As

filed with the Securities and Exchange Commission on October 31, 2023

Registration

No. 333-275123

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT NO. 1

TO

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

BLINK

CHARGING CO.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

03-0608147 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS.

Employer

Identification

Number) |

605

Lincoln Road, 5th Floor

Miami

Beach, Florida 33139

(305)

521-0200

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brendan

S. Jones

Chief

Executive Officer

Blink

Charging Co.

605

Lincoln Road, 5th Floor

Miami

Beach, Florida 33139

(305)

521-0200

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of all communications to:

Spencer

G. Feldman, Esq.

Olshan

Frome Wolosky LLP

1325

Avenue of the Americas, 15th Floor

New

York, New York 10019

(212)

451-2300

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☒ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

|

Smaller

reporting company ☐ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains:

| |

● |

a

base prospectus which covers the offering, issuance and sale by us of up to $400,000,000 in the aggregate of the securities identified

herein from time to time in one or more offerings; and |

| |

|

|

| |

● |

an

at-the-market offering prospectus supplement covering the offer, issuance and sale of up to a maximum aggregate offering price of

$213,471,838 of our common stock that may be issued and sold under our sales agreement (the “Sales Agreement”)

with Barclays Capital Inc., BofA Securities, Inc., HSBC Securities (USA) Inc., ThinkEquity LLC, H.C. Wainwright & Co., LLC

and Roth Capital Partners, LLC (each, a “Sales Agent” and collectively, the “Sales Agents”), dated September

2, 2022. |

The

base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus

will be specified in a prospectus supplement to the base prospectus. The at-the-market offering prospectus supplement immediately follows

the base prospectus. The $213,471,838 of common stock that may be offered, issued and sold under the at-the-market offering prospectus

supplement is included in the $400,000,000 of securities that may be offered, issued and sold by us under the base prospectus. As of

the date of this registration statement, we have sold $36,528,162 under the Sales Agreement. We are registering the offer and

sale of the remaining $213,471,838 that has not been sold under the Sales Agreement. Upon termination of the Sales Agreement with

the Sales Agents, any portion of the $213,471,838 included in the at-the-market offering prospectus supplement that is not sold

pursuant to the Sales Agreement will be available for sale in other offerings pursuant to the base prospectus and a corresponding prospectus

supplement, and if no shares are sold under the Sales Agreement, the full $213,471,838 of securities may be sold in other offerings

pursuant to the base prospectus and a corresponding prospectus supplement.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED OCTOBER 31, 2023

PROSPECTUS

$400,000,000

COMMON

STOCK

PREFERRED

STOCK

SENIOR

DEBT SECURITIES

SUBORDINATED

DEBT SECURITIES

WARRANTS

RIGHTS

UNITS

From

time to time, we may offer and sell any combination of the securities described in this prospectus in one or more offerings. The securities

we may offer may be convertible into or exercisable or exchangeable for other securities. We may offer the securities separately or together,

in separate classes or series and in amounts, at prices and on terms that will be determined at the time the securities are offered.

In

addition, certain selling stockholders may from time to time offer and sell shares of our common stock. We will not receive any of the

proceeds from the sale of shares of our common stock by selling stockholders, if any, pursuant to this prospectus.

This

prospectus describes some of the general terms that may apply to these securities. Each time securities are sold, the specific terms

and amounts of the securities being offered, and any other information relating to the specific offering will be set forth in a supplement

to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

In any prospectus supplement relating to any sales by the selling stockholders, we will, among other things, identify the number of shares

of our common stock that the selling stockholders will be selling. The prospectus supplement and any related free writing prospectus

may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus

supplement and any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the

securities being offered. This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

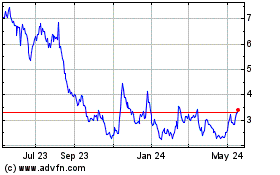

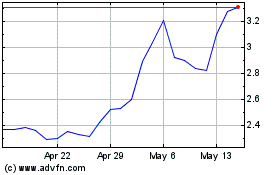

Our

shares of common stock trade on The Nasdaq Capital Market under the symbol “BLNK.” On October 27, 2023, the closing

price of our common stock was $2.34. The applicable prospectus supplement will contain information, where applicable, as to any

other listing, if any, of the securities covered by the applicable prospectus supplement.

We,

or any selling stockholders as it only relates to shares of common stock, may offer and sell our securities to or through one or more

underwriters, dealers and agents, or directly to purchasers, on an immediate, continuous or delayed basis. The names of any underwriters,

dealers or agents and the terms of the arrangements with such entities will be stated in the accompanying prospectus supplement. See

the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading

“Risk Factors” on page 2 of this prospectus as well as those contained in the applicable prospectus supplement and any

related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus or the applicable

prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

About

This Prospectus

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) under

the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. Under the

shelf registration process, we may from time to time, offer and sell to the public any or all of the securities described in this prospectus

in one or more offerings for an aggregate offering amount of up to $400,000,000. In addition, under this shelf registration process,

selling stockholders may from time to time sell shares of our common stock in one or more offerings. Before purchasing any securities,

you should read this prospectus and any applicable prospectus supplement together with the additional information described under the

headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

This

prospectus only provides you with a general description of the securities we and/or the selling stockholders may offer. Each time we

sell a type or series of securities under this prospectus, we will provide a prospectus supplement that will contain more specific information

about the terms of the offering, including the specific amounts, prices and terms of the securities offered. We may also authorize one

or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. This prospectus

may not be used to sell our securities unless accompanied by a prospectus supplement. Each such prospectus supplement and any free writing

prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in

documents incorporated by reference into this prospectus. If this prospectus is inconsistent with the prospectus supplement or free writing

prospectus, you should rely upon the prospectus supplement or free writing prospectus.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where

You Can Find More Information.”

This

prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference,

market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not

independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated

by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions

and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk

Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under

similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place

undue reliance on this information.

