, documentary charges, recording fees or similar taxes,

charges, fees, or expenses, if any, that become due and payable as a result of the transactions contemplated by this Agreement.

ARTICLE

VIII

selleR’s covenants

Section 8.01 Seller’s Covenants.

Seller covenants that:

(a) From

the Effective Date until the Closing, Seller shall:

(i) Bear

the cost of all Taxes required to be paid by the Company for any Pre-Closing Tax Periods; and

(ii) Promptly

deliver or cause to be delivered to Purchaser, upon request, copies of the most recent financial statements of the Company.

(b) From

the Effective Date until the Closing, the Seller shall not, without Purchaser’s prior written approval, which approval shall not

be unreasonably withheld:

(i) Enter

into any agreement that would require the consent of a third party to consummate the transactions contemplated by this Agreement;

(ii) Sell,

transfer, encumber, or change the status of title of all or any portion of the Sale Membership Interests; or

(iii) Consent

to any amendment to the Organizational Documents that would materially affect Seller’s rights or obligations in the Company.

ARTICLE

IX

REPRESENTATIONS

AND WARRANTIES

Section 9.01 Seller’s Representations

and Warranties.

(a) Seller

represents and warrants to the Purchaser and the Company that:

(i) Seller

is a corporation duly formed and in good standing under the laws of the State of Delaware. Seller has the corporate power to enter into

and perform this Agreement in accordance with its terms. The execution, delivery and performance of this Agreement, including the sale

of the Sale Membership Interests to the Purchaser as contemplated hereby, has been duly authorized by the Seller and the Company.;

(ii) This

Agreement has been duly executed and delivered by the Seller and constitutes the valid and binding obligation of the Seller, enforceable

against the Seller in accordance with its terms, subject to bankruptcy, reorganization, and other similar laws affecting the enforcement

of creditors’ rights generally and to general equity principles;

(iii) Schedule

II is a true, correct, and complete list of all Organizational Documents of the Company;

(iv) The

sale of the Sale Membership Interests as contemplated hereby does not violate any preemptive or similar rights of any person under the

Organizational Documents of the Company or any agreement, arrangement or other understanding to which either the Seller or the Company

is a party or by which either of them is bound or the Sale Membership Interests are subject;

(v) Seller

has good and valid title to the Membership Interests, including the Sale Membership Interests, free and clear of all liens, pledges,

charges, security interests, rights of first refusal, purchase options, or other Encumbrances of any kind;

(b) All

representations and warranties made to Seller’s knowledge in this Agreement are made based on the actual knowledge of Luisa Ingargiola,

without any duty to review or investigate the matters to which such knowledge, or the absence thereof, pertains and with no imputed knowledge

whatsoever, whether from any partner, officer, director, member, shareholder, or employee of Seller. Luisa Ingargiola shall have no personal

liability arising out of any representations or warranties made herein.

Section 9.02 Purchaser’s Representations

and Warranties. Purchaser represents and warrants to the Seller and the Company that:

(a) Purchaser

has the legal capacity to enter into and perform this Agreement in accordance with its terms.

(b) This

Agreement has been duly executed and delivered by the Purchaser and constitutes the valid and binding obligation of the Purchaser, enforceable

against the Purchaser in accordance with its terms, subject to bankruptcy, reorganization, and other similar laws affecting the enforcement

of creditors’ rights generally and to general equity principles.

(c) The

purchase of the Sale Membership Interests as contemplated hereby does not violate any agreement, arrangement or other understanding to

which the Purchaser is a party or by which he is bound. The Purchaser has readily available cash resources in an amount sufficient for

him to complete the purchase of the Sale Membership Interests, including the payment of the Purchase Price as contemplated hereby.

(d) Purchaser

is an “accredited investor” as such term is defined in Rule 501 of Regulation D under the Securities Act of 1933, as amended

(the “Securities Act”). Purchaser is acquiring the Sale Membership Interests solely for his own account for investment

purposes and not with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act.

