Filed pursuant to Rule 424(b)(3)

Registration No.: 333-279994

PROSPECTUS SUPPLEMENT No. 7

(To the Prospectus dated June 14, 2024)

BIODEXA PHARMACEUTICALS PLC

2,486,270,400 Ordinary Shares Representing 6,215,676

American Depositary Shares

This prospectus supplement

No. 7 (the “Prospectus Supplement”) amends and supplements our prospectus contained in our Registration Statement on Form

F-1, effective as of June 14, 2024 (the “Prospectus”), related to the resale by the selling shareholders identified in the

Prospectus of up to an aggregate of 2,486,270,400 of our ordinary shares, nominal value £0.001 per share, represented by 6,215,676

American Depositary Shares (the “Depositary Shares”).

This Prospectus Supplement

is being filed in order to incorporate into and include in the Prospectus the information contained in our attached Form 6-K, filed with

the Securities and Exchange Commission on November 1, 2024.

This Prospectus Supplement

should be read in conjunction with the Prospectus and is qualified by reference to the Prospectus except to the extent that the information

in this Prospectus Supplement supersedes the information contained therein.

Our Depositary Shares are

listed on the NASDAQ Capital Market under the symbol “BDRX.” The last reported closing price of Depositary Shares on the NASDAQ

Capital Market on November 1, 2024 was $5.91.

Investing in our securities

involves risks. See “Risk Factors” beginning on page 11 of the Prospectus and in the documents incorporated by reference in

the Prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

______________________________

The date of this Prospectus Supplement is November

4, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 001-37652

Biodexa Pharmaceuticals PLC

(Translation of registrant’s name into English)

1 Caspian Point,

Caspian Way

Cardiff, CF10 4DQ, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

Biodexa Pharmaceuticals

plc (the “Company”) is furnishing this Report on Form 6-K to report on the appointment of PKF Littlejohn LLP as its

independent registered public accounting firm, with an effective date of October 31, 2024, and the resignation of Forvis Mazars LLP

(formerly known as Mazars LLP) as the Company’s independent registered public accounting firm with effect from October 25, 2024.

The change in auditors was

made following notice from Forvis Mazars LLP of their intent to resign and a subsequent tender process. Both the commercial terms and

expertise of the tender participants were assessed during the tender process. As a result of this process, the Audit Committee of the

Board of Directors and the Board selected and, following the resignation of Forvis Mazars LLP, approved the appointment of PKF Littlejohn

LLP as our independent registered public accounting firm. During the Company’s fiscal years ended December 31, 2022 and 2023, and

through October 30, 2024, neither the Company, nor anyone acting on its behalf, consulted with PKF Littlejohn LLP regarding (i) the application

of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered

on the Company’s financial statements, and no written report or oral advice was provided that PKF Littlejohn LLP concluded was an

important factor considered by the Company in reaching a decision as to any such accounting, auditing or financial reporting issue, or

(ii) any matter that was the subject of a disagreement (as defined in Item 16F(a)(1)(iv) of Form 20-F and the related instructions) or

a reportable event (as described in Item 16F(a)(1)(v) of Form 20-F).

The reports of Forvis Mazars

LLP on our consolidated financial statements for the fiscal years ended December 31, 2022 and 2023 contained no adverse opinion or disclaimer

of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle, except that the audit report for

the years ended December 31, 2022 and 2023 contained a modification regarding the Company’s ability to continue as a going concern.

During the two fiscal years

ended December 31, 2022 and 2023 and the subsequent interim period through October 25, 2024, there were no disagreements, as that term

is defined in Item 16F(a)(1)(iv) of Form 20-F, with Forvis Mazars LLP on any matter of accounting principles or practices, financial statement

disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Forvis Mazars LLP, would have caused

Forvis Mazars LLP to make reference thereto in their reports on our consolidated financial statements for such fiscal years.

During the two fiscal years

ended December 31, 2022 and 2023 and the subsequent interim period through October 25, 2024, there were no “reportable events”

as that term is defined in Item 16F(a)(1)(v) of Form 20-F.

The Company provided Forvis

Mazars LLP with a copy of the disclosures it is making in this Report on Form 6-K and requested that Forvis Mazars LLP furnish it with

a letter addressed to the U.S. Securities and Exchange Commission (“SEC”) stating whether or not it agrees with the above

disclosures and, if not, stating the respects in which it does not agree. A copy of Forvis Mazars LLP’s letter to the SEC, dated

November 1, 2024, is attached as Exhibit 16.1 to this Report on Form 6-K.

The Company intends to

use this Report on Form 6-K and the accompanying exhibit to satisfy its reporting obligations under Item 16F(a) of its Form 20-F for the

year ending December 31, 2024, to the extent provided in and permitted by Paragraph 2 of the instructions to Item 16F of Form 20-F and

plans to incorporate this Report on Form 6-K by reference into its Form 20-F to the extent necessary to satisfy such reporting obligations.

The information

included in this Report on Form 6-K, including Exhibit 16.1, shall be deemed to be incorporated by reference into the registration statements

on Form S-8 (File Number 333-209365) and Form F-3 (File Number 333-267932) of the

Company (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this

Report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SUBMITTED HEREWITH

Attached to the Registrant’s Form 6-K filing

for the month of October 2024 is:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Biodexa Pharmaceuticals PLC |

| |

|

|

| Date: November 1, 2024 |

By: |

/s/ Stephen Stamp |

| |

|

Stephen Stamp |

| |

|

Chief Executive Officer and Chief Financial Officer |

Exhibit 16.1

30

Old Bailey

London

EC4M 7AU

Tel: +44 (0)20 7063 4000

forvismazars.com/uk |

|

| Private & Confidential |

|

|

|

Securities and Exchange Commission

100 F Street

NE Washington

D.C. 20549

United States of America |

|

|

| |

Date: |

1 November 2024 |

Ladies and Gentlemen,

We have been furnished with a copy of the form 6-K

to be filed by our former client, Biodexa Pharmaceuticals plc, to satisfy its reporting obligations under Item 16F(a) of its Form 20-F

for the year ending December 31, 2024.

We agree with the statements made in the form 6-K in

response to that Item insofar as they relate to our Firm.

/s/ Forvis Mazars LLP

Forvis Mazars LLP

London

Forvis Mazars LLP

Forvis Mazars LLP is the UK firm of Forvis Mazars Group, a leading global professional services network. Forvis Mazars LLP is a limited

liability partnership registered in England and Wales with registered number OC308299 and with its registered office at 30 Old Bailey,

London, EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details

about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861. VAT number: GB 839 8356 73

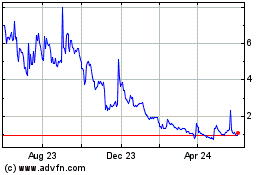

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

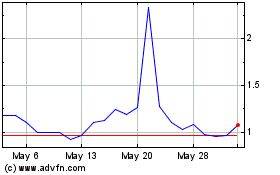

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Nov 2023 to Nov 2024