0001779372December 312023Q2FALSE00017793722023-01-012023-06-300001779372us-gaap:CommonClassAMember2023-01-012023-06-300001779372us-gaap:WarrantMember2023-01-012023-06-3000017793722023-08-09xbrli:shares00017793722023-06-30iso4217:USD00017793722022-12-310001779372us-gaap:RelatedPartyMember2023-06-300001779372us-gaap:RelatedPartyMember2022-12-31iso4217:USDxbrli:shares00017793722023-04-012023-06-3000017793722022-04-012022-06-3000017793722022-01-012022-06-300001779372us-gaap:CommonStockMember2023-03-310001779372us-gaap:AdditionalPaidInCapitalMember2023-03-310001779372us-gaap:RetainedEarningsMember2023-03-3100017793722023-03-310001779372us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001779372us-gaap:CommonStockMember2023-04-012023-06-300001779372us-gaap:RetainedEarningsMember2023-04-012023-06-300001779372us-gaap:CommonStockMember2023-06-300001779372us-gaap:AdditionalPaidInCapitalMember2023-06-300001779372us-gaap:RetainedEarningsMember2023-06-300001779372us-gaap:CommonStockMember2022-03-310001779372us-gaap:AdditionalPaidInCapitalMember2022-03-310001779372us-gaap:RetainedEarningsMember2022-03-3100017793722022-03-310001779372us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001779372us-gaap:CommonStockMember2022-04-012022-06-300001779372us-gaap:RetainedEarningsMember2022-04-012022-06-300001779372us-gaap:CommonStockMember2022-06-300001779372us-gaap:AdditionalPaidInCapitalMember2022-06-300001779372us-gaap:RetainedEarningsMember2022-06-3000017793722022-06-300001779372us-gaap:CommonStockMember2022-12-310001779372us-gaap:AdditionalPaidInCapitalMember2022-12-310001779372us-gaap:RetainedEarningsMember2022-12-310001779372us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001779372us-gaap:CommonStockMember2023-01-012023-06-300001779372us-gaap:RetainedEarningsMember2023-01-012023-06-300001779372us-gaap:CommonStockMember2021-12-310001779372us-gaap:AdditionalPaidInCapitalMember2021-12-310001779372us-gaap:RetainedEarningsMember2021-12-3100017793722021-12-310001779372us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001779372us-gaap:CommonStockMember2022-01-012022-06-300001779372us-gaap:RetainedEarningsMember2022-01-012022-06-30beat:segment0001779372us-gaap:StockOptionMember2023-01-012023-06-300001779372us-gaap:StockOptionMember2022-01-012022-06-300001779372us-gaap:RestrictedStockMember2023-01-012023-06-300001779372us-gaap:RestrictedStockMember2022-01-012022-06-300001779372us-gaap:WarrantMember2023-01-012023-06-300001779372us-gaap:WarrantMember2022-01-012022-06-300001779372us-gaap:PrivatePlacementMember2023-05-022023-05-020001779372us-gaap:PrivatePlacementMember2023-05-020001779372us-gaap:PrivatePlacementMember2023-04-202023-04-200001779372us-gaap:PrivatePlacementMember2023-04-2000017793722023-05-0200017793722023-05-022023-05-020001779372beat:MaverickCapitalPartnersLLCMemberus-gaap:PrivatePlacementMember2023-02-28xbrli:pure0001779372us-gaap:ConvertibleDebtMemberbeat:MaverickCapitalPartnersLLCMember2023-02-280001779372beat:MaverickCapitalPartnersLLCMemberus-gaap:PrivatePlacementMember2023-03-092023-03-090001779372beat:CertainInvestorsMemberus-gaap:PrivatePlacementMember2023-02-010001779372beat:CertainInvestorsMemberus-gaap:PrivatePlacementMember2023-02-172023-02-220001779372beat:CertainInvestorsMemberus-gaap:PrivatePlacementMember2023-02-2200017793722019-12-3100017793722022-01-012022-12-310001779372beat:A2015EquityIncentivePlanMemberbeat:ShareBasedPaymentArrangementOptionAndRestrictedStockUnitsRSUsMember2015-12-310001779372beat:A2015EquityIncentivePlanMemberbeat:ShareBasedPaymentArrangementOptionAndRestrictedStockUnitsRSUsMember2023-06-300001779372beat:A2022EquityPlanMember2022-06-150001779372beat:A2022EquityPlanMember2022-06-152022-06-150001779372beat:A2022EquityPlanMember2023-01-010001779372beat:A2022EquityPlanMember2023-01-012023-01-010001779372beat:A2015EquityIncentivePlanMember2022-06-152022-06-150001779372beat:A2015EquityIncentivePlanMember2023-06-300001779372beat:A2022EquityPlanMember2023-06-300001779372srt:MinimumMember2023-01-012023-06-300001779372srt:MaximumMember2023-01-012023-06-300001779372srt:MinimumMember2022-01-012022-06-300001779372srt:MaximumMember2022-01-012022-06-300001779372us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001779372us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001779372us-gaap:RestrictedStockUnitsRSUMember2022-12-310001779372us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001779372us-gaap:RestrictedStockUnitsRSUMember2023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:EmployeeStockOptionMember2023-04-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:EmployeeStockOptionMember2022-04-012022-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:EmployeeStockOptionMember2023-01-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001779372us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300001779372us-gaap:EmployeeStockOptionMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001779372us-gaap:EmployeeStockOptionMemberus-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001779372us-gaap:EmployeeStockOptionMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001779372us-gaap:EmployeeStockOptionMemberus-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-3000017793722019-05-012019-05-010001779372us-gaap:SubsequentEventMemberbeat:A2022EquityPlanMember2023-07-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number: 001-41060

HEARTBEAM, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | | 47-4881450 |

State or Other Jurisdiction of Incorporation or Organization | | I.R.S. Employer

Identification No. |

| | |

2118 Walsh Avenue, Suite 210 Santa Clara, CA | | 95050 |

| Address of Principal Executive Offices | | Zip Code |

(408) 899-4443

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

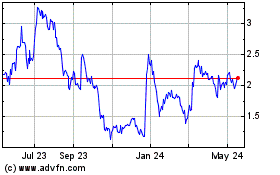

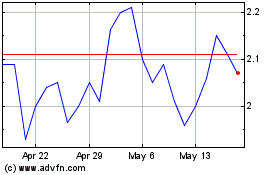

| Common Stock | | BEAT | | NASDAQ |

| Warrants | | BEATW | | NASDAQ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Number of shares of common stock outstanding as of August 9, 2023 was 26,311,904.

