Tab-cel® U.S. BLA on Track for

Submission in Q2 2024 Following Positive Pre-BLA Meeting

Allogeneic CAR T Pipeline Expands Into

Autoimmune Disease With Plans to Initiate an ATA3219 Lupus

Nephritis Study in H2 2024, and Initial Clinical Data Expected H1

2025

ATA3219 NHL Study Enrolling With Initial

Clinical Data Expected in Q4 2024

Cash Runway Into 2027 Enables Key Pipeline

Readouts

Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a leader in T-cell

immunotherapy, leveraging its novel allogeneic Epstein-Barr virus

(EBV) T-cell platform to develop transformative therapies for

patients with cancer and autoimmune diseases, today reported

financial results for the fourth quarter and full year 2023, recent

business highlights, and key upcoming milestones for 2024.

“We are expanding Atara’s proven EBV T-cell platform into

allogeneic CAR T therapy for both oncology and autoimmune disease,”

said Pascal Touchon, President and Chief Executive Officer of

Atara. “This includes strong momentum for our lead CAR T program,

ATA3219, which is positioned to deliver near-term clinical data for

both non-Hodgkin’s lymphoma and lupus nephritis. We also are

focused on submitting our BLA for tab-cel in the second quarter,

the progress of which triggers financial milestones and sales

royalty opportunities in our partnership with Pierre Fabre.”

Tabelecleucel (tab-cel® or Ebvallo™) for

Post-Transplant Lymphoproliferative Disease (PTLD)

- Atara recently held a positive pre-BLA meeting with the U.S.

Food and Drug Administration (FDA) that supports its plan to submit

the tab-cel relapsed or refractory Epstein-Barr virus positive

post-transplant lymphoproliferative disease (EBV+ PTLD) Biologics

License Application (BLA) in Q2 2024

- Data from the pivotal Phase 3 ALLELE study of tab-cel were

published in The Lancet Oncology and showed a significant 51.2%

objective response rate (ORR) and 23.0-month median duration of

response in relapsed or refractory EBV+ PTLD subjects. Tab-cel was

well tolerated with no events of graft-versus-host disease related

to tab-cel

- Positive new data presented at the 2023 ESMO-IO meeting from

the actively enrolling, multicohort Phase 2 EBVision trial with a

pooled analysis demonstrated a 77.8% ORR in 18 central nervous

system (CNS) EBV+ PTLD subjects including front line EBV+ PTLD

- Atara and Pierre Fabre Laboratories closed the expanded global

partnership in December 2023 for the development, manufacturing,

and commercialization rights of tab-cel in the United States and

all remaining markets

- Atara received approximately $27 million in cash upfront at the

closing of the deal. Under the agreement, Atara has the potential

to receive up to $640 million in additional payments and

significant double-digit tiered royalties on net sales, including

up to $100 million in potential regulatory milestones through BLA

approval

- Atara expects to receive $20 million of these regulatory

milestones in April based on the recent positive pre-BLA meeting,

another $20 million in connection with BLA acceptance, and the

remaining $60 million in potential regulatory milestones in

connection with BLA approval

- In addition, Pierre Fabre Laboratories will reimburse Atara for

tab-cel regulatory and development costs through BLA approval, and

purchase tab-cel inventory manufactured through BLA transfer

ATA3219: CD19 Program in Lupus Nephritis

- Investigational New Drug (IND) application cleared for the use

of ATA3219 as a monotherapy for the treatment of systemic lupus

erythematosus (SLE) with kidney involvement (lupus nephritis

[LN])

- Atara plans to initiate a Phase 1 LN study in H2 2024 with

initial clinical data anticipated H1 2025

- The Phase 1 open-label, dose-escalation study is designed to

evaluate safety, preliminary efficacy, pharmacokinetics, and

biomarkers of a single dose of ATA3219 administered to LN subjects

refractory to one or more lines of treatment. Subjects will receive

lymphodepletion (LD) treatment followed by ATA3219 at a dose of 40,

80, or 160 x 106 CAR+ T cells. Each dose level is designed to

enroll 3-6 patients

- In vitro data demonstrated the CD19 antigen-specific functional

activity of ATA3219 and CAR-mediated activity against B cells from

SLE patients. ATA3219 led to near-complete CD19-specific B-cell

depletion compared to controls. These preclinical data were

submitted as part of a late-breaking abstract which was accepted

for poster presentation at the upcoming International Society for

Cell & Gene Therapy meeting held May 29-June 1, 2024

ATA3219: CD19 Program in Non-Hodgkin’s Lymphoma (NHL)