In

this prospectus, except as otherwise indicated, the words “Blink,” “Blink Charging” or the “Registrant”

refer to Blink Charging Co. and the words “company,” “we,” “us,” “our” and “ours”

refer to Blink Charging Co. together with its consolidated subsidiaries. In this prospectus, references to “securities” collectively

means our common stock, preferred stock, warrants, debt securities, or any combination of the foregoing securities.

You

should rely only on information contained or incorporated by reference in this prospectus. Neither we, any selling stockholders, nor

any underwriters have authorized any person to provide you with information that differs from what is contained or incorporated by reference

in this prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference

in this prospectus, you should not rely on it. This prospectus is not an offer to sell or the solicitation of an offer to buy any securities

other than the securities to which it relates, or an offer or solicitation in any jurisdiction where offers or sales are not permitted.

The information contained in this prospectus is accurate only as of the date of this prospectus, even though this prospectus may be delivered

or shares may be sold under this prospectus on a later date. Our business, financial condition, results of operation and prospects may

have changed since those dates.

about

the company

Overview

Blink

Charging Co., through its wholly-owned subsidiaries, is a leading manufacturer, owner, operator and provider of electric vehicle (“EV”)

charging equipment and networked EV charging services in the rapidly growing U.S. and international markets for EVs. Blink offers residential

and commercial EV charging equipment and services, enabling EV drivers to recharge at various location types. Blink’s principal

line of products and services is its nationwide Blink EV charging networks (the “Blink Networks”) and Blink EV charging equipment,

also known as electric vehicle supply equipment (“EVSE”), and other EV-related services. The Blink Networks are a proprietary,

cloud-based system that operates, maintains and manages Blink charging stations and handles the associated charging data, back-end operations

and payment processing. The Blink Networks provide property owners, managers, parking companies, state and municipal entities, and other

types of commercial customers (“Property Partners”) with cloud-based services that enable the remote monitoring and management

of EV charging stations. The Blink Networks also provide EV drivers with vital station information, including station location, availability

and fees.

In

order to capture more revenues derived from providing EV charging equipment to commercial customers and to help differentiate Blink in

the EV infrastructure market, Blink offers Property Partners a comprehensive range of solutions for EV charging equipment and services

that generally fall into one of the business models below, differentiated by who bears the costs of installation, equipment and maintenance,

and the percentage of revenue shared.

| |

● |

In

our Blink-owned turnkey business model, we incur the costs of the charging equipment and installation. We own and operate

the EV charging station and provide connectivity of the charging station to the Blink Networks. In this model, which favors recurring

revenues, we incur most costs associated with the EV charging stations; thus, we retain substantially all EV charging revenues after

deducting network connectivity and processing fees. Typically, our agreement with the Property Partner lasts seven years with extensions

that can bring the term to a total of up to 21 years. |

| |

|

|

| |

● |

In

our Blink-owned hybrid business model, we incur the costs of the charging equipment while the Property Partner incurs the

costs of installation. We own and operate the EV charging station and provide connectivity to the Blink Networks. In this model,

the Property Partner incurs the installation costs associated with the EV station; thus, we share a more generous portion of the

EV charging revenues with the Property Partner generated from the EV charging station after deducting network connectivity and processing

fees. Typically, our agreement with the Property Partner lasts five years with extensions that can bring the term up to 15 years. |

| |

|

|

| |

● |

In

our host-owned business model, the Property Partner purchases, owns and operates the Blink EV charging station and incurs

the installation costs. We work with the Property Partner by providing site recommendations, connectivity to the Blink Networks,

payment processing and optional maintenance services. In this model, the Property Partner retains and keeps all the EV charging revenues

after deducting network connectivity and processing fees. |

| |

|

|

| |

● |

In

our Blink-as-a-Service model, we own and operate the EV charging station, while the Property Partner incurs the installation

costs. The Property Partner pays us a fixed monthly fee for the service and keeps all the EV charging revenues after deducting network

connectivity and processing fees. Typically, our agreement with the Property Partner lasts five years. |

We

also operate an EV based ride-sharing business through our wholly-owned subsidiary, Blink Mobility LLC (“Blink Mobility”).

Blink Mobility operates a car sharing program in Los Angeles, California, through its subsidiary, BlueLA Rideshare, LLC, which allows

customers the ability to rent electric vehicles through a subscription service and charge those cars through our charging stations. In

April 2023, Blink Mobility acquired Envoy Technologies, Inc. (“Envoy Technologies”), a software and mobility services company

offering shared EVs as an amenity for national real estate developers and owners. In connection with the acquisition of Envoy Technologies,

our board of directors authorized our management to begin planning the spin-off and initial public offering of Blink Mobility. As of

the date of this prospectus supplement, we have engaged an investment bank to assist with this process, but there is no guarantee the

spin-off or initial public offering will occur.

As

part of our mission to facilitate the adoption of EVs through the deployment and operation of EV charging infrastructure globally, we

are dedicated to slowing climate change by reducing greenhouse gas emissions caused by road vehicles. With the goal of being a leader

in the build-out of EV charging infrastructure and increasing our share of the EV charging market, we have established strategic commercial,

municipal and retail partnerships across industry verticals and encompassing numerous transit/destination locations, including airports,

auto dealers, healthcare/medical, hotels, mixed-use, municipal sites, multifamily residential and condos, parks and recreation areas,

parking lots, religious institutions, restaurants, retailers, schools and universities, stadiums, supermarkets, transportation hubs and

workplace locations.

In

2022 and 2023, through the acquisitions of SemaConnect, Inc., Envoy Technologies, Inc. and Electric Blue Limited, we added new offices

in Bowie, Maryland, St. Albans, United Kingdom, and Los Angeles, California, and manufacturing facilities in Bowie, Maryland and Bangalore,

India. These new office and manufacturing facilities add to our expanding U.S. and international capacity to develop and manufacture

hardware and innovate new software capabilities to better meet the needs of an evolving EV charging landscape, while also serving as

a key hub for operations serving the Europe, Asia Pacific and Middle East regions. This expansion in footprint is part of our growth

strategy to grow our global engineering teams and develop operational hubs to facilitate expansion into new international regions.

