As filed with the Securities and Exchange Commission

on December 20, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CASI Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Its

Charter)

| Cayman

Islands |

|

Not

Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

1701-1702, China Central Office Tower 1

No. 81 Jianguo Road Chaoyang District

Beijing, 100025

People’s Republic of China

+86 (10) 6508 6063

(Address and telephone number of Registrant’s

principal executive offices)

Rui Zhang

VP of Finance and Operations

CASI Pharmaceuticals, Inc.

9620 Medical Center Drive, Suite 300

Rockville, MD 20850

240-864-2600

(Name, address and telephone number of agent

for service)

Copies of all communications, including

communications sent to agent for service, should be sent to:

Copies to:

Alexander R. McClean, Esq.

C. Christopher Murillo, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, NY 14604

Tel: (585) 232-6500

Fax: (585) 232-2152

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ¨

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

Pursuant to the provisions of Rule 429 under

the Securities Act, the prospectus contained in this registration statement also relates to the Registrant’s registration

statement on Form F-3 (File No. 333-279096). Upon effectiveness, this registration statement will also act as a post-effective

amendment to such earlier registration statement.

EXPLANATORY NOTE

On May 3, 2024, CASI

Pharmaceuticals, Inc., or the Company filed a registration statement, or the Prior Registration Statement, on Form F-3 (File

No. 333-279096) with the U.S. Securities and Exchange Commission, or the SEC, related to the offer and sale of up to an aggregate

of $50.0 million of any combination of the securities described in the prospectus relating to the Prior Registration Statement, or the

Prior Securities. The Prior Registration Statement was subsequently declared effective on May 10, 2024. Pursuant to Rule 429

under the Securities Act of 1933, as amended, or the Securities Act, this registration statement, which is a new registration statement,

combines the Prior Securities from the Prior Registration Statement, all of which remain unissued, with the additional securities registered

hereby for offer and sale by the Company, to enable the offer and sale of up to an aggregate of $200.0 million of the Company’s

ordinary shares, preferred shares, warrants, subscription rights, and/or units, from time to time in one or more offerings, pursuant

to a combined base prospectus. Pursuant to Rule 429 under the

Securities Act, this F-3 Registration Statement also constitutes a post-effective amendment to the Prior Registration Statement, and

such post-effective amendment shall hereafter become effective concurrently with the effectiveness of this F-3 Registration Statement

in accordance with Section 8(c) of the Securities Act.

Additionally, this registration

statement contains a Sales Agreement prospectus covering the offering, issuance and sale by the Company of up to $50.0 million of the Company’s

ordinary shares that may be issued and sold from time to time under an Open Market Sale AgreementSM the Company has entered

into with Jefferies LLC, as sales agent, or the Sales Agreement.

The combined base prospectus

relating to the offer and sale of up to $200.0 million of the Company’s ordinary shares, preferred shares, warrants, subscription

rights, and/or units immediately follows this explanatory note. The specific terms of any other securities to be offered pursuant to

the combined base prospectus will be specified in one or more prospectus supplements to the combined base prospectus.

The Sales Agreement prospectus

immediately follows the combined base prospectus. The $50.0 million of the Company’s ordinary shares that may be offered, issued

and sold from time to time under the Sales Agreement prospectus is included in the $200.0 million of securities that may be offered, issued

and sold by the Company under the combined base prospectus. Upon termination of the Sales Agreement, any portion of the $50.0 million

included in the Sales Agreement prospectus that is not sold pursuant to the Sales Agreement will be available for sale in other offerings

pursuant to the combined base prospectus and a corresponding prospectus supplement, and if no shares are sold under the Sales Agreement,

the full $200.0 million of securities may be sold in other offerings pursuant to the combined base prospectus and a corresponding prospectus

supplement.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities

in any jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated

December 20, 2024

PROSPECTUS

$200,000,000

Ordinary Shares

Preferred Shares

Warrants

Subscription Rights

Units

We may offer and sell from

time to time, in one or more offerings, up to an aggregate of $200.0 million of any combination of the securities described in this prospectus,

which are referred to as the securities. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange

or exercise of the securities, including any applicable anti-dilution provisions.

We may offer and sell any

of the securities described in this prospectus in different series, at times, in amounts, at prices and on terms to be determined at

or prior to the time of each offering. This prospectus describes the general terms of these securities and the general manner in which

these securities will be offered. We will provide the specific terms of these securities and the specific manner in which these securities

will be offered in supplements to this prospectus. You should read this prospectus, the applicable prospectus supplement and any related

free writing prospectus, as well as any documents incorporated by reference, before you invest.

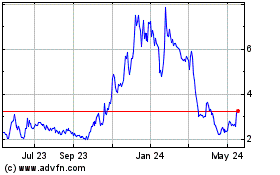

Our ordinary shares are traded

on The Nasdaq Capital Market under the symbol “CASI.” On December 18, 2024, the last sale price of our ordinary shares

as reported by The Nasdaq Capital Market was $2.86 per share. The applicable prospectus supplement will contain information, where applicable,

as to other listings, if any, on The Nasdaq Capital Market or other securities exchange of the securities covered by the applicable prospectus

supplement. Prospective purchasers of the securities are urged to obtain current information as to the market prices of the securities,

where applicable.

Investing in our securities involves a high

degree of risk. We may be subject to various legal and operational risks as a result of doing business in the PRC, risks relating to

our auditor, risks relating to cash and asset transfers among CASI and its subsidiaries, and risks relating to permission and filing

procedures required from the governmental authorities of the PRC with respect to the operation of our PRC subsidiaries and future offerings

in the United States. You should carefully review the risks and uncertainties described under the section titled “Risk Factors”

on page 8 of this prospectus and, if applicable, any risk factors described in any applicable prospectus supplement and in our filings

with the U.S. Securities and Exchange Commission, or SEC, that are incorporated by reference in this prospectus.

