Aptorum Group Limited (Nasdaq: APM), a clinical stage

biopharmaceutical company (“Aptorum”), and privately-held

YOOV Group Holding Ltd. (“YOOV”) jointly announced today

that they entered into an Agreement and Plan of Merger (as it may

be amended from time to time, the “Merger Agreement”). The

Merger Agreement was approved by Aptorum’s and YOOV’s boards of

directors (each board of directors, the “Board”), respectively. If

the Merger Agreement is approved by Aptorum’s and YOOV’s

shareholders (and the other closing conditions are satisfied or

waived in accordance with the Merger Agreement), and upon

consummation of the transactions contemplated by the Merger

Agreement (the “Closing”, and the date of the Closing, the

“Closing Date”), a wholly-owned subsidiary of Aptorum

organized under the laws of the British Virgin Islands (“Merger

Sub”) will merge with and into YOOV (collectively, the

“Merger”).

In addition, on March 1, 2024, Aptorum, its major shareholder,

Jurchen Investment Corporation (“Jurchen”), which is

controlled by Ian Huen, Executive Director and Chief Executive

Officer of Aptorum, and Aptorum Therapeutics Limited

(“ATL”), a wholly-owned subsidiary of Aptorum have entered

into a split-off agreement (the “Split-Off Agreement”).

Pursuant to the Split-Off Agreement, Aptorum will assign and

transfer the assets and liabilities of its legacy business to ATL,

and Jurchen will acquire 100% issued and outstanding shares of ATL

from Aptorum and surrender certain ordinary shares of Aptorum held

by Jurchen to Aptorum (the “Separation”). The Separation

will become effective immediately following completion of the

Merger. The Separation and the Merger are referred hereto as the

“Proposed Transactions.” Aptorum upon the Closing is referred to

herein as the “combined company.”

Merger Consideration

Upon completion of the Merger, the existing Aptorum shareholders

and existing YOOV shareholders expect to own approximately 10% and

90%, respectively, of the outstanding shares of the combined

company. Aptorum agreed to issue Class A ordinary shares, par value

$0.00001 each (the “Class A ordinary shares”), and Class B

ordinary shares, par value $0.00001 each (the “Class B ordinary

shares”), to YOOV’s shareholders. The total number of ordinary

shares of Aptorum to be issued in the merger equals the number of

aggregate fully diluted shares of YOOV multiply by the “Conversion

Ratio.” The Conversion Ratio is calculated by dividing (i)

Aptorum’s outstanding Class A ordinary shares and Class B ordinary

shares multiplied by nine (ii) by the aggregate fully diluted

shares of YOOV.

This Merger is considered to be a “reverse merger” because the

shareholders of YOOV will own more than a majority of the

outstanding ordinary shares of the combined company following the

Merger. As such, the Merger is subject to NASDAQ’s approval of the

combined company’s initial listing application.

"This transaction marks a significant milestone for YOOV Group

Holding, and we are thrilled about the immense opportunities it

brings. Listing on Nasdaq is a testament to our growth trajectory

and we believe this will propel our company's development and

expansion,” said Phil Wong, Co-Founder and Chief Executive Officer

of YOOV Group Holding Limited.

“We are pleased to announce our proposed reverse merger with

YOOV Group Holding, which we believe will be in the best interest

of our shareholders,” said Ian Huen, Executive Director and Chief

Executive Officer of Aptorum Group. Mr. Huen added, “YOOV is a

promising AI-enabled software and automation platform. The merger

is an exciting and important transaction that will take YOOV to

listing on Nasdaq, which I believe will open further opportunities

for the company to drive growth towards new heights.”