Corporate

Information

We

were incorporated in Nevada in October 2006. Our principal executive offices are located at 605 Lincoln Road, 5th Floor, Miami Beach,

Florida 33139, and our telephone number is (305) 521-0200. We maintain a website at www.BlinkCharging.com. We make our periodic and current

reports that are filed with the SEC available, free of charge, on our website as soon as reasonably practicable after such material is

electronically filed with, or furnished to, the SEC. Information contained on, or accessible through, our website is not a part of, and

is not incorporated by reference into, this prospectus or any accompanying prospectus supplement.

Risk

Factors

Investing

in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should carefully consider

the risks described under the heading “Risk Factors” in the applicable prospectus supplement and any related free writing

prospectus, and discussed under “Part I, Item 1A. Risk Factors” contained in our most recent annual report on Form 10-K,

and in subsequent quarterly reports on Form 10-Q filed subsequent to such Form 10-K, as well as any amendments thereto, which are incorporated

by reference into this prospectus and the applicable prospectus supplement in their entirety, together with other information in this

prospectus and the applicable prospectus supplement, the documents incorporated by reference herein and therein, and any free writing

prospectus that we may authorize for use in connection with a specific offering. See “Where You Can Find More Information.”

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any prospectus supplement and any related free writing prospectus, including the information incorporated by reference herein

and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations,

beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements

are often, but are not always, made through the use of words or phrases such as “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or the negative of these words or other comparable terminology. Accordingly, these statements

involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them.

Given

these uncertainties, you should not place undue reliance on these forward-looking statements as actual events or results may differ materially

from those projected in the forward-looking statements due to various factors, including, but not limited to, those set forth under the

heading “Risk Factors” in any applicable prospectus supplement, the documents incorporated by reference therein or any free

writing prospectus that we authorized. Our actual future results may be materially different from what we expect. We qualify all of the

forward-looking statements contained in this prospectus, in the documents incorporated by reference herein and in any prospectus supplement

by these cautionary statements. These forward-looking statements speak only as of the date on which the statements were made and are

not guarantees of future performance. Although we undertake no obligation to revise or update any forward-looking statements, whether

as a result of new information, future events or otherwise, you are advised to review any additional disclosures we make in the documents

we subsequently file with the SEC that are incorporated by reference in this prospectus and any prospectus supplement. See “Where

You Can Find More Information.”

Use

of Proceeds

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of securities offered by this prospectus

and any applicable prospectus supplement for general corporate purposes. Until we apply the proceeds from a sale of securities to their

intended purposes, we may invest those proceeds in short-term, interest-bearing, investment-grade, securities or hold as cash.

We

will not receive any of the proceeds from the sale of shares of our common stock by selling stockholders, if any, pursuant to this prospectus.

DESCRIPTION

OF OUR CAPITAL STOCK

The

following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such

securities, and is qualified by reference to the Articles of Incorporation, as amended (the “Articles of Incorporation”),

the Bylaws, as amended (the “Bylaws”), and the warrant-related documents described herein, which are exhibits to the registration

statement of which this prospectus is a part. We urge you to read each of the Articles of Incorporation, the Bylaws and the warrant-related

documents described herein in their entirety for a complete description of the rights and preferences of our securities.

Authorized

Capital Stock

We

are authorized to issue 540,000,000 shares of capital stock, consisting of 500,000,000 shares of common stock, par value $0.001 per share,

and 40,000,000 shares of preferred stock, par value $0.001 per share.

Common

Stock

Dividend

Rights. Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of our common

stock may, pursuant to Article VI of our Bylaws, receive dividends out of funds legally available if our board, in its discretion, determines

to issue dividends and then only at the times and in the amounts that our board may determine. We have not paid any dividends on our

common stock and do not contemplate doing so in the foreseeable future.

Voting

Rights. In accordance with Nevada Revised Statutes Section 78.350, holders of our common stock are entitled to one vote for each

share held on all matters submitted to a vote of stockholders. We have not provided for cumulative voting for the election of directors

in our Articles of Incorporation.

No

Preemptive or Similar Rights. In accordance with Nevada Revised Statutes Section 78.267, our common stock is not entitled to preemptive

rights and is not subject to conversion, redemption or sinking fund provisions.

Right

to Receive Liquidation Distribution. In accordance with Nevada Revised Statutes Sections 78.565 to 78.620, if we become subject to

a liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable among

the holders of our common stock and our participating preferred stock outstanding at that time, subject to prior satisfaction of all

outstanding debt and liabilities and the preferential rights and payment of liquidation preferences on any outstanding shares of preferred

stock.

Fully

Paid and Non-Assessable. In accordance with Nevada Revised Statutes Sections 78.195 and 78.211 and the assessment of our Board, all

of the outstanding shares of our common stock are fully paid and nonassessable.

Nasdaq

Capital Market. Our shares of common stock are traded on The Nasdaq Capital Market under the symbol “BLNK.”

Transfer

Agent and Registrar. The transfer agent and registrar for our common stock is Worldwide Stock Transfer, LLC, Hackensack, New Jersey.

Blank

Check Preferred Stock

We

are authorized to issue 40,000,000 shares of preferred stock, par value $0.001 per share. Pursuant to our Articles of Incorporation,

our Board of Directors (the “Board”) is authorized to authorize and issue preferred stock and to fix the designations, preferences

and rights of the preferred stock pursuant to a board resolution. Our Board may designate the rights, preferences, privileges and restrictions

of the preferred stock, including dividend rights, conversion rights, voting rights, redemption rights, liquidation preference, sinking

fund terms and the number of shares constituting any series or the designation of any series.

Anti-Takeover

Effects of Nevada Law and Our Articles of Incorporation and Bylaws

Provisions

of the Nevada Revised Statutes and our Articles of Incorporation and Bylaws could make it more difficult to acquire us by means of a

tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. These provisions, summarized below, would

be expected to discourage certain types of takeover practices and takeover bids our Board may consider inadequate and to encourage persons

seeking to acquire control of us to first negotiate with us. We believe that the benefits of increased protection of our ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us will outweigh the disadvantages of discouraging

takeover or acquisition proposals because, among other things, negotiation of these proposals could result in an improvement of their

terms.

