Credit Acceptance Announces Increase and Extension of Revolving Secured Warehouse Facility

December 05 2024 - 3:02PM

Credit Acceptance Corporation (Nasdaq: CACC)

(referred to as the “Company”, “Credit Acceptance”, “we”, “our”, or

“us”) announced today that we have increased the amount of

Warehouse Facility V (the “Facility”), one of our revolving secured

warehouse facilities, from $200.0 million to $250.0 million. We

also extended the date on which the Facility will cease to revolve

from December 29, 2025 to December 29, 2027. The maturity of the

Facility was also extended from December 27, 2027 to December 27,

2029. The interest rate on borrowings under the Facility has

decreased from the Secured Overnight Financing Rate (“SOFR”) plus

245 basis points to SOFR plus 185 basis points.

There were no other material changes to the

Facility. As of December 5, 2024, we did not have a balance

outstanding under the Facility.

Description of Credit Acceptance

Corporation

We make vehicle ownership possible by providing

innovative financing solutions that enable automobile dealers to

sell vehicles to consumers regardless of their credit history. Our

financing programs are offered through a nationwide network of

automobile dealers who benefit from sales of vehicles to consumers

who otherwise could not obtain financing; from repeat and referral

sales generated by these same customers; and from sales to

customers responding to advertisements for our financing programs,

but who actually end up qualifying for traditional financing.

Without our financing programs, consumers are

often unable to purchase vehicles or they purchase unreliable ones.

Further, as we report to the three national credit reporting

agencies, an important ancillary benefit of our programs is that we

provide consumers with an opportunity to improve their lives by

improving their credit score and move on to more traditional

sources of financing. Credit Acceptance is publicly traded on the

Nasdaq Stock Market under the symbol CACC. For more information,

visit creditacceptance.com.

Investor Relations: Douglas W. Busk

Chief Treasury Officer

(248) 353-2700 Ext. 4432

IR@creditacceptance.com

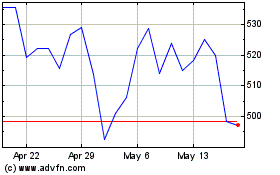

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Dec 2023 to Dec 2024