HEARTBEAM, INC.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). In particular, statements contained in this Quarterly Report on Form 10-Q, including but not limited to, statements regarding the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities; our future results of operations and financial position, business strategy and plan prospects, or costs and objectives of management for future acquisitions, are forward looking statements. These forward-looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” ’‘targets,” “projects,” “contemplates,” ’‘believes,” “seeks,” “goals,” “estimates,” ’‘predicts,” ’‘potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item lA. “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q and those risks identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission on March 16, 2023. Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

NOTE REGARDING COMPANY REFERENCES

Throughout this Quarterly Report on Form 10-Q, “HeartBeam,” “Company,” “we,” “us” and “our” refer to HeartBeam, Inc.

FORM 10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Condensed Unaudited Financial Statements

HEARTBEAM, INC.

Condensed Balance Sheets (Unaudited)

(In thousands, except share data)

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current Assets: | | | |

Cash and cash equivalents | $ | 17,401 | | | $ | 3,594 | |

| Short-term investments | 3,939 | | | — | |

Prepaid expenses and other assets | 292 | | | 445 | |

Total Assets | $ | 21,632 | | | $ | 4,039 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

Accounts payable and accrued expenses (includes related party $1 and $2 respectively) | 570 | | | 1,665 | |

| | | |

| | | |

Total Liabilities | 570 | | | 1,665 | |

| | | |

| Commitments | | | |

|

| | |

| Stockholders’ Equity | | | |

Preferred stock - $0.0001 par value; 10,000,000 authorized; 0 shares outstanding at June 30, 2023 and December 31, 2022 | — | | | — | |

Common stock - $0.0001 par value; 100,000,000 shares authorized; 25,990,516 and 8,009,743 shares issued and outstanding at June 30, 2023 and December 31, 2022 | 3 | | | 1 | |

Additional paid in capital | 50,535 | | | 24,559 | |

Accumulated deficit | (29,476) | | | (22,186) | |

Total Stockholders’ Equity | $ | 21,062 | | | $ | 2,374 | |

| | | |

Total Liabilities and Stockholders’ Equity | $ | 21,632 | | | $ | 4,039 | |

See accompanying notes to the condensed unaudited financial statements

HEARTBEAM, INC.

Condensed Statements of Operations (Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating Expenses: | | | | | | | |

General and administrative | $ | 1,828 | | | $ | 1,793 | | | $ | 4,303 | | | $ | 3,208 | |

Research and development | 1,484 | | | 1,742 | | | 3,165 | | | 2,475 | |

Total operating expenses | 3,312 | | | 3,535 | | | 7,468 | | | 5,683 | |

| | | | | | | |

| Loss from operations | (3,312) | | | (3,535) | | | (7,468) | | | (5,683) | |

| | | | | | | |

| Other Income | | | | | | | |

| Interest income | 158 | | | 10 | | | 178 | | | 12 | |

| Total other income | 158 | | | 10 | | | 178 | | | 12 | |

| | | | | | | |

| Loss before provision for income taxes | $ | (3,154) | | | $ | (3,525) | | | $ | (7,290) | | | $ | (5,671) | |

| | | | | | | |

| Income tax provision | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | |

| Net Loss | $ | (3,154) | | | $ | (3,525) | | | $ | (7,290) | | | $ | (5,671) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.16) | | | $ | (0.43) | | | $ | (0.52) | | | $ | (0.70) | |

| | | | | | | |

| Weighted average common shares outstanding, basic and diluted | 19,690,251 | | | 8,145,967 | | | 13,910,365 | | | 8,092,237 | |

See accompanying notes to the condensed unaudited financial statements

HEARTBEAM, INC.

Condensed Statement of Changes in Stockholders’ Equity (Unaudited)

(In thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2023 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | | |

| Balance - April 1, 2023 | 8,227,074 | | | $ | 1 | | | $ | 25,462 | | | $ | (26,322) | | | $ | (859) | |

| Stock based compensation expense | — | | | — | | | 702 | | | — | | | 702 | |

| Sale of Common Stock, net of issuance costs | 17,666,666 | | | 2 | | | 24,268 | | | — | | | 24,270 | |

| Stock issuance upon vesting and exercise of stock options | 88,026 | | | — | | | 103 | | | — | | | 103 | |

| Stock issuance upon vesting of restricted stock awards | 8,750 | | | — | | | — | | | — | | | — | |

| Stock issuance upon exercise of warrants | — | | | — | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | (3,154) | | | (3,154) | |

Balance – June 30, 2023 | 25,990,516 | | | $ | 3 | | | $ | 50,535 | | | $ | (29,476) | | | $ | 21,062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three months ended June 30, 2022 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | | |

| Balance - April 1, 2022 | 7,958,888 | | | $ | 1 | | | $ | 23,596 | | | $ | (11,370) | | | $ | 12,227 | |

| Stock based compensation expense | — | | | — | | | 264 | | | — | | | 264 | |

| Stock issuance upon vesting and exercise of stock options | 19,370 | | | — | | | 2 | | | — | | | 2 | |

| Stock issuance upon vesting of restricted stock units | 3,750 | | | — | | | — | | | | | — | |

| Net loss | — | | | — | | | — | | | (3,525) | | | (3,525) | |

| Balance – June 30, 2022 | 7,982,008 | | | $ | 1 | | | $ | 23,862 | | | $ | (14,895) | | | $ | 8,968 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2023 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | | |

| Balance - January 1, 2023 | 8,009,743 | | | $ | 1 | | | $ | 24,559 | | | $ | (22,186) | | | $ | 2,374 | |

| Stock based compensation expense | — | | | — | | | 1,095 | | | — | | | 1,095 | |

| Sale of Common Stock, net of issuance costs | 17,872,955 | | | 2 | | | 24,762 | | | — | | | 24,764 | |

| Stock issuance upon vesting and exercise of stock options | 88,026 | | | — | | | 103 | | | — | | | 103 | |

| Stock issuance upon vesting of restricted stock awards | 12,500 | | | — | | | — | | | — | | | — | |