This prospectus may not be

used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

The securities may be sold

directly by us to investors, through agents designated from time to time or to or through underwriters or dealers, on a continuous or

delayed basis. For additional information on the methods of sale, you should refer to the section titled “Plan of Distribution”

in this prospectus. If any agents or underwriters are involved in the sale of the securities with respect to which this prospectus is

being delivered, the names of such agents or underwriters will be set forth in a prospectus supplement. The price to the public of such

securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

We are a “foreign private

issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, and, as such, we have elected to comply with

certain reduced public company reporting requirements for this prospectus and future filings. Please see the section titled “Implications

of Being a Foreign Private Issuer” in this prospectus.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 2024.

INTRODUCTORY COMMENTS

We are not a Chinese operating

company but a Cayman Islands holding company with business operations primarily conducted by our Chinese subsidiaries. This holding company

structure and our operation in China may involve risks. We currently conduct our business through the following consolidated subsidiaries:

CASI Pharmaceuticals (China) Co., Ltd., referred to as CASI China; CASI Pharmaceuticals (Wuxi) Co., Ltd., referred to as CASI

Wuxi; CASI Biopharmaceuticals (WUXI) Co., Ltd, referred to as CASI Biopharmaceuticals; and CASI Pharmaceuticals Co., Limited, referred

to as CASI Hong Kong.

Risks and

Uncertainties Relating to Doing Business in China

We face various risks and

uncertainties related to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex

and evolving PRC laws and regulations. The PRC government’s significant authority in regulating our operations and its oversight

and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline

or become worthless. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, could

result in a material change in our operations and may cause the value of our securities to significantly decline or become worthless.

Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and

quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our

ordinary shares. For example, China’s government has in recent years issued statements and regulatory actions to regulate certain

market players or to improve its supervision of the market in general, such as those related to data security or anti-monopoly concerns.

While we currently do not believe such regulatory actions have materially impacted our business operations, our ability to accept foreign

investments, or our ability to maintain listing with the Nasdaq Stock Market, there is no assurance that any new rules or regulations

promulgated in the future will not impose additional requirements on us. If any such rules or regulations are adopted, we may be

subject to more stringent regulatory scrutiny for our operation and financing efforts, which may in turn result in us incurring additional

compliance costs and expenses, delay our investment and financing activities, or otherwise impact our ability to conduct our business,

accept foreign investments, or list on a U.S. or other foreign exchange.

In addition to our existing

operations in China, we conduct clinical development of certain of our product candidates outside of China. In connection with these

efforts we have licensed the exclusive worldwide rights to certain product candidates, including CID-103, which rights are held by us

outside of China.

Risks Relating to Our Auditor

Our auditor, the independent

registered public accounting firm that issues the audit report contained in our annual report, as an auditor of companies that are traded

publicly in the United States and a firm registered with the Public Company Accounting Oversight Board, or PCAOB, is subject to laws

in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with applicable professional standards.

Our auditor is located in mainland China, a jurisdiction where the PCAOB was historically unable to conduct inspections and investigations

completely before 2022. As a result, we and investors in CASI Pharmaceuticals, Inc., a Delaware corporation, our predecessor prior

to the redomicile merger, referred to as CASI Delaware were deprived of the benefits of such PCAOB inspections. Pursuant to the Holding

Foreign Companies Accountable Act, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public

accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our securities

from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On December 16, 2021,

the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered

public accounting firms headquartered in mainland China and Hong Kong and CASI Delaware’s auditor was subject to that determination.

In April 2022, the SEC conclusively listed CASI Delaware as a Commission-Identified Issuer under the HFCAA following the filing

of its annual report on Form 10-K for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued

a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions

where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect we will

be identified as a Commission-Identified Issuer under the HFCAA for the fiscal year ended December 31, 2024.

Each year in the future,

the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions.

If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland

China and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial

statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report for

the relevant fiscal year. In accordance with the HFCAA, our ordinary shares would be prohibited from being traded on a national securities

exchange or in the over-the-counter trading market in the United States if we are identified as a Commission-Identified Issuer for two

consecutive years in the future. If our ordinary shares are prohibited from trading in the United States, there is no certainty that

we will be able to list on a non-U.S. exchange or that a market for our ordinary shares will develop outside of the United States. A

prohibition of being able to trade in the United States would substantially impair your ability to sell or purchase our ordinary shares

when you wish to do so, and the risk and uncertainty associated with delisting would have a negative impact on the price of such shares.

Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable to us, or at all, which would have

a material adverse impact on our business, financial condition, and prospects.

Cash and Asset Transfer

among CASI and its Subsidiaries

We provide funding to our

subsidiaries from time to time through capital contributions or loans, subject to satisfaction of applicable government registration

and approval requirements. For the year ended December 31, 2023, we provided funding of US$1.0 million through capital contributions

to CASI Hong Kong, our newly incorporated Hong Kong subsidiary.

Our subsidiaries may pay

dividends and make other distributions to us subject to satisfaction of applicable government filing and approval requirements. Such

dividend or other distributions may be subject to limitations and certain tax consequences, a discussion on which is set forth below.

For the year ended December 31, 2023, no dividends or other distributions were made by our subsidiaries.

We also pay service fees

to our PRC subsidiaries pursuant to certain sales support service agreements and research and development support service agreements.

For the year ended December 31 2023, we paid service fees of US$1.1 million to CASI China, one of our PRC subsidiaries. Under PRC

tax laws and regulations, the earnings of our subsidiaries under such agreements are subject to a statutory tax rate of 25%.

In the year ended December 31,

2023, no assets other than cash were transferred through our organization.

All cash transfers among

us and our subsidiaries have been eliminated in our consolidated statement of cash flows.

The existing PRC foreign

exchange regulations may limit our ability to initiate and complete cash transfers within our group. Approval from the State Administration

of Foreign Exchange, or SAFE, and the People’s Bank of China, or PBOC, may be required where RMB are to be converted into foreign

currencies, including U.S. dollars, and approval from SAFE and PBOC or their branches may be required where RMB are to be remitted out

of China.