Purchaser acknowledges that the Sale Membership Interests constitute “restricted securities” under Rule 144 under the Securities

Act, have not been registered under the Securities Act, or any state securities laws, and that the Sale Membership Interests may not

be transferred or sold except pursuant to the registration provisions of the Securities Act or pursuant to an applicable exemption therefrom

and subject to state securities laws and regulations, as applicable. The Purchaser acknowledges that an appropriate transfer restriction

above will be noted in the Company’s books and records and will be placed on any certificate representing any of the Sale Membership

Interests.

ARTICLE

X

CONDITIONS TO CLOSING

Section 10.01 Conditions to Obligations

of Seller. Notwithstanding anything to the contrary contained herein, the obligation of Seller to close the transaction in accordance

with this Agreement is expressly conditioned on the fulfillment by and as of the Closing Date of each of the conditions listed below,

provided that Seller, at its election, evidenced by written notice delivered to Purchaser at or prior to the Closing, may waive any of

such conditions:

(a) Purchaser

shall have: (i) executed and delivered to Seller all documents required to be delivered by Purchaser at Closing; (ii) paid the full balance

of the Purchase Price in accordance with Section 3.01(b); and (iii) paid all other sums of money required under this Agreement, if any.

(b) Purchaser

shall not be in default of any covenant or agreement to be performed by Purchaser under this Agreement and shall have performed all other

obligations required to be performed by it under this Agreement on or prior to the Closing Date.

(c) On

the Closing Date, all representations and warranties made by Purchaser in Section 9.02 shall be true and correct as if made on the Closing

Date.

(d) The

Managing Member Approval shall have been obtained pursuant to Section 10.03 hereof.

Section 10.02 Conditions to Obligations

of Purchaser. Notwithstanding anything to the contrary contained herein, the obligation of Purchaser to close the transaction and

pay the Purchase Price in accordance with this Agreement is expressly conditioned on the fulfillment by and as of the Closing Date of

each of the conditions listed below, provided that Purchaser, at its election, evidenced by written notice delivered to Seller at or

prior to the Closing, may waive all or any of such conditions:

(a) Seller

shall have executed and delivered to Purchaser all documents required to be delivered by Seller at the Closing and shall have taken all

other action required of Seller at the Closing.

(b) All

representations and warranties made by Seller in Section 9.01 shall be true and correct in all material respects as if made on the Closing

Date; provided, however, to the extent the facts and circumstances underlying such representations and warranties may have changed as

of the Closing Date, Seller shall have the right to update its representations and warranties as of the Closing Date.

(c) The

Managing Member Approval shall have been delivered pursuant to Section 10.03.

Section 10.03 Managing Member Approval.

The Managing Member’s consent to the: (a) transfer of the Sale Membership Interests to Purchaser (or its designee); and (b)

admission of the Purchaser (or its designee) as a member in the Company (the “Managing Member Approval”) shall be

a condition precedent to Purchaser’s and Seller’s obligation to close the transaction under this Agreement. The Managing

Member Approval shall be in form and substance acceptable to Purchaser and substantially in the form attached hereto as Exhibit C.

Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser the Managing Member Approval.

Section 10.04 Failure of Conditions to Closing.

(a) If,

except as provided in 10.04(c), Purchaser is unable to timely satisfy (and Seller has not waived in writing) the conditions precedent

to Seller’s obligation to effect the Closing, then such failure shall constitute a default hereunder, in which case, Seller shall

have the right to terminate this Agreement by notice thereof to Purchaser in accordance with the terms of this Agreement. If this Agreement

is so terminated, then Seller shall be entitled to receive the Earnest Money Deposit and thereafter, neither Party shall have any further

obligations hereunder, except those expressly stated to survive the termination hereof, if any.