| Stock issuance upon exercise of warrants | 7,292 | | | — | | | 16 | | | — | | | 16 | |

| Net loss | — | | | — | | | — | | | (7,290) | | | (7,290) | |

| Balance – June 30, 2023 | 25,990,516 | | | $ | 3 | | | $ | 50,535 | | | $ | (29,476) | | | $ | 21,062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six months ended June 30, 2022 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | | |

| Balance - January 1, 2022 | 7,809,912 | | | $ | 1 | | | $ | 22,633 | | | $ | (9,224) | | | $ | 13,410 | |

| Stock based compensation expense | — | | | — | | | 423 | | | — | | | 423 | |

| Sale of Common Stock and warrants | 136,025 | | | | | 804 | | | | | 804 | |

| Stock issuance upon vesting and exercise of stock options | 28,571 | | | — | | | 2 | | | — | | | 2 | |

| Stock issuance upon vesting of restricted stock units | 7,500 | | | — | | | — | | | | | — | |

| Net loss | — | | | — | | | — | | | (5,671) | | | (5,671) | |

| Balance – June 30, 2022 | 7,982,008 | | | $ | 1 | | | $ | 23,862 | | | $ | (14,895) | | | $ | 8,968 | |

See accompanying notes to the condensed unaudited financial statements

HEARTBEAM, INC.

Condensed Statements of Cash Flows (Unaudited)

(In thousands)

| | | | | | | | | | | |

| Six months ended June 30, |

| 2023 | | 2022 |

| Cash Flows From Operating Activities | | | |

Net loss | $ | (7,290) | | | $ | (5,671) | |

Adjustments to reconcile net loss to net cash used in operating activities |

| | |

Stock-based compensation expense | 1,095 | | | 423 | |

Changes in operating assets and liabilities: |

| | |

Prepaid expenses and other current assets | 152 | | | 342 | |

Accounts payable and accrued expenses | (1,094) | | | 638 | |

Net cash used in operating activities | (7,137) | | | (4,268) | |

| | | |

| Cash Flows From Investing Activities | | | |

| Purchase of short-term investments | (3,939) | | | — | |

Net cash used in investing activities | (3,939) | | | — | |

| | | |

| Cash Flows From Financing Activities | | | |

| Proceeds from sale of equity, net of issuance costs | 24,764 | | | 348 | |

| Proceeds from exercise of stock options | 103 | | | 2 | |

| Proceeds from exercise of warrants | 16 | | | — | |

Net cash provided by financing activities | 24,883 | | | 350 | |

| | | |

Net increase (decrease) in cash | 13,807 | | | (3,918) | |

| | | |

| Cash and Cash Equivalents – Beginning of period | 3,594 | | | 13,192 | |

| | | |

| Cash and Cash Equivalents – Ending of period | $ | 17,401 | | | $ | 9,274 | |

| | | |

| Supplemental Disclosures of Cash Flow Information: | | | |

Taxes paid | $ | — | | | $ | — | |

|

| | |

Supplemental Disclosures of Non-cash Financing Activities: | | | |

| Issuance of common stock and warrants to settle accrued expenses | $ | — | | | $ | 456 | |

See accompanying notes to the condensed unaudited financial statements

HEARTBEAM, INC.

NOTES TO CONDENSED UNAUDITED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND OPERATIONS

HeartBeam, Inc. (“HeartBeam” or the “Company”) is a cardiac technology company focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease outside a healthcare facility setting. The Company’s ability to develop higher resolution ECG solutions is achieved through the development of the Company’s proprietary and patented Vector Electrocardiography (“VECG”) technology platform. HeartBeam’s VECG is capable of developing three-dimensional (3D) images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital-based ECG systems.

The Company has validated this novel technology and is seeking U.S. Food and Drug Administration (“FDA”) clearance of its initial telehealth products during 2023 and 2024.

The Company was incorporated in 2015 as a Delaware corporation. The Company’s operations are based in Santa Clara, California and operates as one segment.

NOTE 2 – LIQUIDITY, GOING CONCERN AND OTHER UNCERTAINTIES

The Company is subject to a number of risks similar to those of early stage companies, including dependence on key individuals and products, the difficulties inherent in the development of a commercial market, the potential need to obtain additional capital, competition from larger companies, other technology companies and other technologies.

The Company has incurred losses each year since inception and has experienced negative cash flows from operations in each year since inception. As of June 30, 2023 the Company has a cash and cash equivalents and short-term investments balance of approximately $21.3 million. Based on its current business plan assumptions and expected cash burn rate, the Company believes that the existing cash and cash equivalents and short-term investments are sufficient to fund operations for the next twelve months following the issuance of these unaudited condensed financial statements.

The Company’s continued operations will depend on its ability to raise additional capital through various potential sources, such as equity and/or debt financings, strategic relationships and revenue. The Company expects no material commercial revenue in 2023. Management can provide no assurance that such financing or strategic relationships will be available on acceptable terms, or at all, which would likely have a material adverse effect on the Company and its financial statements.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying condensed unaudited financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("US GAAP") and in conformity with the instructions on Form 10-Q and Rule 8-03 of Regulation S-X and the related rules and regulations of the Securities and Exchange Commission (“SEC”) and have been prepared on a basis which assumes that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. In the opinion of management, the unaudited interim condensed financial statements reflect all adjustments, which include only normal recurring adjustments necessary for the fair statement of the balances and results of operations for the periods presented. The interim operating results are not necessarily indicative of results that may be expected for any subsequent period. The accompanying condensed unaudited financial statements should be read in conjunction with the Company’s audited financial statements and notes thereto included in the Company’s Form 10-K filed with the SEC on March 16, 2023 (“2022 Annual Report”).

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash deposits. The Company maintains its cash in institutions insured by the Federal Deposit Insurance Corporation and has cash balances in accounts which exceed the federally insured limits as of June 30, 2023 and December 31, 2022.

SHORT-TERM INVESTMENTS

Short-term investments consist of debt securities classified as held-to-maturity and have original maturities greater than 90 days but, less than one year as of the balance sheet date. Held-to-maturity investments are recorded at the amortized cost basis until date of maturity and are carried at amortized cost net of allowance for credit losses, which approximates their fair value determined based on Level 2 inputs. As of June 30, 2023, the short-term investments have an amortized cost basis of $3,939,151.

