Form SC 13G/A - Statement of Beneficial Ownership by Certain Investors: [Amend]

November 07 2024 - 3:51PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

|

| |

| SCHEDULE 13G/A |

|

|

| |

| Under the Securities Exchange Act of 1934 |

| |

| (Amendment No. 2)* |

| |

|

Biodexa Pharmaceuticals

PLC |

| (Name of Issuer) |

| |

|

Ordinary shares,

nominal value £0.001 per share |

| (Title of Class of Securities) |

| |

|

59564R708** |

| (CUSIP Number) |

| |

|

September 30, 2024 |

| (Date of Event Which Requires Filing of this Statement) |

| |

| |

| Check the appropriate box to designate the rule pursuant to which this Schedule 13G/A is filed: |

| |

| ¨ |

Rule 13d-1(b) |

| x |

Rule 13d-1(c) |

| ¨ |

Rule 13d-1(d) |

| |

| (Page 1 of 10 Pages) |

______________________________

* The remainder of this

cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

** There is no CUSIP number

assigned to the Ordinary Shares. The CUSIP number 59564R708 has been assigned to the American Depositary Shares (“ADSs”) of

the Issuer, which are quoted on The Nasdaq Capital Market under the symbol “BDRX.” Each ADS represents 400 Ordinary Shares.

The information required

in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| CUSIP No. 59564R708 | 13G/A | Page 2 of 10 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Cavalry Fund I LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

- 0 - |

| 6 |

SHARED VOTING POWER

- 0 - |

| 7 |

SOLE DISPOSITIVE POWER

- 0 - |

| 8 |

SHARED DISPOSITIVE POWER

- 0 - |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0% |

| 12 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 3 of 10 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Cavalry Fund I Management LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

- 0 - |

| 6 |

SHARED VOTING POWER

- 0 - |

| 7 |

SOLE DISPOSITIVE POWER

- 0 - |

| 8 |

SHARED DISPOSITIVE POWER

- 0 - |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0% |

| 12 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 4 of 10 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Cavalry Investment Fund LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

- 0 - |

| 6 |

SHARED VOTING POWER

- 0 - |

| 7 |

SOLE DISPOSITIVE POWER

- 0 - |

| 8 |

SHARED DISPOSITIVE POWER

- 0 - |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0% |

| 12 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 5 of 10 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Cavalry Fund GP, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

- 0 - |

| 6 |

SHARED VOTING POWER

- 0 - |

| 7 |

SOLE DISPOSITIVE POWER

- 0 - |

| 8 |

SHARED DISPOSITIVE POWER

- 0 - |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0% |

| 12 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 6 of 10 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Thomas Walsh |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

- 0 - |

| 6 |

SHARED VOTING POWER

- 0 - |

| 7 |

SOLE DISPOSITIVE POWER

- 0 - |

| 8 |

SHARED DISPOSITIVE POWER

- 0 - |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0% |

| 12 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 7 of 10 Pages |

| Item 1(a). |

NAME OF ISSUER: |

| |

|

| |

The name of the issuer is Biodexa Pharmaceuticals PLC (the “Issuer”). |

| Item 1(b). |

ADDRESS OF ISSUER'S PRINCIPAL EXECUTIVE OFFICES: |

| |

|

| |

The Issuer's principal executive offices are located at 1 Caspian Point, Caspian Way, Cardiff, CF10 4DQ, United Kingdom. |

| Item 2(a). |

NAME OF PERSON FILING: |

| |

This statement is filed by: |

| |

(i) |

Cavalry Fund I LP, a Delaware limited partnership (“Cavalry Fund I”); |

| |

|

| |

(ii) |

Cavalry Fund I Management LLC, a Delaware limited liability company (“Cavalry Fund I Management”); |

| |

|

|

| |

(iii) |

Cavalry Investment Fund LP, a Delaware limited partnership (“Cavalry Investment Fund”); |

| |

|

|

| |

(iv) |

Cavalry Fund GP, LLC, a Delaware limited liability company (“Calvary Fund GP”); and |

| |

|

|

| |

(v) |

Thomas Walsh (“Mr. Walsh”). |

| |

The foregoing persons are hereinafter sometimes collectively referred to as the “Reporting Persons.” |

| |

|

| |

Cavalry Fund I Management is the general partner of Cavalry Fund I. Calvary Fund GP is the general partner of Cavalry Investment Fund. Mr. Walsh is the Manager of Cavalry Fund I Management and the Managing Member of Calvary Fund GP. As such, Cavalry Fund I Management may have been deemed to beneficially own the securities underlying the ADSs that were held by Cavalry Fund I, and Calvary Fund GP may have been deemed to beneficially own the securities underlying the ADSs that were held by Cavalry Investment Fund. Mr. Walsh may have been deemed to beneficially own the securities underlying the ADSs that were held by Cavalry Fund I and Cavalry Investment Fund. To the extent Mr. Walsh was deemed to beneficially own such securities, Mr. Walsh disclaims beneficial ownership of these securities for all other purposes. |

| Item 2(b). |

ADDRESS OF PRINCIPAL BUSINESS OFFICE OR, IF NONE, RESIDENCE: |

| |

The address of the business office of each of the Reporting Persons is 61 82 E. Allendale Rd. Ste 5B, Saddle River, New Jersey 07458. |