We have never declared or

paid dividends on our ordinary shares or any other securities and we do not anticipate paying any dividends on our ordinary shares in

the foreseeable future. We may rely on dividends from our subsidiaries in China to pay dividend and other distributions on our ordinary

shares. PRC regulations may restrict the ability of our PRC subsidiaries to pay dividends to us. In addition to applicable foreign exchange

limitations, under the current regulatory regime in China, a PRC company may pay dividends only out of its accumulated profit, if any,

determined in accordance with PRC accounting standards and regulations, and is required to set aside as general reserves at least 10%

of its after-tax profit, until the cumulative amount of such reserves reaches 50% of its registered capital, prior to any dividend distribution.

In addition, a PRC company shall not distribute any profits in a given year until any losses from prior fiscal years have been offset.

Permission and Filing

Procedures Required from the PRC Authorities with respect to the Operations of Our PRC Subsidiaries and Future offering in the US

As the date hereof, our PRC

subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for our business

operations, including, among others, the Business License, the Drug Distribution License, the Drug Manufacturing Permit, the Clinical

Trial Application with the PRC National Medical Products Administration, or NMPA, and the notification filing for international collaborative

clinical trial or the application for international collaborative scientific research with the China Human Genetic Resources Administrative

Office, or HGRAO. We also work with our business partners which have obtained the requisite licenses and permits for their business collaboration

with us, including, among others, the Import Drug Registration for product(s) we promote and distribute in China. Given the uncertainties

of interpretation and implementation of relevant laws and regulations and the enforcement practices of the relevant government authorities,

we may be required to obtain additional permissions or approvals for our business operations.

As

the date hereof, we and our PRC subsidiaries (i) except for the requisite CSRC Filing(s) (as defined below), are not

required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, (ii) are not required to go through

cybersecurity review by the Cyberspace Administration of China, or the CAC, and (iii) have not been asked to obtain or were denied

such permissions by applicable PRC authority. On July 7, 2022, the CAC published the Guidelines for Data Export Security Assessment

(《数据出境安全评估办法》),

or the Guidelines, which took effect on September 1, 2022. Pursuant to the Guidelines, the data processor who intends to transfer

certain important data or large volumes of personal information outside of China shall complete a prior CAC-led data outbound transfer

security assessment. For the data we accessed through or obtained from clinical trials, we have complied with the laws and regulations

then-in-effect, and completed the registration with HGRAO, but it is unclear if we will be required to go through the CAC-led or CAC-involved

security assessment or if the current HGRAO registration procedure will be changed in the future. We will closely monitor and review

any regulatory developments and comply with any new approval or license requirement when necessary. If (i) we have erroneously concluded

that such permissions or approvals are not required, or (ii) applicable laws, regulations, or interpretations change and we are

required to obtain such permissions or approvals in the future, we may have to expend significant time and costs to procure them. If

we are unable to do so, on commercially reasonable terms, in a timely manner or otherwise, we may become subject to sanctions imposed

by the PRC regulatory authorities, which could include fines and penalties, proceedings against us, and other forms of sanctions, and

our ability to conduct our business, invest into China as foreign investments or accept foreign investments, or be listed on a U.S. or

other overseas exchange may be restricted, and our business, reputation, financial condition, and results of operations may be materially

and adversely affected.

On

February 17, 2023, the CSRC released the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic

Companies (《境内企业境外发行证券和上市管理试行办法》)

and five ancillary interpretive guidelines, collectively, the Overseas Listing Trial Measures, as amended, supplemented or otherwise

modified from time to time, which apply to overseas offerings and listing by PRC-based companies, or domestic companies, of equity shares,

depository receipts, corporate bonds convertible to equity shares, and other equity securities, and came into effect on March 31,

2023. According to the Overseas Listing Trial Measures, (1) domestic companies that seek to offer or list securities overseas, both

directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC, and if an overseas-listed PRC-based

issuer issues new securities in the same overseas market after the overseas offering and listing, it is also required to file with the

CSRC within three business days after the completion of the issuance, or the CSRC Filing; if a domestic company fails to complete the

filing procedure or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject

to administrative penalties, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person

directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines; (2) if

a foreign-incorporated issuer meets both of the following conditions, its overseas offering and listing shall be determined as an indirect

overseas offering and listing by a domestic company of the PRC: (i) any of the total assets, net assets, revenues or profits of

the domestic operating entities of the issuer in the most recent accounting year accounts for more than 50% of the corresponding line

items in the issuer’s audited consolidated financial statements for the same period; and (ii) its major operational activities

are carried out in China or its main places of business are located in China, or the senior managers in charge of operation and management

of the issuer are mostly Chinese citizens or are domiciled in China; in addition to the aforementioned conditions, the determination

of an indirect overseas offering and listing by a domestic enterprise adheres to the principle of substance over form; and (3) where

a domestic company seeks to indirectly offer and list securities in an overseas market (including issuance of new securities after its

overseas offering and listing), the issuer shall designate a major domestic operating entity responsible for all filing procedures with

the CSRC.

Furthermore, in case any

of the following major events occurs after the overseas offering and listing, the issuer is also required to report the relevant information

to the CSRC within three business days of the occurrence and the announcement of the relevant events: (1) change of control; (2) the

foreign securities regulatory body or the relevant competent authority has taken such measures as investigation and punishment; (3) conversion

of listing status or listing board; and (4) voluntary of compulsory termination of listing. Where there is any material change in

the major business and operation of the issuer after overseas offering and listing, and such change does not fall within the scope of

filing, the issuer shall, within three business days of the occurrence of such change, submit a special report and a legal opinion issued

by a domestic law firm to the CSRC to explain the relevant situation.