Blank

Check Preferred. Our Articles of Incorporation permit our Board to issue preferred stock with voting, conversion and exchange rights

that could negatively affect the voting power or other rights of our common stockholders. The issuance of our preferred stock could delay

or prevent a change of control of our company.

Board

Vacancies to be filled by Remaining Directors. Our Bylaws provide that casual vacancies on the Board may be filled by the remaining

directors then in office.

Removal

of Directors by Stockholders. Our Bylaws and the Nevada Revised Statutes provide that directors may be removed with or without cause

at any time by a vote of two-thirds of the stockholders entitled to vote thereon, at a special meeting of the stockholders called for

that purpose.

Stockholder

Action. Our Bylaws provide that special meetings of the stockholders may be called by the Board or such person or persons authorized

by the Board.

Amendments

to our Articles of Incorporation and Bylaws. Under the Nevada Revised Statutes, our Articles of Incorporation may not be amended

by stockholder action alone. Amendments to our Articles of Incorporation require a board resolution approved by the majority of the outstanding

capital stock entitled to vote. Our Bylaws may only be amended by a majority vote of the stockholders at any annual meeting or special

meeting called for that purpose. Subject to the right of stockholders as described in the immediately preceding sentence, the Board has

the power to make, adopt, alter, amend and repeal, from time to time, our Bylaws.

Nevada

Anti-Takeover Statute. We may be subject to Nevada’s Combination with Interested Stockholders Statute (Nevada Revised Statutes

Sections 78.411 to 78.444) which prohibits an “interested stockholder” from entering into a “combination” with

the corporation, unless certain conditions are met. An “interested stockholder” is a person who, together with affiliates

and associates, beneficially owns (or within the prior two years, did beneficially own) 10% or more of the corporation’s capital

stock entitled to vote.

Limitations

on Liability and Indemnification of Officers and Directors

The

Nevada Revised Statutes limit or eliminate the personal liability of directors to corporations and their stockholders for monetary damages

for breaches of directors’ fiduciary duties as directors. Our Bylaws include provisions that require the company to indemnify our

directors or officers against monetary damages for actions taken as a director or officer of our company. We are also expressly authorized

to carry directors’ and officers’ insurance to protect our directors, officers, employees and agents for certain liabilities.

Our Articles of Incorporation do not contain any limiting language regarding director immunity from liability.

The

limitation of liability and indemnification provisions under Nevada Revised Statutes and in our Articles of Incorporation and Bylaws

may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. These provisions may also

have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful,

might otherwise benefit us and our stockholders. However, these provisions do not limit or eliminate our rights, or those of any stockholder,

to seek non-monetary relief such as injunction or rescission in the event of a breach of a director’s fiduciary duties. Moreover,

the provisions do not alter the liability of directors under the federal securities laws. In addition, your investment may be adversely

affected to the extent that, in a class action or direct suit, we pay the costs of settlement and damage awards against directors and

officers pursuant to these indemnification provisions.

Authorized

but Unissued Shares

Our

authorized but unissued shares of common stock and preferred stock will be available for future issuance without stockholder approval,

except as may be required under the listing rules of any stock exchange on which our common stock is then listed. We may use additional

shares for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and

employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult

or discourage an attempt to obtain control of our company by means of a proxy contest, tender offer, merger or otherwise.

DESCRIPTION

OF OUR DEBT SECURITIES

This

summary, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms

and provisions of the debt securities that we may offer under this prospectus. While the terms we have summarized below will generally

apply to any future debt securities we may offer, we will describe the particular terms of any debt securities that we may offer in more

detail in the applicable prospectus supplement. The terms of any debt securities we offer under a prospectus supplement may differ from

the terms we describe below.

The

debt securities may be either secured or unsecured and will either be senior debt securities or subordinated debt securities. We will

issue the senior notes under the senior indenture which we will enter into with one or more trustees. We will issue the subordinated

notes under the subordinated indenture which we will enter into with one or more trustees. We have filed forms of these documents as

exhibits to the registration statement of which this prospectus forms a part. We use the term “indentures” to refer to both

the senior indenture and the subordinated indenture.

The

indentures will be qualified under the Trust Indenture Act of 1939, as amended, (the “Trust Indenture Act”). We use the term

“debenture trustee” to refer to either the senior trustee or the subordinated trustee, as applicable.

The

following summaries of the material provisions of the senior notes, the subordinated notes and the indentures are subject to, and qualified

in their entirety by reference to, all of the provisions of the indenture applicable to a particular series of debt securities. We urge

you to read the applicable prospectus supplements related to the debt securities that we sell under this prospectus, as well as the complete

indenture that contain the terms of the debt securities. Except as we may otherwise indicate, the terms of the senior indenture and the

subordinated indenture are identical.

General

We

will describe in the applicable prospectus supplement the terms relating to a series of debt securities, including, to the extent applicable:

| |

● |

the

title; |

| |

|

|

| |

● |

the

principal amount being offered and, if a series, the total amount authorized and the total amount outstanding; |

| |

|

|

| |

● |

any

limit on the amount that may be issued; |

| |

|

|

| |

● |

whether

or not we will issue the series of debt securities in global form and, if so, the terms and who the depositary will be; |

| |

|

|

| |

● |

the

maturity date; |

| |

|

|

| |

● |

the

principal amount due at maturity and whether the debt securities will be issued with any original issue discount; |

| |

|

|

| |

● |

whether

and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a U.S. person

for U.S. federal income tax purposes, and whether we can redeem the debt securities if we have to pay such additional amounts; |

| |

|

|

| |

● |

the

annual interest rate, which may be fixed or variable, or the method for determining the rate, the date interest will begin to accrue,

the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates; |

| |

|

|

| |

● |

whether

or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

| |

● |

whether

or not the debt securities will be senior or subordinated, and the terms of the subordination of any series of subordinated debt; |

| |

|

|

| |

● |

the

place where payments will be payable; |

| |

|

|

| |

● |

restrictions

on transfer, sale or other assignment, if any; |

| |

|

|

| |

● |

our

right, if any, to defer payment of interest and the maximum length of any such deferral period; |