- Atara initiated enrollment of a multi-center, Phase 1

open-label, dose-escalation clinical trial of ATA3219 in NHL,

including large B-cell lymphomas, follicular lymphoma, and mantle

cell lymphoma, with initial clinical data anticipated in Q4

2024

- Study designed to evaluate safety, preliminary efficacy,

pharmacokinetics, and biomarkers. Subjects will receive LD

treatment followed by ATA3219 at a dose of 40, 80, 240, or 480 x

106 CAR+ T cells. Each dose level is designed to enroll 3-6

patients

- Preclinical data previously presented demonstrated superior in

vivo persistence and CD19-specific anti-tumor efficacy compared to

an autologous CD19 CAR T benchmark with no observed toxicity or

alloreactivity

ATA3431: CD19/CD20 Program for B-Cell Malignancies

- Preclinical data presented at ASH 2023 demonstrated early

evidence of potent antitumor activity, long-term persistence, and

superior tumor growth inhibition compared to an autologous

CD19/CD20 CAR T benchmark

- Dual CD19 and CD20 targeting designed to address CD19 escape

and tumor variability and may provide additional efficacy in

lymphoma

- Atara is progressing toward an IND submission in 2025

Fourth Quarter and Full Year 2023 Financial Results

- Cash, cash equivalents and short-term investments as of

December 31, 2023 totaled $51.7 million, as compared to $102.4

million as of September 30, 2023 and $242.8 million as of December

31, 2022

- Net cash used in operating activities was $50.4 million and

$193.0 million for the fourth quarter and fiscal year 2023, as

compared to $56.9 million and $270.4 million in the same periods in

2022

- Atara reported net losses of $60.5 million, or $0.56 per share,

and $276.1 million, or $2.61 per share, for the fourth quarter and

fiscal year 2023, respectively, as compared to $74.6 million, or

$0.72 per share, and $228.3 million, or $2.24 per share, for the

same periods in 2022

- Total costs and operating expenses include non-cash stock-based

compensation, depreciation and amortization expenses of $11.1

million and $50.2 million for the fourth quarter and fiscal year

2023, respectively, as compared to $12.6 million and $59.5 million

for the same periods in 2022

- Total costs and operating expenses include restructuring

expense of $6.7 million for the fourth quarter and fiscal year 2023

related to the reduction in force Atara announced in November 2023

and which reduced its headcount at that time by approximately 30%.

This reduction in force was substantially completed in December

2023

- Atara announced an additional reduction in force in January

2024 that further reduced its headcount by approximately 25% to

approximately 170 employees

- Research and development expenses were $49.6 million and $224.8

million for the fourth quarter and fiscal year 2023, respectively,

as compared to $62.5 million and $272.5 million for the same

periods in 2022

- Research and development expenses include $5.8 million and

$26.5 million of non-cash stock-based compensation expenses for the

fourth quarter and fiscal year 2023, respectively, as compared to

$7.0 million and $31.4 million for the same periods in 2022

- General and administrative expenses were $11.5 million and

$50.9 million for the fourth quarter and fiscal year 2023,

respectively, as compared to $13.2 million and $71.6 million for

the same periods in 2022

- General and administrative expenses include $4.1 million and

$18.9 million of non-cash stock-based compensation expenses for the

fourth quarter and fiscal year 2023, respectively, as compared to

$4.4 million and $22.5 million for the same periods in 2022

2024 Outlook and Cash Runway

- The cash, cash equivalents and short-term investments of $51.7

million as of December 31, 2023 does not include the approximately

$27 million received in January 2024 from Pierre Fabre Laboratories

from the closing of the expanded global partnership, the

approximately $15 million in proceeds from the issuance of

pre-funded warrants received in the Company’s January 2024

registered direct offering, or the approximately $10 million in

proceeds from the Company’s at-the-market facility (ATM) received

in Q1 2024. The cash, cash equivalents and short-term investments

as of December 31, 2023, together with these amounts results in a

pro-forma December 31, 2023 cash balance of approximately $104

million

- In addition, Atara expects to achieve $40 million of the $100

million in total potential regulatory milestones by BLA acceptance

- Atara expects to receive $20 million of these regulatory

milestones in April based on the recent positive pre-BLA meeting,

another $20 million in connection with BLA acceptance, and the

remaining $60 million in potential regulatory milestones in

connection with BLA approval

- Atara expects full year 2024 operating expenses to decrease by

approximately 35% year-over-year, with the large majority of the

reduction beginning in Q2 2024 and continuing for the remainder of

the year

- Atara expects that cash, cash equivalents and short-term

investments as of December 31, 2023, plus the proceeds received in

Q1 2024 as outlined above from:

- Closing of the expanded global partnership with Pierre Fabre

Laboratories;

- Issuance of pre-funded warrants; and

- The Company’s ATM program;