As substantially all of our

operations are currently based in the PRC, our future offerings and major changes shall be subject to the filing procedures under the

Overseas Listing Trial Measures. We cannot assure you that we can meet such requirements, obtain the requisite permits from the relevant

government authorities, or complete such filing in a timely manner or at all. Any failure may significantly limit or completely hinder

our ability to continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part

of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration

process under the Securities Act of 1933, as amended, or the Securities Act. Under this shelf registration process, we may, from time

to time, sell up to an aggregate of $200.0 million of the securities described in this prospectus, either individually or in combination

with the other securities. This prospectus provides you with a general description of the securities that may be offered by us. Each

time we sell any type or series of securities, we will provide you a prospectus supplement accompanied by this prospectus. The prospectus

supplement will contain more specific information about the nature of the persons offering securities and the terms the securities being

offered at that time. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information

relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to

you may also add, update or change any of the information contained in this prospectus or in the documents we have incorporated by reference

into this prospectus. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in

this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement.

You should carefully read both this prospectus and the applicable prospectus supplement and any related free writing prospectus, together

with the additional information described under “Where You Can Find More Information” and “Information Incorporated

by Reference,” before buying any of the securities being offered.

To the extent there is a

conflict between the information contained in this prospectus, on the one hand, and the information contained in any prospectus supplement,

any free writing prospectus or in any document incorporated by reference in this prospectus, on the other hand, you should rely on the

information in this prospectus, provided that if any statement in one of these documents is inconsistent with a statement in another

document having a later date—for example, a prospectus supplement or a document incorporated by reference in this prospectus—the

statement in the document having the later date modifies or supersedes the earlier statement.

The information contained

in this prospectus, the applicable prospectus supplement, any applicable free writing prospectus or any document incorporated by reference

herein or therein is accurate only as of such documents’ respective dates, regardless of the time of delivery of this prospectus,

the applicable prospectus supplement, any applicable free writing prospectus or the documents incorporated by reference in this prospectus

or the sale of any securities. Our business, financial condition, results of operations and prospects may have changed materially since

those dates.

This prospectus may not be

used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

Neither we, nor any agent,

underwriter or dealer has authorized any person to give any information or to make any representation other than those contained or incorporated

by reference in this prospectus, any applicable prospectus supplement or any related free writing prospectus prepared by or on behalf

of us or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus, any applicable supplement to this prospectus or any related free writing prospectus does not constitute an offer to

sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus,

any applicable supplement to this prospectus or any related free writing prospectus constitute an offer to sell or the solicitation of

an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume that

the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate

on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is

correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus, any applicable prospectus

supplement or any related free writing prospectus is delivered, or securities are sold, on a later date.

This prospectus contains

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred

to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this

prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You

Can Find More Information.”

For investors outside the

United States, neither we nor any underwriters, dealers or agents have taken any action that would permit the offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities described herein and the distribution of this prospectus outside the United States.

Throughout this prospectus,

references to the “Company,” “we,” “our,” “us,” “registrant,” “CASI”

or similar terms used in this prospectus refer to CASI Pharmaceuticals, Inc., an exempted company with limited liability under the

laws of the Cayman Islands, including its consolidated subsidiaries, unless the context otherwise indicates.

“PRC” or “China”

refers to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan, Hong Kong and Macau, “RMB”

or “Renminbi” refers to the legal currency of China, and “$”, “US$” or “U.S. Dollars”

refers to the legal currency of the United States.

This prospectus may contain

translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation

that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi,

as the case may be, at any particular rate or at all.

INDUSTRY AND MARKET DATA

In this prospectus and the

documents incorporated by reference in this prospectus, we present industry data, information and statistics regarding the markets in

which the Company and its subsidiaries compete as well as publicly available information, industry and general publications and research

and studies conducted by third parties. This information is supplemented where necessary with the Company’s own internal estimates

and information obtained from discussions with its customers, taking into account publicly available information about other industry

participants and the Company’s management’s judgment where information is not publicly available.

Industry publications, research,

studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that

the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these

sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus or any document

incorporated by reference into this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due

to a variety of factors, including those described under the section entitled “Risk Factors.” These and other factors

could cause results to differ materially from those expressed in any forecasts or estimates.

TRADEMARKS

AND TRADENAMES

This prospectus and the

information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks,

service marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any

related free writing prospectus are the property of their respective owners.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does

not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire

prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities

discussed under the section titled “Risk Factors” contained in this prospectus, the applicable prospectus supplement and

any related free writing prospectus, and under similar sections in the other documents that are incorporated by reference into this prospectus.

You should also carefully read the other information incorporated by reference into this prospectus, including our consolidated and condensed

consolidated financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

We are a biopharmaceutical

company focused on developing and commercializing innovative therapeutics and pharmaceutical products in China, the United States, and

throughout the world.

Holding Company Structure

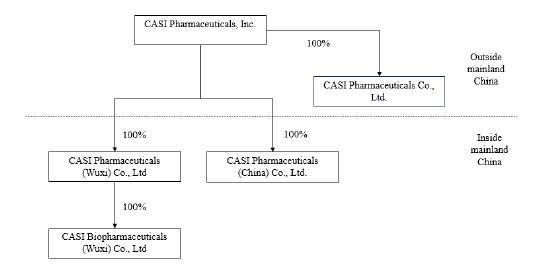

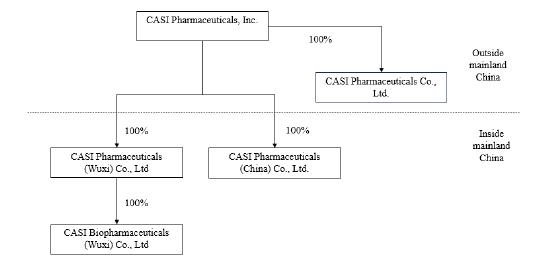

CASI is not a Chinese operating

company but a Cayman Islands holding company with a significant portion of the business operations expected to be conducted by its Chinese

subsidiaries. This holding company structure and our operation in China may involve risks. We currently conduct our business through

the following consolidated subsidiaries:

| · | CASI

Pharmaceuticals (China) Co., Ltd., referred to as CASI China; |

| · | CASI

Pharmaceuticals (Wuxi) Co., Ltd., referred to as CASI Wuxi; |

| · | CASI

Biopharmaceuticals (WUXI) Co., Ltd, referred to as CASI Biopharmaceuticals; and |

| · | CASI

Pharmaceuticals Co., Limited, referred to as CASI Hong Kong. |

We do not

have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages

in leasing, hedging or product development services with us. The organizational chart of CASI as of December 18, 2024 is set forth

below:

Note: Currently CASI Hong Kong has no meaningful operations.