| |

|

|

| |

● |

the

date, if any, after which, the conditions upon which, and the price at which we may, at our option, redeem the series of debt securities

pursuant to any optional or provisional redemption provisions, and any other applicable terms of those redemption provisions; |

| |

|

|

| |

● |

provisions

for a sinking fund, purchase or other analogous fund, if any; |

| |

|

|

| |

● |

the

date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions

or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities; |

| |

|

|

| |

● |

whether

the indenture will restrict our ability and/or the ability of our subsidiaries to: |

| |

● |

incur

additional indebtedness; |

| |

|

|

| |

● |

issue

additional securities; |

| |

|

|

| |

● |

create

liens; |

| |

|

|

| |

● |

pay

dividends and make distributions in respect of our capital stock and the capital stock of our subsidiaries; |

| |

|

|

| |

● |

redeem

capital stock; |

| |

|

|

| |

● |

place

restrictions on our subsidiaries’ ability to pay dividends, make distributions or transfer assets; |

| |

|

|

| |

● |

make

investments or other restricted payments; |

| |

|

|

| |

● |

sell

or otherwise dispose of assets; |

| |

|

|

| |

● |

enter

into sale-leaseback transactions; |

| |

|

|

| |

● |

engage

in transactions with stockholders and affiliates; |

| |

|

|

| |

● |

issue

or sell stock of our subsidiaries; or |

| |

|

|

| |

● |

effect

a consolidation or merger; |

| |

● |

whether

the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios; |

| |

|

|

| |

● |

a

discussion of any material or special U.S. federal income tax considerations applicable to the debt securities; |

| |

|

|

| |

● |

information

describing any book-entry features; |

| |

● |

the

procedures for any auction and remarketing, if any; |

| |

|

|

| |

● |

the

denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple

thereof; |

| |

|

|

| |

● |

if

other than U.S. dollars, the currency in which the series of debt securities will be denominated; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, including any events of default

that are in addition to those described in this prospectus or any covenants provided with respect to the debt securities that are

in addition to those described above, and any terms which may be required by us or advisable under applicable laws or regulations

or advisable in connection with the marketing of the debt securities. |

Conversion

or Exchange Rights

We

will set forth in the applicable prospectus supplements the terms on which a series of debt securities may be convertible into or exchangeable

for common stock or other securities of ours or a third party, including the conversion or exchange rate, as applicable, or how it will

be calculated, and the applicable conversion or exchange period. We will include provisions as to whether conversion or exchange is mandatory,

at the option of the holder or at our option. We may include provisions pursuant to which the number of our securities or the securities

of a third party that the holders of the series of debt securities receive upon conversion or exchange would, under the circumstances

described in those provisions, be subject to adjustment, or pursuant to which those holders would, under those circumstances, receive

other property upon conversion or exchange, for example in the event of our merger or consolidation with another entity.

Consolidation,

Merger or Sale

The

indentures in the form initially filed as exhibits to the registration statement of which this prospectus forms a part may contain covenants

that restrict our ability to merge or consolidate, or sell, convey, transfer or otherwise dispose of all or substantially all of our

assets. However, any successor of ours or acquirer of such assets must assume all of our obligations under the indentures and the debt

securities.

If

the debt securities are convertible into our other securities, the person with whom we consolidate or merge or to whom we sell all of

our property must make provisions for the conversion of the debt securities into securities which the holders of the debt securities

would have received if they had converted the debt securities before the consolidation, merger or sale.

Events

of Default Under the Indentures

Unless

otherwise specified in the applicable prospectus supplement, the following are events of default under the indentures with respect to

any series of debt securities that we may issue:

| |

● |

if

we fail to pay interest when due and payable and our failure continues for 90 days and the time for payment has not been validly

extended; |

| |

|

|

| |

● |

if

we fail to pay the principal, or premium, if any, or to make payment required by any sinking fund or analogous fund when due and

payable and the time for payment has not been validly extended; |

| |

|

|

| |

● |

if

we fail to observe or perform any other covenant contained in the debt securities or the indentures, other than a covenant specifically

relating to another series of debt securities, and our failure continues for 30 days after we receive notice from the debenture trustee

or holders of at least 25% in aggregate principal amount of the outstanding debt securities of the applicable series; and |

| |

|

|

| |

● |

if

specified events of bankruptcy, insolvency or reorganization occur. |

If

an event of default with respect to debt securities of any series occurs and is continuing, other than an event of default specified

in the last bullet point above, the debenture trustee or the holders of at least 25% in aggregate principal amount of the outstanding

debt securities of that series may, by notice to us in writing (and to the debenture trustee if notice is given by such holders), declare

the unpaid principal, premium, if any, and accrued interest, if any, due and payable immediately. If an event of default specified in

the last bullet point above occurs with respect to us, the principal amount of and accrued interest, if any, of each series of debt securities

then outstanding shall be due and payable without any notice or other action on the part of the debenture trustee or any holder.

The

holders of a majority in principal amount of the outstanding debt securities of an affected series may waive any default or event of

default with respect to the series and its consequences, except defaults or events of default regarding payment of principal, premium,

if any, or interest, unless we have cured the default or event of default in accordance with the indenture.

Subject

to the terms of the indentures, if an event of default under an indenture shall occur and be continuing, the debenture trustee will be

under no obligation to exercise any of its rights or powers under such indenture at the request or direction of any of the holders of

the applicable series of debt securities, unless such holders have offered the debenture trustee reasonable indemnity. The holders of

a majority in principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place

of conducting any proceeding for any remedy available to the debenture trustee, or exercising any trust or power conferred on the debenture

trustee, with respect to the debt securities of that series, provided that:

| |

● |

the

direction so given by the holder is not in conflict with any law or the applicable indenture; and |

| |

|

|

| |

● |

subject

to its duties under the Trust Indenture Act, the debenture trustee need not take any action that might involve it in personal liability

or might be unduly prejudicial to the holders not involved in the proceeding. |

A

holder of the debt securities of any series will only have the right to institute a proceeding under the indentures or to appoint a receiver

or trustee, or to seek other remedies, if:

| |

● |

the

holder has given written notice to the debenture trustee of a continuing event of default with respect to that series; |

| |

|

|

| |

● |

the

holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made written request,

and such holders have offered reasonable indemnity to the debenture trustee, to institute the proceeding as trustee; and |

| |

|

|

| |

● |

the

debenture trustee does not institute the proceeding and does not receive from the holders of a majority in aggregate principal amount

of the outstanding debt securities of that series other conflicting directions, within 60 days after the notice, request and offer. |

These

limitations do not apply to a suit instituted by a holder of debt securities if we default in the payment of the principal, premium,

if any, or interest on the debt securities.