Conditions to Closing of the Merger and the

Separation

The closing of the Merger is subject to satisfaction or waiver

of certain conditions including, but not limited to: (i) obtaining

the approval by the shareholders of Aptorum and YOOV of the matters

required under the Merger Agreement, (ii) approval of the Initial

Listing Application by Nasdaq, (iii) delivery of legal opinions

from British Virgin Islands counsel and Hong Kong counsel of YOOV

to Aptorum and Merger Sub, (iv) delivery of legal opinions from

Cayman Islands counsel of Aptorum and British Virgin Islands

counsel of Merger Sub to YOOV, (v) delivery of a fairness opinion

by Colliers International (Hong Kong) Limited to the Board of

Aptorum to the effect that (subject to various qualifications and

assumptions) that merger consideration (the total Class A ordinary

shares and Class B ordinary shares to be issued to YOOV’s

shareholders) is fair, from a financial point of view (based on the

conclusion that the equity value of YOOV is no less than $250

million), to the shareholders of Aptorum. (vi) availability of

audited financial statements for YOOV and its Subsidiaries as of

March 31, 2023 and 2022 the related audited consolidated statements

of operations, of changes in shareholders’ equity and of cash flows

for the year ended March 31, 2023 and 2022 in conformity with

International Financial Reporting Standards, which shall not be

materially different from the unaudited financial statements of

YOOV for the same period as presented to Aptorum, as determined by

Aptorum in its sole discretion, (vii) delivery of fully executed

lock-up agreement and support agreement by the major shareholder of

Aptorum and the delivery of fully executed lock-up agreement by the

directors and officers of YOOV and by the shareholders of YOOV who

will beneficially own 5% or more outstanding shares of the combined

company.

The closing of the Separation is subject to satisfaction or

waiver of certain conditions including, but not limited to: (i)

proper transfer of shares, by way of duly endorsed certificates, by

Aptorum to Jurchen, (ii) payment of the purchase price, by way of

duly endorsed certificates, by Jurchen to Aptorum, (iii) proper

transfer of records by Aptorum to ATL, as well as between Jurchen

and ATL to Aptorum in regard to records that relate to Aptorum,

(iv) delivery and exchange of Instruments of Assignment, as defined

in the Split-off Agreement, between ATL and Jurchen, (v) delivery

and execution of a release by Jurchen to ATL and Aptorum, (vi)

approval by Aptorum shareholders as to the Separation outlined in

the Split-off Agreement, and (vii) the simultaneous consummation of

the Merger.

For further information regarding the terms and conditions

contained in the Merger Agreement and the Split-off Agreement,

please see Aptorum’s current report on Form 6-K, which was filed

with the U.S. Securities and Exchange Commission in connection with

the Merger and the Separation.

About YOOV Group Holding

YOOV is a business artificial intelligence (AI) and automation

platform that goes beyond traditional automation by applying

advanced AI techniques to optimize various aspects of business

operations. With its comprehensive suite of tools and technologies,

YOOV empowers businesses to streamline their operations, improve

efficiency, and drive digital transformation. YOOV seamlessly

combines its robotic process automation (RPA) platform with

advanced AI capabilities, which offers a variety of possible

solutions to cater to the emerging needs of companies across

different sectors. Over the years, YOOV has been growing rapidly in

the Asia Pacific region and serves companies of all sizes from

diverse industry verticals.

For more information about YOOV, please visit www.yoov.com.

About Aptorum Group

Aptorum Group Limited (Nasdaq: APM) is a clinical stage

biopharmaceutical company dedicated to the discovery, development

and commercialization of therapeutic assets to treat diseases with

unmet medical needs, particularly in oncology (including orphan

oncology indications) and infectious diseases. The pipeline of

Aptorum is also enriched through the co-development of a novel

molecular-based rapid pathogen identification and detection

diagnostics technology with Accelerate Technologies Pte Ltd,

commercialization arm of the Singapore’s Agency for Science,

Technology and Research.

For more information about Aptorum, please visit

www.aptorumgroup.com.