- When combined with certain anticipated payments from Pierre

Fabre contingent upon the successful filing and approval of the

tab-cel BLA, and operating efficiencies resulting from completed

workforce reductions, and the planned transition of substantially

all activities relating to tab-cel at the time of the BLA transfer

to Pierre Fabre, in total will enable funding of planned operations

into 2027

About ATA3219

ATA3219 combines the natural biology of unedited T cells with

the benefits of an allogeneic therapy. It consists of allogeneic

Epstein-Barr virus (EBV)-sensitized T cells that express a CD19 CAR

construct for the treatment of CD19+ relapsed or refractory B-cell

malignancies, including B-cell non-Hodgkin’s lymphoma and B-cell

mediated autoimmune diseases including systemic lupus erythematosus

(SLE) with kidney involvement (lupus nephritis [LN]). ATA3219 has

been optimized to offer a potential best-in-class profile,

featuring off-the-shelf availability. It incorporates multiple

clinically validated technologies including a modified CD3�

signaling domain (1XX) that optimizes expansion and mitigates

exhaustion, enrichment during manufacturing for a less

differentiated phenotype for robust expansion and persistence and

retains the endogenous T-cell receptor without gene editing as a

key survival signal for T cells contributing to persistence.

About ATA3431

ATA3431 is an allogeneic, bispecific CAR directed against CD20

and CD19, built on Atara’s EBV T-cell platform. The design consists

of a tandem CD20-CD19 design, with binders oriented to optimize

potency. Dual targets address the limitations of single antigen

loss and tumor variability. ATA3431 features a novel 1XX

costimulatory domain, memory phenotype, and retained, unedited

T-cell receptor. Preclinical data have demonstrated early evidence

of antitumor activity, long-term persistence, and superior tumor

growth inhibition compared to an autologous CD19/CD20 CAR T

benchmark.

Next-Generation Allogeneic CAR T Approach

Atara is focused on applying Epstein-Barr virus (EBV) T-cell

biology, featuring experience in over 600 patients treated with

allogeneic EBV T cells, and novel chimeric antigen receptor (CAR)

technologies to meet the current limitations of autologous and

allogeneic CAR therapies head-on by advancing a potential

best-in-class CAR T pipeline in oncology and autoimmune disease.

Unlike gene-edited approaches aimed at inactivating T-cell receptor

(TCR) function to reduce the risk for graft-vs-host disease,

Atara’s allogeneic platform maintains expression of the native EBV

TCR that promote in vivo functional persistence while also

demonstrating inherently low alloreactivity due to their

recognition of defined viral antigens and partial human leukocyte

antigen (HLA) matching. A molecular toolkit of clinically-validated

technologies—including the 1XX costimulatory domain designed for

better cell fitness and less exhaustion while maintaining

stemness—offers a differentiated approach to addressing significant

unmet need with the next generation CAR T.

About Atara Biotherapeutics, Inc.

Atara is harnessing the natural power of the immune system to

develop off-the-shelf cell therapies for difficult-to-treat cancers

and autoimmune conditions that can be rapidly delivered to patients

from inventory. With cutting-edge science and differentiated

approach, Atara is the first company in the world to receive

regulatory approval of an allogeneic T-cell immunotherapy. Our

advanced and versatile T-cell platform does not require T-cell

receptor or HLA gene editing and forms the basis of a diverse

portfolio of investigational therapies that target EBV, the root

cause of certain diseases, in addition to next-generation

AlloCAR-Ts designed for best-in-class opportunities across a broad

range of hematological malignancies and B-cell driven autoimmune

diseases. Atara is headquartered in Southern California. For more

information, visit atarabio.com and follow @Atarabio on X and

LinkedIn.

Forward-Looking Statements

This press release contains or may imply "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. For

example, forward-looking statements include statements regarding:

(1) the development, timing and progress of tab-cel®, including a

potential BLA, the potential characteristics and benefits of

tab-cel®, and the progress and results of, and prospects for, the

expanded global partnership with Pierre Fabre Laboratories

involving tab-cel®, and the potential financial benefits to Atara

as a result of the expanded global partnership with Pierre Fabre

Laboratories, including any payments thereunder; (2) the

development, timing and progress of Atara’s AlloCAR-T programs

(including ATA3219 and ATA3431), including the timing of the start

of any clinical trials, and the safety and efficacy of product

candidates emerging from such programs; (3) Atara’s cash runway,

receipt of potential milestone payments, and operating expenses,

including Atara’s ability to fund its planned operations into 2027;