We

will periodically file statements with the debenture trustee regarding our compliance with specified covenants in the indentures.

Modification

of Indenture; Waiver

We

and the debenture trustee may modify an indenture without the consent of any holders with respect to specific matters, including, without

limitation:

| |

● |

to

fix any ambiguity, defect or inconsistency in the indenture or in the debt securities of any series; |

| |

|

|

| |

● |

to

comply with the provisions described above under “Consolidation, Merger or Sale”; |

| |

|

|

| |

● |

to

comply with any requirements of the SEC in connection with the qualification of any indenture under the Trust Indenture Act; |

| |

|

|

| |

● |

to

evidence and provide for the acceptance of appointment under the indenture by a successor trustee; |

| |

|

|

| |

● |

to

provide for uncertificated debt securities in addition to or in place of certificated securities and to make all appropriate changes

for such purpose; or |

| |

|

|

| |

● |

to

change anything that does not adversely affect the rights of any holder of debt securities of any series in any material respect. |

In

addition, under the indentures, the rights of holders of debt securities of any series may be changed by us and the debenture trustee

with the written consent of the holders of at least a majority in aggregate principal amount of the outstanding debt securities of each

series that is affected. However, we and the debenture trustee may only make the following changes with the consent of each holder of

any outstanding debt securities affected:

| |

● |

extending

the fixed maturity of the debt securities of any series; |

| |

|

|

| |

● |

reducing

the principal amount, reducing the rate of or extending the time of payment of interest or reducing any premium payable upon the

redemption of any debt securities; or |

| |

|

|

| |

● |

reducing

the percentage of debt securities the holders of which are required to consent to any supplemental indenture. |

Discharge

The

indentures provide that we can elect to be discharged from our obligations with respect to one or more series of debt securities, except

for certain obligations, including obligations to:

| |

● |

register

the transfer or exchange of debt securities of the series; |

| |

|

|

| |

● |

replace

mutilated, destroyed, lost or stolen debt securities of the series; |

| |

|

|

| |

● |

maintain

paying agencies; and |

| |

|

|

| |

● |

compensate

and indemnify the debenture trustee. |

In

order to exercise our rights to be discharged, we must deposit with the debenture trustee money or government obligations, or a combination

of both, sufficient to pay all of the principal, premium, if any, and interest on the debt securities of the series on the dates payments

are due.

Information

Concerning the Debenture Trustee

The

debenture trustee, other than during the occurrence and continuance of an event of default under an indenture, undertakes to perform

only those duties as are specifically set forth in the applicable indenture. Upon an event of default under an indenture, the debenture

trustee must use the same degree of care as a prudent person would exercise or use in the conduct of his or her own affairs. Subject

to this provision, the debenture trustee is under no obligation to exercise any of the powers given it by the indentures at the request

of any holder of debt securities unless it is offered reasonable security and indemnity against the costs, expenses and liabilities that

it might incur.

Payment

and Paying Agents

Unless

we otherwise indicate in the applicable prospectus supplement, we will make payment of the interest on any debt securities on any interest

payment date to the person in whose name the debt securities, or one or more predecessor securities, are registered at the close of business

on the regular record date for the interest.

We

will pay principal of, and any premium and interest on, the debt securities of a particular series at the office of the paying agents

designated by us, except that, unless we otherwise indicate in the applicable prospectus supplement, we may make certain payments by

check which we will mail to the holder or by wire transfer to certain holders. Unless we otherwise indicate in a prospectus supplement,

we will designate an office or agency of the debenture trustee in the city of New York as our sole paying agent for payments with respect

to debt securities of each series. We will name in the applicable prospectus supplement any other paying agents that we initially designate

for the debt securities of a particular series. We will maintain a paying agent in each place of payment for the debt securities of a

particular series.

All

money we pay to a paying agent or the debenture trustee for the payment of the principal of or any premium or interest on any debt securities

which remains unclaimed at the end of two years after such principal, premium or interest has become due and payable will be repaid to

us, and the holder of the debt security thereafter may look only to us for payment thereof.

Governing

Law

The

indentures and the debt securities will be governed by and construed in accordance with the laws of the State of New York, except to

the extent that the Trust Indenture Act is applicable.

Subordination

of Subordinated Debt Securities

The

subordinated debt securities will be subordinate and junior in priority of payment to certain of our other indebtedness to the extent

described in a prospectus supplement. The indentures in the form initially filed as exhibits to the registration statement of which this

prospectus forms a part do not limit the amount of indebtedness which we may incur, including senior indebtedness or subordinated indebtedness,

and do not limit us from issuing any other debt, including secured debt or unsecured debt. Additional or different subordination provisions

may be described in a prospectus supplement relating to a particular series of debt securities.

DESCRIPTION

OF OUR WARRANTS

This

summary, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms

and provisions of the warrants that we may offer under this prospectus, which consist of warrants to purchase our common stock, preferred

stock and/or debt securities in one or more series. Warrants may be offered independently or together with our common stock, preferred

stock, debt securities and/or rights offered by any prospectus supplement and may be attached to or separate from those securities. While

the terms we have summarized below will generally apply to any future warrants we may offer under this prospectus, we will describe the

particular terms of any warrants that we may offer in more detail in the applicable prospectus supplement. The terms of any warrants

we offer under a prospectus supplement may differ from the terms we describe below.