In addition to our existing

operations in China, we conduct clinical development of certain of our product candidates outside of China. In connection with these

efforts we have licensed the exclusive worldwide rights to certain product candidates, including CID-103, which rights are held by us

outside of China.

Nasdaq Capital Market Listing; Redomiciliation

Our ordinary shares are traded

on The Nasdaq Capital Market under the symbol “CASI.” In March 2023, we completed a redomicile merger, with CASI surviving

the merger as the surviving company and successor issuer, and CASI’s ordinary shares continued trading on The Nasdaq Capital Market

under the symbol “CASI.” CASI is treated for U.S. federal income tax purposes as a U.S. corporation, including with respect

to any dividends paid by it, which dividends may be subject to U.S. withholding taxes.

Corporate Information

Our principal executive offices

are located at 1701-1702, China Central Office Tower 1, No. 81 Jianguo Road Chaoyang District, Beijing, 100025, People’s Republic

of China. Our telephone number at this address is +86 (10) 6508 6063. Our registered office in the Cayman Islands is located at

Maples Corporate Services Limited, P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

Our agent for service of

process in the United States is located at 9620 Medical Center Drive, Suite 300, Rockville, MD 20850, 240-864-2600.

Implications of Being a Foreign Private Issuer

As a “foreign private

issuer,” CASI is subject to different U.S. securities laws than domestic U.S. issuers. The rules governing the information

that CASI must disclose differ from those governing U.S. corporations pursuant to the Securities Exchange Act of 1934, as amended, or

the Exchange Act. Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the

securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

| · | the

rules under the Exchange Act requiring the filing with the SEC of quarterly reports

on Form 10-Q or current reports on Form 8-K; |

| · | the

sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations

in respect of a security registered under the Exchange Act; |

| · | the

sections of the Exchange Act requiring insiders to file public reports of their stock ownership

and trading activities and liability for insiders who profit from trades made in a short

period of time; and |

| · | the

selective disclosure rules by issuers of material nonpublic information under Regulation

FD. |

We are required to file

an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on

a quarterly basis as press releases, distributed pursuant to the rules and regulations of the Nasdaq Stock Market. Press releases

relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are

required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC

by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you

were you investing in a U.S. domestic issuer.

In addition, as a foreign

private issuer, CASI’s officers and directors and holders of more than 10% of the issued and outstanding ordinary shares are exempt

from the rules under the Exchange Act requiring insiders to report purchases and sales of ordinary shares as well as from Section 16

short swing profit reporting and liability. A company will lose its foreign private issuer status if more than 50% of its outstanding

voting securities are owned by U.S. residents and any of the following three circumstances applies: (i) the majority of its executive

officers or directors are U.S. citizens or residents, (ii) more than 50% of its assets are located in the United States or (iii) its

business is administered principally in the United States.

Risks Associated with our Business

Our business is subject to

numerous risks, as described under the heading “Risk Factors” contained in the applicable prospectus supplement and

in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar headings that are

incorporated by reference into this prospectus, including, without limitation, the further risks discussed below.

Our Recurring Operating

Losses have Raised Substantial Doubt Regarding Our Ability to Continue as a Going Concern.

Our recurring operating losses

raise substantial doubt about our ability to continue as a going concern. Since our inception in 1991, we have incurred significant losses

from operations and, as of June 30, 2024, had incurred an accumulated deficit of $677.3 million. For the six months ended June 30, 2024,

we had a net loss of $16.5 million and a cash outflow for operating activities of $18.1 million. As of June 30, 2024, we had net current

assets of $27.6 million. In addition, we had long term borrowing and non-current dividends payable in a total amount of $19.5 million,

which may become payable on demand if certain events of default occur (including with respect to a certain revenue threshold to be met

by CASI Wuxi in 2024, see Note 9 to our unaudited condensed consolidated financial statements for the six months ended June 30, 2024 included

elsewhere in this prospectus (the “Financial Statements”)). We also entered into an agreement with Precision Autoimmune Therapeutics

Co., Ltd., (“PAT”) and one of the investors of PAT, to purchase 19.8876% equity interest of PAT from the investor. The total

consideration is RMB 28.4 million plus interest and will be paid in three installments. We paid RMB 10.0 million in August 2024. The remaining

two installments will be paid by March 31, 2025 and December 31, 2025, respectively. Therefore, we will require additional liquidity to

continue our operations over the next 12 months. These factors raise substantial doubt about our ability to continue as a going concern

within a reasonable period of time, which is considered to be one year from the issuance date of the unaudited condensed consolidated

financial statements for the six months ended June 30, 2024. Our financial statements included into this prospectus do not include any

adjustments that might result if we are unable to continue as a going concern and, therefore, be required to realize our assets and discharge

our liabilities other than in the normal course of business, which could cause investors to suffer the loss of all or a substantial portion

of their investment. In order to have sufficient cash and cash equivalents to fund our operations in the future, we will need to raise

additional equity or debt capital and cannot provide any assurance that we will be successful in doing so. The perception of our ability

to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could

result in the loss of confidence by investors, suppliers and employees.

Risks and Uncertainties Relating

to Doing Business in China

We face various risks and

uncertainties related to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex

and evolving PRC laws and regulations. The PRC government’s significant authority in regulating our operations and its oversight

and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline

or become worthless. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, could

result in a material change in our operations and may cause the value of our securities to significantly decline or become worthless.

Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and

quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our

ordinary shares. For example, China’s government has in recent years issued statements and regulatory actions to regulate certain

market players or to improve its supervision of the market in general, such as those related to data security or anti-monopoly concerns.

