Ascendis Pharma A/S (Nasdaq: ASND) today announced financial

results for the second quarter ended June 30, 2024, and provided a

business update.

“The recent FDA approval of YORVIPATH demonstrates why our

unrelenting focus on helping patients suffering from

hypoparathyroidism and other serious diseases with considerable

unmet need is so important for Ascendis,” said Jan Mikkelsen,

Ascendis Pharma’s President and Chief Executive Officer. “Already,

two out of our three Endocrine Rare Disease TransCon product

candidates have been approved by the FDA and European Commission.

Our first, SKYTROFA, has achieved U.S. market value leadership,

and, we believe, now with broader market access, remains well

positioned to reach blockbuster status in the U.S. alone. Looking

forward, we are preparing for our second U.S. launch with YORVIPATH

and are on track to report pivotal data in the coming weeks for our

third TransCon product candidate, TransCon CNP.”

Select Highlights & Anticipated 2024

Milestones

- TransCon

hGH:(lonapegsomatropin, marketed as SKYTROFA)

- SKYTROFA revenue for

the second quarter of 2024 totaled €26.2 million, a 27%

year-over-year decrease compared to €35.9 million during the same

period in 2023. 134% year-over-year volume growth was offset by the

cost associated with broader market access for SKYTROFA which also

resulted in a negative adjustment to prior period sales deductions

of €27.1 million, where €19.5 million and €7.6 million were

attributable to the three months ended March 31, 2024, and periods

prior to January 1, 2024, respectively.

- SKYTROFA revenue for

the first half of 2024 totaled €91.2 million, a 35% year-over-year

increase compared to €67.4 million during the same period of 2023.

159% year-over-year volume growth was offset by the cost associated

with broader market access for SKYTROFA which also resulted in a

negative adjustment to prior period sales deductions of €7.6

million, which were attributable to periods prior to January 1,

2024.

- On track to submit a

supplemental Biologics License Application to the FDA for adult

growth hormone deficiency in the third quarter of 2024.

- Topline results from

Phase 2 New InsiGHTS Trial in Turner syndrome expected in the

fourth quarter of 2024.

- TransCon PTH:(palopegteriparatide,

marketed as YORVIPATH)

- Received U.S. FDA

approval for TransCon PTH, under the brand name YORVIPATH, for the

treatment of hypoparathyroidism in adults.

- Completing

manufacturing of commercial product for the U.S. market and

anticipate initial supply will be available in the first quarter of

2025. The Company is in dialogue with the FDA about

commercialization of existing manufactured product, which if

agreed, could be introduced in the U.S. in the fourth quarter of

2024.

- Second quarter

YORVIPATH revenue totaled €5.2 million, reflecting the first full

quarter of commercial launch in Germany and Austria as well initial

revenue in International Markets. Initial revenue in France

expected starting in the fourth quarter of 2024.

- TransCon CNP(navepegritide)

- Topline data from

pivotal ApproaCH Trial expected in the coming weeks, and, if

successful, plan to submit a New Drug Application to FDA for

children with achondroplasia (age 2-11 years) in the first quarter

of 2025.

- Plan to complete

enrollment in the combination TransCon hGH and TransCon CNP COACH

trial of children with achondroplasia (ages 2-11 years) during the

third quarter of 2024; topline Week 26 data expected in the second

quarter of 2025.

- Expect to initiate

teACH, a Phase 2 trial in adolescents with achondroplasia, in the

fourth quarter of 2024.

- Oncology Programs

- Presented new and updated results

from the ongoing Phase 1/2 IL-Believe Trial of TransCon IL-2 β⁄γ in

a poster presentation at ASCO 2024. As of the April 16, 2024, data

cutoff, 40% of efficacy-evaluable patients (2 out of 5) in the

initial cohort of patients with anti-PD-1 refractory melanoma

treated with TransCon IL-2 β⁄γ in combination with TransCon

TLR7/8 Agonist exhibited confirmed clinical responses with no new

safety signals.