We

will issue the warrants directly or under a warrant agreement which we will enter into with a warrant agent to be selected by us. Each

series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant

agent, all as set forth in the prospectus supplement relating to the particular issue of offered warrants. We use the term “warrant

agreement” to refer to any of these warrant agreements. We use the term “warrant agent” to refer to the warrant agent

under any of these warrant agreements. The warrant agent will act solely as an agent of ours in connection with the warrants and will

not act as an agent for the holders or beneficial owners of the warrants.

The

following summary of material provisions of the warrants and the warrant agreements are subject to, and qualified in their entirety by

reference to, all of the provisions of the warrant agreement applicable to a particular series of warrants. We urge you to read the applicable

prospectus supplements related to the warrants that we sell pursuant to this prospectus, as well as the complete warrant agreements that

contain the terms of the warrants.

General

We

will describe in the applicable prospectus supplements the terms relating to a series of warrants.

If

warrants for the purchase of our common stock or preferred stock are offered, the prospectus supplements will describe the following

terms, to the extent applicable:

| |

● |

the

offering price and the aggregate number of warrants offered; |

| |

|

|

| |

● |

the

total number of shares that can be purchased if a holder of the warrants exercises them and, in the case of warrants for preferred

stock, the designation, total number and terms of the series of preferred stock that can be purchased upon exercise; |

| |

|

|

| |

● |

the

designation and terms of any series of preferred stock with which the warrants are being offered and the number of warrants being

offered with each share of common stock or preferred stock; |

| |

|

|

| |

● |

the

date on and after which the holder of the warrants can transfer them separately from the related common stock or series of preferred

stock; |

| |

|

|

| |

● |

the

number of shares of common stock or preferred stock that can be purchased if a holder exercises the warrant and the price at which

such common stock or preferred stock may be purchased upon exercise, including, if applicable, any provisions for changes to or adjustments

in the exercise price and in the securities or other property receivable upon exercise; |

| |

|

|

| |

● |

the

terms of any rights to redeem or call, or accelerate the expiration of, the warrants; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants begins and the date on which that right expires; |

| |

|

|

| |

● |

the

number of warrants outstanding, if any; |

| |

|

|

| |

● |

a

discussion of any material U.S. federal income tax considerations applicable to the warrants; |

| |

● |

the

terms, if any, on which we may accelerate the date by which the warrants must be exercised; |

| |

|

|

| |

● |

whether

the warrants are issued pursuant to a warrant agreement with a warrant agent or issued directly by us; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the warrants. |

Warrants

for the purchase of common stock or preferred stock will be in registered form only.

If

warrants for the purchase of debt securities are offered, the prospectus supplement will describe the following terms, to the extent

applicable:

| |

● |

the

offering price and the aggregate number of warrants offered; |

| |

|

|

| |

● |

the

currencies in which the warrants are being offered; |

| |

|

|

| |

● |

the

designation, aggregate principal amount, currencies, denominations and terms of the series of debt securities that can be purchased

if a holder exercises a warrant; |

| |

|

|

| |

● |

the

designation and terms of any series of debt securities with which the warrants are being offered and the number of warrants offered

with each such debt security; |

| |

|

|

| |

● |

the

date on and after which the holder of the warrants can transfer them separately from the related series of debt securities; |

| |

|

|

| |

● |

the

principal amount of the series of debt securities that can be purchased if a holder exercises a warrant and the price at which and

currencies in which such principal amount may be purchased upon exercise; |

| |

|

|

| |

● |

the

terms of any rights to redeem or call the warrants; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants begins and the date on which such right expires; |

| |

|

|

| |

● |

the

number of warrants outstanding, if any; |

| |

|

|

| |

● |

a

discussion of any material U.S. federal income tax considerations applicable to the warrants; |

| |

|

|

| |

● |

the

terms, if any, on which we may accelerate the date by which the warrants must be exercised; |

| |

|

|

| |

● |

whether

the warrants are issued pursuant to a warrant agreement with a warrant agent or issued directly by us; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the warrants. |

Warrants

for the purchase of debt securities will be in registered form only.

A

holder of warrant certificates may exchange them for new certificates of different denominations, present them for registration of transfer

and exercise them at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement.

Until any warrants to purchase common stock or preferred stock are exercised, holders of the warrants will not have any rights of holders

of the underlying common stock or preferred stock, including any rights to receive dividends or to exercise any voting rights, except

to the extent set forth under “Warrant Adjustments” below. Until any warrants to purchase debt securities are exercised,

the holder of the warrants will not have any of the rights of holders of the debt securities that can be purchased upon exercise, including

any rights to receive payments of principal, premium or interest on the underlying debt securities or to enforce covenants in the applicable

indenture.

Exercise

of Warrants

Each

holder of a warrant is entitled to purchase the number of shares of common stock or preferred stock or principal amount of debt securities,

as the case may be, at the exercise price described in the applicable prospectus supplements. After the close of business on the day

when the right to exercise terminates (or a later date if we extend the time for exercise), unexercised warrants will become void.

A

holder of warrants may exercise them by following the general procedure outlined below:

| |

● |

delivering

to us or to the warrant agent the payment required by the applicable prospectus supplements to purchase the underlying security; |

| |

|

|

| |

● |

properly

completing and signing the reverse side of the warrant certificate representing the warrants; and |

| |

|

|

| |

● |

delivering

the warrant certificate representing the warrants to us or to the warrant agent within five business days of receipt of payment of

the exercise price. |

If

the holder complies with the procedures described above, the warrants will be considered to have been exercised when we receive or the

warrant agent receives, as applicable, payment of the exercise price, subject to the transfer books for the securities issuable upon

exercise of the warrant not being closed on such date. After the holder has completed those procedures and subject to the foregoing,

we will, as soon as practicable, issue and deliver to such holder the common stock, preferred stock or debt securities that such holder

purchased upon exercise. If the holder exercises fewer than all of the warrants represented by a warrant certificate, a new warrant certificate

will be issued to such holder for the unexercised amount of warrants. Holders of warrants will be required to pay any tax or governmental

charge that may be imposed in connection with transferring the underlying securities in connection with the exercise of the warrants.