and (4) Atara’s planned transition of substantially all activities

relating to tab-cel at the time of the BLA transfer to Pierre Fabre

and the timing thereof. Because such statements deal with future

events and are based on Atara’s current expectations, they are

subject to various risks and uncertainties and actual results,

performance or achievements of Atara could differ materially from

those described in or implied by the statements in this press

release. These forward-looking statements are subject to risks and

uncertainties, including, without limitation, risks and

uncertainties associated with the costly and time-consuming

pharmaceutical product development process and the uncertainty of

clinical success; the COVID-19 pandemic and the wars in Ukraine and

the Middle East, which may significantly impact (i) our business,

research, clinical development plans and operations, including our

operations in Southern California and Denver and at our clinical

trial sites, as well as the business or operations of our

third-party manufacturer, contract research organizations or other

third parties with whom we conduct business, (ii) our ability to

access capital, and (iii) the value of our common stock; the

sufficiency of Atara’s cash resources and need for additional

capital; and other risks and uncertainties affecting Atara’s and

its development programs, including those discussed in Atara’s

filings with the Securities and Exchange Commission , including in

the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s most recently filed periodic reports on Form 10-K and

Form 10-Q and subsequent filings and in the documents incorporated

by reference therein. Except as otherwise required by law, Atara

disclaims any intention or obligation to update or revise any

forward-looking statements, which speak only as of the date hereof,

whether as a result of new information, future events or

circumstances or otherwise.

Financials

ATARA BIOTHERAPEUTICS,

INC.

Consolidated Balance

Sheets

(Unaudited)

(In thousands)

December 31,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

25,841

$

92,942

Short-term investments

25,884

149,877

Restricted cash

146

146

Accounts receivable

34,108

40,221

Inventories

9,706

1,586

Other current assets

6,184

10,308

Total current assets

101,869

295,080

Property and equipment, net

3,856

6,300

Operating lease assets

54,935

68,022

Other assets

4,844

7,018

Total assets

$

165,504

$

376,420

Liabilities and stockholders’ equity

(deficit)

Current liabilities:

Accounts payable

$

3,684

$

6,871

Accrued compensation

11,519

17,659

Accrued research and development

expenses

17,364

24,992

Deferred revenue

77,833

8,000

Other current liabilities

31,826

21,394

Total current liabilities

142,226

78,916

Deferred revenue - long-term

37,562

77,000

Operating lease liabilities -

long-term

45,693

58,064

Liability related to the sale of future

revenues - long-term

34,623

30,236

Other long-term liabilities

4,631

5,564

Total liabilities

$

264,735

$

249,780

Stockholders’ (deficit) equity:

Common stock

11

10

Additional paid-in capital

1,870,112

1,821,721

Accumulated other comprehensive loss

(204

)

(2,067

)

Accumulated deficit

(1,969,150

)

(1,693,024

)

Total stockholders’ (deficit) equity

(99,231

)

126,640

Total liabilities and stockholders’

(deficit) equity

$

165,504

$

376,420

ATARA BIOTHERAPEUTICS,

INC.

Consolidated Statements of

Operations and Comprehensive Loss

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

Commercialization revenue

$

4,189

$

—

$

7,886

$

—

License and collaboration revenue

63

221

687

63,573

Total revenue

4,252

221

8,573

63,573

Costs and operating expenses:

Cost of commercialization revenue

3,160

—

8,886

—

Research and development expenses

49,600

62,515

224,785

272,533

General and administrative expenses

11,454

13,245

50,908

71,553

Total costs and operating expenses

64,214

75,760

284,579

344,086

Loss from operations

(59,962

)

(75,539

)

(276,006

)

(280,513

)

Gain on sale of ATOM Facility

—

—

—

50,237

Interest and other income, net

(477

)

969

(105

)

1,986

Total other income (expense), net

(477

)

969

(105

)

52,223

Loss before provision for income taxes

(60,439

)

(74,570

)

(276,111

)

(228,290

)

Provision for income taxes

11

2

15

12

Net loss

$

(60,450

)

$

(74,572

)

$

(276,126

)

$

(228,302

)

Other comprehensive gain (loss):

Unrealized gain (loss) on

available-for-sale securities

367

892

1,863

(1,699

)

Comprehensive loss

$

(60,083

)

$

(73,680

)

$

(274,263

)

$

(230,001

)

Basic and diluted net loss per common

share

$

(0.56

)

$

(0.72

)

$

(2.61

)

$

(2.24

)

Basic and diluted weighted-average shares

outstanding

108,135

103,178

105,912

101,990

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240328081178/en/

Investor and Media Relations: Jason Awe, Ph.D. Senior

Director, Corporate Communications & Investor Relations (805)

217-2287 jawe@atarabio.com

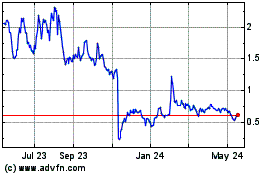

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

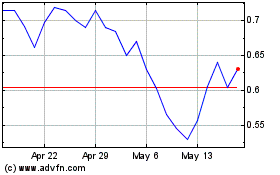

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Feb 2024 to Feb 2025