(b) If

Seller is unable to timely satisfy the conditions precedent to Purchaser’s obligation to effect the Closing (and Purchaser has

not waived the same in writing), then Seller may, if it so elects and without any abatement in the Purchase Price: (i) adjourn the Closing

Date for a period or periods not to exceed twenty (20) Business Days in the aggregate after the Closing Date; and (ii) if, after any

such extension, the conditions precedent to Purchaser’s obligation to effect the Closing continue not to be satisfied (and Purchaser

has not waived the same in writing) or Seller does not elect such extension and, in either case, such failure of condition precedent

is not the result of Seller’s default hereunder, then Purchaser or Seller shall be entitled to terminate this Agreement by notice

thereof to the other Party in accordance with the terms of this Agreement. If this Agreement is so terminated, then Purchaser shall be

entitled to receive the Earnest Money Deposit and thereafter neither Party shall have any further obligations hereunder, except those

expressly stated to survive the termination hereof, if any.

(c) If

the Managing Member Approval has not been obtained by the Closing Date, then provided that both parties have used reasonably diligent

efforts to obtain the approval and are not otherwise in default under this Agreement, either Purchaser or Seller shall be entitled to

terminate this Agreement by notice thereof to the other Party in accordance with the terms of this Agreement. If this Agreement is so

terminated, then Purchaser shall be entitled to receive the Earnest Money Deposit and thereafter neither Party shall have any further

obligations hereunder, except those expressly stated to survive the termination hereof, if any.

ARTICLE

XI

ADDITIONAL AGREEMENTS

Section 11.01 Additional Membership Interest

Purchase Option.

(a) At

any time during the period beginning on the Closing Date and ending on the date twelve (12) months after the Closing Date (the “Option

Period”), Purchaser shall have the right (the “Membership Interest Purchase Option”), upon delivery of a

written notice stating the Purchaser’s intent to exercise its rights pursuant to this Section 11.01 (and the number of Membership

Interests the Purchaser intends to purchase from Seller) (a “Membership Interest Call Notice”), to purchase, from

the Seller up to seventy percent (70%) of the Membership Interests for up to Seven Million dollars ($7,000,000) in cash (the “Membership

Interest Call Price”), and in accordance with the procedures and on the terms and conditions set forth in this Section 11.01

(the “Membership Interest Call Transaction”), provided, however, that if the Purchaser elects to exercise the Membership

Interest Purchase Option within the Option Period, and has delivered the Membership Interest Call Notice within such Option Period, but

requires additional time to close the Membership Interest Call Transaction and in good faith believes that Purchaser will be able to

obtain the necessary capital to close the Membership Interest Call Transaction, then, prior to the expiration of the Option Period, the

Purchaser shall reaffirm their exercise of the Membership Interest Purchase Option in writing to the Seller and accompany such reaffirmation

with reasonable evidence of financial commitments for the Membership Interest Call Price, and the Purchaser shall have an additional

ninety (30) day period to execute and deliver the membership interest purchase agreement with respect to the Membership Interest Call

Transaction. In the event the Purchaser fails to provide such reaffirmation prior to the end of the Option Period, the Membership Interest

Purchase Option shall terminate on December 31,2024, unless otherwise agreed to by the parties.

(b) Promptly

following the delivery of a Membership Interest Call Notice by the Purchaser, the Purchaser and the Seller shall cooperate in good faith

to execute and deliver a membership interest purchase agreement (the “Option Exercise MIPA”), substantially in the

same form as this Agreement, with such other changes as otherwise agreed upon by the Purchaser and the Seller at the time the Membership

Interest Call Notice is exercised, which Option Exercise MIPA shall include, among others, covenants: (i) for the repayment of the Existing

Mortgage Financing by the Seller or the Company, as the case may be, immediately following the closing under the Option Exercise MIPA

from the proceeds of the Membership Interest Call Transaction and release of all liens related thereto; and (ii) to cooperate in good

faith between the Seller and the Purchaser to file all necessary tax, recording of title and other filings that may be required to be

filed in connection with the transfer of all rights, title and interest in the Membership Interests and the Property by Seller to Purchaser.