Amendments

and Supplements to the Warrant Agreements

We

may amend or supplement a warrant agreement without the consent of the holders of the applicable warrants to cure ambiguities in the

warrant agreement, to cure, correct or supplement a defective provision in the warrant agreement, or to provide for other matters under

the warrant agreement that we and the warrant agent deem necessary or desirable, so long as, in each case, such amendments or supplements

do not materially adversely affect the interests of the holders of the warrants.

Warrant

Adjustments

Unless

the applicable prospectus supplements state otherwise, the exercise price of, and the number of securities covered by, a common stock

warrant or preferred stock warrant will be adjusted proportionately if we subdivide or combine our common stock or preferred stock, as

applicable.

In

addition, unless the prospectus supplements state otherwise, if we, without payment therefor:

| |

● |

issue

capital stock or other securities convertible into or exchangeable for common stock or preferred stock, or any rights to subscribe

for, purchase or otherwise acquire any of the foregoing, as a dividend or distribution to holders of our common stock or preferred

stock; |

| |

|

|

| |

● |

pay

any cash to holders of our common stock or preferred stock other than a cash dividend paid out of our current or retained earnings

or other than in accordance with the terms of the preferred stock; |

| |

|

|

| |

● |

issue

any evidence of our indebtedness or rights to subscribe for or purchase our indebtedness to holders of our common stock or preferred

stock; or |

| |

|

|

| |

● |

issue

common stock or preferred stock or additional stock or other securities or property to holders of our common stock or preferred stock

by way of spinoff, split-up, reclassification, combination of shares or similar corporate rearrangement; |

then

the holders of common stock warrants and preferred stock warrants, as applicable, will be entitled to receive upon exercise of the warrants,

in addition to the securities otherwise receivable upon exercise of the warrants and without paying any additional consideration, the

amount of stock and other securities and property such holders would have been entitled to receive had they held the common stock or

preferred stock, as applicable, issuable under the warrants on the dates on which holders of those securities received or became entitled

to receive such additional stock and other securities and property.

Except

as stated above, the exercise price and number of securities covered by a common stock warrant or preferred stock warrant, and the amounts

of other securities or property to be received, if any, upon exercise of those warrants, will not be adjusted or provided for if we issue

those securities or any securities convertible into or exchangeable for those securities, or securities carrying the right to purchase

those securities or securities convertible into or exchangeable for those securities.

Holders

of common stock warrants and preferred stock warrants may have additional rights under the following circumstances:

| |

● |

certain

reclassifications, capital reorganizations or changes of the common stock or preferred stock, as applicable; |

| |

|

|

| |

● |

certain

share exchanges, mergers, or similar transactions involving us and which result in changes of our common stock or preferred stock,

as applicable; or |

| |

|

|

| |

● |

certain

sales or dispositions to another entity of all or substantially all of our property and assets. |

If

one of the above transactions occurs and holders of our common stock or preferred stock are entitled to receive stock, securities or

other property with respect to or in exchange for their securities, the holders of the common stock warrants and preferred stock warrants

then outstanding, as applicable, will be entitled to receive upon exercise of their warrants the kind and amount of shares of stock and

other securities or property that they would have received upon the applicable transaction if they had exercised their warrants immediately

before the transaction.

DESCRIPTION

OF OUR RIGHTS

This

summary, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms

and provisions of the rights that we may offer under this prospectus, which consist of rights to purchase our common stock, preferred

stock and/or debt securities in one or more series. Rights may be offered independently or together with our common stock, preferred

stock, debt securities and/or warrants offered by any prospectus supplement and may be attached to or separate from those securities.

While the terms we have summarized below will generally apply to any future rights we may offer pursuant to this prospectus, we will

describe the particular terms of any rights that we may offer in more detail in the applicable prospectus supplements. The terms of any

rights we offer under a prospectus supplement may differ from the terms we describe below.

The

applicable prospectus supplements relating to any rights that we offer will include specific terms of any offering of rights for which

this prospectus is being delivered, including the following, to the extent applicable:

| |

● |

the

date for determining the persons entitled to participate in the rights distribution; |

| |

|

|

| |

● |

the

price, if any, per right; |

| |

|

|

| |

● |

the

exercise price payable for each share of common stock, share of preferred stock or debt security upon the exercise of the rights; |

| |

|

|

| |

● |

the

number of rights issued or to be issued to each holder; |

| |

|

|

| |

● |

the

number and terms of the shares of common stock, shares of preferred stock or debt securities that may be purchased per each right; |

| |

|

|

| |

● |

the

extent to which the rights are transferable; |

| |

|

|

| |

● |

any

other terms of the rights, including the terms, procedures and limitations relating to the exchange and exercise of the rights; |

| |

|

|

| |

● |

the

respective dates on which the holder’s ability to exercise the rights will commence and will expire; |

| |

|

|

| |

● |

the

number of rights outstanding, if any; |

| |

|

|

| |

● |

a

discussion of any material U.S. federal income tax considerations applicable to the rights; |

| |

|

|

| |

● |

the

extent to which the rights may include an over-subscription privilege with respect to unsubscribed securities; and |

| |

|

|

| |

● |

if

applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with the offering

of such rights. |

The

description in the applicable prospectus supplements of any rights that we may offer will not necessarily be complete and will be qualified

in its entirety by reference to the applicable rights agreement and/or rights certificate, which will be filed with the SEC in connection

therewith.

DESCRIPTION

OF OUR UNITS

This

summary, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms

and provisions of the units that we may offer under this prospectus, which may consist of one or more shares of our common stock, shares

of our preferred stock, debt securities, warrants, rights or any combination of such securities. While the terms we have summarized below

will generally apply to any future units we may offer pursuant to this prospectus, we will describe the particular terms of any units

that we may offer in more detail in the applicable prospectus supplements. The terms of any units we offer under a prospectus supplement

may differ from the terms we describe below.

The

applicable prospectus supplements relating to any units that we offer will include specific terms of any offering of units for which

this prospectus is being delivered, including the following, to the extent applicable:

| |

● |

the