While we currently do not believe such regulatory actions have materially impacted our business operations, our ability to accept foreign

investments, or our ability to maintain listing with the Nasdaq Stock Market, there is no assurance that any new rules or regulations

promulgated in the future will not impose additional requirements on us. If any such rules or regulations are adopted, we may be

subject to more stringent regulatory scrutiny for our operation and financing efforts, which may in turn result in us incurring additional

compliance costs and expenses, delay our investment and financing activities, or otherwise impact our ability to conduct our business,

accept foreign investments, or list on a U.S. or other foreign exchange.

Risks Relating to Our Auditor

Our auditor, the independent

registered public accounting firm that issues the audit report contained in our annual report, as an auditor of companies that are traded

publicly in the United States and a firm registered with the Public Company Accounting Oversight Board, or PCAOB, is subject to laws

in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with applicable professional standards.

Our auditor is located in mainland China, a jurisdiction where the PCAOB was historically unable to conduct inspections and investigations

completely before 2022. As a result, we and investors in CASI Pharmaceuticals, Inc., a Delaware corporation, our predecessor prior

to the redomicile merger, referred to as CASI Delaware were deprived of the benefits of such PCAOB inspections. Pursuant to the Holding

Foreign Companies Accountable Act, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public

accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our securities

from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On December 16, 2021,

the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered

public accounting firms headquartered in mainland China and Hong Kong and CASI Delaware’s auditor was subject to that determination.

In April 2022, the SEC conclusively listed CASI Delaware as a Commission-Identified Issuer under the HFCAA following the filing

of its annual report on Form 10-K for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued

a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions

where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect we will

be identified as a Commission-Identified Issuer under the HFCAA for the fiscal year ended December 31, 2024.

Each year in the future,

the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions.

If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland

China and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial

statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report for

the relevant fiscal year. In accordance with the HFCAA, our ordinary shares would be prohibited from being traded on a national securities

exchange or in the over-the-counter trading market in the United States if we are identified as a Commission-Identified Issuer for two

consecutive years in the future. If our ordinary shares are prohibited from trading in the United States, there is no certainty that

we will be able to list on a non-U.S. exchange or that a market for our ordinary shares will develop outside of the United States. A

prohibition of being able to trade in the United States would substantially impair your ability to sell or purchase our ordinary shares

when you wish to do so, and the risk and uncertainty associated with delisting would have a negative impact on the price of such shares.

Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable to us, or at all, which would have

a material adverse impact on our business, financial condition, and prospects.

Cash and Asset Transfer among

the Company and its Subsidiaries

We provide funding to our

subsidiaries from time to time through capital contributions or loans, subject to satisfaction of applicable government registration

and approval requirements. For the year ended December 31, 2023, we provided funding of US$1.0 million through capital contributions

to CASI Hong Kong, our newly incorporated Hong Kong subsidiary.

Our subsidiaries may pay

dividends and make other distributions to us subject to satisfaction of applicable government filing and approval requirements. Such

dividend or other distributions may be subject to limitations and certain tax consequences, a discussion on which is set forth below.

For the year ended December 31, 2023, no dividends or other distributions were made by our subsidiaries.

We also pay service fees

to our PRC subsidiaries pursuant to certain sales support service agreements and research and development support service agreements.

For the year ended December 31 2023, we paid service fees of US$1.1 million to CASI China, one of our PRC subsidiaries. Under PRC

tax laws and regulations, the earnings of our subsidiaries under such agreements are subject to a statutory tax rate of 25%.

In the year ended December 31,

2023, no assets other than cash were transferred through our organization.

All cash transfers among

us and our subsidiaries have been eliminated in our consolidated statement of cash flows.

The existing PRC foreign

exchange regulations may limit our ability to initiate and complete cash transfers within our group. Approval from the State Administration

of Foreign Exchange, or SAFE, and the People’s Bank of China, or PBOC, may be required where RMB are to be converted into foreign

currencies, including U.S. dollars, and approval from SAFE and PBOC or their branches may be required where RMB are to be remitted out

of China.

We have never declared or

paid dividends on our ordinary shares or any other securities and we do not anticipate paying any dividends on our ordinary shares in

the foreseeable future. We may rely on dividends from our subsidiaries in China to pay dividend and other distributions on our ordinary

shares. PRC regulations may restrict the ability of our PRC subsidiaries to pay dividends to us. In addition to applicable foreign exchange

limitations, under the current regulatory regime in China, a PRC company may pay dividends only out of its accumulated profit, if any,

determined in accordance with PRC accounting standards and regulations, and is required to set aside as general reserves at least 10%

of its after-tax profit, until the cumulative amount of such reserves reaches 50% of its registered capital, prior to any dividend distribution.

In addition, a PRC company shall not distribute any profits in a given year until any losses from prior fiscal years have been offset.

Permission and Filing Procedures

Required from the PRC Authorities with Respect to the Operations of Our PRC Subsidiaries and Future Offering in the US

As the date hereof, our PRC

subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for our business

operations, including, among others, the Business License, the Drug Distribution License, the Drug Manufacturing Permit, the Clinical

Trial Application with the PRC National Medical Products Administration, or NMPA, and the notification filing for international collaborative

clinical trial or the application for international collaborative scientific research with the China Human Genetic Resources Administrative

Office, or HGRAO. We also work with our business partners which have obtained the requisite licenses and permits for their business collaboration

with us, including, among others, the Import Drug Registration for product(s) we promote and distribute in China. Given the uncertainties

of interpretation and implementation of relevant laws and regulations and the enforcement practices of the relevant government authorities,

we may be required to obtain additional permissions or approvals for our business operations.

