American Lithium Announces Financial and Operating Highlights for Third Quarter Ended November 30, 2023

January 16 2024 - 6:00AM

American Lithium Corp. (“American Lithium” or the “Company”)

(TSX-V:LI | Nasdaq:AMLI | Frankfurt:5LA1) provides financial and

operating highlights for the third quarter ended November 30, 2023.

Unless otherwise stated, all amounts presented are in Canadian

dollars.

Simon Clarke, CEO of American Lithium comments,

“This was an extremely busy period with significant achievements

across our projects in Peru and Nevada. This momentum has continued

past quarter end with the completion of the updated PEA for

Falchani, highlighting very robust economics for the project,

including a tripling of NPV from the last PEA.”

Highlights of the Quarter:

- Resource Update at Falchani

– newly updated mineral resource estimate (“MRE”) resulted

in a 476% increase in Measured and Indicated Resources (“M&I”)

to 5.53 million tonnes (“Mt”) of lithium carbonate (447 Mt @ 2,327

parts per million (“ppm”) Li) to the block model.

- Unanimous Ruling in Peru

- Peru’s Superior Court unanimously upheld the previously

announced ruling in favour of the Company’s subsidiary, Macusani

Yellowcake in relation to title over 32 disputed concessions out of

172 owned by Macusani. The Court ruling clearly establishes that

Macusani is the rightful owner of these concessions and highlights

that the action launched by the Geological, Mining, and

Metallurgical Institute (“INGEMMET”) and Ministry of Energy and

Mines (“MINEM”) in October 2018 was baseless and

unsubstantiated.

- Semi-Detailed Environmental

Impact Study (EIA-sd) – submitted for Falchani to the

MINEM ahead of schedule. With the filing acknowledged by MINEM,

regulatory approval for the EIA-sd is anticipated in the coming

months.

- Lithium Discovery at

Quelcaya in Peru – new lithium (“Li”) discovery 6

kilometres west of Falchani with assays up to 2,668 ppm lithium and

over 222 metres of continuous mineralization.

- Flow Sheet

Refinement - continued refinement of the TLC PEA flow

sheet with higher Li purity (99.54%) indicating enhanced economic

potential of this project.

- Annual General Meeting

– shareholders voted in favor of the proposals set forth

in the Management Information Circular, including the re-election

of seven members to the board of directors for the fiscal

year.

Subsequent Events:

- Updated PEA for

Falchani – highlights robust economics, after-tax NPV

triples to US $5.11 billion, IRR of 32% and low opex of $5,093 /t

LCE.

- Technical Report Filed for

Falchani - independent National Instrument 43-101

Technical Report on the updated MRE for the Falchani filed

showcasing the 476% increase in M&I Resources.

- Resource Footprint Expanded

at TLC – step out drilling has expanded the measured

resource footprint at the TLC Lithium Project. A total of 26

diamond core holes and 16 reverse circulation holes drilled in 2022

and 2023 will be added to the updated mineral resource block model

and incorporated into an updated MRE on TLC.

- Petition Filed in Peru

– following the unanimous ruling from the Peruvian

Superior Court confirming the Company’s title to 32 disputed

concessions, INGEMMET and MINEM petitioned the Supreme Court in a

final attempt to reverse the ruling.

Selected Financial Data

The following selected financial data is

summarized from the Company’s consolidated financial statements and

related notes thereto (the “Financial Statements”)

for the third quarter ended November 30, 2023. Copies of the

Financial Statements and MD&A are available at

www.americanlithiumcorp.com or on SEDAR+ at www.sedarplus.ca.

|

|

Three MonthsNovember 30,

2023 |

Three MonthsNovember 30,

2022 |

|

Loss and comprehensive loss |

($11,169,972) |

($5,436,973) |

|

Loss per share - basic and diluted |

($0.05) |

($0.03) |

|

|

As AtNovember 30, 2023 |

As AtFebruary 28, 2023 |

|

Cash, cash equivalents and guaranteed investment certificates |

$17,086,502 |

$40,622,180 |

|

Short-term investments |

$4,171,420 |

- |

|

Total assets |

$177,178,511 |

$194,280,141 |

|

Total current liabilities |

$2,195,227 |

$1,738,766 |

|

Total liabilities |

$4,389,041 |

$1,890,074 |

|

Total shareholders’ equity |

$172,789,470 |

$192,390,067 |

About American

Lithium

American Lithium is actively engaged in the

development of large-scale lithium projects within mining-friendly

jurisdictions throughout the Americas. The Company is currently

focused on enabling the shift to the new energy paradigm through

the continued development of its strategically located TLC lithium

project (“TLC”) in the richly mineralized Esmeralda lithium

district in Nevada, as well as continuing to advance its Falchani

lithium (“Falchani”) and Macusani uranium (“Macusani”)

development-stage projects in southeastern Peru. All three

projects, TLC, Falchani and Macusani have been through robust

preliminary economic assessments, exhibit strong significant

expansion potential and enjoy strong community support.

Pre-feasibility is advancing well TLC and Falchani.

For more information, please contact the Company

at info@americanlithiumcorp.com or visit our website

at www.americanlithiumcorp.com.

Follow us

on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of

American Lithium Corp.

“Simon Clarke”

CEO & Director

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward

Looking InformationThis news release contains certain

forward-looking information and forward-looking statements

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, statements regarding the business plans,

expectations and objectives of American Lithium. Forward-looking

statements are frequently identified by such words as "may",

"will", "plan", "expect", "anticipate", "estimate", "intend",

“indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”,

“efforts”, “option” and similar words, or the negative connotations

thereof, referring to future events and results. Forward-looking

statements are based on the current opinions and expectations of

management and are not, and cannot be, a guarantee of future

results or events. Although American Lithium believes that the

current opinions and expectations reflected in such forward-looking

statements are reasonable based on information available at the

time, undue reliance should not be placed on forward-looking

statements since American Lithium can provide no assurance that

such opinions and expectations will prove to be correct. All

forward-looking statements are inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including risks,

uncertainties and assumptions related to: American Lithium’s

ability to achieve its stated goals;, which could have a material

adverse impact on many aspects of American Lithium’s businesses

including but not limited to: the ability to access mineral

properties for indeterminate amounts of time, the health of the

employees or consultants resulting in delays or diminished

capacity, social or political instability in Peru which in turn

could impact American Lithium’s ability to maintain the continuity

of its business operating requirements, may result in the reduced

availability or failures of various local administration and

critical infrastructure, reduced demand for the American Lithium’s

potential products, availability of materials, global travel

restrictions, and the availability of insurance and the associated

costs; the ongoing ability to work cooperatively with stakeholders,

including but not limited to local communities and all levels of

government; the potential for delays in exploration or development

activities; the interpretation of drill results, the geology, grade

and continuity of mineral deposits; the possibility that any future

exploration, development or mining results will not be consistent

with our expectations; risks that permits will not be obtained as

planned or delays in obtaining permits; mining and development

risks, including risks related to accidents, equipment breakdowns,

labour disputes (including work stoppages, strikes and loss of

personnel) or other unanticipated difficulties with or

interruptions in exploration and development; risks related to

commodity price and foreign exchange rate fluctuations; risks

related to foreign operations; the cyclical nature of the industry

in which American Lithium operates; risks related to failure to

obtain adequate financing on a timely basis and on acceptable terms

or delays in obtaining governmental approvals; risks related to

environmental regulation and liability; political and regulatory

risks associated with mining and exploration; risks related to the

uncertain global economic environment and the effects upon the

global market generally, any of which could continue to negatively

affect global financial markets, including the trading price of

American Lithium’s shares and could negatively affect American

Lithium’s ability to raise capital and may also result in

additional and unknown risks or liabilities to American Lithium.

Other risks and uncertainties related to prospects, properties and

business strategy of American Lithium are identified in the “Risk

Factors” section of American Lithium’s Management’s Discussion and

Analysis filed on October 16, 2023, and in recent securities

filings available at www.sedarplus.ca. Actual events or results may

differ materially from those projected in the forward-looking

statements. American Lithium undertakes no obligation to update

forward-looking statements except as required by applicable

securities laws. Investors should not place undue reliance on

forward-looking statements.

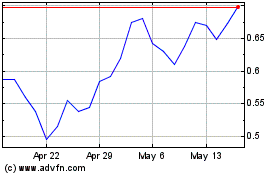

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Feb 2024 to Feb 2025