| CUSIP No. 59564R708 | 13G/A | Page 8 of 10 Pages |

| |

Cavalry Fund I is a limited partnership organized under the laws of the State of Delaware. Cavalry Fund I Management is a limited liability company organized under the laws of the State of Delaware. Cavalry Investment Fund is a limited partnership organized under the laws of the State of Delaware. Cavalry Fund GP is a limited liability company organized under the laws of the State of Delaware. Mr. Walsh is a citizen of the United States. |

| Item 2(d). |

TITLE OF CLASS OF SECURITIES: |

| |

|

| |

Ordinary shares, nominal value £0.001 per share (the “Ordinary Shares”). |

| Item 2(e). |

CUSIP NUMBER: |

| |

|

| |

There is no CUSIP number assigned to the Ordinary Shares. The CUSIP number 59564R708 has been assigned to the American Depositary Shares (“ADSs”) of the Issuer, which are quoted on The Nasdaq Capital Market under the symbol “BDRX.” Each ADS represents 400 Ordinary Shares. |

| Item 3. |

IF THIS STATEMENT IS FILED PURSUANT TO §§ 240.13d-1(b) OR 240.13d-2(b) OR (c), CHECK WHETHER THE PERSON FILING IS A: |

| |

(a) |

¨ |

Broker or dealer registered under Section 15 of the Act (15 U.S.C. 78o); |

| |

(b) |

¨ |

Bank as defined in Section 3(a)(6) of the Act (15 U.S.C. 78c); |

| |

(c) |

¨ |

Insurance company as defined in Section 3(a)(19) of the Act (15 U.S.C. 78c); |

| |

(d) |

¨ |

Investment company registered under Section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8); |

| |

(e) |

¨ |

Investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E); |

| |

(f) |

¨ |

Employee benefit plan or endowment fund in accordance

with

Rule 13d-1(b)(1)(ii)(F);

|

| |

(g) |

¨ |

Parent holding company or control person in accordance

with

Rule 13d-1(b)(1)(ii)(G); |

| |

(h) |

¨ |

Savings association as defined in Section 3(b) of the Federal Deposit Insurance

Act (12 U.S.C. 1813);

|

| |

(i) |

¨ |

Church plan that is excluded from the definition of an investment company

under Section 3(c)(14) of the Investment Company Act (15 U.S.C. 80a-3);

|

| |

(j) |

¨ |

Non-U.S. institution in accordance with Rule 13d-1(b)(1)(ii)(J); |

| |

(k) |

¨ |

Group, in accordance with Rule 13d-1(b)(1)(ii)(K). |

| |

|

|

|

| |

If filing as a non-U.S. institution in accordance with Rule 13d-1(b)(1)(ii)(J), please specify the type of institution: _________________________________ |

| |

|

|

|

| CUSIP No. 59564R708 | 13G/A | Page 9 of 10 Pages |

| |

|

The information required by Items 4(a) - (c) is set forth in Rows 5 - 11 of the cover page for each Reporting Person hereto and is incorporated herein by reference for each Reporting Person. |

| Item 5. |

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS: |

| |

|

| |

If this statement is being filed to report the fact that as of the date hereof the Reporting Persons have ceased to be the beneficial owner of more than five percent of the class of securities, check the following: ý |

| Item 6. |

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON: |

| |

|

| |

Not applicable. |

| Item 7. |

IDENTIFICATION AND CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY: |

| |

|

| |

Not applicable. |

| Item 8. |

IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP: |

| |

|

| |

Not applicable. |

| Item 9. |

NOTICE OF DISSOLUTION OF GROUP: |

| |

|

| |

Not applicable. |

| |

Each of the Reporting Persons hereby makes the following certification: |

| |

|

| |

By signing below, each Reporting Person certifies that, to the best of his or its knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect. |

| CUSIP No. 59564R708 | 13G/A | Page 10 of 10 Pages |

SIGNATURES

After reasonable inquiry

and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete

and correct.

DATED: November 7, 2024

| |

|

Cavalry Fund I LP |

| |

|

|

| |

|

By: Cavalry Fund I Management LLC,

its General Partner |

| |

|

|

| |

By: |

/s/ Thomas Walsh |

| |

|

Name: Thomas Walsh |

| |

|

Title: Manager |

| |

|

|

| |

|

|

| |

|

Cavalry Fund I Management LLC |

| |

|

|

| |

By: |

/s/ Thomas Walsh |

| |

|

Name: Thomas Walsh |

| |

|

Title: Manager |

| |

|

|

| |

|

|

| |

|

Cavalry Investment Fund LP |

| |

|

By: Cavalry Fund GP, LLC, its General Partner |

| |

|

|

| |

By: |

/s/ Thomas Walsh |

| |

|

Name: Thomas Walsh |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

|

Cavalry Fund GP, LLC |

| |

|

|

| |

By: |

/s/ Thomas Walsh |

| |

|

Name: Thomas Walsh |

| |

|

Title: Managing Member |

| |

|

|

| |

By: |

/s/ Thomas Walsh |

| |

|

Thomas Walsh |

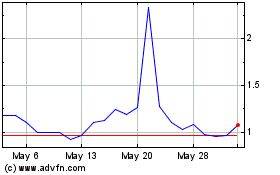

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

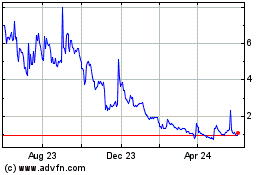

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Nov 2023 to Nov 2024