- Initial results from

the Phase 2 dose expansion cohort of the IL-Believe Trial of

TransCon IL-2 β⁄γ in combination with chemotherapy in

platinum-resistant ovarian cancer (PROC) will be presented later

this month at the European Society for Medical Oncology (ESMO) 2024

Congress in Barcelona, Spain.

- Financial Update and Outlook Based

on Current Plans

- As of June 30, 2024,

Ascendis Pharma had cash, cash equivalents, and marketable

securities totaling €259 million, compared to €399 million as of

December 31, 2023.

- Full year 2024

SKYTROFA revenue expected to be €220 million to €240 million.

- Expect total

operating expenses (SG&A and R&D) to be approximately €600

million for 2024.

- Pending launch

timing of YORVIPATH in the U.S., expect to be operating cash flow

breakeven on a quarterly basis in 2024 or 2025

- Subsequent to the

quarter end, entered into a $150 million capped synthetic royalty

funding agreement with Royalty Pharma relating to net sales of

YORVIPATH in the United States. More information on this funding

can be found in a separate press release issued today and available

here on the Investors & News section of the Ascendis Pharma

website.

Second Quarter 2024 Financial ResultsTotal

revenue for the second quarter of 2024 was €36.0 million, compared

to €47.4 million during the same period for 2023. Results in the

quarter were primarily impacted by a negative adjustment to prior

periods’ estimates and assumptions for sales deductions of €27.1

million, where €19.5 million and €7.6 million were attributable to

the three months ended March 31, 2024, and periods prior to January

1, 2024, respectively. This was partially offset by increased

demand for SKYTROFA in the U.S. and revenue contribution from

YORVIPATH. In addition, non-product revenue was €4.6 million in the

second quarter of 2024, compared to €11.5 million during the same

period for 2023.

|

Total Revenue (In EUR'000s) |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Revenue from external customers |

|

|

|

|

|

|

|

|

| Commercial

sale of products |

31,389 |

|

35,895 |

|

97,888 |

|

67,446 |

|

|

Licenses |

869 |

|

589 |

|

25,639 |

|

1,203 |

|

| Other |

3,740 |

|

10,909 |

|

8,365 |

|

12,333 |

|

|

Total revenue from external customers |

35,998 |

|

47,393 |

|

131,892 |

|

80,982 |

|

Research and development (R&D) costs for the second quarter

of 2024 were €83.5 million, compared to €105.0 million during the

same period in 2023. The decline was largely tied to lower external

development costs for TransCon TLR 7/8 Agonist and lower costs for

TransCon PTH, as well as lower employee costs as a result of the

Eyconis spin-off.

Selling, general, and administrative (SG&A) expenses for the

second quarter of 2024 were €74.3 million, compared to €70.3

million during the same period in 2023. The increase was primarily

due to higher employee costs, including the impact from commercial

expansion.

Total operating expenses for the second quarter of 2024 were

€157.8 million compared to €175.3 million during the same period in

2023.

Net finance income for the second quarter of 2024 was €29.4

million compared to a net finance income of €26.4 million during

the same period in 2023.

For the second quarter of 2024, Ascendis Pharma reported a net

loss of €109.4 million, or €1.91 per share (basic and diluted)

compared to a net loss of €121.4 million, or €2.16 per share (basic

and diluted) for the same period in 2023.

As of June 30, 2024, Ascendis Pharma had cash, cash equivalents,

and marketable securities totaling €258.7 million compared to

€399.4 million as of December 31, 2023. As of June 30, 2024,

Ascendis Pharma had 58,231,484 ordinary shares outstanding,

including 881,730 ordinary shares represented by ADSs held by the

company.

Conference Call and Webcast InformationAscendis

Pharma will host a conference call and webcast today at 4:30 pm

Eastern Time (ET) to discuss its second quarter 2024 financial

results.