In addition, Purchaser shall have the right, at his sole expense, (i) to perform or cause to be performed building inspections of the

Property, (ii) to request title reports in relation to the Property, and (iii) to retain a title company or legal counsel as his closing

agent. The definitive terms of any Membership Interest Call Transaction shall be set forth in the Option Exercise MIPA.

(c) Each

of the Purchaser and the Seller shall bear its own costs and expenses incurred in connection with any Membership Interest Call Transaction

(whether or not consummated), including all attorneys’ fees and charges, all accounting fees and charges and all finders, brokerage

or investment banking fees, charges or commissions.

(d) Each

of the Purchaser and the Seller shall execute and deliver all related documentation and take such other action in support of a Membership

Interest Call Transaction as shall be reasonably requested by either party in order to carry out the terms and provisions of this Section

11.01.

(e) Upon

the closing of the Membership Interest Call Transaction, the Purchaser and the Seller shall if requested by the Purchaser, amend and

restate the Operating Agreement.

ARTICLE

XII

GENERAL PROVISIONS

Section

12.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby

shall be paid by the party incurring such costs and expenses.

Section

12.02 Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective affiliates

to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably

required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

Section

12.03 Notices. All notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in

writing and shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by

the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or e-mail of

a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next Business Day

if sent after normal business hours of the recipient or (d) on the third day after the date mailed, by certified or registered mail,

return receipt requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or

at such other address for a party as shall be specified in a notice given in accordance with this Section 12.03:

| If to the Seller: |

Avalon GloboCare Corp.

4400 Route 9 South, Suite 3100

Freehold, New Jersey 07728

E-mail: luisa@avalon-globocare.com

Attention: Luisa Ingargiola |

| |

|

with a copy to (which shall not constitute notice):

If to the Purchaser: |

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

E-mail: sskolnick@lowenstein.com

Attention: Steven Skolnick

Wenzhao Lu

16 Evan, Morganville, NJ 07751

E-mail: Daniel@avalon-globocare.com

Attention: Wenzhao Lu |

Section

12.04 Headings. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section

12.05 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction,

such invalidity, illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render

unenforceable such term or provision in any other jurisdiction. Upon such determination that any term or other provision is invalid,

illegal or unenforceable, the parties hereto shall negotiate in good faith to modify the Agreement so as to effect the original intent

of the parties as closely as possible in a mutually acceptable manner in order that the transactions contemplated hereby be consummated

as originally contemplated to the greatest extent possible.

Section

12.06 Entire Agreement. This Agreement and the documents to be delivered hereunder constitute the sole and entire agreement

of the parties to this Agreement with respect to the subject matter contained herein, and supersede all prior and contemporaneous understandings

and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements

in the body of this Agreement and those in documents to be delivered hereunder, the Exhibits and the Schedules, the statements in the

body of this Agreement will control.

Section

12.07 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto

and their respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior

written consent of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning

party of any of its obligations hereunder.

Section

12.08 No Third-Party Beneficiaries. This Agreement is for the sole benefit of the parties hereto and their respective successors

and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person or entity any legal

or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section

12.09 Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing

signed by each party hereto.

Section

12.10 Waiver. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in

writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure,

breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring

before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this

Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or

privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

Section

12.11 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State

of New Jersey without giving effect to any choice or conflict of law provision or rule (whether of the State of New Jersey or any other

jurisdiction).

Section 12.12 Submission

to Jurisdiction. EACH PARTY HERETO AGREES THAT ALL ACTIONS OR PROCEEDINGS ARISING IN CONNECTION WITH THIS AGREEMENT AND THE

TRANSACTIONS CONTEMPLATED HEREBY SHALL BE TRIED AND LITIGATED IN STATE OR FEDERAL COURTS LOCATED IN THE STATE OF NEW JERSEY, UNLESS SUCH

ACTIONS OR PROCEEDINGS ARE REQUIRED TO BE BROUGHT IN ANOTHER COURT TO OBTAIN SUBJECT MATTER JURISDICTION OVER THE MATTER IN CONTROVERSY.