USE OF ESTIMATES

The preparation of financial statements in conformity with US GAAP, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates. Due to the inherent uncertainty involved in making estimates, actual results reported in future periods may be based on amounts that differ from those estimates.

NET LOSS PER COMMON SHARE

Basic net loss per share excludes the effect of dilution and is computed by dividing the net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding.

Diluted net loss per share is computed by giving effect to all potential shares of common stock, including stock options and warrants to the extent dilutive. Basic net loss per share was the same as diluted net loss per share for the three and six months ended June 30, 2023 and 2022 as the inclusion of all potential common shares outstanding would have an anti-dilutive effect.

In accordance with ASC 260-10-45-13, exercisable penny options are included in the calculation of weighted average basic and diluted earnings per share. As of June 30, 2023, 177,355 penny options have been included in the calculation of weighted average basic and diluted earnings per share.

The following is a summary of awards outstanding as of June 30, 2023 and 2022, which are not included in the computation of basic and diluted weighted average shares:

| | | | | | | | | | | | | | | | | |

| | | Three and Six months ended June 30, |

| | | | 2023 | | 2022 |

| Stock options (excluding exercisable penny stock options) | | | | | 2,851,383 | | | 1,868,218 | |

| Restricted stock awards | | | | | 246,470 | | | 22,500 | |

| Warrants | | | | | 5,152,397 | | | 3,908,276 | |

| Total | | | | | 8,250,250 | | | 5,798,994 | |

NOTE 4 – STOCKHOLDERS’ EQUITY

COMMON STOCK

On May 2, 2023, the Company entered into a Securities Purchase Agreement with an accredited investor, for the purchase and sale in a registered direct offering of 1,000,000 shares of the Company’s common stock at a price of $1.50 per share, generating net proceeds from the offering of approximately $1.1 million after deducting financial advisory and legal fees as well as other estimated offering expenses.

On April 20, 2023, the Company entered into a Placement Agency Agreement with Public Ventures, LLC to consummate an offering of 16,666,666 shares of Common Stock at an offering price of $1.50 per share, which closed in accordance with the subscription agreement dated May 2, 2023. The Company received $23.2 million in net proceeds from the offering after deducting placement agent discounts and commission and other estimated offering expenses payable by the Company. In addition, the subscription agreement grants placement agent warrants to purchase up to 1,666,666 shares of common stock

at a per share exercise price of $1.875 and are exercisable after a 180-day lock-up period. The warrants will expire five years from the date of issuance.

On February 2, 2023, the Company entered into a securities purchase agreement and a note purchase agreement (“SPA”, NPA” or together “Agreements”) with Maverick Capital Partners, LLC (“Maverick” or “Investor”). Pursuant to the terms of the Agreements, as amended, the Company agreed to sell up to $4,000,000 of the Company’s common stock at 75% of the average calculated Volume Weighted Average Price (“VWAP”) per share.

On February 28, 2023, the Company issued a $500,000 Convertible Note to the Investor pursuant to the NPA. On March 9, 2023, the Convertible Note was settled upon the execution of the SPA and related issuance of 200,105 shares of common stock pursuant to the SPA draw down notice dated March 9, 2023. These shares of common stock were registered under the Company’s registration statement on Form S-3 dated February 10, 2023 and the related prospectus supplement dated March 9, 2023, whereby, the Company received total proceeds of $500,000. These were the only transactions consummated under the SPA and NPA and the respective agreements expired on May 31 2023.

On February 1, 2023, the Company entered into a Sales Agreement with certain investors to issue and sell through the sales agent shares of the Company’s common stock. The issuance and sale of shares of Common Stock to or through the sales agent will be effected pursuant to the Registration Statement dated February 2, 2023. The Company shall pay to the sales agent in cash, upon each sale of placement shares through the sales agent pursuant to the Sales Agreement, an amount equal to 3.00% of the aggregate gross proceeds from each sale of placement shares. In connection to the Sales Agreement, on February 17, 2023 and February 22, 2023, the Company sold 6,184 shares at $3.76 per share for gross proceeds of approximately $23,000.

Total stock issuance costs, which consist primarily of legal, accounting and underwriting fees in connection with the above stated transactions was approximately $174,000, which as of June 30 2023, was fully recorded in additional paid in capital.

WARRANTS

On May 2, 2023 the Company issued 1,666,666 placement agent warrants to purchase shares of Common Stock sold in the offering, with an exercise price of $1.875 per share and are exercisable for five years from the date of issuance, after a 180-day lockup period.

During 2019, milestone warrants to purchase common stock were issued to certain executives totaling 407,272 warrants (“Penny Warrants”). These warrants were valued on the date of grant at $0.0003 and vest upon meeting certain milestones. These warrants expired unissued in February 2023.

The following is a summary of warrant activity during the six months ended June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of

shares | | Weighted

average exercise

price | | Weighted

average

remaining life (years) | | Aggregate

intrinsic value

(in thousands) |

Outstanding - December 31, 2022 | 3,908,276 | | | $ | 5.42 | | | 3.47 | | $ | 2,020 | |

| Issued | 1,666,666 | | | 1.88 | | | — | | — | |

| Exercised | (11,638) | | | 2.75 | | | — | | — | |

| Expired | (410,907) | | | — | | | — | | — | |

Outstanding and Exercisable – June 30, 2023 | 5,152,397 | | | $ | 4.71 | | | 3.85 | | $ | 892 | |

During the six months ended June 30, 2023, 11,638 warrants were exercised, of these 5,817 were exercised in the form of a cashless exercise utilizing 4,347 warrants which resulted in the issuance of 1,471 common shares and 5,821 warrants were exercised for approximately $16,000.

NOTE 5 – STOCK-BASED COMPENSATION

In 2015, the Company’s Board of Directors approved the HeartBeam, Inc. 2015 Equity Incentive Plan ("2015 Plan"), to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees, directors, and consultants, and to promote the success of the Company’s business. The 2015 Plan provides for the grant of stock options and RSU’s to purchase common stock of which 1,636,362 were authorized by the board of which

1,083,749 are outstanding. The 2015 Plan was terminated upon shareholder approval of the 2022 Equity Incentive Plan (“2022 Equity Plan”) whereby no new awards can be issued under the 2015 Plan.