Those who would like to participate may access the live webcast

here, or register in advance for the teleconference here. The link

to the live webcast will also be available on the Investors &

News section of the Ascendis Pharma website at

https://investors.ascendispharma.com. A replay of the webcast will

be available on this section of the Ascendis Pharma website shortly

after conclusion of the event for 30 days.

About Ascendis Pharma A/SAscendis Pharma is

applying its innovative TransCon technology platform to build a

leading, fully integrated biopharma company focused on making a

meaningful difference in patients’ lives. Guided by its core values

of Patients, Science, and Passion, Ascendis uses its TransCon

technologies to create new and potentially best-in-class therapies.

Ascendis is headquartered in Copenhagen, Denmark and has additional

facilities in Europe and the United States. Please visit

ascendispharma.com to learn more.

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, included in this press release

regarding Ascendis’ future operations, plans and objectives of

management are forward-looking statements. Examples of such

statements include, but are not limited to, statements relating to

(i) the timing of topline results from the ApproaCH Trial, (ii)

Ascendis’ expectations regarding full year 2024 SKYTROFA revenue,

(iii) Ascendis’ expectations regarding SKYTROFA’s potential to

reach blockbuster status, (iv) Ascendis’ plan to submit a

supplemental Biologics License Application for SKYTROFA for adult

growth hormone deficiency in the third quarter of 2024, (v) the

timing of topline results from the Phase 2 trial of TransCon hGH in

Turner syndrome, (vi) Ascendis’ plan to submit a New Drug

Application for TransCon CNP for children with achondroplasia,

(vii) Ascendis’ expectations regarding completing manufacturing of

YORVIPATH commercial product for the U.S. market and the timing of

initial supply, (viii) dialogue with FDA regarding

commercialization of existing YORVIPATH manufactured product and,

if agreed, the potential timing of introduction, (ix) Ascendis’

expectations regarding initial revenue in France from YORVIPATH,

(x) Ascendis’ plan to complete enrollment in the COACH Trial, (xi)

the timing of topline Week 26 data from the COACH Trial, (xii) the

timing of initiating the teACH Phase 2 trial in adolescents, (xiii)

Ascendis’ plan to present initial results from the Phase 2 dose

expansion cohort of the IL-Believe Trial, (xiv) Ascendis’

expectations regarding its total operating expenses for 2024, (xv)

Ascendis’ expectation to be operating cash flow breakeven on a

quarterly basis in 2024 or 2025, (xvi) Ascendis’ ability to apply

its TransCon technology platform to build a leading, fully

integrated biopharma company, and (xvii) Ascendis’ use of its

TransCon technologies to create new and potentially best-in-class

therapies. Ascendis may not actually achieve the plans, carry out

the intentions or meet the expectations or projections disclosed in

the forward-looking statements and you should not place undue

reliance on these forward-looking statements. Actual results or

events could differ materially from the plans, intentions,

expectations and projections disclosed in the forward-looking

statements. Various important factors could cause actual results or

events to differ materially from the forward-looking statements

that Ascendis makes, including the following: dependence on third

party manufacturers, distributors and service providers for

Ascendis’ products and product candidates; unforeseen safety or

efficacy results in Ascendis’ development programs or on-market

products; unforeseen expenses related to commercialization of any

approved Ascendis products; unforeseen expenses related to

Ascendis’ development programs; unforeseen selling, general and

administrative expenses, other research and development expenses

and Ascendis’ business generally; delays in the development of its

programs related to manufacturing, regulatory requirements, speed

of patient recruitment or other unforeseen delays; Ascendis’

ability to obtain additional funding, if needed, to support its

business activities; the impact of international economic,

political, legal, compliance, social and business factors. For a

further description of the risks and uncertainties that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to Ascendis’

business in general, see Ascendis’ Annual Report on Form 20-F filed

with the U.S. Securities and Exchange Commission (SEC) on February

7, 2024 and Ascendis’ other future reports filed with, or submitted

to, the SEC. Forward-looking statements do not reflect the

potential impact of any future licensing, collaborations,

acquisitions, mergers, dispositions, joint ventures, or investments

that Ascendis may enter into or make. Ascendis does not assume any

obligation to update any forward-looking statements, except as

required by law.