As

the date hereof, we and our PRC subsidiaries (i) except for the requisite CSRC Filing(s) (as defined below), are not

required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, (ii) are not required to go through

cybersecurity review by the Cyberspace Administration of China, or the CAC, and (iii) have not been asked to obtain or were denied

such permissions by applicable PRC authority. On July 7, 2022, the CAC published the Guidelines for Data Export Security Assessment

(《数据出境安全评估办法》),

or the Guidelines, which took effect on September 1, 2022. Pursuant to the Guidelines, the data processor who intends to transfer

certain important data or large volumes of personal information outside of China shall complete a prior CAC-led data outbound transfer

security assessment. For the data we accessed through or obtained from clinical trials, we have complied with the laws and regulations

then-in-effect, and completed the registration with HGRAO, but it is unclear if we will be required to go through the CAC-led or CAC-involved

security assessment or if the current HGRAO registration procedure will be changed in the future. We will closely monitor and review

any regulatory developments and comply with any new approval or license requirement when necessary. If (i) we have erroneously concluded

that such permissions or approvals are not required, or (ii) applicable laws, regulations, or interpretations change and we are

required to obtain such permissions or approvals in the future, we may have to expend significant time and costs to procure them. If

we are unable to do so, on commercially reasonable terms, in a timely manner or otherwise, we may become subject to sanctions imposed

by the PRC regulatory authorities, which could include fines and penalties, proceedings against us, and other forms of sanctions, and

our ability to conduct our business, invest into China as foreign investments or accept foreign investments, or be listed on a U.S. or

other overseas exchange may be restricted, and our business, reputation, financial condition, and results of operations may be materially

and adversely affected.

On

February 17, 2023, the CSRC released the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic

Companies (《境内企业境外发行证券和上市管理试行办法》)

and five ancillary interpretive guidelines, collectively, the Overseas Listing Trial Measures, as amended, supplemented or otherwise

modified from time to time, which apply to overseas offerings and listing by PRC-based companies, or domestic companies, of equity shares,

depository receipts, corporate bonds convertible to equity shares, and other equity securities, and came into effect on March 31,

2023. According to the Overseas Listing Trial Measures, (1) domestic companies that seek to offer or list securities overseas, both

directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC, and if an overseas-listed PRC-based

issuer issues new securities in the same overseas market after the overseas offering and listing, it is also required to file with the

CSRC within three business days after the completion of the issuance, or the CSRC Filing; if a domestic company fails to complete the

filing procedure or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject

to administrative penalties, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person

directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines; (2) if

a foreign-incorporated issuer meets both of the following conditions, its overseas offering and listing shall be determined as an indirect

overseas offering and listing by a domestic company of the PRC: (i) any of the total assets, net assets, revenues or profits of

the domestic operating entities of the issuer in the most recent accounting year accounts for more than 50% of the corresponding line

items in the issuer’s audited consolidated financial statements for the same period; and (ii) its major operational activities

are carried out in China or its main places of business are located in China, or the senior managers in charge of operation and management

of the issuer are mostly Chinese citizens or are domiciled in China; in addition to the aforementioned conditions, the determination

of an indirect overseas offering and listing by a domestic enterprise adheres to the principle of substance over form; and (3) where

a domestic company seeks to indirectly offer and list securities in an overseas market (including issuance of new securities after its

overseas offering and listing), the issuer shall designate a major domestic operating entity responsible for all filing procedures with

the CSRC.

Furthermore, in case any

of the following major events occurs after the overseas offering and listing, the issuer is also required to report the relevant information

to the CSRC within three business days of the occurrence and the announcement of the relevant events: (1) change of control; (2) the

foreign securities regulatory body or the relevant competent authority has taken such measures as investigation and punishment; (3) conversion

of listing status or listing board; and (4) voluntary of compulsory termination of listing. Where there is any material change in

the major business and operation of the issuer after overseas offering and listing, and such change does not fall within the scope of

filing, the issuer shall, within three business days of the occurrence of such change, submit a special report and a legal opinion issued

by a domestic law firm to the CSRC to explain the relevant situation.

As substantially all of our

operations are currently based in the PRC, our future offerings and major changes shall be subject to the filing procedures under the

Overseas Listing Trial Measures. We cannot assure you that we can meet such requirements, obtain the requisite permits from the relevant

government authorities, or complete such filing in a timely manner or at all. Any failure may significantly limit or completely hinder

our ability to continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless.

Recent Developments

In December 2024, we received

a Termination Process Letter from Acrotech of a certain License Agreement (the “License Agreement”), dated September 17, 2014,

between Spectrum Pharmaceuticals, Inc. and us granting the exclusive rights to us to commercialize Evomela® in China, which was later

assigned to Acrotech on March 1, 2019. Acrotech alleged in such letter that we materially breached the License Agreement and failed to

cure such breach, and the License Agreement was therefore terminated. Pursuant to the License Agreement, we can continue to distribute

and sell Evomela® for a reasonable wind-down period not to exceed 24 months, so we do not expect any disruption to our current distribution

plan for Evomela® during such period.

On October 24, 2024,

we announced that the Center for Drug Evaluation of the NMPA has approved our Clinical Trial Application to proceed with a phase 1/2 study

of CID-103 in adult patients with chronic Immune Thrombocytopenia in China. This China study is part of the global study that was approved

by the U.S. Food and Drug Administration, or FDA, in May 2024.

In July 2024, with respect

to our previously announced dispute with Juventas, a PRC court issued an asset freezing order against Juventas in aid of the arbitration

proceedings we initiated at the Hong Kong International Arbitration Centre in connection to Juventas’s purported termination of

the parties’ agreements with respect to the commercialization of CNCT19 (the “Arbitration Proceeding”). In an order

dated July 15, 2024 and received by us on July 18, 2024, the First Intermediate People’s Court of Tianjin Municipality, where Juventas

is headquartered, granted our application to freeze Juventas’s assets while the Arbitration Proceeding is ongoing and decided to

freeze up to RMB 190 million in Juventas’s bank accounts or seize and freeze Juventas’s other assets of equivalent value (the

“Asset Freezing Order”). The Asset Freezing Order took effect upon issuance and the court has taken steps to enforce the Asset

Freezing Order.

In July 2024, we entered into

an agreement with PAT and one of the investors of PAT, to purchase 19.8876% equity interest of PAT from the investor. The total consideration

is RMB 28.4 million plus interest and will be paid in three installments. We paid RMB 10.0 million in August 2024. The remaining two installments

will be paid by March 31, 2025 and December 31, 2025, respectively.