The Company’s shareholders approved the 2022 Equity Plan at the annual meeting of stockholders held on June 15, 2022, pursuant to which 1,900,000 shares of common stock were authorized for issuance. Under the 2022 Equity Plan, the number of shares available for issuance will be increased on the first day of each fiscal year beginning with the 2023 fiscal year, in an amount equal to the lesser of 3,800,000 shares, five percent (5%) of the total number of shares of all classes of common stock of the Company outstanding on the last day of the immediately preceding fiscal year, and a lesser number of shares determined by the administrator. On January 1, 2023 400,487 shares, equivalent to five percent (5%) of common stock outstanding were added to the shares available for issuance under the 2022 Equity Plan.

The 2022 Equity Plan includes a provision to add-back any cancelled options from the 2015 Plan up to 1,372,816 shares. As of June 30, 2023, there are 160,689 shares from the 2015 Plan that are included in the 222,885 shares available for issuance under the 2022 Equity Plan.

The Company received proceeds of $0.1 million from the exercise of stock options during the quarter ended June 30, 2023 and a de minimis amount during the quarter ended June 30, 2022.

STOCK OPTIONS

The following is a summary of stock option activity during the six months ended June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of

options

outstanding | | Weighted

average

exercise

price | | Average

remaining

contractual life

(in years) | | Aggregate

intrinsic value

(in thousands) |

| | | | | | | |

Outstanding – December 31, 2022 | 2,196,798 | | | $ | 1.76 | | | 8.7 | | $ | 6,770 | |

Options granted | 1,115,800 | | | 2.62 | | | — | | | — | |

Options exercised | (88,026) | | | 1.17 | | | — | | | — | |

| Options cancelled | (195,834) | | | 1.70 | | | — | | | — | |

| | | | | | | |

Outstanding – June 30, 2023 | 3,028,738 | | | 2.10 | | | 8.7 | | 2,040 | |

Exercisable – June 30, 2023 | 1,052,605 | | | $ | 1.64 | | | 7.6 | | $ | 1,177 | |

The Company estimates the fair values of stock options using the Black-Scholes option-pricing model on the date of grant. For the six months ended June 30, 2023 and 2022, the assumptions used in the Black-Scholes option pricing model, which was used to estimate the grant date fair value per option, were as follows:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2023 | | 2022 |

| Weighted-average Black-Scholes option pricing model assumptions: | | | |

| Volatility | 110.23% - 111.73% | | 107.25% - 110.98% |

| Expected term (in years) | 5.71 - 6.07 | | 5.73 - 5.80 |

| Risk-free rate | 3.54% - 3.80% | | 1.47% - 2.85% |

| Expected dividend yield | $ | — | | | $ | — | |

| Weighted average grant date fair value per share | $1.73 - $3.38 | | $1.08 - $1.75 |

RESTRICTED STOCK UNITS

The following is a summary of RSU’s awards activity: | | | | | | | | | | | | | | |

| | Six months ended June 30, 2023 |

| | Numbers of Shares | | Weighted Average Grant Date Fair value |

| Non-Vested at beginning of period | | 253,970 | | | $ | 1.47 | |

| Shares granted | | 5,000 | | | 2.24 | |

| Shares vested | | (12,500) | | | 2.82 | |

| Non-vested | | 246,470 | | | $ | 1.44 | |

STOCK BASED COMPENSATION

The following is a summary of stock-based compensation expense:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| General and administrative | | | | | | | | | | | |

| Stock options | 507,200 | | | 175,900 | | | 707,200 | | | 296,800 | | | | | |

| RSU’s | 116,400 | | | 23,100 | | | 217,400 | | | 35,000 | | | | | |

| Total general and administrative | 623,600 | | | 199,000 | | | 924,600 | | | 331,800 | | | | | |

| R&D | | | | | | | | | | | |

| Stock options | 78,800 | | | 64,800 | | | 170,800 | | | 90,900 | | | | | |

| Total | $ | 702,400 | | | $ | 263,800 | | | $ | 1,095,400 | | | $ | 422,700 | | | | | |

As of June 30, 2023, total compensation cost not yet recognized related to unvested stock options and unvested RSUs was approximately $3.5 million and $0.01 million, respectively, which is expected to be recognized over a weighted-average period of 2.23 years and 0.03 years, respectively.

NOTE 6 – RELATED PARTY TRANSACTIONS

During the course of business, the Company obtains accounting services from CTRLCFO, a firm in which an executive of the Company has significant influence. The Company incurred accounting fees from this firm of approximately $4,000 and $9,000 during the three and six months ended June 30, 2023, respectively and approximately $4,000 and $11,000 during the three and six months ended June 30, 2022, respectively. The Company had balances due to these firms amounting to approximately $1,100 and $2,000 as of June 30, 2023 and December 31, 2022, respectively.

NOTE 7 – COMMITMENTS

Lease Obligations

On May 1, 2019, the Company entered into a month to month lease agreement for their headquarters. The agreement is for an undefined term and can be cancelled at any time, given one month’s notice by either party. The Company’s monthly rent expense associated with this agreement is approximately $1,440. The Company’s month to month headquarters lease is in the name of the Company’s Chief Executive Officer, and the cost is reimbursed monthly.

For the three and six months ended June 30, 2023 and 2022, rent expense was approximately $4,000 and $8,000, respectively for each period.

Professional Services Agreement

In March 2022, the Company entered into a professional services agreement with Triple Ring Technologies, Inc (“TRT”) a co-development company, which was followed by several amendments.

The Company currently has one open committed project for device cost reductions totaling $1.7 million. As of June 30, 2023 the Company has a remaining commitment of $0.8 million.

NOTE 8 - SUBSEQUENT EVENTS

At the July 7, 2023 Annual Shareholders’ Meeting, the proposal to amend the 2022 Equity Incentive Plan to increase the number of authorized shares from 1,900,000 shares to 5,900,000 shares was approved.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following management’s discussion and analysis is intended as a review of significant factors affecting our financial condition and results of operations for the periods indicated. The discussion should be read in conjunction with our condensed unaudited financial statements and the notes presented herein included in this Form 10-Q and the audited financial statements and the other information set forth in the 2022 Form 10-K. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect” and the like, and/or future tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. In addition to historical information, the following Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties including, but not limited to, those set forth below under “Risk Factors” and elsewhere herein, and those identified under Part I, Item 1A of our 2022 Form 10-K. Our actual results could differ significantly from those anticipated in these forward-looking statements as a result of certain factors discussed herein and any other periodic reports filed and to be filed with the Securities and Exchange Commission.