TO THE EXTENT PERMITTED BY LAW, EACH PARTY HERETO IRREVOCABLY WAIVES ANY RIGHT ANY PARTY HERETO MAY HAVE TO ASSERT THE DOCTRINE OF FORUM

NON CONVENIENS, TO ASSERT THAT ANY PARTY HERETO IS NOT SUBJECT TO THE JURISDICTION OF THE AFORESAID COURTS, OR TO OBJECT TO VENUE

TO THE EXTENT ANY PROCEEDING IS BROUGHT IN ACCORDANCE WITH THIS ARTICLE XII. SERVICE OF PROCESS, SUFFICIENT FOR PERSONAL JURISDICTION

IN ANY ACTION AGAINST ANY PARTY HERETO, MAY BE MADE BY REGISTERED OR CERTIFIED MAIL, RETURN RECEIPT REQUESTED, TO ANY SUCH PARTY’S ADDRESS

INDICATED IN SECTION 12.03 HEREOF.

Section 12.13 Waiver

of Jury Trial. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE

COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL

BY JURY IN RESPECT OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY.

EACH PARTY TO THIS AGREEMENT CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE,

THAT SUCH OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION, (B) SUCH PARTY HAS CONSIDERED THE

IMPLICATIONS OF THIS WAIVER, (C) SUCH PARTY MAKES THIS WAIVER VOLUNTARILY, AND (D) SUCH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT

BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 12.13.

Section 12.14 Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall

be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic

transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have caused this

Agreement to be executed as of the date first written above.

PURCHASER:

WENZHAO LU

| By: |

/s/ Wenzhao Lu |

|

| |

Name: Wenzhao Lu |

|

| |

Title: |

|

SELLER:

AVALON GLOBOCARE CORP., a Delaware corporation

| By: |

/s/ Luisa Ingargiola |

|

| |

Name: Luisa Ingargiola |

|

| |

Title: CFO |

|

EXHIBITS

| Schedule I |

|

Wire Instructions |

| Schedule II |

|

Organizational Documents of the Company |

| Exhibit A |

|

Members’ Schedule |

| Exhibit B |

|

Joinder Agreement |

| Exhibit C |

|

Managing Member Approval |

Schedule I

Wire Instructions

Schedule II

Organizational Documents of the Company

Exhibit A

MEMBERS’ SCHEDULE

| Member | |

Capital

Contribution | | |

Number Series A

Membership

Interests | |

%

Ownership | |

| Avalon Globocare Corp. | |

$ | 7,070,228 | | |

1-70 | |

| 70 | % |

| Wenzhao Lu | |

$ | 3,000,000 | | |

71-100 | |

| 30 | % |

Exhibit B

JOINDER AGREEMENT

The undersigned is executing and delivering this

Joinder Agreement pursuant to the Operating Agreement of Avalon RT 9 Properties, LLC, a New Jersey limited liability company (the “Company”),

dated as of February 28, 2017 (as in effect from time to time, the “Operating Agreement”), by and among the Company

and its Members party thereto.

By executing and delivering this Joinder Agreement

to the Operating Agreement, the undersigned hereby agrees to become a party to, to be bound by, and to comply with the provisions of

the Operating Agreement in the same manner as if the undersigned were an original signatory to such agreement as a Member. In connection

therewith, effective as of the date hereof the undersigned hereby makes the representations and warranties contained in the Operating

Agreement.