Ascendis, Ascendis Pharma, the Ascendis Pharma logo, the company

logo, TransCon, SKYTROFA®, and YORVIPATH® are trademarks owned by

the Ascendis Pharma group. © September 2024 Ascendis Pharma

A/S.

|

Investor Contacts: |

Media

Contact: |

| Tim Lee |

Melinda Baker |

| Ascendis Pharma |

Ascendis Pharma |

| +1 (650) 374-6343 |

+1 (650) 709-8875 |

| tle@ascendispharma.com |

media@ascendispharma.com |

| ir@ascendispharma.com |

|

| |

|

| Patti Bank |

|

| ICR Westwicke |

|

| +1 (415) 513-1284 |

|

| patti.bank@westwicke.com |

|

FINANCIAL TABLES FOLLOW

|

Ascendis Pharma A/S Consolidated Statements of Profit or

Loss and Comprehensive Income / (Loss) (In EUR'000s, except share

and per share data) |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Consolidated Statement of Profit or Loss |

|

|

|

|

|

|

|

| Revenue |

|

35,998 |

|

|

|

47,393 |

|

|

|

131,892 |

|

|

|

80,982 |

|

| Cost of

sales |

|

11,465 |

|

|

|

12,929 |

|

|

|

19,034 |

|

|

|

17,551 |

|

|

Gross profit |

|

24,533 |

|

|

|

34,464 |

|

|

|

112,858 |

|

|

|

63,431 |

|

| Research and

development costs |

|

83,478 |

|

|

|

105,021 |

|

|

|

154,165 |

|

|

|

211,134 |

|

| Selling,

general and administrative expenses |

|

74,312 |

|

|

|

70,281 |

|

|

|

141,095 |

|

|

|

136,820 |

|

|

Operating profit/(loss) |

|

(133,257 |

) |

|

|

(140,838 |

) |

|

|

(182,402 |

) |

|

|

(284,523 |

) |

| Share of

profit/(loss) of associate |

|

(5,322 |

) |

|

|

(7,451 |

) |

|

|

(11,118 |

) |

|

|

(8,677 |

) |

| Finance

income |

|

49,052 |

|

|

|

35,761 |

|

|

|

14,395 |

|

|

|

80,374 |

|

| Finance

expenses |

|

19,624 |

|

|

|

9,334 |

|

|

|

58,553 |

|

|

|

18,652 |

|

|

Profit/(loss) before tax |

|

(109,151 |

) |

|

|

(121,862 |

) |

|

|

(237,678 |

) |

|

|

(231,478 |

) |

| Income

taxes/(expenses) |

|

(229 |

) |

|

|

429 |

|

|

|

(2,737 |

) |

|

|

(868 |

) |

| Net

profit/(loss) for the period |

|

(109,380 |

) |

|

|

(121,433 |

) |

|

|

(240,415 |

) |

|

|

(232,346 |

) |

| Attributable

to owners of the Company |

|

(109,380 |

) |

|

|

(121,433 |

) |

|

|

(240,415 |

) |

|

|

(232,346 |

) |

| Basic and

diluted earnings/(loss) per share |

€ |

(1.91 |

) |

|

€ |

(2.16 |

) |

|

€ |

(4.21 |

) |

|

€ |

(4.14 |

) |

| Number of

shares used for calculation (basic and diluted) |

|

57,345,613 |

|

|

|

56,218,257 |

|

|

|

57,114,435 |

|

|

|

56,155,441 |

|

| |

|

|

|

|

|

|

|

| |

(EUR’000) |

|

|

|

Consolidated Statement of Comprehensive Income or

(Loss) |

|

|

|

|

|

|

|

| Net

profit/(loss) for the period |

|

(109,380 |

) |

|

|

(121,433 |

) |

|

|

(240,415 |

) |

|

|

(232,346 |

) |

| Items that

may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

| Exchange

differences on translating foreign operations |