Overview

We are a medical technology company primarily focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease outside a healthcare facility setting. Our ability to develop higher resolution ECG solutions is achieved through the development of our proprietary and patented Vector Electrocardiography (“VECG”) technology platform. Our VECG technology is capable of developing three-dimensional (3D) images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that has demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital based ECG systems.

Our aim is to deliver ambulatory cardiac health monitoring technologies that can be used for patients anywhere, especially where critical cardiac care decisions need to be made on a more timely basis. Our products (hereinafter “Product” or “Products”) require Food and Drug Administration (“FDA”) clearance and have not been cleared for marketing.

We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. We are developing our telehealth Product (“HeartBeam AIMIGoTM”), to address the rapidly growing field of ambulatory cardiac health monitoring. HeartBeam AIMIGo is comprised of a credit card sized electrocardiogram device and other powerful cloud-based diagnostic expert software systems. We believe that we are uniquely positioned to play a central role in remote monitoring of high-risk coronary artery disease patients, as initial studies have shown that our ischemia detection system may be more accurate than existing ambulatory cardiac health monitoring solutions.

To date, we have developed a working prototype for HeartBeam AIMIGo. In addition, we recently filed a 510(k) submission for our HeartBeam AIMIGo device. In June 2023, we submitted a request for a pre-submission meeting to the FDA for the software algorithms that synthesize a 12L ECG from the HeartBeam AIMIGo device. After the pre-submission meeting with the FDA, we plan to file a second 510(k) for the synthesize 12L ECG. The result of these two 510(k) submissions, once cleared by the FDA, will be an ambulatory device, carried by patients, which can synthesize a 12L ECG for physician review.

In an effort to focus on the HeartBeam AIMIGo product, we withdrew our FDA 510(k) application for the HeartBeam AIMI™ product. HeartBeam AIMI is focused on Emergency Room use, which is a significantly smaller opportunity than its HeartBeam AIMIGo ambulatory ECG market. This decision will allow the company to focus on the product development, clinical, regulatory, and market preparation efforts for HeartBeam AIMIGo.

The custom software and hardware of our Products, are classified as Class II medical devices by the FDA, running on an FDA registered Class I software platform. Premarket review and clearance by the FDA for Class II devices is generally accomplished through the 510(k) premarket notification process or De-Novo process. Given the proposed intended use of our device, the 510(k) submission would require clinical data to support FDA clearance.

HeartBeam has ten issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963, U.S. 11,701,049, U.S. 11,529,085, U.S. 10,980,433, U.S. 11,412,972, U.S. and 11,234,658), and eight pending U.S applications. Four of the pending applications have been published, the remaining four pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands and United Kingdom and seven pending applications in Canada, China, the European Union, Japan and Australia. HeartBeam has three pending Patent Cooperation Treaty applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

As of June 30, 2023, we had 10 employees. We intend to hire or engage additional full-time professionals, employees, and / or consultants in alignment with our growth strategy. Although the market is highly competitive for attracting and retaining highly qualified professionals in our industry, we continue our endeavor to find such candidates for our Company. Our management team and additional personnel that we may hire in the future will be primarily responsible for executing and implementing growth opportunities, making tactical decisions related to our strategy and pursuing opportunities to invest in new technologies through strategic partnerships and acquisitions.

Recent Developments

On May 2 2023, we completed a sale of approximately $25 million from a secondary offering of 16,666,666 shares of our common stock. We received net proceeds of $23.2 million, after deducting the placement agent fees on the secondary offering and expenses.

On May 4, 2023, we completed a Registered Direct Offering of 1,000,000 shares of our common stock. We received net proceeds of $1.1 million after deducting expenses.

On May 17 2023, we filed our 510(k) submission for our HeartBeam AIMIGo device. In June 2023, we submitted a request for a pre-submission meeting to the FDA for the software algorithms that synthesize a 12L ECG from the HeartBeam AIMIGo device. The result of these two submissions, when cleared by FDA, will be ambulatory device, carried by patients, which can synthesize a 12L ECG for physician review. In an effort to focus on the HeartBeam AIMIGo product, we also withdrew our FDA 510(k) application for the HeartBeam AIMI™ product. HeartBeam AIMI is focused on emergency room use, which is a significantly smaller opportunity than its HeartBeam AIMIGo ambulatory ECG market. This decision will allow the company to focus on the product development, clinical, regulatory, and market preparation efforts for HeartBeam AIMIGo.

At the July 7, 2023 Annual Shareholders’ Meeting, the proposal to amend the 2022 Equity Incentive Plan to increase the number of authorized shares from 1,900,000 shares to 5,900,000 shares was approved.

In August 2023, we announced our first peer-reviewed publication based on our novel VECG technology. We believe this is a foundational study demonstrating the ability of our VECG platform to detect the presence of coronary artery occlusions. The publication, entitled “Coronary Artery Occlusion Detection Using 3-Lead ECG System Suitable for Credit Card-Size Personal Device Integration,” appeared in JACC: Advances, a journal of the American College of Cardiology.

Other Transactions and Events:

Stock Purchase Agreement and Note Purchase Agreement

On February 28, 2023, the Company entered into a securities purchase agreement and a note purchase agreement (“SPA”, NPA” or together “Agreements”) with Maverick Capital Partners, LLC. Pursuant to the terms of the Agreements, as amended, the Company agreed to sell up to $4,000,000 of the Company’s common stock at 75% of the average calculated Volume Weighted Average Price per share during a Drawdown Pricing Period as defined in the Agreements. On March 1, 2023, the Company issued a $500,000 Convertible Note to the Investor pursuant to the NPA resulting in gross proceeds of $500,000, before deducting other expenses. On March 7, 2023, the Company paid off $500,000 principal amount of the Convertible Note plus accumulated interest. On March 7, 2023, the Company issued a draw down notice under the SPA for 200,105 shares of Common Stock and received net proceeds of $500,000 under the SPA. The Agreements expired May 31, 2023.