On June 26, 2024, we

entered into Subscription Agreements and Subscription and Purchase Agreements with certain investors including Dr. Wei-Wu He, the

Chairman of the board of directors and Chief Executive Officer of the Company and his family trust. On July 15, 2024, the transaction

contemplated under such agreements closed, pursuant to which we issued 1,020,000 ordinary shares and Warrants to purchase 1,980,000 ordinary

shares to the investors for aggregate gross proceeds of approximately $15.0 million, before deducting placement agent fees and other private

placement expenses.

Our board of directors received

a preliminary non-binding proposal letter, or the Proposal Letter, dated June 21, 2024, from Dr. Wei-Wu He, Chairman of the

Board and CEO of the Company, to acquire the entire business operations of the Company in China and all license-in, distribution and related

rights in Asia (excluding Japan) related to all of our pipeline products, including but not limited to EVOMELA®, FOLOTYN®, CNCT19,

BI-1206, CB-5339,CID-103 and Thiotepa, for an aggregate purchase price of $40.0 million, which shall include assumption of up to $20.0

million of indebtedness of the Company, or the Proposed Transaction. On June 25, 2024, our board of directors formed a special committee

comprised solely of incumbent independent directors, or the Special Committee, to evaluate the transaction contemplated under the Proposal

Letter and such other strategic and business alternatives available to us in respect of the our business operations in China. As of the

date hereof, no decisions have been made by the Special Committee with respect to the Proposed Transaction or any alternative strategic

option that we may pursue.

Liquidity

and Capital Resources

The Financial Statements have

been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal

course of business. However, substantial doubt about our ability to continue as a going concern exists.

Since our inception in 1991,

we have incurred significant losses from operations and, as of June 30, 2024, had incurred an accumulated deficit of $677.3 million. For

the six months ended June 30, 2024, we had a net loss of $16.5 million and a cash outflow for operating activities of $18.1 million. As

of June 30, 2024, we had a net current asset of $27.6 million. In addition, we had long term borrowing and non-current dividends payable

in total amount of $19.5 million which may become payable on demand if certain events of default occur (including with respect to a certain

revenue threshold to be met by CASI Wuxi in 2024, see Note 9 to the Financial Statements). We also subsequently paid RMB 10.0 million

in August 2024, with two remaining installments to be paid by March 31, 2025 and December 31, 2025, respectively, for total consideration

of RMB 28.4 million plus interest related to investment in PAT. Therefore, we will require additional liquidity to continue our operations

over the next 12 months.

Historically, we have relied

principally on proceeds from equity financing and bank borrowings to finance our operations and business expansion. We have evaluated

plans to continue as a going concern which include, but are not limited to, (i) exploring opportunities for further equity financing (ii)

reducing discretionary capital and operating expenses (iii) negotiate with creditor to ease the credit terms (iv) obtaining additional

facilities from banks or other financial institutions. Notwithstanding this, we may be unable to access further equity or debt financing

when needed. As such, there can be no assurance that we will be able to obtain additional liquidity when needed or under acceptable terms,

if at all.

The unaudited interim condensed

consolidated financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities, and

reported expenses that may be necessary if we were unable to continue as a going concern.

RISK FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks and uncertainties described under the section titled “Risk Factors” contained in the applicable prospectus

supplement and any related free writing prospectus, and discussed under the section titled

“Risk Factors” contained in our most recent annual report on Form 20-F and in our current reports on Form 6-K, as

well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus

in their entirety, together with other information in this prospectus, the documents incorporated by reference and any free writing prospectus

that we may authorize for use in connection with a specific offering. See “Where You Can Find More Information.”

The

risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown

or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future

results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to

anticipate results or trends in future periods. If any of these risks actually occur, our business, financial condition, results of operations

or cash flow could be harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of

your investment. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This

prospectus and the documents we have filed with the SEC that are incorporated by reference contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

Exchange Act. The statements contained in this prospectus or incorporated by reference herein that are not purely historical are forward-looking

statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations,

hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

You can identify some of

these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,”

“potential,” “continue” or other similar expressions. These forward-looking statements include, among others,

statements regarding the timing of our commercial launch of products, clinical trials, our cash position and future expenses, and our

future revenues. We have based these forward-looking statements largely on our current expectations and projections about future events

that we believe may affect our financial condition, results of operations, business strategy and financial needs.

Actual

results could differ materially from those currently anticipated due to a number of factors, including: uncertainties related to the

Proposal Letter to acquire the Company’s business operations in China; the risk that we may be unable to continue as a going concern

as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may be delisted from trading

on The Nasdaq Capital Market if we fail to satisfy applicable continued listing standards; the volatility in the market price of our

ordinary shares; the risk of substantial dilution of existing shareholders in future share issuances; the difficulty of executing our

business strategy on a global basis including China; our inability to enter into strategic partnerships for the development, commercialization,

manufacturing and distribution of our proposed product candidates or future candidates; legal or regulatory developments in China that

adversely affect our ability to operate in China; our lack of experience in manufacturing products and uncertainty about our resources

and capabilities to do so on a clinical or commercial scale; risks relating to the commercialization, if any, of our products and proposed

products (such as marketing, safety, regulatory, patent, product liability, supply, competition and other risks); our inability to predict

when or if our product candidates will be approved for marketing by the U.S. FDA, EMA, NMPA, or other regulatory authorities; our inability

to receive approval for renewal of license of our existing products; the risks relating to the need for additional capital and the uncertainty

of securing additional funding on favorable terms; the risks associated with our product candidates, and the risks associated with our

other early-stage products under development; the risk that result in preclinical and clinical models are not necessarily indicative

of clinical results; uncertainties relating to preclinical and clinical trials, including delays to the commencement of such trials;

our ability to protect our intellectual property rights; the lack of success in the clinical development of any of our products and our

dependence on third parties; the risks related to our dependence on Juventas to partner with us to co-market CNCT19; risks related to

the uncertainty in connection with the ongoing arbitration proceedings between us and Juventas with respect to Juventas’ purported