Forward Looking Statements

This press release includes "forward-looking statements" within

the meaning of U.S. federal securities laws. Words such as

"expect," "estimate," "project," "budget," "forecast,"

"anticipate," "intend," "plan," "may," "will," "could," "should,"

"believes," "predicts," "potential," "continue" and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results and, consequently, you

should not rely on these forward-looking statements as predictions

of future events. These forward-looking statements and factors that

may cause such differences include, without limitation, Aptorum's

and YOOV's expectations with respect to future performance, ability

to recognize the anticipated benefits of the merger; costs related

to the Proposed Transactions; the satisfaction of the closing

conditions to the Proposed Transactions; the timing of the

completion of the Proposed Transactions; global economic

conditions; geopolitical events and regulatory changes; and other

risks and uncertainties indicated from time to time in filings with

the SEC. The foregoing list of factors is not exclusive. Additional

information concerning these and other risk factors is contained in

Aptorum's most recent filings with the SEC and will be contained in

the Form F-4 and other filings to be filed as result of the

transactions described above. All subsequent written and oral

forward-looking statements concerning Aptorum, Merger Sub or YOOV

or the transactions described herein or other matters and

attributable to Aptorum, Merger Sub or YOOV, or any person acting

on their behalf are expressly qualified in their entirety by the

cautionary statements above. Readers are cautioned not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. Neither Aptorum, Merger Sub nor YOOV

undertake or accept any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statement

to reflect any change in their expectations or any change in

events, conditions or circumstances on which any such statement is

based.

Participants in Solicitation

YOOV, Aptorum and their respective directors, executive officers

and other members of their management and employees may be deemed

to be participants in the solicitation of proxies of Aptorum’s

shareholders in connection with the potential transactions

described herein under the rules of the SEC. Investors and security

holders may obtain more detailed information regarding the names,

affiliations and interests of YOOV’s and Aptorum’s officers and

directors in the registration statement on Form F-4 to be filed

with the SEC and will also be contained in the proxy

statement/prospectus relating to the proposed transactions when it

is filed with the SEC. These documents may be obtained free of

charge from the sources indicated below.

Non-Solicitation

This press release is not a notice of shareholders meeting or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the proposed transactions and shall

not constitute an offer to sell or a solicitation of an offer to

buy the securities of Aptorum or YOOV, nor shall there be any sale

of any such securities in any state or jurisdiction in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended.

Additional Information about the Transactions and Where to

Find It

In connection with the Proposed Transactions, Aptorum will file

a registration statement on Form F-4 with the SEC and will mail

notices of shareholders meeting and other relevant documents to its

shareholders. Investors and security holders of Aptorum are advised

to read, when available, the Form F-4, and amendments thereto, the

notice to shareholders, and amendments thereto, in connection with

Aptorum’s solicitation of proxies for its shareholder’ meeting to

be held to approve the transactions described herein because the

notice to shareholders will contain important information about the

transactions and the parties to the transactions. The notices to

shareholders will be mailed to Aptorum’s shareholders as of a

record date to be established for voting on the transactions.

Shareholders will also be able to obtain copies of the notice,

without charge, once available, at the SEC’s website at www.sec.gov

or by directing a request to: 17 Hanover Square, London W1S 1BN,

United Kingdom, attention: Ian Huen.

A registration statement relating to these securities will be

filed with the SEC but has not yet become effective. These

securities may not be sold, nor may offers to buy be accepted,

prior to the time the registration statement becomes effective.

This Form 6-K shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. A copy of Aptorum’s registration statement on Form

F-4, once available, can be viewed on the SEC's website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306738845/en/

Aptorum Group Limited Investor Relations Email:

investor.relations@aptorumgroup.com Tel: +44 20 80929299

YOOV Group Holding Limited Investor Relations E-mail:

ir@yoov.com

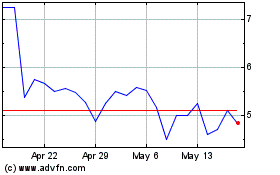

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Nov 2024 to Dec 2024

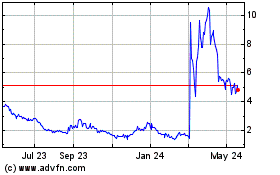

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Dec 2023 to Dec 2024