ATM Program

On February 10, 2023, we entered into a sales agreement (the “Sales Agreement”) with A.G.P./Alliance Global Partners as placement agent pursuant to which the Company may issue and sell, from time to time, shares of our common stock having an initial aggregate offering price of up to $13.0 million in at-the-market offerings (“ATM”) sales. The issuance and sale of these placement shares are made under the Sales Agreement pursuant to our effective “shelf” registration statement on Form S-3 (Registration No. 333-269520). There were 0 and 6,184 shares issued under the ATM during the three and six months ended June 30, 2023, respectively. As of June 30, 2023 there was approximately $11.0 million available for issuance under the ATM following the use of the shelf registration on Form S-3 for the Agreements and the ATM during the period.

Results of operations

The following table summarizes our results of operations for the periods presented on our statement of operations data.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For three months ended June 30, | | For six months ended June 30, | | |

| 2023 | | 2022 | | $ Change | | % Change | | 2023 | | 2022 | | $ Change | | % Change | | | | | | | | |

| (In thousands, except percentages) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | |

| General and administrative | $ | 1,828 | | | $ | 1,793 | | | $ | 35 | | | 2 | % | | $ | 4,303 | | | $ | 3,208 | | | $ | 1,095 | | | 34 | % | | | | | | | | |

| Research and development | 1,484 | | | 1,742 | | | (258) | | | (15) | % | | 3,165 | | | 2,475 | | | 690 | | | 28 | % | | | | | | | | |

| Total operating expenses | 3,312 | | | 3,535 | | | (223) | | | (6) | % | | 7,468 | | | 5,683 | | | 1,785 | | | 31 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Loss from operations | (3,312) | | | (3,535) | | | 223 | | | (6) | % | | (7,468) | | | (5,683) | | | (1,785) | | | 31 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interest income (expense) | 158 | | | 10 | | | 148 | | | 1,480 | % | | 178 | | | 12 | | | 166 | | | 1,383 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Income tax provision | — | | | — | | | — | | | — | % | | — | | | — | | | — | | | — | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | $ | (3,154) | | | $ | (3,525) | | | $ | 371 | | | (11) | % | | $ | (7,290) | | | $ | (5,671) | | | $ | (1,619) | | | 29 | % | | | | | | | | |

Summary of Statements of Operations for the three and six months ended June 30, 2023 compared with the three and six months ended June 30, 2022:

General and administrative expenses during the three and six months ended June 30, 2023, were $1.8 million and $4.3 million, respectively, representing an increase of $0.04 million, or 2%, and $1.1 million, or 34%, when compared to the same periods in 2022.

There is no material change during the three months ended June 30, 2023. The $1.1 million increase in expense during the six months ended June 30, 2023 is primarily due to non-cash stock-based compensation expense and costs associated with transitioning our commercial team.

Research and development expenses (“R&D”) are primarily from internally developed software and our credit-card sized collection device. R&D expenses were $1.5 million and $3.2 million for the three and six months ended June 30, 2023, respectively, representing a decrease of $0.3 million, or 15%, and an increase of $0.7 million, or 28%, respectively, when compared to the same periods in 2022.

Our spending increase of $0.7 million in R&D during the six months ended June 30, 2023 occurred during the first quarter, and is primarily $0.5 million with our service provider, Triple Ring Technologies, $0.2 million representing an increase in headcount and $0.2 million in other R&D expenses, offset by spending reductions in the quarter ended June 30, 2023 when compared to June 30, 2022, which were due to our refined focus on development projects.

During the three months ended June 30, 2022, our focus was on preparing for FDA submission of our first product using consultants, during the three months ended June 30, 2023 we prepared for the FDA submission of our hardware device using our internal development team supported by regulatory and quality consultants.

Interest income during the three and six months ended June 30, 2023, and 2022 is related to interest earned on our cash balances. The increase is primarily related to our increased cash balance coupled with higher interest rates.

Liquidity and Capital Resources

Our cash requirements are and will continue to be dependent upon a variety of factors. We expect to continue devoting significant capital resources to R&D and go to market strategies.

As of June 30, 2023, we had approximately $17.4 million in cash, an increase of $13.8 million from $3.6 million as of December 31, 2022. In addition, we had short-term investments of $3.9 million that are scheduled to mature in September 2023.

During the six months ended June 30, 2023, we raised $24.8 million from the sale of securities.

Our cash is as follows (in thousands):

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| Cash | | $ | 17,401 | | | $ | 3,594 | |

Cash flows for the six months ended June 30, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | |

| | Six months ended June 30, |

| | 2023 | | 2022 |

| Net cash used in operating activities | | $ | (7,137) | | | $ | (4,268) | |

| Net cash used in investing activities | | (3,939) | | | — | |

| Net cash provided by financing activities | | 24,883 | | | 350 | |

Operating Activities:

Net cash used by our operating activities of $7.1 million during the six months ended June 30, 2023, is primarily due to our net loss of $7.3 million less $1.1 million in non-cash expenses and $0.9 million of net changes in operating assets and liabilities.

Net cash used by our operating activities of $4.3 million during the six months ended June 30, 2022, is primarily due to our

net loss of $5.7 million less $0.4 million in non-cash expenses and $1.0 million of net changes in operating assets and liabilities.

Investing Activities:

Net cash used in investing activities during the six months ended June 30, 2023, of $3.9 million, is from the purchase of short-term investments.

Financing Activities:

Net cash provided by financing activities during the six months ended June 30, 2023, of $24.9 million, is primarily from net proceeds of $23.2 million from the issuance of common stock under the Placement Agency Agreement, $1.1 million net proceeds from the issuance of common stock under a registered direct offering and $0.5 million from the issuance of common stock under the SPA.

Net cash provided by financing activities during the six month ended June 30, 2022, of $0.3 million, is primarily from the issuance of common stock under the February Stock Purchase Agreement.

Critical Accounting Policies and Estimates

There have been no material changes to our critical accounting policies and estimates from the information provided in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included in our 2022 Annual Report.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

We do not hold any derivative instruments and do not engage in any hedging activities.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

We have adopted and maintain disclosure controls and procedures that are designed to provide reasonable assurance that information required to be disclosed in the reports filed under the Exchange Act, such as this Quarterly Report on Form 10-Q, is collected, recorded, processed, summarized and reported within the time periods specified in the rules of the SEC.