Accordingly, the undersigned has executed and delivered

this Joinder Agreement as of the __ day of _______, 2023.

| |

|

| |

Signature of Member |

| |

|

| |

|

| |

Print Name of Member |

Exhibit C

WRITTEN

CONSENT OF THE SOLE MEMBER

OF AVALON RT 9 PROPERTIES, LLC

Dated as of December __, 2023

The undersigned, being the sole member (the “Sole

Member”) of Avalon RT 9 Properties, LLC, a New Jersey limited liability company (the “Company”), in lieu

of holding a meeting of the Sole Member, hereby waives any notice and other requirements for the holding of a meeting of the members

and takes the following actions and adopts the following resolutions by written consent with the same force and effect as if they have

been adopted at a duly called meeting, pursuant to the applicable laws of the jurisdiction in which the Company is organized. Capitalized

terms used but not defined herein have the meanings ascribed to such terms in the Purchase Agreement (as defined below):

WHEREAS, Avalon GloboCare Corp., a Delaware

corporation (the “Seller”), owns ONE HUNDRED percent (100%) of the issued and outstanding membership interests in

the Company (the “Membership Interests”);

WHEREAS, the Company is the property owner

of a one hundred percent (100%) fee simple interest in the property located at 4400 Route 9 South, Freehold, Block 4 Lot 46.03, on the

municipal Tax map of Freehold Township, New Jersey 07728;

WHEREAS, the Company desires to enter into

that certain Membership Interest Purchase Agreement (together with all exhibits, schedules and attachments thereto, the “Purchase

Agreement”), by and among Wenzhao Lu (“Purchaser”) and the Seller, a copy of which is attached hereto as

Exhibit A, pursuant to which, among other things, Purchaser shall purchase from the Seller thirty percent (30%) of the Membership

Interests, on the terms and subject to the conditions set forth in the Purchase Agreement (the “Transaction”);

WHEREAS, the Transaction is proposed to

be effected pursuant to the terms and conditions of the Purchase Agreement; and

WHEREAS, the Transaction has been approved

by the Board of Directors of the Seller.

NOW, THEREFORE, BE IT:

RESOLVED, that the Purchase Agreement,

the performance thereof by the Company and the consummation by the Company of the Transaction contemplated thereby be, are each authorized,

approved, ratified and confirmed in all respects, with such changes therein and additions thereto as the proper officers of the Company

shall approve, the execution and delivery thereof to be conclusive evidence of such approval; and be it further

RESOLVED, that the proper officers of the

Company be, and each of them hereby is, authorized, empowered and directed, in the name and on behalf of the Company, to execute and

deliver, and to cause to be performed the obligations of the Company under, the Purchase Agreement, with such changes therein and additions

thereto as the proper officers of the Company shall approve, the execution and delivery thereof to be conclusive evidence of such approval;

and be it further

RESOLVED, that the proper officers of the

Company be, and each of them hereby is, authorized and directed, in the name and on behalf of the Company, to take or cause to be taken

any and all such further actions and to prepare, execute and deliver or cause to be prepared, executed and delivered all such further

agreements, documents, certificates and undertakings, and to incur all such fees and expenses, as in his or her judgment shall be necessary,

appropriate or advisable to carry out and effectuate the purpose and intent of any and all of the foregoing resolutions; and be it further

RESOLVED, that all actions previously taken

by any officer, manager, representative or agent of the Company, in the name or on behalf of the Company or any of its affiliates in

connection with the transactions contemplated by the foregoing resolutions be, and each of the same hereby is, adopted, ratified, confirmed

and approved in all respects as the act and deed of the Company; and be it further

RESOLVED, that this Written Consent may

be executed in one or more counterparts, each of which shall be deemed an original and together they shall be deemed one and the same

instrument.

[Signature pages follow]

IN WITNESS WHEREOF, the undersigned have

executed this Written Consent as of the date first written above.

| |

Sole Member: |

| |

|

| |

AVALON GLOBOCARE CORP. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

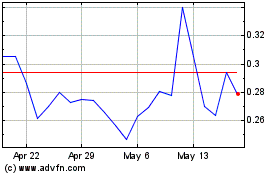

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Feb 2024 to Feb 2025