|

15 |

|

|

|

(1,016 |

) |

|

|

78 |

|

|

|

(1,803 |

) |

|

Other comprehensive income/(loss) for the period, net of

tax |

|

15 |

|

|

|

(1,016 |

) |

|

|

78 |

|

|

|

(1,803 |

) |

|

Total comprehensive income/(loss) for the period, net of

tax |

|

(109,365 |

) |

|

|

(122,449 |

) |

|

|

(240,337 |

) |

|

|

(234,149 |

) |

| Attributable

to owners of the Company |

|

(109,365 |

) |

|

|

(122,449 |

) |

|

|

(240,337 |

) |

|

|

(234,149 |

) |

|

Ascendis Pharma A/S Consolidated Statements of Financial

Position (In EUR'000s) |

June 30, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

Non-current assets |

|

|

|

|

Intangible assets |

4,186 |

|

|

4,419 |

|

| Property,

plant and equipment |

104,041 |

|

|

110,634 |

|

| Investment

in associates |

20,564 |

|

|

5,686 |

|

| Other

receivables |

2,186 |

|

|

2,127 |

|

| |

130,977 |

|

|

122,866 |

|

|

Current assets |

|

|

|

|

Inventories |

251,199 |

|

|

208,931 |

|

| Trade

receivables |

49,163 |

|

|

35,874 |

|

| Income tax

receivables |

1,841 |

|

|

802 |

|

| Other

receivables |

29,679 |

|

|

19,097 |

|

|

Prepayments |

36,743 |

|

|

38,578 |

|

| Marketable

securities |

— |

|

|

7,275 |

|

| Cash and

cash equivalents |

258,696 |

|

|

392,164 |

|

| |

627,321 |

|

|

702,721 |

|

|

Total assets |

758,298 |

|

|

825,587 |

|

| |

|

|

|

|

Equity and liabilities |

|

|

|

|

Equity |

|

|

|

| Share

capital |

7,819 |

|

|

7,749 |

|

|

Distributable equity |

(328,952 |

) |

|

(153,446 |

) |

|

Total equity |

(321,133 |

) |

|

(145,697 |

) |

| |

|

|

|

|

Non-current liabilities |

|

|

|

|

Borrowings |

219,052 |

|

|

222,996 |

|

| Contract

liabilities |

5,000 |

|

|

5,949 |

|

| Deferred tax

liabilities |

7,644 |

|

|

5,830 |

|

| |

231,696 |

|

|

234,775 |

|

|

Current liabilities |

|

|

|

|

Convertible notes, matures in April 2028 |

|

|

|

|

Borrowings |

432,190 |

|

|

407,095 |

|

| Derivative

liabilities |

159,059 |

|

|

143,296 |

|

| |

591,249 |

|

|

550,391 |

|

|

Other current liabilities |

|

|

|

|

Borrowings |

21,397 |

|

|

14,174 |

|

| Contract

liabilities |

1,293 |

|

|

1,184 |

|

| Trade

payables and accrued expenses |

99,527 |

|

|

94,566 |

|

| Other

liabilities |

26,411 |

|

|

41,176 |

|

| Income tax

payables |

1,090 |

|

|

2,299 |

|

|

Provisions |

106,768 |

|

|

32,719 |

|

| |

256,486 |

|

|

186,118 |

|

| |

847,735 |

|

|

736,509 |

|

|

Total liabilities |

1,079,431 |

|

|

971,284 |

|

|

Total equity and liabilities |

758,298 |

|

|

825,587 |

|

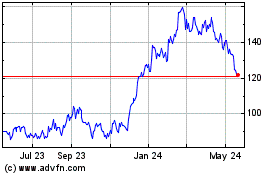

Ascendis Pharma AS (NASDAQ:ASND)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ascendis Pharma AS (NASDAQ:ASND)

Historical Stock Chart

From Sep 2023 to Sep 2024