Our disclosure controls and procedures are also designed to ensure that such information is accumulated and communicated to management to allow timely decisions regarding required disclosure. Based upon the most recent evaluation of internal controls over financial reporting, our Chief Executive Officer (our principal executive officer) and our Chief Financial Officer (our principal financial officer) identified material weaknesses in our internal control over financial reporting. The material weaknesses identified to date include (i) policies and procedures which are not yet adequately documented, (ii) lack of proper approval processes and review processes and documentation for such reviews, (iii) insufficient GAAP experience regarding complex transactions and reporting, and (iv) insufficient number of staff to maintain optimal segregation of duties and levels of oversight. As of June 30, 2023, based on evaluation of our disclosure controls and procedures, management concluded that our disclosure controls and procedures were not effective.

Notwithstanding the material weaknesses described above, our management, including the Chief Executive Officer and Chief Financial Officer, have concluded that the condensed unaudited financial statements, and other financial information included in this quarterly report, fairly presents in all material respects our financial condition, results of operations, and cash flows as of and for the periods presented in this quarterly report.

We have taken and continue to take remedial steps to improve our internal controls over financial reporting, which includes hiring additional personnel, we will continue to assess the weaknesses as these individuals progress through our onboarding process. We also continue to expand the functionality of our internal accounting systems to provide for higher levels of automation and assurance in our financial reporting function.

Changes in Internal Control

There has been no change in our internal control procedures over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during our fiscal quarter ended June 30, 2023 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II-OTHER INFORMATION

Item 1. Legal Proceedings.

There are no actions, suits, proceedings, inquiries or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 1A. Risk Factors.

Not applicable as we are a smaller reporting company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

(A) Unregistered Sales of Equity Securities

There were no sales of equity securities sold during the period covered by this Quarterly Report that were not registered under the Securities Act and were not previously reported in a Current Report on Form 8-K filed by the Company.

(B) Use of Proceeds

Not applicable.

(C) Issuer Purchases of Equity Securities

Not applicable.

Item 3. Defaults Upon Senior Securities.

Not applicable

Item 4. Mine Safety Disclosures (Removed and Reserved)

Not applicable.

Item 5. Other Information.

Not applicable.

Item 6. Exhibits

The exhibit index set forth below is incorporated by reference in response to this Item 6.

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| 3.1 | | |

| 3.2 | | |

| 3.3 | | |

| 3.4 | | |

| 31.1 | | |

| 31.2 | | |

| 32.1 | | |

| 32.2 | | |

| 101.INS | | XBRL Instance Document+ |

| 101.SCH | | XBRL Taxonomy Extension Schema Document+ |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document+ |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document+ |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document+ |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document+ |

| 104 | | Cover Page Interactive Data File - The cover page iXBRL tags are embedded within the inline XBRL document+ |

| * | | Filed herewith. |

| ** | | Furnished herewith. |

| + | | Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files in Exhibit 101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| HEARTBEAM, Inc. |

| | |

| By: | /s/ Branislav Vajdic |

| Name: | Branislav Vajdic |

| Title: | Chief Executive Officer |

| | (Principal Executive Officer) |

| | |

| By: | /s/ Richard Brounstein |

| Name: | Richard Brounstein |

| Title: | Chief Financial Officer |

| Dated: August 10, 2023 | | (Principal Financial and Accounting Officer) |

Exhibit 31.1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO RULE 13a-14(a)/RULE 15d-14(a) OF THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Branislav Vajdic, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of HeartBeam, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| | |

| Date: August 10, 2023 | | By: /s/ Branislav Vajdic |

| | Branislav Vajdic |

| | Chief Executive Officer |

| | (Principal Executive Officer) |

Exhibit 31.2

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO RULE 13a-14(a)/RULE 15d-14(a) OF THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Richard Brounstein, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of HeartBeam, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| | |

| Date: August 10, 2023 | | By: /s/ Richard Brounstein |

| | Richard Brounstein |

| | Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of HeartBeam, Inc. (the “Registrant”) on Form 10-Q for the period ending June 30, 2023 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Branislav Vajdic, Chief Executive Officer of the Registrant, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to my knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant.

| | | | | | | | |

| | |

| Date: August 10, 2023 | | By: /s/ Branislav Vajdic |

| | Branislav Vajdic |

| | Chief Executive Officer |

| | (Principal Executive Officer) |

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of HeartBeam, Inc. (the “Registrant”) on Form 10-Q for the period ending June 30, 2023 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Richard Brounstein, Chief Financial Officer of the Registrant, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to my knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant. | | | | | | | | |

| | |

| Date: August 10, 2023 | | By: /s/ Richard Brounstein |

| | Richard Brounstein |

| | Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

v3.23.2

Cover Page - shares

|

6 Months Ended |

|

Jun. 30, 2023 |

Aug. 09, 2023 |

| Document Information [Line Items] |

|

|

| Document Type |

10-Q

|

|

| Document Quarterly Report |

true

|

|

| Document Period End Date |

Jun. 30, 2023

|

|

| Document Transition Report |

false

|

|

| Entity File Number |

001-41060

|

|

| Entity Registrant Name |

HEARTBEAM, INC.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity Tax Identification Number |

47-4881450

|

|

| Entity Address, Address Line One |

2118 Walsh Avenue

|

|

| Entity Address, Address Line Two |

Suite 210

|

|

| Entity Address, City or Town |

Santa Clara

|

|

| Entity Address, State or Province |

CA

|

|

| Entity Address, Postal Zip Code |

95050

|

|

| City Area Code |

408

|

|

| Local Phone Number |

899-4443

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

| Entity Small Business |

true

|

|

| Entity Emerging Growth Company |

true

|

|

| Entity Ex Transition Period |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

26,311,904

|

| Entity Central Index Key |

0001779372

|

|

| Current Fiscal Year End Date |

--12-31

|

|

| Document Fiscal Year Focus |

2023

|

|

| Document Fiscal Period Focus |

Q2

|

|

| Amendment Flag |

false

|

|

| Class A common Stock |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Common Stock

|

|

| Trading Symbol |

BEAT

|

|

| Security Exchange Name |

NASDAQ

|

|

| Redeemable Warrants |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Warrants

|

|

| Trading Symbol |

BEATW

|

|

| Security Exchange Name |

NASDAQ

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |