A-Mark Precious Metals, Inc. (NASDAQ:

AMRK) (A-Mark), a leading fully integrated precious metals

platform, has acquired an additional 8% of the outstanding equity

interest in Calgary-based Silver Gold Bull Inc. (SGB) for

approximately $9.6 million. The investment brings A-Mark’s

ownership in SGB to 55.4% and continues to expand A-Mark’s

direct-to-consumer (DTC) footprint in the international market.

A-Mark acquired its initial stake in SGB in 2014, increasing its

investment to 47.4% in 2022.

Founded in 2009, SGB is a leading e-commerce

precious metals retailer in Canada focused on providing online

innovation, high-quality products, competitive pricing, and

excellent customer service.

Transaction Summary

- A-Mark paid approximately $9.6

million for an additional 8% of the outstanding equity interest in

SGB.

- A-Mark’s previous option to

increase its ownership interest in SGB has been reduced from 75% to

70%. The option, previously set to expire in September 2024, has

been extended to September 2025.

- Employment agreements have been

entered into with key SGB management, including Nikolas Morianos,

Mihali Belandis and President and Co-Founder Bob Belandis.

SGB financial and operational highlights

for the fiscal year ended April 30, 2024, include:

- Net sales of $467.9 million, gross

profit of $20.8 million (4.4% of net sales), and pre-tax income of

$4.2 million (0.9% of net sales).

- Sold more than 7.85 million ounces

of silver and 151,000 ounces of gold

- Added approximately 53,000 new

customers, for a total of 520,000 customers as of April 30,

2024

- Processed

approximately 105,000 orders

Management

Commentary“Increasing our stake in SGB aligns with our

strategy to expand internationally,” said A-Mark CEO Greg Roberts.

“Since our 2014 investment, SGB has shown consistent growth in

Canada and abroad. We aim to strengthen our partnership with SGB

and may further increase our ownership in the company in the

future.”

Bob Belandis commented: “This marks another

milestone in our enduring partnership with A-Mark. Their previous

investments have fueled significant growth for us. This additional

backing positions us for further expansion in Canada and new

markets.”

Transaction AdvisorsFrye & Hsieh LLP and

Fasken Martineau DuMoulin LLP acted as legal advisors to A-Mark.MLT

Aikins LLP acted as legal advisor to SGB.

About A-Mark Precious

Metals Founded in 1965, A-Mark Precious Metals, Inc.

is a leading fully integrated precious metals platform that offers

an array of gold, silver, platinum, palladium, and copper bullion,

numismatic coins, and related products to wholesale and retail

customers via a portfolio of channels. The company conducts its

operations through three complementary segments: Wholesale Sales

& Ancillary Services, Direct-to-Consumer, and Secured Lending.

The company’s global customer base spans sovereign and private

mints, manufacturers and fabricators, refiners, dealers, financial

institutions, industrial users, investors, collectors, e-commerce

customers, and other retail customers.

A-Mark’s Wholesale Sales & Ancillary

Services segment distributes and purchases precious metal products

from sovereign and private mints. As a U.S. Mint-authorized

purchaser of gold, silver, and platinum coins since 1986, A-Mark

purchases bullion products directly from the U.S. Mint for sale to

customers. A-Mark also has longstanding distributorships with other

sovereign mints, including Australia, Austria, Canada, China,

Mexico, South Africa, and the United Kingdom. The company sells

more than 200 different products to e-commerce retailers, coin and

bullion dealers, financial institutions, brokerages, and

collectors. In addition, A-Mark sells precious metal products to

industrial users, including metal refiners, manufacturers, and

electronic fabricators.

Located in the heart of Hong Kong’s Central

Financial District, LPM Group Limited (LPM), is one of Asia’s

largest precious metals dealers. LPM was acquired by AM/LPM

Ventures, LLC, a subsidiary of A-Mark. LPM offers a wide selection

of products to its wholesale customers, through its retail showroom

and 24/7 online trading platform, including recently released

silver coins, gold bullion, certified coins, and the latest

collectible numismatic issues.

Through its A-M Global Logistics subsidiary,

A-Mark provides its customers with a range of complementary

services, including managed storage options for precious metals as

well as receiving, handling, inventorying, processing, packaging,

and shipping of precious metals and coins on a secure basis.

A-Mark’s mint operations, which are conducted through its wholly

owned subsidiary Silver Towne Mint, enable the company to offer

customers a wide range of proprietary coin and bar offerings and,

during periods of market volatility when the availability of silver

bullion from sovereign mints is often product constrained,

preferred product access.

A-Mark’s Direct-to-Consumer segment operates as

an omni-channel retailer of precious metals, providing access to a

multitude of products through its wholly owned subsidiaries, JM

Bullion and Goldline. JM Bullion is a leading e-commerce retailer

of precious metals and operates eight separately branded,

company-owned websites targeting specific niches within the

precious metals

market: JMBullion.com, ProvidentMetals.com, Silver.com, Gold.com, GoldPrice.org, SilverPrice.org, BGASC.com,

and BullionMax.com. JMB also owns CyberMetals.com, an

online platform where customers can purchase and sell fractional

shares of digital gold, silver, platinum, and palladium bars in a

range of denominations. Goldline markets precious metals directly

to the investor community through various channels, including

television, radio, and telephonic sales efforts. A-Mark also holds

minority ownership interests in three additional direct-to-consumer

brands.

The company operates its Secured Lending segment

through its wholly owned subsidiary, Collateral Finance Corporation

(CFC). Founded in 2005, CFC is a California licensed finance lender

that originates and acquires loans secured by bullion and

numismatic coins. Its customers include coin and precious metal

dealers, investors, and collectors.

A-Mark is headquartered in El Segundo, CA and

has additional offices and facilities in the neighboring Los

Angeles area as well as in Dallas, TX, Las Vegas, NV, Winchester,

IN, Vienna, Austria, and Hong Kong. For more information, visit

www.amark.com.

A-Mark periodically provides information for

investors on its corporate website, www.amark.com, and its

investor relations website, ir.amark.com. This includes press

releases and other information about financial performance, reports

filed or furnished with the SEC, information on corporate

governance, and investor presentations.

Company Contact:Steve Reiner, Executive Vice

President, Capital Markets & Investor RelationsA-Mark Precious

Metals, Inc.1-310-587-1410sreiner@amark.com

Investor Relations Contacts:Matt Glover and

Greg BradburyGateway Group,

Inc.1-949-574-3860AMRK@gateway-grp.com

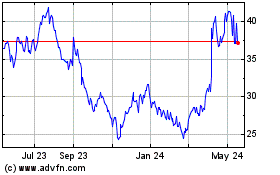

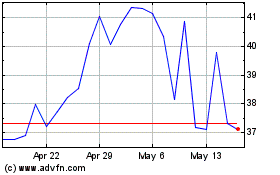

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Dec 2023 to Dec 2024